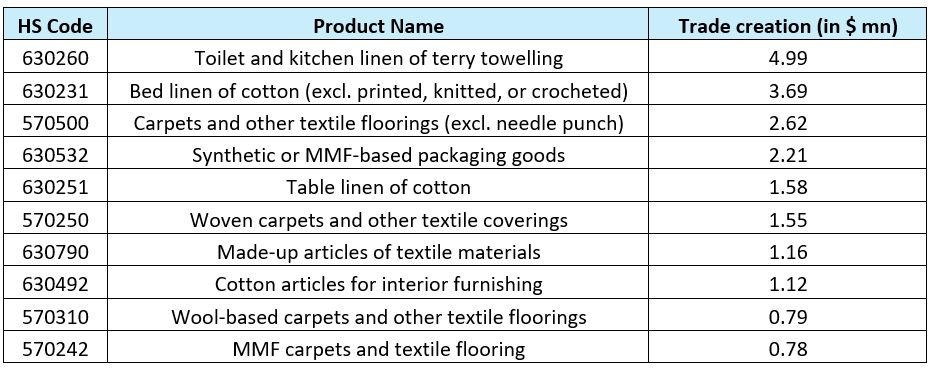

Table 1: Indian home textile products which are set to benefit from the tariff reduction

Source: Analysis using the SMART tool of WITS

Table 1 lists the Indian products that would experience a ‘trade creation’ effect post tariff reduction on those products under the India-UK FTA agreement. Trade creation in $ millions is the increase in total trade value (in millions of dollars) between the countries after the agreement. The table shows India’s trade creation in millions in top 10 categories within home textiles.

It can be observed that the list majorly includes cotton-based products which usually is a category India excels in, given the abundance of the raw material. However, the synthetic and man-made fibre industry in India would get some momentum through the trade creation affecting those products such as synthetic packaging goods material and man-made fibre-based carpets. Manufacturers exporting these products could see an uptick in their revenues if the India-UK FTA terms are favourable to the Indian textile industry.

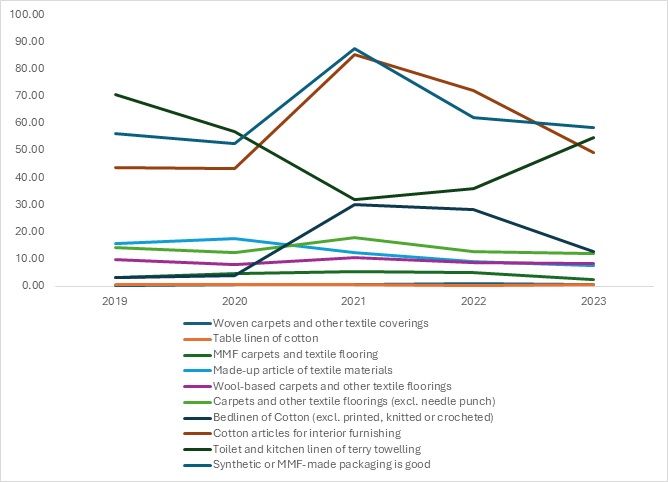

Exhibit 1: India’s export to the UK from CY 2019 to CY 2024 (in $ million)

Source: TexPro, F2F Analysis

Trends over the years

The data reveals various trends in the textile and carpet sectors between 2019 and 2023, highlighting both growth and decline in different product categories. Woven carpets and other textile coverings saw fluctuations, peaking at $1.03 million in 2021 but maintaining a generally stable range over the period. Table linen of cotton experienced a decline in 2021 but bounced back in 2023, indicating market recovery. MMF carpets and textile flooring displayed strong growth initially, reaching $5.51 million in 2021 before dropping to $2.42 million by 2023, suggesting volatility or reduced demand. Made-up articles of textile materials exhibited a steady decrease, from $15.65 million in 2019 to $7.48 million in 2023, pointing towards a diminishing market. In contrast, wool-based carpets and other textile floorings remained fairly stable with minor fluctuations but no drastic shifts. The category of carpets and other textile floorings (excluding needle punch) also saw a steady drop after a peak in 2021.

Bed linen of cotton experienced significant growth, reaching a peak of $30.12 million in 2021 before declining to $12.65 million in 2023, which may indicate a temporary surge in demand followed by stabilisation. Cotton articles for interior furnishing showed a noticeable surge from $43.45 million in 2019 to $85.15 million in 2021, but declined to $49.26 million by 2023, suggesting a dip in growth after a peak period. Toilet and kitchen linen of terry towelling experienced a decline after 2019 but stabilised at $54.66 million in 2023, potentially indicating steady but reduced demand. Finally, synthetic or MMF-based packaging goods maintained a relatively stable trend, with minor fluctuations but no drastic change in demand over the five years.

Welfare effects on the UK consumers

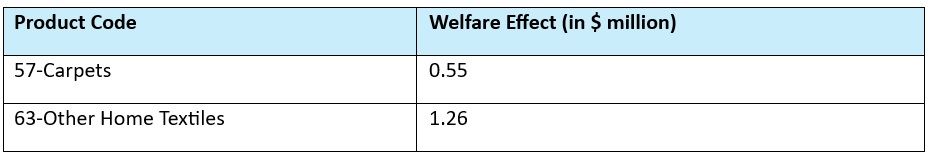

Table 2: Welfare effects for the UK consumers (in $ million)

Source: Analysis using the SMART tool of WITS

Welfare effects are what any country would want out of a free trade agreement. UK consumers gain effectively from the trade to a total of $1.81 million combined from both home textile categories. Consumers stand to benefit directly from the opening of the economy through more choices, especially in high-quality Indian home textile products.

Road ahead

India can benefit from textiles, especially cotton-based products. If Basic Customs Duty on import of long-staple cotton and organic cotton is eliminated, it will propel the home textiles industry further. However, certain sub-categories within the carpet industry, for e.g., wool-based carpets, are difficult to produce given the import dependence on input materials. In addition, the dip in the current trends (CY 2024 Jan-Aug) for man-made carpets is concerning given the investments that are being made in the man-made fibre industry of the country through the Product Linked Incentive (PLI) scheme.

To discourage the influx of cheap fibre imports, the customs duty of five per cent will be increased to 10 per cent on imported man-made fibre spun yarn as stated in the Union Budget 2024-2025. This is not deemed beneficial for home textile exporters, particularly those in man-made fibre-based carpets. Based on 2022 data, MMF carpets are set to gain from the India-UK FTA tariff reduction, however, the Union Budget and policies for 2024-2025 might impact the product and could push it out from the benefitting list of textiles products. Relief can be expected if there are concerted efforts to develop the man-made fibre industry in India through policies and investments along with technological upgradation.

India should also act as per the needs of consumers in the UK market by understanding their requirements. The UK consumers are more concerned with sustainability being the focal point for all their purchases. Several Indian home textile giants such as Welspun and Indo-Count have already aligned their profit objectives with the SDGs as their primary goals. The Indian government plans to announce a National Textile Fund to support MSMEs, especially for technology upgrades. A considerable amount will be focused on adopting renewable technology. India should promote these policies while negotiating for tariff reduction in the home textiles segment.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!