The Cambodian textile industry exemplifies early industrialisation, relying on relatively simple machinery and abundant, inexpensive labour to drive its growth. Many developing nations have embarked on their industrialisation journeys through the expansion of local textile industries and their exports to partner countries. Cambodia's textile story began in the 1990s, fuelled by an influx of foreign investment. Investors are drawn to Cambodia for its low labour costs, preferential market access—including duty and quota-free entry to the US and EU markets—its proximity to ASEAN markets, and its closeness to key sources of foreign direct investment in garments, such as Hong Kong, Indonesia, Malaysia, Singapore, and Taiwan.

Cambodia's FDI focus: Dominance of the textile and garment Sector

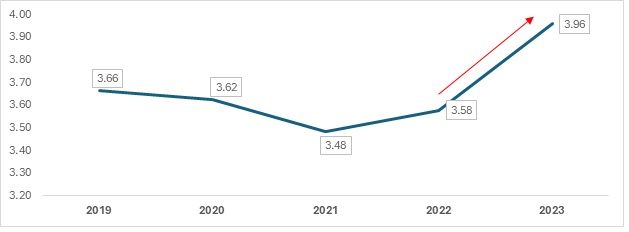

Exhibit 1: Cambodia’s foreign direct investment (in $ mn)

Source: World Bank, F2F Analysis

From 2019 to 2023, Cambodia's foreign direct investment (FDI) data reflect a consistent emphasis on the textile sector, which has become a cornerstone of the country's economic development. Total FDI figures have ranged from $3.48 to $3.96 billion, while textile FDI specifically has remained robust, ranging from $2.26 to $2.57 billion during this period. This translates to a total FDI growth rate of approximately 8.16 per cent over the four years, while textile FDI experienced a growth rate of about 13.73 per cent. These figures demonstrate that textiles account for a significant portion of overall FDI, underscoring the sector's vital role in attracting foreign investment. The stability in these numbers indicates a competitive environment, with foreign investors drawn to Cambodia's advantages such as low labour costs and favourable trade agreements.

Cambodia’s advantage in wages, ease of doing business, and trade agreements

Cambodia has emerged as a competitive player in the textile and apparel sector, benefitting from competitive wages, although its wages are higher than those in Bangladesh and Vietnam. However, Bangladesh's ongoing political and economic instability is likely to impact its production capabilities. The country's low minimum wages have faced significant criticism, leading to protests against the Hasina government. Despite recent uprisings aimed at improving working conditions, European standards demand ethically produced textiles and garments. This presents an opportunity for Cambodia to position itself as a more viable alternative in the Southeast Asian market.

In terms of the business environment, Cambodia ranks 144th in ease of doing business, significantly better than Bangladesh's ranking of 168th. Vietnam outperforms both, holding the 70th position among 199 countries. Cambodia's attractive policies for foreign textile companies, such as the exemption from the prepayment of taxes for private investors, facilitate its integration into the Global Value Chain. These measures not only enhance employment opportunities but also attract renewed investment in the sector.

Trade agreements further bolster Cambodia's position, particularly through the Everything But Arms (EBA) agreement, which allows access to the European market. However, Bangladesh remains a competitive exporter. The EU has raised concerns in its assessment report on the Generalised Scheme of Preferences (GSP) covering the period 2020-2022, indicating that preferences could be withdrawn from any GSP beneficiaries found to be systematically violating core human and labour rights conventions. Cambodia has previously faced a temporary removal of GSP benefits due to human rights issues and continues to experience a partial withdrawal of EBA benefits. Cambodia's transition out of its least developed country (LDC) status has opened the door to explore the GSP+ option offered by European countries, further enhancing its prospects in the global textile market.

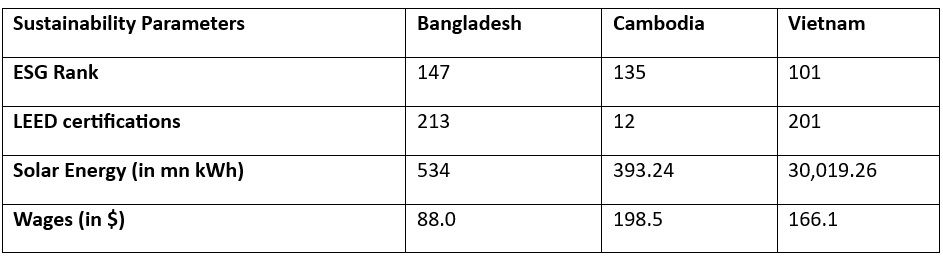

Table 1: Sustainability paraments for Bangladesh, Cambodia and Vietnam (in 2023)

Source: GBIG, TexPro, F2F Analysis

The data highlight significant disparities in environmental performance among Bangladesh, Cambodia, and Vietnam. Despite Bangladesh ranking lowest in ESG (Environmental, Social, and Governance) at 147, it leads in LEED certifications with 213, suggesting a commitment to sustainable building practices. Cambodia, with an ESG rank of 135 and only 12 LEED certifications, may be facing challenges in integrating sustainability into its development. Conversely, Vietnam, ranking highest at 101, shows robust solar energy production at over 30,000 million kWh, indicating a strong commitment to renewable energy. Cambodia’s higher wages compared to Bangladesh and Vietnam suggest better salaries for its working population. This indicates that Cambodia is committed to not only increasing its production and trade capabilities but also maintaining the well-being of its workforce.

