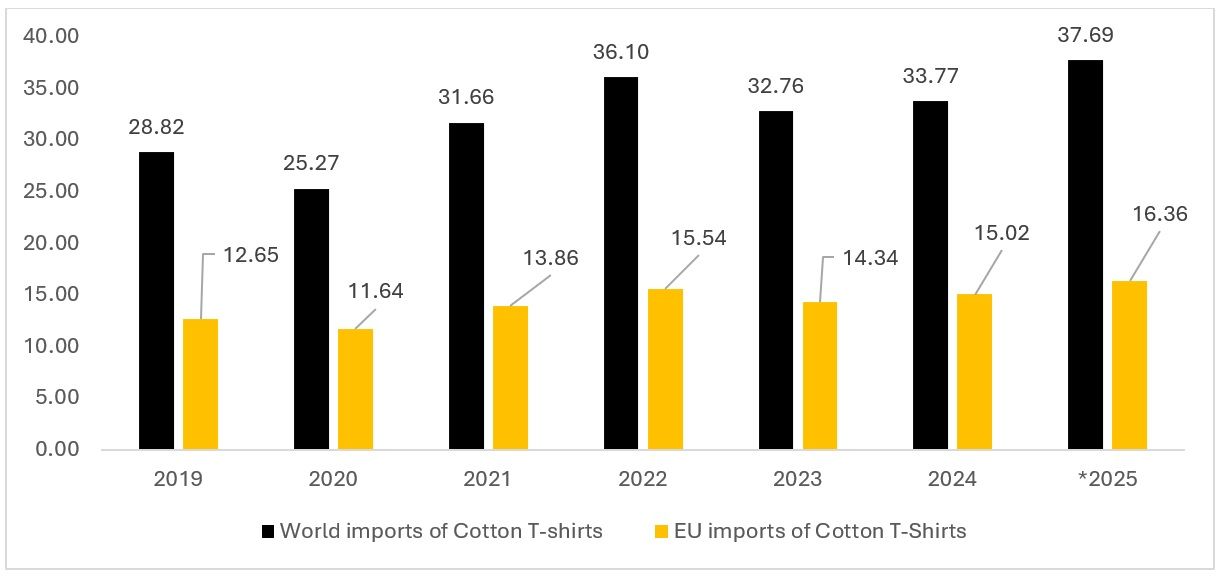

The EU’s import of cotton T-shirts over the years

Exhibit 1: World imports and EU imports for cotton T-shirts (2019-2025) (in $ bn)

Source: TexPro, F2F Analysis

*Please note that the values for CY 2025 are projected.

Between 2019 and 2025, EU imports of cotton T-shirts grew steadily from $12.65 billion to $16.36 billion, reflecting a 5 per cent increase. Despite global disruptions such as the COVID-19 pandemic, which caused a dip in 2020, the EU market demonstrated strong resilience and consistent growth. The EU’s share of global imports remained relatively stable, fluctuating between 43 per cent and 46 per cent, indicating that the region continues to hold a significant portion of global cotton T-shirt demand. While global imports also increased by 6 per cent during the same period, the EU maintained its position as a key market, showing that it remains mature yet still expanding. This trend suggests ongoing opportunities for exporters, especially those aligning with EU standards and consumer preferences.

