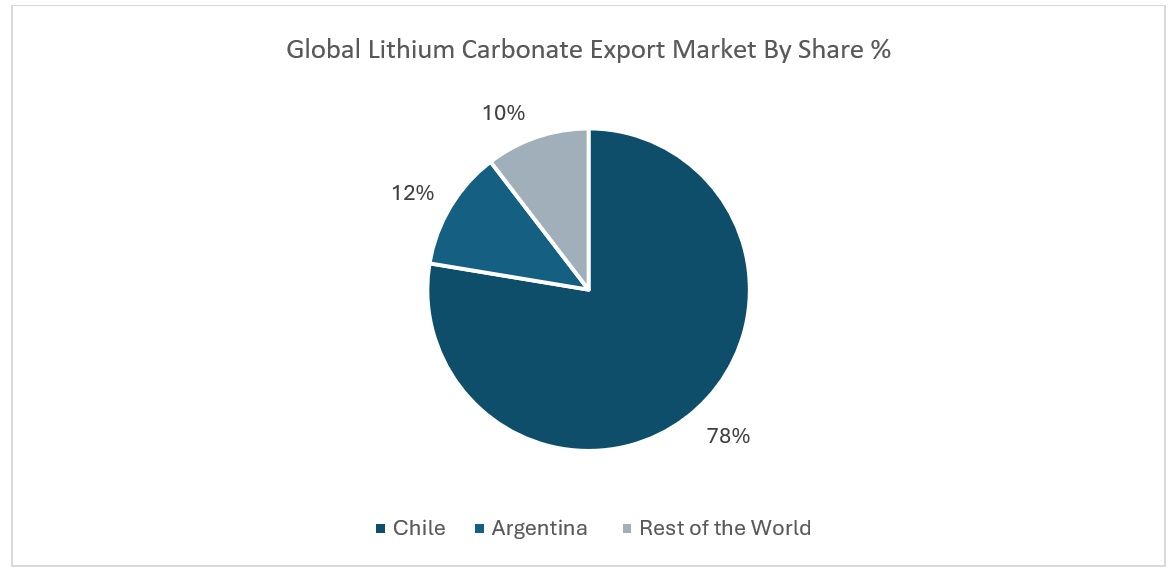

Lithium carbonate is a key compound in the production of lithium-ion batteries, which are widely used in electric vehicles, consumer electronics, and energy storage systems. On a global scale, Chile dominates lithium carbonate production, contributing roughly 78 per cent of total output. Globally, Chile holds the largest share of lithium carbonate production, accounting for approximately 78 per cent export of the market.

Argentina ranks second in global export with around 12 per cent of the market share. The remaining 10 per cent of the market is distributed among other countries.

In China, the price of lithium carbonate experienced a significant increase in August. It rose from approximately $9.6 per kilogram in the first week to around $11.2 per kilogram by the end of the month, marking an increase of about 16.5 per cent over the period. The surge was driven by expectations of potential supply disruptions and robust demand from the energy storage sector.

A key factor contributing to supply-side concerns is the production halt in Chile, one of the world’s major lithium carbonate producers. Such disruptions in global supply chains can trigger anticipatory buying, intensifying short-term price volatility.

Lithium carbonate pricing is highly sensitive to fluctuations in supply and demand. Supply constraints, whether due to geopolitical tensions, operational halts, or logistical challenges, combined with expanding demand from energy storage systems that rely on lithium carbonate and lithium iron phosphate, tend to create upward pressure on prices. This reflects the classic dynamics of commodities, where constrained supply and strong demand accelerate price movements.

Figure 1:

Source: ALCHEMPro

Analysts note that the August price rally reflects a combination of supply-side disruptions, policy-driven compliance, and market self-regulation. Despite the recent spike, the long-term oversupply of lithium carbonate persists, suggesting that prices may stabilise near cost levels once short-term supply risks, such as the Chilean production halt, are resolved.

Conclusion

The sharp rise in China’s lithium carbonate prices in August highlights the market’s sensitivity to both supply disruptions and surging demand from the energy storage sector. While the production halt in Chile and potential export constraints have triggered short-term price volatility, long-term oversupply in the global market suggests that prices are likely to stabilise near production cost levels once these temporary supply risks are addressed. Market participants should continue monitoring geopolitical developments and energy storage growth, as these factors will remain key drivers of lithium carbonate dynamics in the near term.

ALCHEMPro News Desk (VK)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!