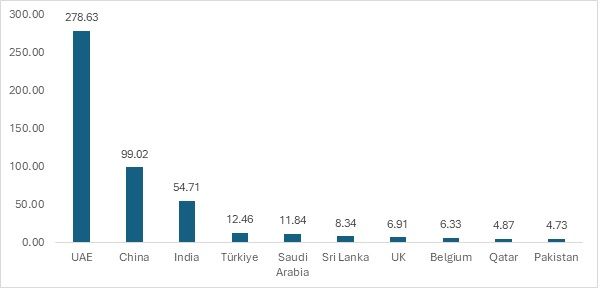

Exhibit 1: Top textile and apparel exporters to Oman in CY 2024 (in $ mn)

Source: TexPro

India exported textiles and apparel worth $54.71 million to Oman, consistently retaining its position among the top three countries exporting textiles to the country. However, India has always found itself competing with two key players—the UAE and China. The UAE benefits from its close proximity to Oman through a shared border, while China’s mass manufacturing capabilities make it a dominant exporting power.

Although India is geographically close to Oman via the Arabian Sea, it cannot match the reduced trade costs enabled by the UAE's land connectivity. Similarly, China’s cost-effectiveness has always influenced Oman’s import decisions for discretionary items like textiles and apparel. China exports to Oman at an average of $2.45 per apparel (in number), whereas India’s average export price is $4.90 per apparel (in number).

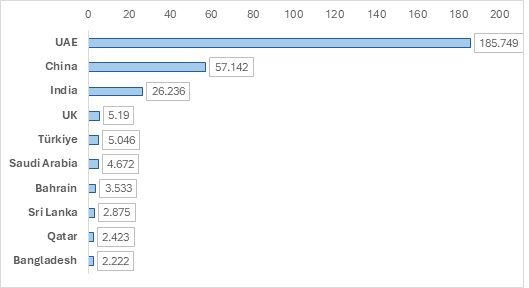

Exhibit 2: Top apparel exporters to Oman in CY 2024 (in $ mn)

Source: TexPro

India’s top competitors in apparel exports to Oman also happen to be the UAE and China. In the mix, we also see India’s Southeast Asian neighbours, Sri Lanka and Bangladesh. Sri Lanka exports apparel at an average of $21 per piece, suggesting it may be one of the few countries specialising in specific categories, such as men’s suits, trousers, and rubber gloves, which Oman imports from Sri Lanka. Apart from this, Bangladesh is the usual competitor from the Asian region. The UK and Turkiye, in the European and Eurasian regions, point towards Oman’s need for high-quality products, especially in the apparel category.

India’s tariff woes to ease: A comparison with key competitors

Table 1: Top 10 apparel exporting countries to Oman and their CAGR (2020-2024 in %)

Source: F2F Analysis

From 2020 to 2024, Oman’s apparel import landscape shifted notably. During the COVID-19 pandemic, the UAE (~$249.27 million) and Qatar (~$3.47 million) benefitted from their geographic proximity and strong logistics, helping Oman navigate global supply disruptions. However, as supply chains recovered, their exports declined—UAE by -7 per cent CAGR and Qatar by -9 per cent CAGR—due to Oman shifting to direct sourcing from producers. Meanwhile, China (+35 per cent), Bangladesh (+49 per cent), and the UK (+43 per cent) saw strong growth, driven by competitive pricing and supply reliability. India’s steady 9 per cent growth signals further potential, especially with favourable trade terms. The trend reflects a move from proximity-driven trade to cost- and value-driven sourcing.

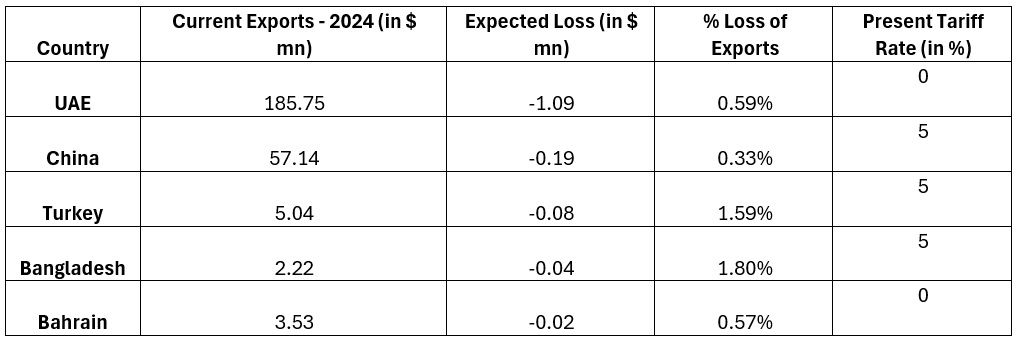

Oman applies a 5 per cent tariff on average on most of its apparel products on a Most-Favoured-Nation (MFN) basis. For GCC countries, Oman applies a zero per cent tariff on its GCC partners such as the UAE, Bahrain, and Qatar. With a probable full reduction from 5 per cent to 0 per cent and textiles and apparel being moved to the tariff elimination list, India’s gains are expected to result in export losses for rival countries.

Table 2: Top 5 countries likely to face export losses under a potential India-Oman FTA

Source: SMART Analysis using WITS, F2F Analysis

If Oman reduces its apparel import tariff for India from 5 per cent to 0 per cent, the countries most affected in terms of export losses would be the UAE, China, Turkiye, Bangladesh, and Bahrain. While the UAE faces the largest absolute loss of approximately $1.09 million, it only represents 0.59 per cent of its total apparel exports to India. China, with a loss of $0.19 million, sees an even smaller relative impact of 0.33 per cent. In contrast, Turkiye and Bangladesh, though facing smaller absolute losses (around $0.08 million and $0.04 million, respectively), are hit harder in relative terms, losing 1.59 per cent and 1.80 per cent of their current apparel exports to India. Bahrain, with a loss of $0.02 million, sees a moderate impact of 0.57 per cent. These figures suggest that while larger exporters absorb the loss more easily, smaller exporters like Bangladesh and Turkiye are proportionally more vulnerable to India's tariff policy changes.

In conclusion, India stands at a strategic inflection point in strengthening its textile and apparel trade with Oman through the anticipated CEPA. Despite historical tariff disadvantages compared to GCC nations like the UAE and Bahrain, India has consistently remained one of Oman’s top three textile suppliers, showcasing its resilience and competitiveness. With a potential reduction in the existing 5 per cent tariff, India is poised to enhance its cost advantage, likely capturing a greater market share and displacing some exports from current competitors. While large exporters like the UAE and China may see minimal relative impact, countries such as Turkiye and Bangladesh could face more significant proportional losses.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!