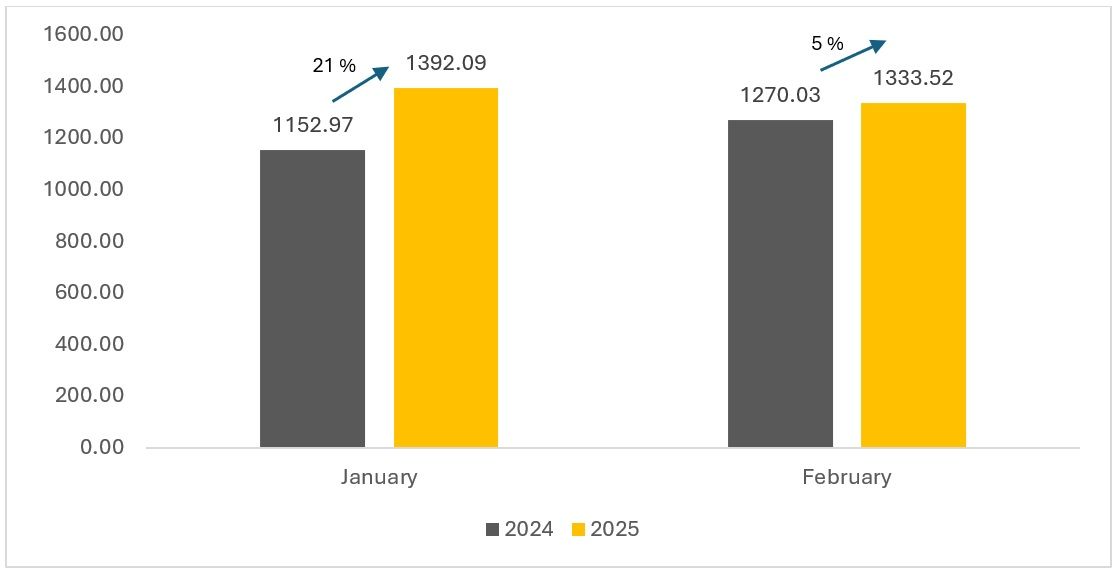

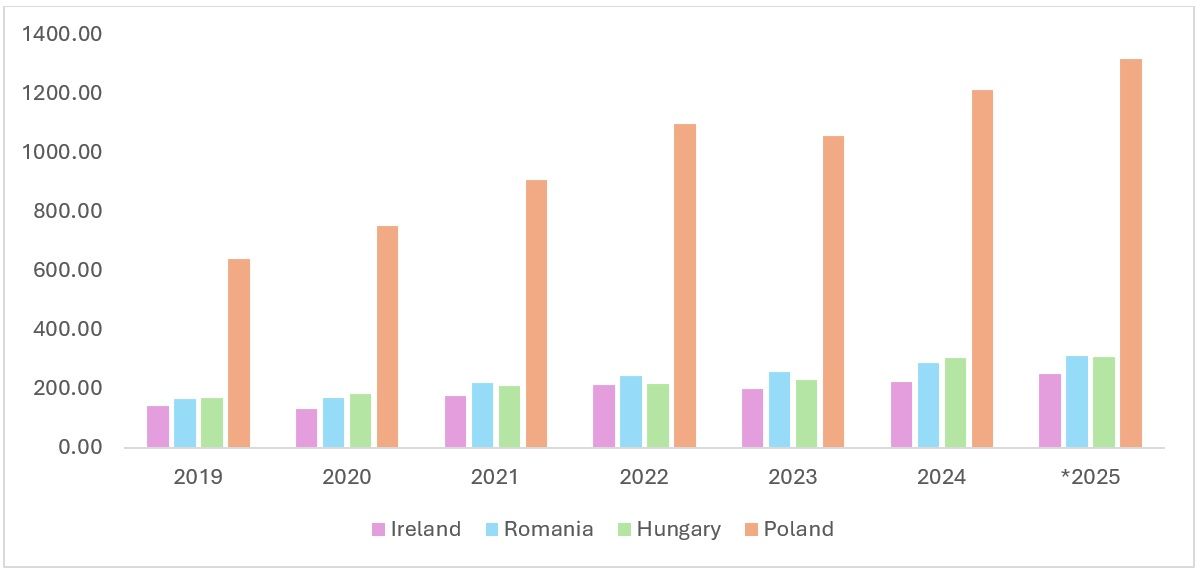

Exhibit 2: Cotton T-Shirts Imports of EU in January and February 2025 (in $ Mn)

Source: TexPro, F2F Analysis

The above data for January and February 2025 show a positive surge in the imported values from the same months in 2024. January 2025 saw an uptick of 21 per cent in comparison to the same month in 2024, and February 2025 saw an increase of 5 per cent year-on-year. This is in line with the forecast of $ 16.36 billion in 2025. For the EU, the consumer sentiment towards discretionary items also seems to be on a positive trend, given the lowering expected inflation rate.

