Turkiye's export competitiveness has significantly declined, particularly in labour-intensive sectors, due to high inflation and a depreciated Turkish lira. Soaring inflation has raised production costs, while the lira's weakness has made Turkish goods more expensive internationally, challenging exporters to maintain market share and profitability. The sharp rise in inflation has posed significant challenges for Turkish businesses, including apparel exporters, by inflating production costs and complicating pricing strategies in international markets.

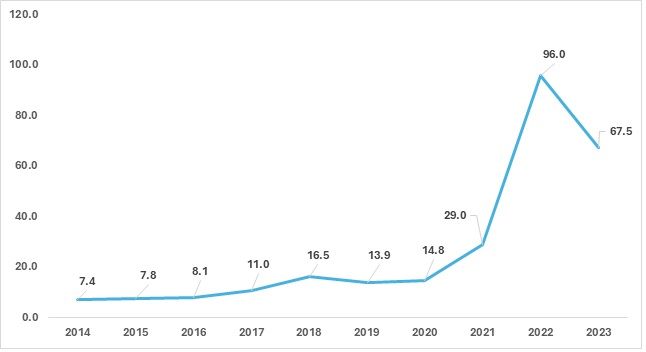

Exhibit 1: Inflation, GDP deflator (annual %) of Turkiye

Source: World Development Indicators

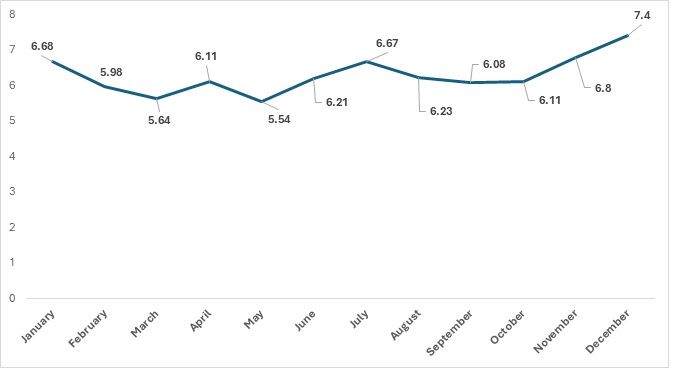

Exhibit 2: Unit rate for apparel exports in number of pieces from Turkiye in CY 2023 (in $)

Source: TexPro, F2F Analysis

In CY 2023, Turkiye’s unit rates experienced several fluctuations across the 12 months. The unit rate is a valuable metric for gauging a country’s product competitiveness in the global market. Turkiye has consistently maintained unit rates much higher than those of its competitors—China, Bangladesh, and Vietnam—in the apparel sector.

Turkiye faces two major challenges: competitors like China, Bangladesh, and Vietnam export at lower prices, while European competitors such as Spain and Italy produce ethical and high-quality products. As a result, Turkiye finds itself at a disadvantage in both categories.

By the end of CY 2023, Turkiye’s unit rates concluded on a dismal note, with the cost per piece reaching a staggering $7.4. Higher unit rates reduce Turkiye’s global competitiveness in apparel exports, making it a less favourable country to export from for both brands and consumers. The increase in unit prices also reflects Turkiye's rising intermediate goods costs, which are contributing to the higher selling price of its apparel products.

Turkiye’s apparel exports

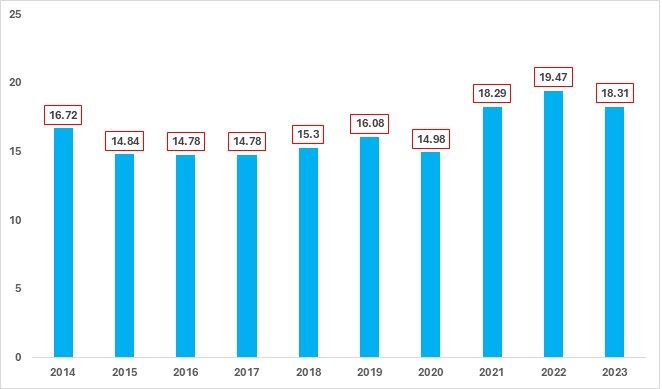

Exhibit 3: Turkiye’s apparel exports to the world (in $ bn)

Source: TexPro, F2F Analysis

The export values of Turkiye's apparel industry from 2014 to 2023, since Erdogan's government came into power, reveal a dynamic landscape marked by fluctuations and notable trends. Starting at $16.72 billion in 2014, the sector experienced a decline over the next few years, reaching a low of $14.78 billion in both 2016 and 2017. This drop in apparel exports could be attributed to the new government's approach to monetary and fiscal policies.

