Employment was the only positive indicator in August, with jobs growth continuing at a historically solid rate.

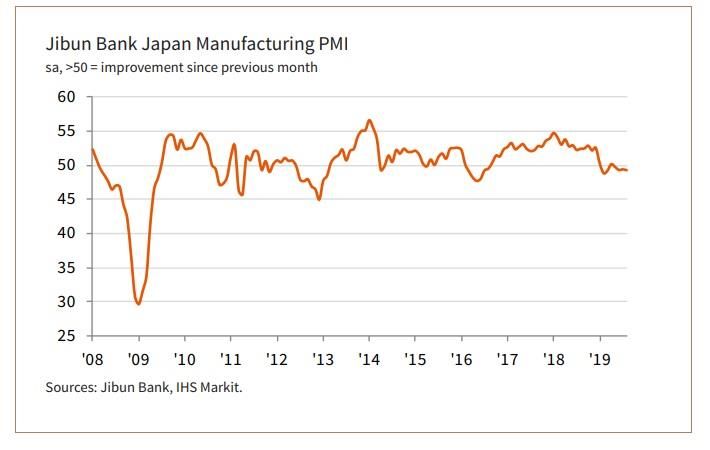

Meanwhile, the headline Jibun Bank Japan Manufacturing Purchasing Managers’ Index (PMI) – a composite single-figure indicator of manufacturing performance – was little-changed from July, recording 49.3 (49.4 previously). This was consistent with a contraction in the manufacturing economy and was among the strongest declines seen across the past three years.

Continuing the trend which has been apparent since the turn of the year, new business placed with Japanese manufacturers fell in August. The reduction gathered pace since July and was the fastest in five months. Slower demand was attributed to tougher conditions in both domestic and overseas markets. Panellists also mentioned China as a particular source of weakness, with survey data showing reduced inflows of new export orders, Jibun Bank said.

"Challenging conditions also led companies to reduce purchasing activity in August, although supplier delivery times continued to lengthen despite a diminished appetite for inputs. Japanese manufacturers also looked to keep stock levels lean, with both pre- and post-production inventories being depleted during the latest survey period," the report added.

"Japanese goods producers continued to signal difficult conditions during August, reflecting the broader regional tone within the APAC manufacturing economy. The headline index was among the lowest seen across the past three years," Joe Hayes, economist at IHS Markit, said.

"Meanwhile, the escalation of tensions with Korea merely adds extra downside risk to an already fragile environment. August data showed a ninth straight month-on-month fall in export sales, while the domestic market was similarly weak. As such, firms were wary towards the manufacturing sector outlook, cautious of the role the consumption tax hike will play, in addition to the drop-off of Olympic Games-related demand ahead of Tokyo 2020.

"With external and domestic headwinds aplenty, it is difficult to envisage any near-term improvements in Japan's manufacturing sector," Hayes added. (RKS)

ALCHEMPro News Desk – India

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!