However, the cotton industry faces numerous challenges. As an agricultural product, cotton is highly dependent on favourable weather conditions, and climate change poses significant risks to crop yields. Unpredictable weather, such as droughts or excessive rainfall, can dramatically affect production and pricing, making the cotton market volatile. These challenges in traditional cotton-growing regions have spurred developing countries, particularly Least Developed Countries (LDCs), to explore and compete in the global cotton market.

With its abundant natural resources and favourable climate for cotton cultivation, Africa has become a key player in this shift. The continent's warm, humid environment is ideal for cotton growth, positioning it as a significant supplier of raw cotton. Furthermore, Africa has seen a surge in foreign direct investment (FDI), which has bolstered its cotton sector. The continent's LDC status has also provided access to various trade benefits, making it increasingly attractive for international investors and trade partners.

Many African nations, such as Benin, Burkina Faso, Sudan, and Tanzania, are already established cotton producers. In recent years, these countries have made strides in increasing raw cotton production and processing it into finished textile products. This shift toward producing finished intermediate goods, such as woven fabrics, yarn, and cotton waste, aligns with Africa's broader industrialisation goals. By moving up the value chain, African countries are poised to capture a larger share of the global textile market, benefitting from the growing demand for sustainably produced and competitively priced cotton products.

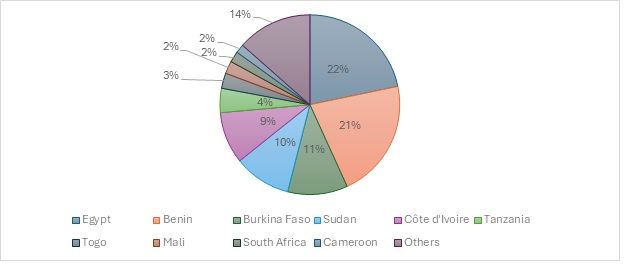

Exhibit 1: Top African economies contributing to global cotton exports (in $ Mn)

Source: ITC Trade Map

African cotton is largely grown by small landowners and is a source of income for a large population of African farmers. Currently, Benin, Burkina Faso, Tanzania, and Côte d'Ivoire lead in the production and export of cotton and cotton products. Fibre2Fashion comprehensively analyses how African cotton exports are performing and how it will make a place for itself amidst traditional partners. Please note that Sudan has not been added to the list due to a lack of current information.