However, the market showed signs of recovery in 2018, with exports increasing to $15.3 billion. The growth in apparel exports during CY 2021 and 2022 was likely driven by pent-up demand and the reopening of several European markets, which are key consumers of Turkish apparel and garments. European markets also found it easier to ship from Turkiye due to lower trade costs and fewer import restrictions, prompting them to avoid Asian exporting countries.

This upward trajectory gained momentum, peaking at $19.47 billion in 2022, reflecting strong demand and competitive positioning in the global market. The following year, 2023, saw a slight decrease to $18.31 billion, suggesting a potential market stabilisation after the significant growth of the preceding years. However, domestic inflation, along with falling shipping costs, is expected to lead to a further dip in exports in the future.

In addition, Turkiye has maintained a consistent 3.6 per cent share in the global apparel market, unlike Bangladesh, Vietnam, and even European nations such as Italy and Germany, which have been able to increase their percentage share in global apparel exports in CY 2023 compared to CY 2014.

Textile firms have urged the government to suspend debt payments and initiate bankruptcy proceedings in order to remain operational. This strain on companies has had broader economic consequences, including delayed payments and increased joblessness. Economists warn that the government's aggressive measures to control inflation are likely to lead to higher unemployment and more bankruptcies, presenting a significant dilemma.

Moreover, gas and electricity prices for small to mid-scale manufacturers have surged dramatically since 2021, contributing to production costs that are now nearly 40 per cent higher than those in competing Asian countries. Exporters point to these rising costs, along with financing barriers and reduced working capital, as major challenges impacting their operations.

Who is set to gain – Asian Giants vs European Underdogs

Turkiye has traditionally maintained a strong position in the global apparel industry, but recent inflation has led to the closure of several garment factories due to rising intermediate costs. As a major exporter to European countries such as Germany, Spain, the Netherlands, the UK, and France, Turkiye has also been a key sourcing partner for fast fashion giants like Zara, H&M, and Mango. Turkiye’s prominence in the European market is partly due to its geographical proximity, which reduces sea-route and trade travel costs.

However, the Turkish garment industry is currently facing significant challenges, including high bankruptcy rates and a depreciating lira, which has driven up oil and diesel costs. This situation places Turkiye at a disadvantage for business operations in the apparel sector.

As a result, other textile giants like China, Vietnam, and Bangladesh are poised to capture orders that were previously directed to Turkiye. Despite facing economic and political challenges that hinder its apparel industry growth, Bangladesh remains a strong competitor. China and Vietnam, though geographically farther from Europe, have established themselves due to their cost-effectiveness and high production capacities.

In addition to these traditional competitors, Turkiye is now facing competition from other exporting nations. Italy (ranked 5th) is gaining ground in Germany, Cambodia (4th) in Spain, and Belgium (5th) in the Netherlands. Italy and Belgium benefit from lower trade costs and fewer regulatory barriers, owing to their European Union membership.

The following analysis will provide insights into which products might shift to these emerging competitors as they gain ground in Turkiye’s top three European apparel markets.

