Fibre2Fashion analyses the economic, logistical, and geopolitical impacts of this directive, especially concerning the textile trade between India and Bangladesh. With the Petrapole land port—previously handling over 75 per cent of Bangladesh’s garment exports to India—rendered inaccessible, this policy shift has the potential to disrupt established trade flows, increase costs, and strain bilateral relations.

Policy overview

India has restricted imports from Bangladesh to only two seaports—Nhava Sheva and Kolkata. The affected goods include ready-made garments (RMG), processed foods and beverages, plastic/PVC finished products, wooden furniture, and cotton waste. However, exemptions apply to goods transiting to Nepal and Bhutan, as well as to imports of fish, LPG, edible oil, and crushed stone.

India-Bangladesh apparel trade overview

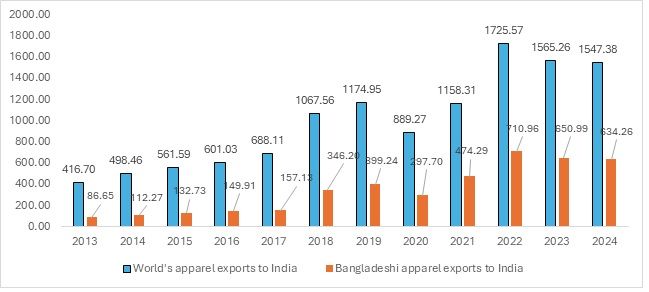

Exhibit 1: India’s apparel imports from Bangladesh and the world (in $ mn)

Source: TexPro

India’s imports of apparel from the world have grown significantly over the past decade. In 2013, India imported about $86 million worth of apparel. By 2024, this figure had risen to over $634 million, indicating a strong demand for imported clothing in India. Apparel now constitutes a larger share of India's total imports than it did previously.

Bangladesh has emerged as the top supplier of apparel to India. This is likely due to a combination of factors, including lower prices, the SAFTA trade agreement, geographical proximity—which allows Bangladeshi garments to enter at zero per cent tariff rates—and Bangladesh’s robust garment manufacturing industry, which has benefitted from consistent subsidies and low labour costs.

Bangladesh currently ranks first in apparel exports to India. With the newly imposed restrictions, Indian apparel manufacturers may benefit from increased demand, while new opportunities could also open up for suppliers from countries such as China, Spain, and Vietnam.

In FY 2024–25, bilateral trade between India and Bangladesh is estimated at $18.2 billion, with Bangladesh exporting around $2.5 billion worth of goods to India. Key export items include ready-made garments (RMG), processed foods, plastic products, and wooden furniture.

