FTAs should ideally be designed in a way that helps labour-intensive industries to benefit from it, considering that a lot of high-end and medium-end products already have lower tariffs. India’s trade agreement with the UK should be geared towards bringing down tariff rates for the Indian textile industry.

According to a think tank, GTRI, high-quality goods especially in the labour-intensive sector would benefit from the upcoming India-UK FTA. Analysing the probability of how much Indian textiles would gain from the trade would make it easier for Indian exporters to put forth their points during the upcoming India-UK FTA negotiations. Fibre2Fashion used the WITS SMART simulation tool to understand the repercussions of a zero per cent tariff rate on Indian textiles entering the UK. The analysis is based on data available for 2022 in the WITS database. This will act as a simple primer for Indian exporters to predict their overall gains if the UK agrees to remove the current tariff rate for India under the Developing Country Trading Scheme.

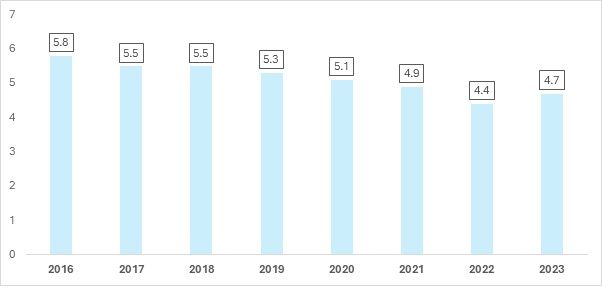

Exhibit 1: India's share in UK's home textiles imports (in %)

Source: ITC Trade Map, F2F Analysis

India’s signing of the FTA is viable for the Indian home textiles industry. Despite UK being India’s second largest market. India has been losing in the UK market with trade being diverted to neighbouring countries like Pakistan and Bangladesh. The year 2022 was a significant year for textiles overall, however, the prominence of India’s home textiles sector decreased within the United Kingdom.

SMART Analysis: Indian Home Textiles to Gain from the UK-India FTA

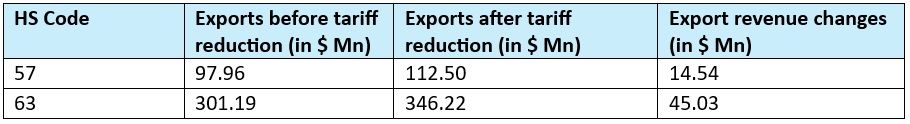

Table 1: India’s revenue changes before and after-tax reduction (in $ Mn)

Source: Analysis of the WITS SMART simulation

Table 1 shows the impact of tariff reductions (at 0%) on India’s exports to the UK for two product categories: HS Code 57 (carpets and textile floor coverings) and HS Code 63 (other made-up textile articles). For HS Code 57, India’s exports increased from $97.96 million to $112.50 million, resulting in a $14.54 million increase in export revenue, reflecting a positive impact from reduced tariffs. Similarly, for HS Code 63, exports rose from $301.19 million to $346.22 million, leading to a $45.03 million increase in export revenue, indicating a stronger growth trajectory in this category. The significant revenue changes in both categories suggest that the tariff reductions have effectively boosted India’s export performance to the UK, with HS Code 63 seeing a notably greater increase in export revenue.

India’s Revenue Impact: Trade Creation and Trade Diversion Effects

India’s textile exporters have been keen on negotiating the textile tariffs imposed on the country under the UK’s DCTS scheme. We can gauge India’s potential benefits from the new duty rate of zero per cent from the average of 6.44 per cent in Carpets and 7.87 per cent in other Home Textiles (Simple Duty Rates). India’s benefits can be highlighted in the following ways:

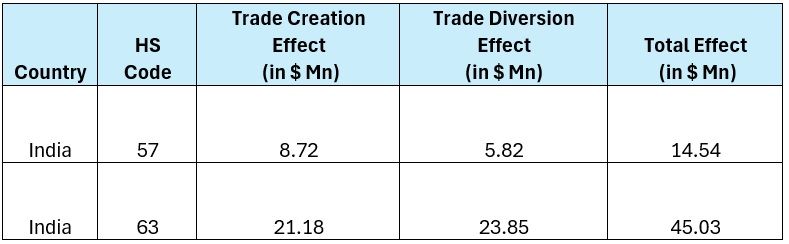

Table 2: India’s Tade Creation and Trade Diversion effects post tariff reduction (in $ Mn)

Source: Analysis of the WITS SMART Simulation

For HS Code 57 (Carpets and Textile Floor Coverings)

India’s exports to the UK have resulted in a trade creation effect of $8.72 million, meaning that due to trade liberalisation (likely under an FTA or reduced tariffs), India can increase its exports of carpets and textile floor coverings to the UK. This represents new trade that would not have occurred without the reduction of trade barriers. On the other hand, the trade diversion effect of $5.82 million indicates that while India has increased its exports to the UK, some of these exports may have shifted from other markets to the UK. Essentially, India is replacing exports that would have gone to other countries with exports to the UK, likely due to the more favourable terms under the trade agreement. The total effect for HS Code 57 is $14.54 million, meaning overall there has been a net positive impact on India’s exports to the UK, with both new trade created and a shift in trade patterns.

