Fibre2Fashion examines the current global trends in various subcategories of bedding products, as well as those with potential for success in the upcoming years.

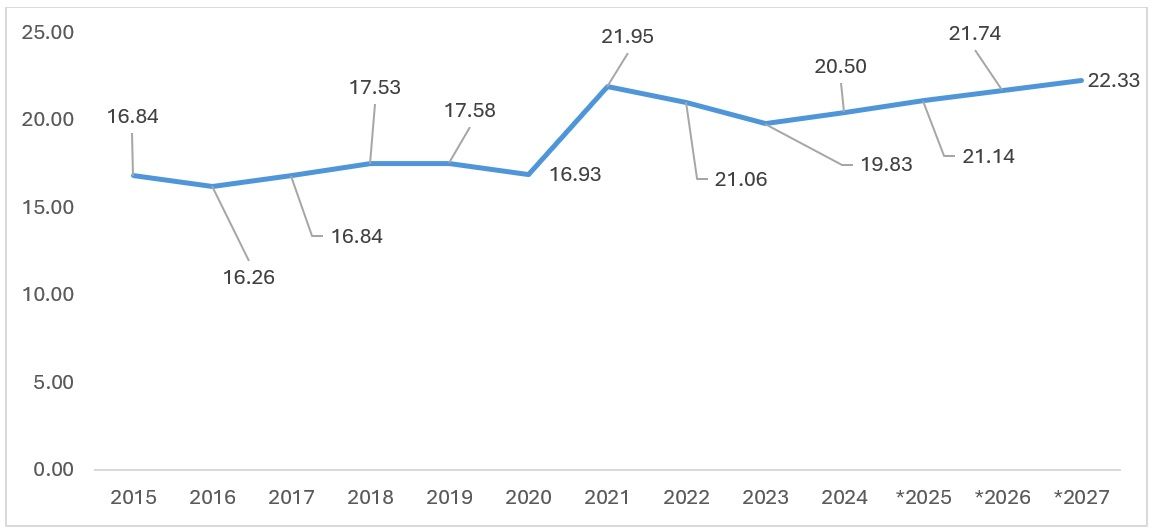

Exhibit 1: Global bed products exports to the world and forecast values (in $ bn)

Source: TexPro, F2F Analysis

The bed products category under home textiles shows a unique trend compared to apparel. Unlike other textile products that witnessed a slump during the COVID-19 pandemic, bedding-related home textiles saw a surge in 2021 due to increased attention towards home stays prompted by pandemic guidelines. Exports returned to pre-pandemic levels, with a slightly uplifted positive outlook from 2022 to 2024. Projections indicate a positive but comparatively stagnant growth in the coming years. However, a potential increase may occur due to continued research and development in the category. Growth is expected to rise by approximately 3 per cent.

Table 1: Analysis of top countries importing bed products

Source: TexPro, F2F Analysis

Kyrgyzstan has shown increased demand for finished goods in the textile category. This trend continues for bed products, with a notable CAGR of 103 per cent. Kyrgyzstan’s rising imports may also indicate growing demand from Central Asian economies, as the country serves as a distribution and transhipment hub for neighbouring nations—signalling an expanding consumer base in the region.

Vietnam and Mexico are emerging economies with rising demand, driven by the increasing purchasing power of their populations. Vietnam’s urban population is expected to grow by 10 per cent, suggesting higher spending on discretionary items such as bed products. Russia, despite recording a high CAGR, is likely to see limited import growth due to geopolitical tensions.

The UAE has signed Free Trade Agreements with countries such as Vietnam and India and is in talks with Pakistan. This positions the UAE as a key importer in the bed products category.

