China has been actively and assertively promoting its currency despite not having a fully open capital account. These efforts have proven successful thus far. Drawing on the lessons from Russia, where accounts were frozen following the Ukraine conflict, China is making strategic moves to decrease dependence on the US dollar by encouraging currency swaps globally. A significant step in this direction is to incorporate Saudi Arabia, one of the largest oil exporters, into the currency swap arrangement. This move aims to enhance the resilience of trade relationships and mitigate risks associated with the dominance of a single currency.

Currency swap agreements

China has inked currency swap agreements with almost 40 countries in the world – from every continent. The list of the countries ranges from the OECD countries like the UK and South Korea to economically struggling countries like Argentina, to vulnerable nations like Pakistan and Sri Lanka. The main purpose of signing a swap agreement is to protect the country and its transactions and trade from excessive fluctuations in the exchange rate which can affect the country’s capital account. With China not having opened its capital account to the world, it is promoting currency swap as an alternative to increase its footprint worldwide. In a currency swap, the countries involved agree to exchange national currencies at a mutually pre-determined exchange rate and at a future date, exchange the currencies at the same rate.

This month, the Saudi Central Bank and the People’s Bank of China have signed a bilateral currency swap agreement worth 50 billion yuan ($6.98 billion or 26 billion Saudi riyals). Valid for three years, the agreement can be renewed upon mutual consent, according to a statement issued by China’s central bank.

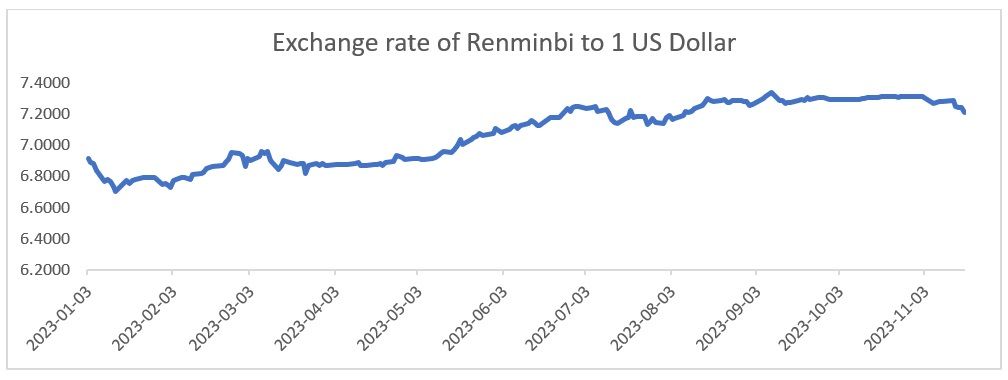

With China importing oil from Saudi Arabia at an increasing rate, it also brings into the picture the fluctuating rate of the US dollar and the recent policies that have made the US dollar stronger against the other currencies. The fluctuating dollar also means pressure on the importing country when it comes to oil with no stability in the same, thus affecting the current and capital account of the country. Having a currency swap agreement in place will lead to minimisation of the risk and enhanced trade between both countries. Although there are no terms mentioned in terms of the swap agreement, the deal is mainly meant to de-dollarise and make trade transactions easier.

Figure 1: Exchange rate of Chinese Yen to US Dollar

Source: Fred Economic Data

Swaps initiated at mutual interests

None of the swap deals can be initiated without the other country being interested as well. In the case of the China-Saudi Arabia deal, both have their vested interests in this kind of agreement. For China, the main purpose is to import oil from Saudi Arabia at a cheaper rate. For Saudi Arabia, it is to ensure that its economy is diversifying, and China can potentially help in expanding into sectors like technology, tourism, sports etc, which is much visible from the kind of investments done by the country. Although this may be possible by an increased FDI by China, how exactly will it affect trade is a question still left unanswered, due to the lack of enough documentation regarding the impact of such swap agreements on trade.