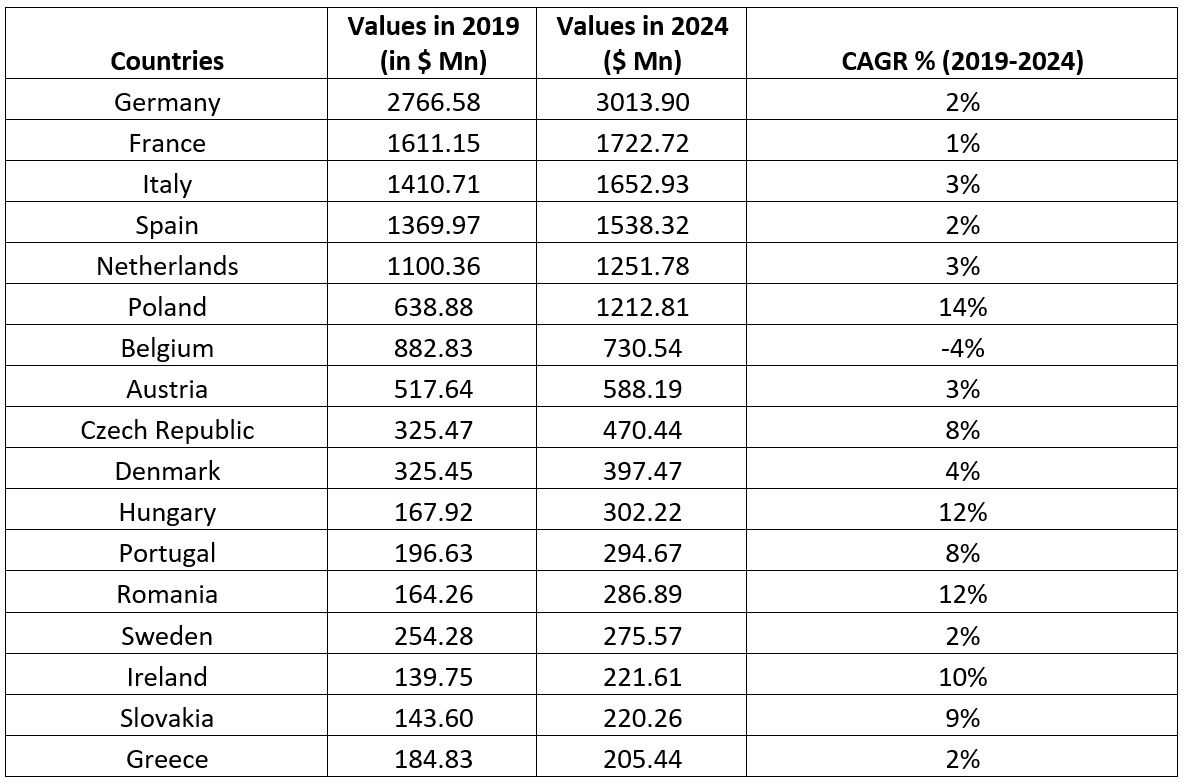

Table 1: Top Cotton T-shirt importing countries within EU

Source: TexPro, F2F Analysis

Poland, Hungary, Romania, and Ireland have continually shown an increasing demand for cotton T-shirts. Cotton T-shirt exporters should focus on countries such as Poland that will act as a distribution hub for Eastern Europe in the coming years. Poland is one of the six largest importers of apparel, which makes up approximately 73 per cent of the apparel market of Europe. Its sizeable demand for apparel along with being a leader in the Eastern region, would catapult Poland to being a major EU country to focus on for cotton T-shirts.

Both Ireland and Romania have shown immense growth in the last decade, with growth rates as high as 117 per cent and 85 per cent, respectively. Ireland’s economy climbed to $564 billion from $259 billion in 2014. Romania now features in one of the top 10 growing economies, with GDP worth $370 billion, growing from $200 billion in 2014.

These markets are expected to lead the European region, offering emerging economies to diversify their exports from traditional markets such as Germany, France, and Italy, which are now experiencing a plateaued growth.

