The findings reveal that key textile-exporting nations—including China, Bangladesh, Pakistan, Türkiye, and Portugal—could experience declining exports in specific product categories due to increased competition from India in the UK market. This article delves into the anticipated impact on each of these countries, examining how their exports might be affected and exploring the possible responses as they navigate the shifting landscape of global textile trade.

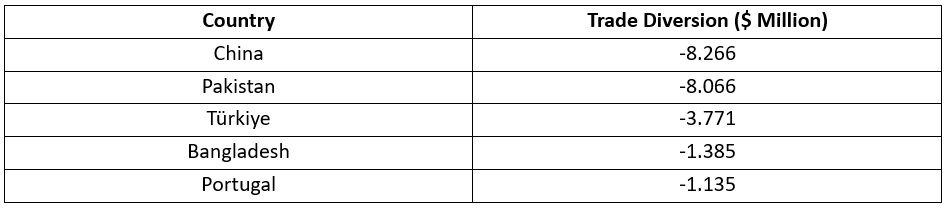

Table 1: Trade Diversion of Top 5 Losing Countries (in $ million)

Source: Analysis using the SMART tool of WITS

If the UK reduces its tariffs on Indian textiles, this will likely result in significant trade diversion. Such a reduction—potentially down to zero per cent for home textiles as part of the India-UK Free Trade Agreement (FTA)—could make Indian textile imports far more competitive in the UK, shifting demand away from other supplier countries that currently face similar or slightly higher tariffs. This shift would benefit India by boosting its textile exports to the UK, but it would simultaneously lead to decreased imports from other key textile-exporting nations. Countries like China, Pakistan, Türkiye, Bangladesh, and Portugal would face varying degrees of trade diversion as a result of this change, with losses across several textile categories.

China and Pakistan are likely to experience the most trade diversion. China may face losses of approximately $8.27 million, with the primary impact on cotton-based textiles (such as bed linen and kitchen linen) and synthetic fibre products (like blankets and carpets). Pakistan will be similarly impacted, with estimated losses of around $8.07 million, as demand for its cotton-based and man-made fibre-based textiles—especially bed linens—shifts towards India.

Türkiye is projected to face moderate trade diversion losses of about $3.77 million. This will mainly affect Türkiye 's exports of towels, kitchen linens, and man-made fibre carpets, which may see reduced demand in the UK due to increased competition from Indian products in these categories.

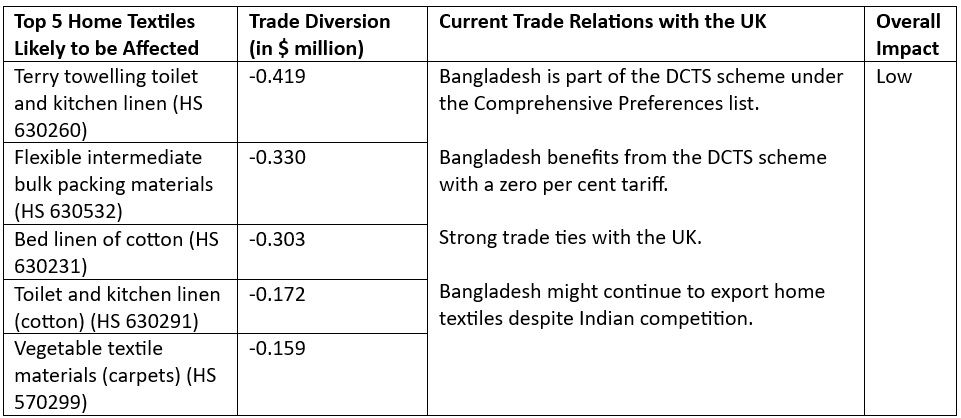

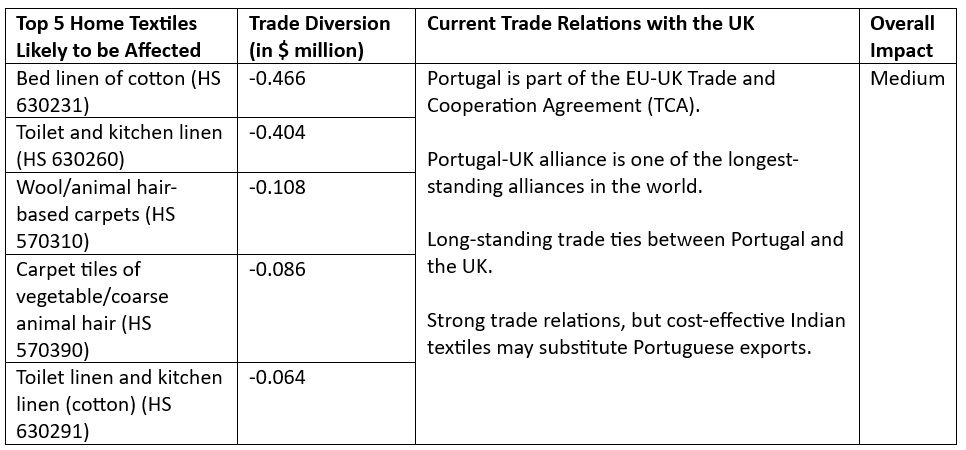

Bangladesh may experience lesser losses, around $1.39 million, mostly in cotton bed linen and printed textiles, as the UK shifts its sourcing preference to Indian products. Of the five, Portugal is likely to be the least affected, with a projected trade diversion loss of $1.14 million. Portugal's exports of wool carpets and cotton textiles would be affected the most, though to a lesser extent compared to other countries.