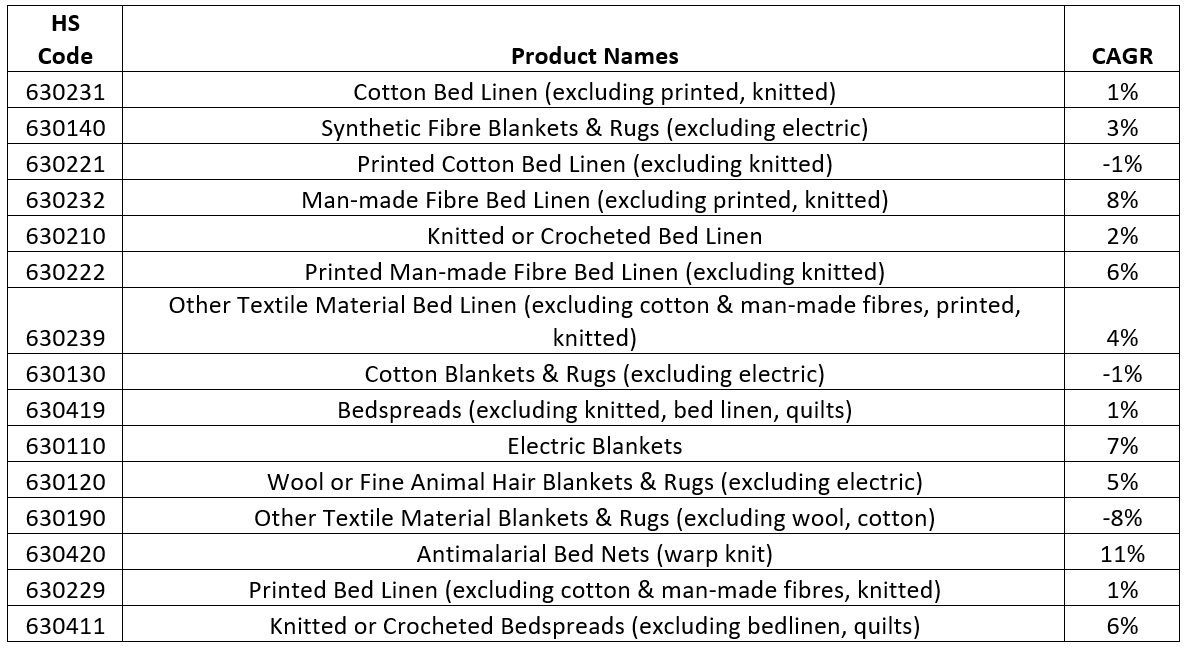

Table 2: 6-digit category-wise CAGR of bed products

Source: F2F Analysis

The figures indicate a strong growth trajectory for man-made fibre-based products, electric blankets, and specialised items like antimalarial bed nets. The significant growth in antimalarial bed nets, with a CAGR of 11 per cent, reflects an increased focus on health and safety, particularly in regions where malaria is prevalent.

In contrast, traditional cotton-based products such as cotton bed linen (excluding printed and knitted) and cotton blankets and rugs (excluding electric) show lower or negative growth rates, indicating a shift in consumer preference towards alternative materials.

This trend suggests that consumers are increasingly favouring synthetic and specialised materials over traditional cotton, driven by factors such as durability, functionality, and specific health benefits. Manufacturers may need to adapt to these changing preferences by innovating and diversifying their product offerings to meet evolving consumer demands.

Table 3: RCA of top bed-related home textile importers - China, Pakistan and India

Source: F2F Analysis

An analysis of Revealed Comparative Advantage (RCA) values across various bed product categories reveals distinct export specialisation trends for China, Pakistan, and India, each aligning with specific material types and product focuses.

Pakistan demonstrates exceptionally high RCA values in several categories, underscoring its global competitiveness in traditional and cotton-based textile exports. Notably, Pakistan records RCA values of 237.31 in cotton bed linen, 235.78 in knitted or crocheted bed linen, and 428.28 in bed products made from textiles other than cotton or man-made fibres. These figures reflect a clear specialisation in traditional and diverse textile segments, particularly those rooted in a cotton-rich heritage and volume-based manufacturing.

India, by contrast, shows moderate but balanced RCA values, indicating competitiveness in select categories. India’s export strength is most pronounced in cotton blankets (RCA: 8.60) and cotton bedspreads (RCA: 36.60), reflecting a niche in decorative and heavier cotton-based bedding products. While not dominant across the broader bed textile spectrum, India’s focus on premium cotton and value-added items provides a stable position, albeit less aligned with fast-growing market trends.

China presents a diversified and innovation-driven RCA profile, with competitive advantages across synthetic and man-made fibre-based bed products. It shows strong RCA values in electric blankets (5.94), printed man-made fibre bed linen (5.54), and synthetic fibre blankets (5.77). This positions China as a leader in high-volume, technologically enhanced, and performance-driven bedding products—particularly those that align with evolving consumer preferences.

When viewed alongside compound annual growth rate (CAGR) trends, China emerges as the most strategically aligned with future demand. Product lines such as man-made fibre bed linen (CAGR: 8 per cent), electric blankets (7 per cent), and antimalarial bed nets (11 per cent) show high growth potential, reinforcing China’s positioning as a key beneficiary of expanding global demand in functional and innovative bedding categories.

Pakistan’s export specialisation remains centred on traditional cotton-based textiles—segments with stable but slower growth. Its exceptionally high RCA values suggest sustained competitiveness in core markets but limited exposure to emerging trends in synthetic or technical textiles.

India, while competitive in certain decorative and cotton-intensive bedding products, risks being sidelined in the long term unless it diversifies into high-growth segments such as synthetics, performance textiles, or smart bedding solutions.

Strategic Opportunities by Country

Each country, therefore, occupies a unique position within the global bed product value chain, shaped by its material specialisation, manufacturing strengths, and alignment with future growth trajectories.

Sustainability and Innovation as Growth Drivers

As environmental concerns rise, opportunities are expanding in biodegradable, organic, and recycled materials. Additionally, smart textiles—such as temperature-regulating or antimicrobial bedding—offer high-value innovation pathways for countries aiming to differentiate beyond cost.

Conclusion

The global bed products market is diversifying, with synthetic and innovation-led segments driving future growth. While China leads in these areas, Pakistan’s traditional dominance and India’s cotton-rich niche offer distinct opportunities. Strategic pivots towards high-growth, sustainable, and value-added segments will define long-term competitiveness in this evolving landscape.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!