Which segments does Cambodia lead in?

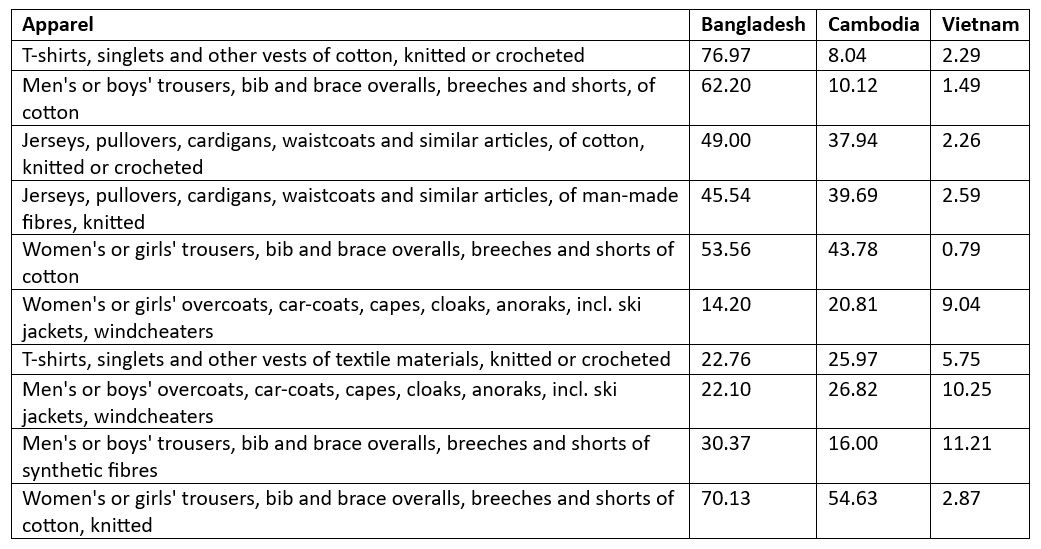

Table 2: Revealed Comparative Advantage of the top 10 most imported apparel products from EU 27 (for Bangladesh, Cambodia, and Vietnam)

Source: TexPro, F2F Analysis

Bangladesh, Cambodia, and Vietnam are prominent players in the global apparel industry, each excelling in different product categories. Bangladesh holds a commanding lead in key cotton-based garments, such as T-shirts, singlets, and other vests of cotton (76.97), and women’s or girls' trousers of cotton (non-knitted) (70.13), underscoring its dominance in cotton garment exports. Vietnam shows competitiveness across various categories, though its presence in cotton-based products is relatively modest compared to Bangladesh.

Cambodia, while smaller in overall export volume, stands out in man-made fibres and synthetic textiles, revealing a unique specialisation. It holds a high Revealed Comparative Advantage (RCA) in women’s or girls’ trousers, bib and brace overalls of cotton (non-knitted) (43.78), and jerseys, pullovers, cardigans, and waistcoats of man-made fibres (39.69), surpassing both Bangladesh and Vietnam, with Vietnam only at 2.59 in the latter category. Cambodia also exhibits a strong RCA in T-shirts, singlets, and other vests of textile materials (non-cotton) (25.97), and men’s or boys' overcoats, car-coats, anoraks, and windcheaters (26.82), outperforming its competitors. This indicates Cambodia’s growing expertise in non-cotton and synthetic fibre apparel, although it maintains some strength in cotton garments, allowing it to carve out a distinct niche compared to Bangladesh and Vietnam, which remain more focused on traditional cotton textiles.

Way forward

An overall analysis reveals that Cambodia ranks second to Bangladesh and Vietnam in several parameters. However, given Bangladesh’s weak position, Cambodia can step in and capture a major share of Bangladesh’s exports to the EU region, one of the biggest consumers of Southeast Asian apparel. Cambodia also has a comparative advantage in some products within the apparel category. Given Bangladesh’s and Vietnam’s reliance on cotton exports, Cambodia should focus on developing its man-made fibre (MMF) industry, due to its growing prominence in apparel made from MMF. Their increased openness to foreign investments through foreign firms will enhance their MMF production capabilities. Cambodian apparel is also more involved in cut-make-trim, which ranks low in the value-addition stages. Therefore, the country should focus on apparel products where it has a comparative advantage and work to bring in processes that allow for the production of these products from start to finish.

Cambodia should also aim to improve its sustainability rankings, given the importance of ethically produced apparel in the European region. Both Bangladesh and Vietnam fall short in some aspects of sustainability, and Cambodia can make improvements by collaborating with its foreign investors. The Industrial Transformation Map for the Textile and Apparel Industry (T&A ITM) 2023-2027 strategy, released in late March this year, serves as an important roadmap for the GFT sector to maintain competitiveness and ensure sustained growth.

However, there is a downside to having many foreign investments, with firms often choosing to employ workers from their own countries. Cambodia lacks a skilled workforce in the textile industry, and increased investment in workforce development will lead to greater economic and social benefits for the country. Cambodia’s open economy allows it to be part of the global supply value chain, but it should aim to become an integral part of this chain by developing its manufacturing capabilities.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!