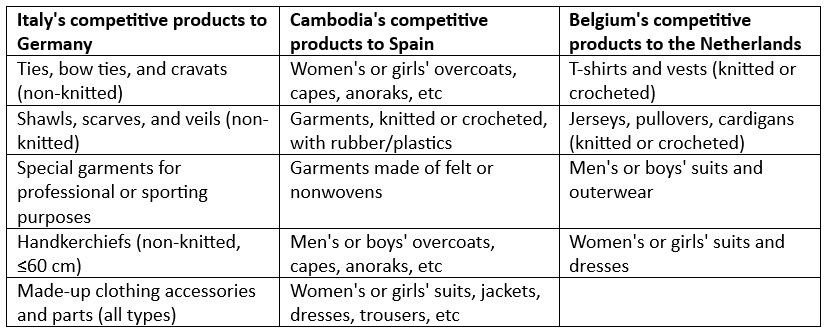

Table 1: Turkiye’s competitors in its top 3 importing markets (Germany, Spain & the Netherlands)

Source: F2F Analysis

The table above provides an analysis of the Revealed Comparative Advantage (RCA) for all 4-digit HS codes related to apparel. This analysis highlights the RCA of individual competitors in the top three importing countries for apparel from Turkiye.

It is observed that Italy holds a competitive advantage in niche products within Germany. This can be attributed to Italy’s expertise in luxurious, high-quality clothing with unique styling. Cambodia has rapidly emerged as a sourcing destination for several brands and countries due to its cost-effectiveness and lower labour costs.

The apparel industry is one of Belgium’s largest sectors. Belgium's trade routes are highly robust and efficiently managed, reflecting its strategic location at the heart of Europe. The country boasts a well-developed infrastructure, including major ports like Antwerp, which is one of the largest and busiest ports in Europe. Belgium's extensive network of highways, railways, and inland waterways enables smooth transportation of goods both within Europe and internationally.

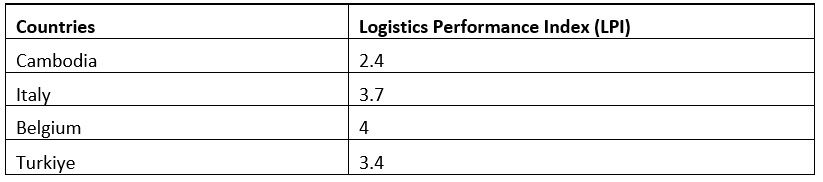

Table 2: Logistics Performance Index of Cambodia, Italy, Belgium and Turkiye for CY 2023

Source: World Bank

The Logistics Performance Index (LPI) scores reveal significant variations in logistics performance among the listed countries. Belgium leads with a score of 4, indicating excellent logistics infrastructure and efficiency. This high score reflects Belgium’s strong logistical capabilities, including its well-managed ports and advanced transport networks. Italy follows with a score of 3.7, indicating good performance but with some room for improvement compared to Belgium.

Turkiye scores 3.4, suggesting a solid but less efficient logistics system in comparison to Italy. Cambodia, with a score of 2.4, faces considerable challenges, reflecting its relatively weaker logistics performance. The lower score for Cambodia highlights issues such as infrastructure deficiencies and less effective supply chain management compared to the other countries.

Turkiye could face serious competition in exports from both Italy and Belgium, particularly in terms of logistics efficiency and international garment shipments.

Future outlook

Turkiye should first focus on reducing its economic crisis by controlling inflation and stabilising the Turkish lira. To address the low exchange rate of the lira against the US dollar, Turkiye should adopt a multifaceted approach involving monetary, fiscal, and structural reforms. Raising interest rates could attract foreign capital and bolster the lira, while controlling inflation through tighter monetary policies is essential for currency stabilisation. Increasing foreign exchange reserves and managing them effectively can instil market confidence, while maintaining fiscal discipline by reducing budget deficits will enhance overall economic stability.

Structural reforms, such as diversifying the economy, investing in productivity, and ensuring political stability, can further support the currency. Engaging with international financial institutions for additional support and expertise may also be beneficial. By addressing these areas, Turkiye can strengthen its currency and improve economic resilience.

In addition, Turkiye could explore markets with lower intermediate costs to benefit the apparel sector, which has been hit by the economic crisis. Turkiye’s increased dependency on the EU market, which currently faces lower overall demand, urges the country to seek new potential markets, particularly in the Middle East and West Asia, where it shares close proximity.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!