For HS Code 63 (other Made-Up Textile articles)

India’s exports of made-up textile articles to the UK show a stronger trade creation effect of $21.18 million, reflecting a substantial increase in exports of products like clothing, blankets, and other textiles, likely driven by more favourable trade terms or a reduction in tariffs. However, the trade diversion effect of $23.85 million is even larger, which means that India can divert some of its textile exports from other markets to the UK due to the better trade conditions in the UK. In other words, India will be able to sell more to the UK, but at the cost of losing exports to other countries. The total effect for HS Code 63 is $45.03 million, which indicates a significant net increase in exports despite the shift away from other markets. This suggests that India’s trade with the UK has the potential to grow substantially in this category, driven by the trade agreement or reduced tariffs, even though trade is being redirected from other markets.

Exporter View Analysis

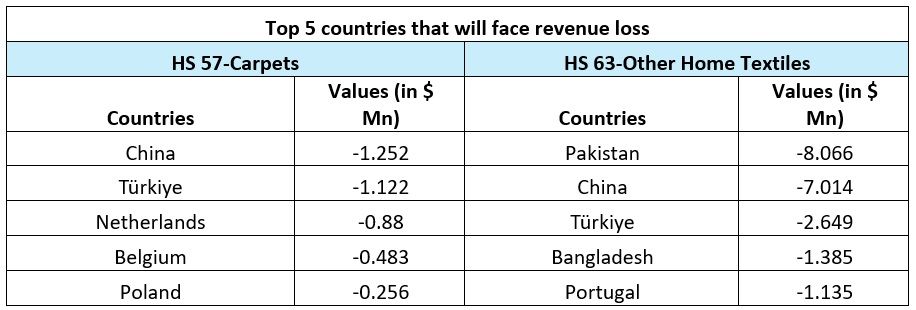

Table 3: Top 5 countries set to lose from the trade deal under India and UK FTA (at 0% rate)

Source: Analysis using the SMART WITS simulation

Table 3 gives a glimpse of which countries would be affected by the lowering of tariffs to zero per cent by the UK on home textiles products. HS 57, which majorly deals with carpets, shows an interesting mix of countries that would lose from the open trade between India and the UK. Apart from the traditional partners like China and Türkiye, the UK’s former coalition group, i.e. EU members Netherlands, Belgium, and Poland would lose from the trade opening towards India. China and Türkiye’s revenue loss is likely to be more than $1 million.

Concerning HS code 63 which includes all kinds of home textiles such as bed linen, curtains, floor mats etc, India’s neighbour Pakistan would be the biggest loser due to its position as the second biggest Home Textile exporting country to the UK. Traditional textile exporters such as China, Türkiye, and Bangladesh also feature in the list. Surprisingly, Portugal, an European country featuring in the list, is placed at the fifth position. Portugal stands ninth in HS code 63 (Home Textiles) and has benefitted from the UK-EU trade and cooperation agreement.

Currently, the UK imports at a much lower rate of $4.13 per kg from India compared to $19.84 per kg from Portugal. Here, India wins due to its cost-effectiveness. European neighbours of the UK such as the Netherlands, Poland, and Portugal do not have the upper hand pertaining to customs procedures and border checks despite having zero tariffs. There are chances that India’s duty-free entry of Home Textiles to the UK will pose a threat to EU markets given the UK’s exit (Brexit) from the European Union. Countries like China, Bangladesh, and Türkiye could also be hurt.

The Way Forward

This analysis is an attempt to understand the gains that India would make along with the negative spillover of the trade diversion that would occur due to the agreement and its effects on rival countries. India would have a positive revenue generation if the UK were to lessen its tariffs on Indian home textiles products. Trade creation would be much more impactful in the carpet sector, which has been India’s weaker segment, only if the UK is open to the idea of importing traditional carpets made in India.

Countries such as Pakistan, China, and Türkiye would lose out to Indian products if the agreement is signed. Pakistan is highly dependent on home textile exports and India’s high-quality goods which have higher tariff rates, would be sold at a price range, at par with Pakistani home textiles goods. India’s high-quality products would further diminish some prominence of EU countries in the UK market.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!