The price rise in Q3 2021 is expected due to a reduction in stocks and increasing operating rates.

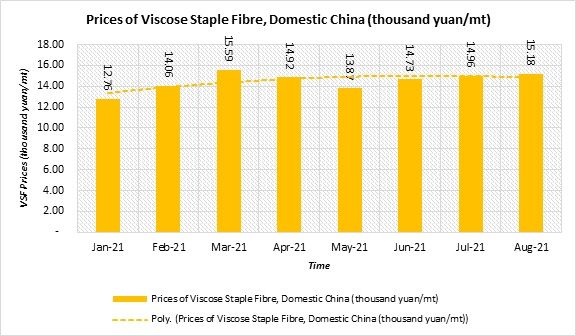

The VSF price in January 2021 was 12.76 thousand yuan/mt, which increased by 22.17 per cent to reach 15.59 thousand yuan/mt in March 2021. After witnessing a surge in March 2021, the price suddenly dropped by 11.04 per cent to 13.87 thousand yuan/mt in May 2021 over the price in March 2021, according to Fibre2Fashion’s market analysis tool TexPro.

In Q1 2021, the VSF price increased due to a modest increase in consumption, strong bullish expectations and a high demand from downstream buyers who prefer easy sourcing. The price rise was supported by ample pre-sales, tight supply of dissolving pulp and rising feedstock prices.

Due to migrant workers’ decision to stay back, very few textile players kept the companies closed during the Chinese New Year holiday, hence the viscose staple fibre consumption improved.

Crude oil and ICE cotton futures also showed considerable rise during the holiday. Many of the large-sized VSF plants became reluctant sellers and stopped selling fibres after the holiday, which further boosted VSF prices.

In March 2021, the prices got stabilised with the resurgence of the pandemic in some states of Europe and America and escalation of Xinjiang issue.

In April 2021, a major price drop was observed due to weak Chinese demand and weak economic recovery and resurgence of COVID-19 in South Asia. Most of the spinners were focused on the consumption of stockpiles.

The price drop in May 2021 was due to low sales as markets closed for the Labour Day holiday. Although some players offered promotional discounts to boost sales, the inventory of VSF plants was growing with slower delivery pace by the spinners. Spinners were not so confident and fresh business was limited.

ALCHEMPro News Desk (KD)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!