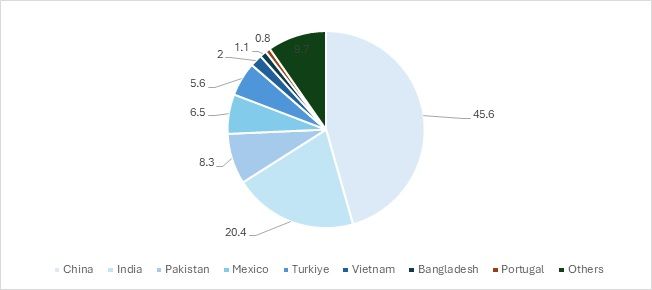

Exhibit 1: US’s leading suppliers of home textile goods (in %)

Source: ITC Trade map, F2F Analysis

Exhibit 1 shows the percentage of shares occupied by the top 10 countries exporting home textile products to the US. China particularly excels due to its high economies of scale and being a particularly high importer of both textile machinery and textile intermediate products like high-grade cotton which goes into the manufacturing of home textiles. India, on the other hand, has domestic access to high-quality cotton as well as established home companies such as Welspun and Trident which are forefront players in the home textiles industry. In addition, traditional handiwork also attracts several takers in developed markets due to their distinct quality and durability.

Current Trends

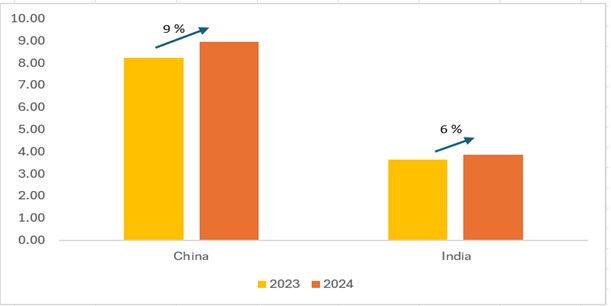

Exhibit 2: China and India’s growth in CY 2024 (Jan-Nov) (in %)

Source: Trade map

Current trends for CY 2024 (Jan-Nov) suggest a growth in the exports from both China and India. However, China leads in the race not only by absolute numbers but also by growth percentage which is currently at 9 per cent for China and 6 per cent for India. Current trends are necessary to understand not only India’s absolute numbers but also to understand their current growth status. Overall, the US witnessed a higher demand for home textiles, whose imports increased from $18 billion CY 2023 to $19.2 billion in CY 2024. However, China’s growth in the sector might be halted due to the induction of tariffs in CY 2025.

Product Analysis- China vs India

India reigns supreme in carpet exports compared to China, however, if India wants to benefit from the tariffs (proposed) imposed on China, India will have to resort to levelling up its supply in select home textile products where China currently holds a major share. However, there are certain products in which India supposedly has had competition with China for several years based on the export similarity index.

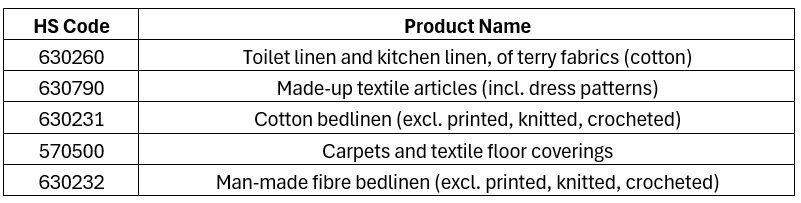

Table 1: China and India’s competing products in Home Textiles

Source: F2F Analysis

Table 1 shows the probable products where India can take up a significant chunk of China’s exports to the US. Both India and China highly compete in these products. India, despite its dominance in cotton production, faces steep competition from China in toilet and kitchen linen, and cotton bed linen. However, India would have the opportunity to do well in the man-made fibre bedlinen category if the US imposes high tariffs on Chinese home textiles. India has the ability to capture an additional 30 share of China’s loss in home textiles sector.

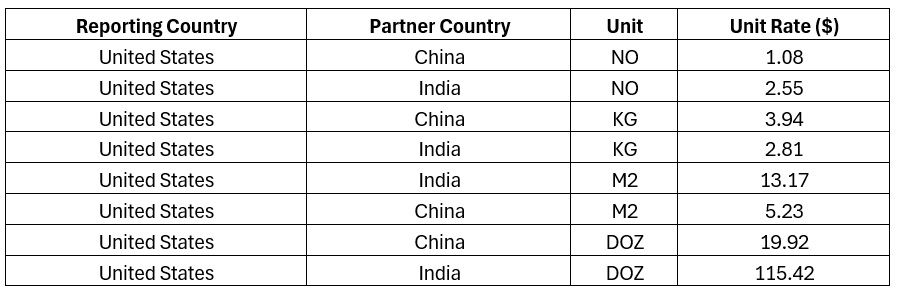

Table 2: China and India’s unit rates in CY 2024 (in $)

Source: TexPro, F2F Analysis

India has comparatively higher unit rate numbers currently than China when exporting to the US. This could be due to China’s continuous efforts to depreciate the yuan. China would continue depreciating the currency now that Trump is back in power. The Indian exports, on the other hand, suffer from high importing prices. India is not able to sell at higher prices due to its inability to produce at the economies of scale on which China currently operates.

How can India benefit from the upcoming tariff increase?

India has held a prominent position in supplying home textiles to the US. However, to utilise fully the gap that will be left by the Chinese home textile products, India will have to take the following steps to boost its exports:

Involve China in the supply chain: India’s intermediate products have higher prices compared to China, making it difficult for finished goods manufacturers of home textiles to sell at lower prices. China would now concentrate on other bigger markets, including India, where demand is abundant. India needs to make use of this by reducing its Quality Control Orders (QCOs) on certain intermediate products which might be of use in home textile production.

Develop man-made fibre capabilities: India’s dominance of cotton products can be harmful in the long-term. Given China’s thriving man-made fibre-based home textile market, India has now the ability to concentrate on its MMF sector. The PLI scheme, in particular, would be beneficial for upgrading the MMF sector.

Invest more in infrastructural projects: India’s higher priced products could also be courtesy of its lack of affordable freight costs and sensitivity due to global disruptions. India saw an increase in its freight rates by 70 per cent across all its ports due to distressed geopolitical situations around the world. To reach the US faster and enhance trade routes, India should invest in direct maritime routes through the Suez Canal, strengthening port infrastructure at key hubs like Jawaharlal Nehru Port (Mumbai) and Chennai for quicker cargo handling. Establishing more direct air cargo flights between major Indian airports (Mumbai, Delhi, Bengaluru) and US destinations (like Los Angeles and New York) would cut transit time.

In conclusion, India has a significant opportunity to capture a larger share of the US home textiles market, especially with the impending tariff increases on Chinese products. By leveraging its strengths in cotton-based products, focusing on expanding its man-made fibre sector, and improving logistical infrastructure, India can position itself to benefit from China’s potential loss in market share. However, it will be crucial for India to enhance its supply chain and competitive pricing strategies to fully capitalise.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!