Table 2: EU Major exporters of cotton T-Shirts to EU and their CAGR (in %)

Source: TexPro, F2F Analysis

The EU imports approximately 44 per cent of its apparel and textile needs from the emerging markets economy. This reflects in the developing countries’ export values of cotton T-shirts to the EU countries. Although the top 3 exporting countries have shown healthy growth in the T-shirt category section, countries such as Poland, Vietnam, Pakistan, Egypt, and the Czech Republic have shown a growth rate of 10 per cent or more. The EU seems to be pushing more towards EU member countries due to proximity and lower trade costs, courtesy zero tariff rates. However, Vietnam’s high manufacturing capabilities at lower costs and Pakistan and Egypt’s natural advantage in abundant cotton are what would lead to the three countries being frontrunners in the export of cotton T-shirts.

Countries that need to concentrate on improving their production values

India: Despite being the 4th largest exporter of cotton T-shirts to the European Union, India has seen a decline of 2 per cent in the past 5 years for its cotton T-shirts. India is the world’s largest producer of cotton, cultivating all Gossypium hirsutum. Upland cotton is the most widely grown, accounting for approximately 94 per cent of India’s hybrid cotton production, which includes all current Bt. cotton hybrids. Upland cotton is widely used for T-shirt production, and India should leverage this in order to increase its cotton T-shirt production values. With the India-EU FTA in talks, India should focus on shifting to the sustainable production of cotton T-shirts for easier access to zero per cent tariff rates.

China: China has continually come under threat for its usage of Xinjiang cotton, with EU taking action against products made from forced labour. China has also seen a decline in its overall apparel export values over the years, indicating a shift from the textile sector to other industries. China’s decline could lead to countries such as Bangladesh and Vietnam filling the gap in the cost-effective cotton T-shirt category.

Cambodia: Cambodia has had a good hold on the EU region for apparel exports, and with the onset of Trump’s proposed high tariffs on Cambodia, the country should look to strengthen its exports to the EU region. With Cambodia’s LDC status set to come to an end, the country will have to increase its production capacity to compete with countries such as China and Bangladesh.

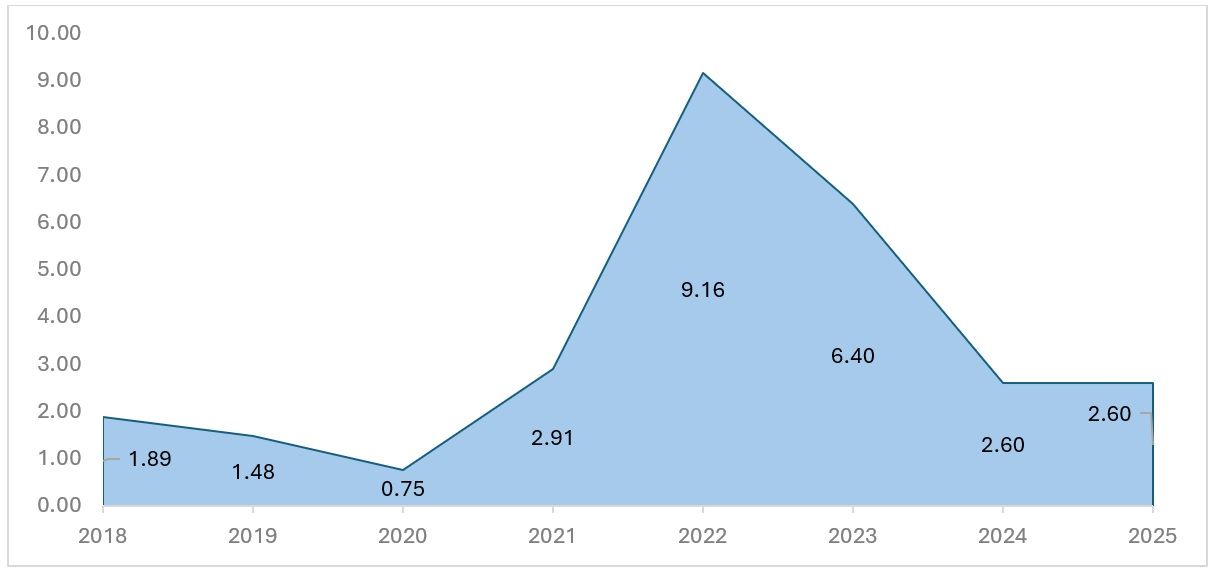

Exhibit 3: EU’s Harmonized Index of Consumer Prices (HICP) Over the Years (2018-2025)

Source: Eurostat, F2F Analysis

*Please note that the numbers are an average of the monthly data for that particular year. For 2025, data has been released for January to April.