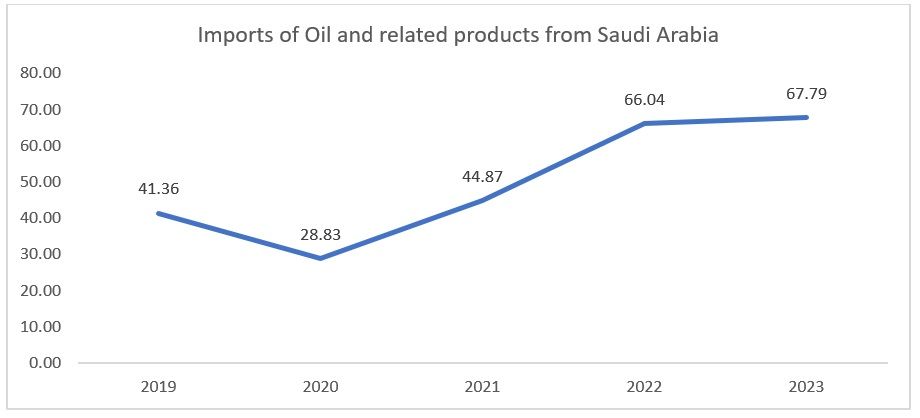

Figure 2: Oil Imports (value in $Mn) of China from Saudi Arabia

Source: ITC Trade Map

Swap currency, increase trade

There is a lack of empirical proof to demonstrate the effect of the currency swaps signed by the countries and the impact on bilateral trade. One research by the Hong Kong University mentions that the trade will triple after the signing of the swap agreements as the exchange rate risks are mitigated to a certain limit as dealing with each other native currency becomes an easier task than converting into dollars by both the countries involved in trade.

The trade between both the countries is also equivalently flourishing, thus making signing of such an agreement more realistic and a feasible option. For Saudi Arabia, China is the largest exporting partner for oil – with the exports to the country hitting an all-time high of $51.3 billion and imports at $3.14 billion. The textile trade may also get affected with Saudi Arabia trying to diversify its economy, thus giving China a greater access to the country’s markets.

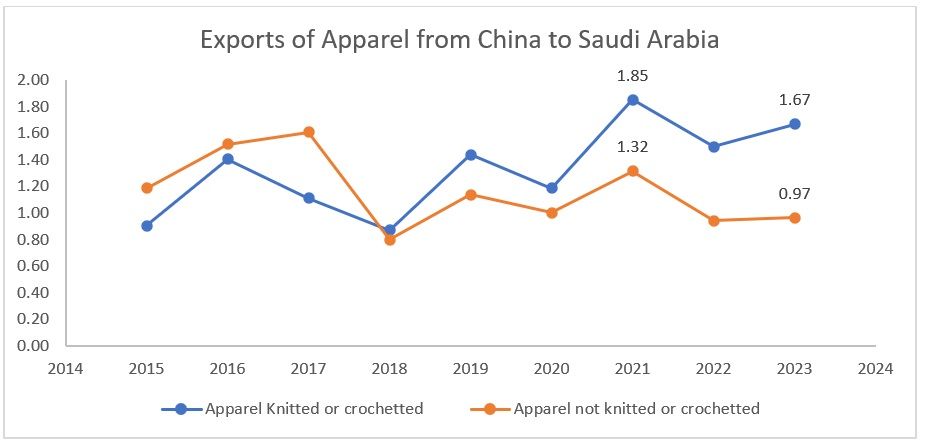

China’s top exports to Saudi Arabia are textiles and technology. In textiles, specifically apparel, is in the top 10 export items. With the signing of the currency swap agreement there will be an increase the investments by China as well as an increase in textile exports – as Saudi Arabia’s Vision 2030 does not include textiles as one of the major sectors, in effect giving more rise to imports. As shown in Figure 3, China’s textile exports to Saudi Arabia are expected to increase in the year 2023.

China is increasingly using bilateral swap as a medium for the expansion of its currency in the international markets. Chinese yuan is ranked as the most traded currency in the world, after the euro, due to the increasing preference for the currency owing to higher instability in the global markets. The US dollar became more volatile due to the decisions taken by the Federal Reserve. With hedging referred to as one of the safest methods to ensure that the transaction does not get affected by currency fluctuations, the swap agreements come across as a breather.

Figure 3: Exports of Apparel from China to Saudi Arabia (In $Mn)

Source: ITC Trade Map

Higher earnings through trade

In addition to finished garments, the trade in the raw materials required to produce textiles may also become cheaper as China sources raw materials for the production of different textile products. Australia and Pakistan are some of the countries that export raw materials to China to produce textiles, and China has a swap agreement with both these countries, which will ensure not only a boost in trade but also a reduction in the cost of the transactions required. China also has an FTA with Australia which will further help to boost the trade.

Based on the research published in the Munich Personal Repository Archive, it is suggested that currency swaps can potentially triple trade for the counterparty involved in the agreement. According to Fibre2Fashion analysis, it is anticipated that trade in the apparel sector is expected to experience a modest uptick of two per cent in the short run.

Currency swap agreements augment the supply of foreign currency within the country, thereby alleviating costs and reducing the overall expense of goods. Many export-oriented companies opt to hedge their earnings as a protective measure against external risks. Having an official agreement for currency swaps ensures a consistent supply of foreign currency into the market, facilitated by the central banks of the respective countries. This, in turn, is poised to stimulate an upswing in apparel trade for both nations.

ALCHEMPro News Desk (MI WE)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!