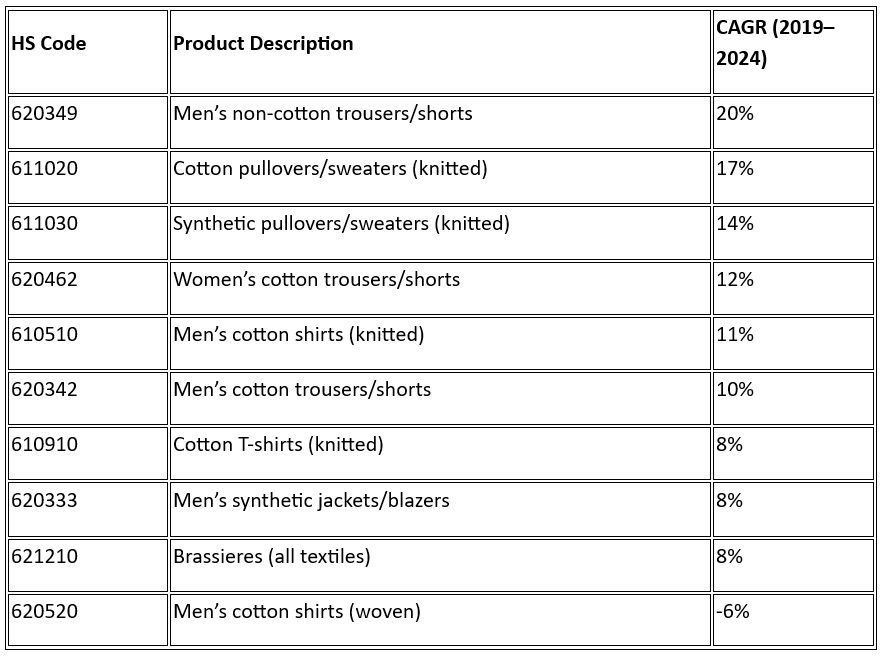

Table 1: India’s top apparel imports from Bangladesh

Source: TexPro, F2F Analysis

India has seen growth in the top 10 apparel items exported from Bangladesh. Except for cotton shirts, other products have taken up a significant share in the Indian market. With the onset of the restrictions, Indian apparel producers will concentrate on filling the gap left by cost-effective Bangladeshi apparel. India’s top imports from Bangladesh are mainly cotton products of the woven category, where India has an advantage owing to vertical integration and an abundance of cotton products.

Role of land ports and impact of restrictions

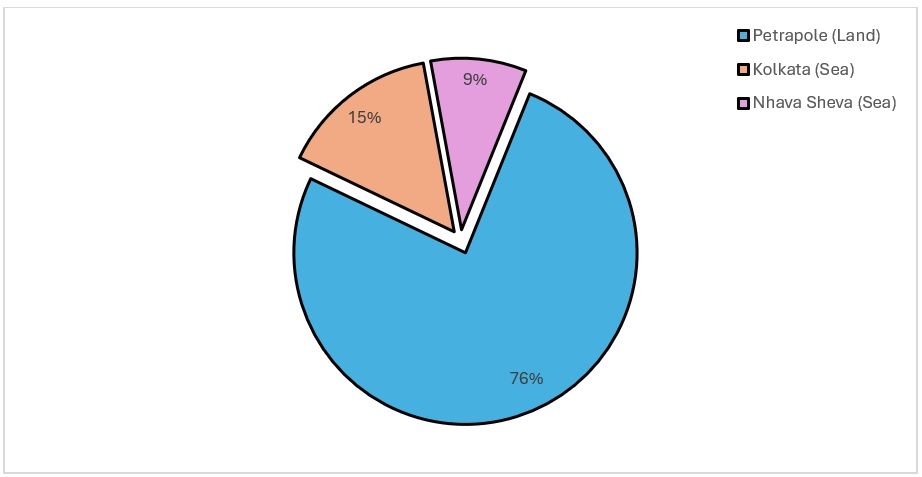

The Petrapole land port, situated on the India–Bangladesh border in West Bengal, is the largest land port in South Asia and a critical hub for cross-border trade. It handles approximately 76 per cent of Bangladesh’s ready-made garment (RMG) exports to India, serving as a lifeline for fast, affordable access to key markets in Eastern and Northeastern India. Its strategic location enables just-in-time deliveries and minimises transportation costs for exporters and importers alike.

Exhibit 2: Percentage of Bangladeshi imports entering via Petrapole, Kolkata & Nhava Sheva ports

Source: India’s Ministry of Commerce and Industry

However, recent restrictions limiting imports from Bangladesh to only the Nhava Sheva and Kolkata seaports are likely to disrupt this efficiency. Redirecting cargo from Petrapole to these seaports leads to longer transit times and higher logistical costs, particularly for perishable or time-sensitive goods such as garments and processed foods. Furthermore, the sudden concentration of trade through just two ports raises concerns about port congestion, delays in customs clearance, and bottlenecks in supply chains. This policy shift could undermine the competitiveness of Bangladeshi exports and adversely impact Indian businesses dependent on timely imports from across the border.

