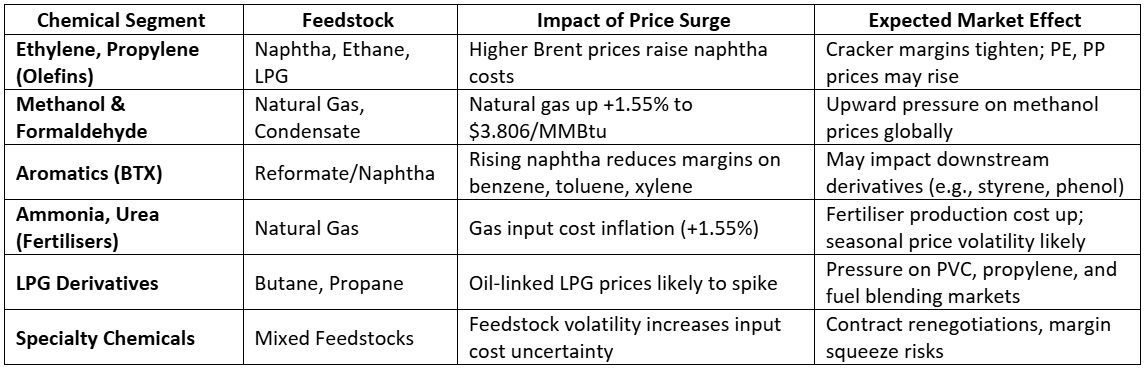

Natural gas and crude oil are foundational inputs for the global chemical industry, serving as critical feedstocks to produce key intermediates such as ethylene, propylene, methanol, aromatics, and their derivatives. Iran’s temporary shutdown of part of the South Pars field the largest natural gas field globally following Israeli attacks has raised alarm regarding near-term availability of condensates, ethane, and LPG. These components are essential to steam crackers and methanol units across Asia and Europe.

Similarly, Israel’s decision to halt over 60 per cent of its natural gas output due to security risks, including the shutdown of the Leviathan offshore field, further compounds the risk of regional feedstock constraints.

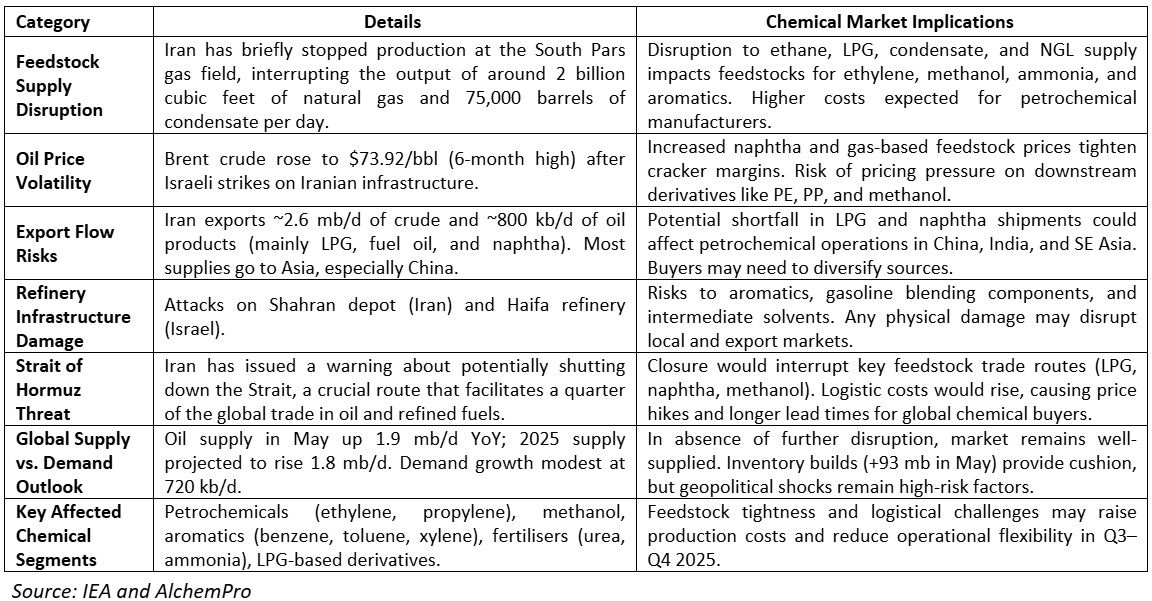

Key Impacts on the Chemical Market (IEA)

While the immediate impact on volumes is still being assessed, even a partial disruption is sufficient to create ripples in spot pricing and shipment schedules for natural gas liquids (NGLs) and related petrochemical inputs.

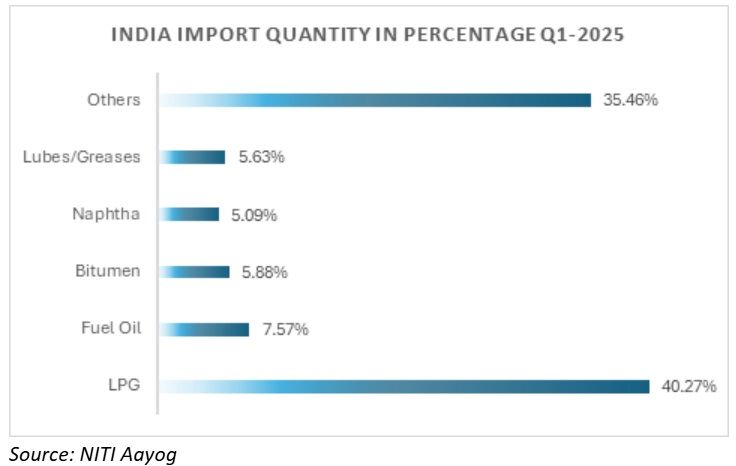

Key Impacts on the Indian Chemical Market

Chemical Market Implications of June 2025 Oil and Natural Gas Price Surge

Trade Routes and Logistics at Risk

The Strait of Hormuz is not only vital for crude exports but also for the transport of refined products and liquefied gases used in chemical manufacturing. Even a temporary closure of this chokepoint would severely impact chemical feedstock flows to Asia, particularly for India and China, both of which are heavily reliant on Middle Eastern supplies.

Logistics costs for bulk chemicals, LPG, and naphtha are also rising due to increased shipping insurance premiums and rerouting concerns. Any sustained conflict may push companies to build up buffer inventories or diversify sourcing strategies, possibly shifting some reliance to US Gulf Coast and West African suppliers, albeit at a higher cost.

ALCHEMPro News Desk (VK)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!