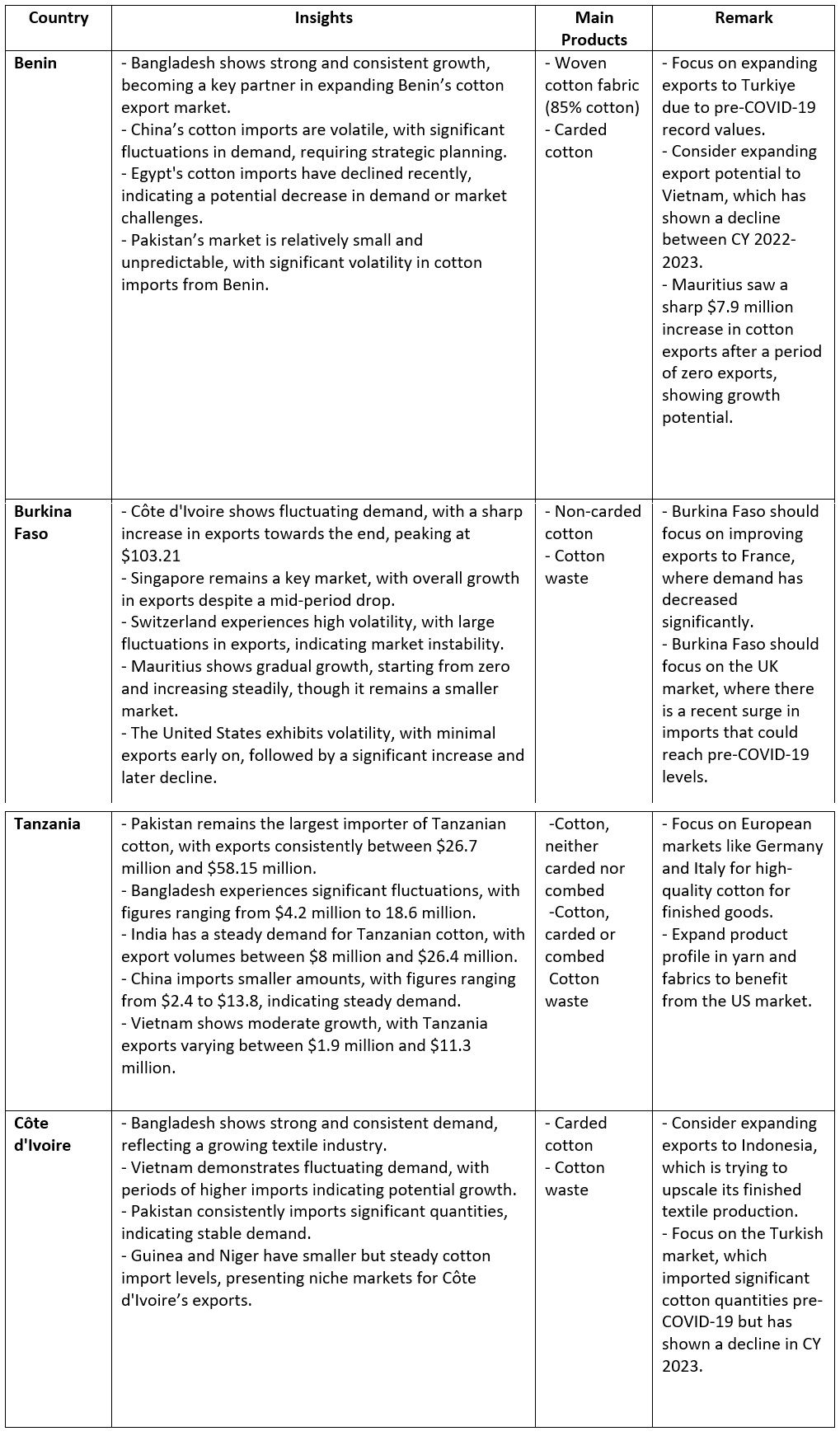

Table 1: Analysis of top cotton exporting countries of Africa

Source: Fibre2Fashion

Africa’s Cotton-4 countries

Africa has four countries that have majorly contributed to cotton exports, namely Benin, Burkina Faso, Chad, and Mali. Benin and Burkina Faso continue to have a stronghold in Africa with regard to cotton and cotton products exports.

The Cotton-4 (C-4) countries, which are key cotton producers in Africa, benefit from several strengths that make them major players in global cotton exports. Their high production volumes, supported by favourable growing conditions and low production costs, allow them to supply significant amounts of raw cotton annually, maintaining a competitive edge in the international market.

These nations have established strong export infrastructures, including robust transport systems and international trade agreements, which facilitate access to major markets such as the European Union, Asia, and North America. The C-4 countries also have a historical role in the cotton trade, known for their high-quality cotton and reliable supply. While they face challenges from global subsidies that distort cotton prices, they remain competitive through their cost advantage. Additionally, these countries are diversifying their export markets, particularly focusing on increasing intra-African trade.

Looking ahead, the short-term outlook for cotton exports remains positive, driven by growing demand in emerging markets and efforts like the African Continental Free Trade Area (AfCFTA). In the medium term, C-4 countries are aiming to increase the value added to their cotton exports by focusing on local processing, which will create jobs and boost income for farmers. However, the impact of climate change on cotton production is a concern, with unpredictable weather patterns affecting yields. To address these risks, the adoption of sustainable practices and climate-resilient cotton varieties will be key for the sector's future growth, supported by initiatives like the Better Cotton Initiative (BCI) and Cotton Made in Africa (CMA).

Way forward

While Africa’s cotton sector has faced numerous challenges, it holds significant untapped potential to drive economic growth and improve livelihoods across the continent. By addressing critical obstacles such as low productivity, lack of technology, and climate change impacts, African governments can increase domestic cotton production. By fostering local processing industries and ensuring more value stays within the continent, Africa could significantly enhance its global position in the cotton value chain. The African Continental Free Trade Area (AfCFTA) presents a unique opportunity to boost intra-regional trade and investment in cotton, positioning the continent to emerge as a key player in both raw and processed cotton markets.

African cotton can market itself differently by moving forward with their Better Cotton Initiative, which focuses on the sustainability aspect of cotton. The Better Cotton Initiative is also expected to attract investment in the region, with their current CY 2023-2024 report suggesting a 7 per cent increase in licensed African cotton farmers that are associated with the Better Cotton Initiative. The Better Cotton Initiative has existing programmes in Benin and Côte d'Ivoire and plans to expand its presence in Mali and Mozambique.

With decisive action and strategic investments, Africa has the potential to transform its cotton sector into a major export revenue source that can fuel long-term economic development and widespread prosperity.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!