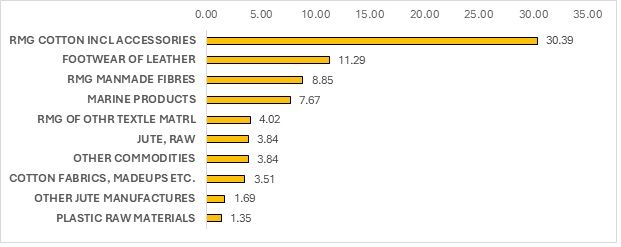

Exhibit 3: Top products entering Via Petrapole land port in January 2025 (in $ mn)

Source: India’s Ministry of Commerce and Industry

The exhibit above shows the dominance of Bangladeshi textile and apparel products entering through the Petrapole port. Out of the top 10 most traded products, six belong to the textile and apparel category, highlighting the country’s reliance on this port for access to India.

Petrapole is the largest land port in South Asia. Located along the international border between India and Bangladesh, 80 km from Kolkata, the port accounts for nearly 30 per cent of land-based trade between the two countries. Seventy-six per cent of Bangladeshi garment exports are routed through this crucial land port, with the remaining 24 per cent reaching India via the Nhava Sheva port and the Kolkata ports, including Haldia Port or the Haldia Complex.

Sea route transportation generally involves longer transit times compared to the reduced trade costs and quicker delivery offered by land ports. With over $500 million in imports coming into India via land ports, delays are expected due to longer transit times when compared to the Petrapole land port.

Trade flow disruptions and risks

Indian yarn exports to Bangladesh: India’s yarn exports to Bangladesh grew by 24 per cent, rising from $1.32 billion in 2023 to $1.75 billion in 2024. This surge, driven by competitive pricing, prompted Bangladesh to close three Indian land entry points—an early move that escalated trade tensions.

India’s retaliatory measures: In response, India withdrew transshipment facilities for Bangladeshi goods and restricted key exports, such as garments and processed foods, to designated seaports—impacting both cost and delivery efficiency.

Bilateral relations and supply chain vulnerabilities

The recent trade restrictions risk undermining India’s longstanding diplomatic goodwill with Bangladesh, a key regional partner. Bangladesh’s garment industry is heavily dependent on Indian raw materials such as cotton, yarn, and dyes. Disruptions to this supply chain could compel Bangladesh to diversify its sourcing, potentially increasing imports from China or other competitors. Such a pivot would not only weaken India’s economic influence in the region but also create opportunities for rival powers to strengthen their foothold in South Asia’s textile trade ecosystem.

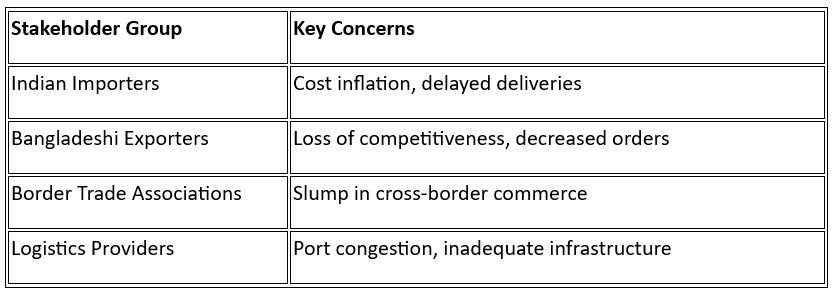

Table 2: Expected stakeholders’ concerns

Conclusion

The DGFT’s decision to restrict imports from Bangladesh to designated seaports carries significant economic and diplomatic ramifications. While the move is ostensibly aimed at correcting trade imbalances and ensuring quality standards, it also presents a strategic opportunity for Indian apparel manufacturers to fill the void with competitively priced, domestically produced garments. To capitalise on this opportunity, Indian manufacturers must leverage the country’s vertically integrated textile ecosystem to boost capacity—particularly in ready-made garment categories traditionally dominated by Bangladeshi exports.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!