The above is data for the Harmonized Index of Consumer Prices (HICP), which shows the annual rate of change of prices. In 2022, the HICP peaked at 9.16 on average, indicating an increase in prices and consequently inflation. According to CBI reports, the European Union spent 4.3 per cent on clothing and footwear compared to 4.7 per cent in 2018, when the price levels were lower. The current scenario is showing stable inflation, good for growth, along with lower prices. With current levels at 2.60 per cent, expected consumer spending on clothing and footwear would be around 4.6 per cent. This is good news for the exports of cotton T-shirts to the EU market, which now seems to be opening up to spending on discretionary items such as apparel.

Exhibit 4: Top emerging economies with increasing demand for cotton T-shirts (in $ Mn)

Source: TexPro, F2F Analysis

Between 2024 and 2025, imports of cotton T-shirts are projected to increase across Ireland, Romania, Hungary, and Poland, reflecting continued growth in demand. Ireland is expected to see the highest year-on-year growth at 12.7 per cent, rising from $221.61 million to $249.82 million, suggesting strong market recovery or rising consumer demand. Romania and Poland also show healthy increases of 8.6 per cent and 8.7 per cent respectively, with Poland remaining the largest importer by far, projected to reach $1.32 billion in 2025. Hungary, however, shows signs of market saturation or a slowdown, with a modest 1.2 per cent growth from $302.22 million to $305.98 million.

The EU cotton T-shirt market continues to grow steadily, driven by stable inflation, rising consumer spending, and increased import values. Emerging markets like Poland, Romania, and Ireland present strong opportunities for exporters due to their rapid growth. India, despite its cotton advantage, must enhance its sustainable production and leverage upcoming trade agreements. As traditional players like China decline, space is opening for cost-effective producers like Vietnam, Bangladesh, and Egypt to expand their market share.

Summary and Conclusion

The European Union remains a dominant and expanding market for cotton T-shirts, showing resilience and growth despite global disruptions. With cotton T-shirt imports projected to reach $16.36 billion in 2025, the EU continues to present a significant opportunity for exporters worldwide. The region’s stable share of global imports (43–46 per cent) reflects its maturity, while rising demand in emerging EU economies such as Poland, Ireland, and Romania signals diversification and market expansion.

Poland’s emergence as both a leading importer and a regional distribution hub, alongside Ireland and Romania’s double-digit growth trajectories, point to shifting consumption patterns and new strategic focal points for exporters. These countries are expected to play an increasingly critical role in the EU’s cotton apparel ecosystem.

From a supply-side perspective, countries like Bangladesh, Vietnam, and Pakistan are well-positioned to capture a larger share of this growing demand due to competitive costs and increasing alignment with EU preferences for sustainable and traceable sourcing. In contrast, India’s declining export CAGR (-2%), despite its cotton production advantage, underscores the urgent need for modernisation, sustainability adoption, and leveraging of ongoing India-EU FTA negotiations.

Meanwhile, China’s decline, driven by reputational concerns and trade restrictions, creates space for others to gain market share, especially those offering ethical, transparent, and eco-friendly manufacturing practices. With consumer inflation stabilising (HICP at 2.6 per cent in early 2025), discretionary spending is expected to rise, further supporting apparel imports.

In summary, the EU cotton T-shirt market is entering a new phase of growth, defined by evolving consumer behaviour, sustainability-driven sourcing, and geopolitical trade realignments. Exporters that adapt to these dynamics, particularly by focusing on value-added, ethical, and cost-effective production, will be best placed to thrive in this competitive and lucrative market.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!