In summary, the India-UK FTA, with reduced or eliminated tariffs on Indian textiles, could result in substantial trade diversions, strongly impacting China and Pakistan, with moderate to minimal effects on Türkiye, Bangladesh, and Portugal. This shift underscores India’s competitive advantage in cost-effective textile production, particularly in categories like carpets, towels, and various cotton-based products.

Product-Level Trade Diversion: Country-by-Country Analysis of Shifting Markets

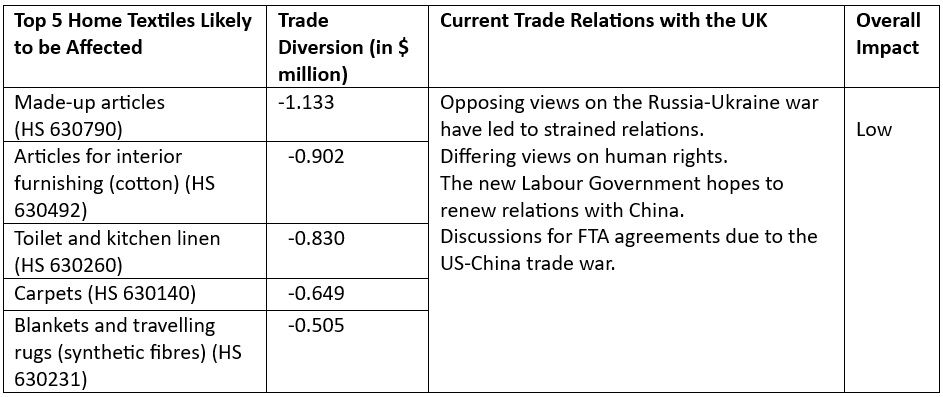

Table 2: Trade Diversion for China at Product level (in $ million)

Source: Analysis using the SMART tool of WITS

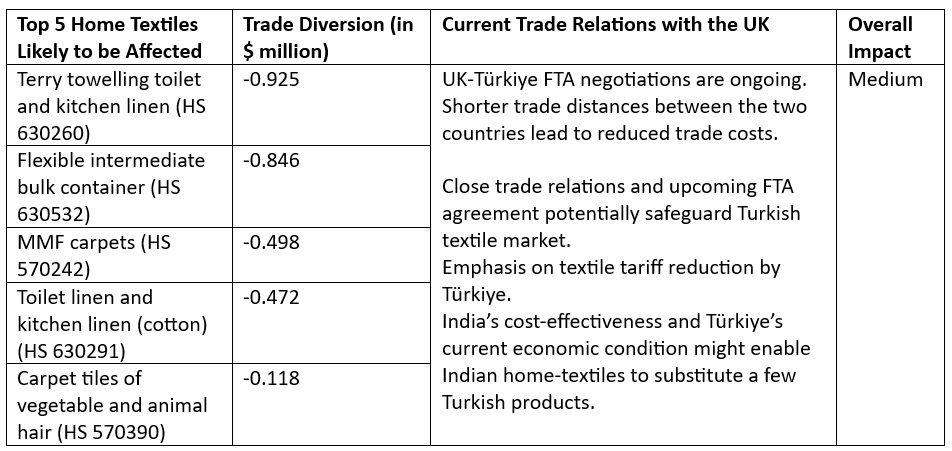

Table 3: Trade Diversion for Türkiye at Product level (in $ million)

Source: Analysis using the SMART tool of WITS

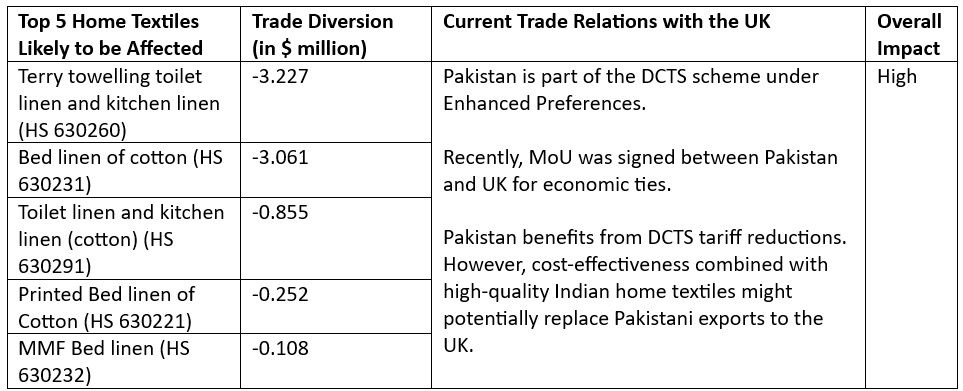

Table 4: Trade Diversion for Pakistan at Product Level (in $ million)

Source: Analysis using SMART tool of WITS

Table 5: Trade Diversion for Bangladesh at Product level (in $ million)

Source: Analysis using the SMART tool of WITS

Table 6: Trade Diversion for Portugal at Product level (in $ million)

Source: Analysis using SMART tool of WITS

Conclusion:

India’s negotiations with the UK should aim not only to expand its market access but also to carefully consider the potential impacts on, and from, the other major home textiles exporting countries. To compete effectively with textile giants such as China and Bangladesh, India must enhance its economies of scale—achievable only through substantial market access, combined with a robust focus on technology and productivity improvements.

Economic downturns currently affecting Bangladesh and Türkiye are likely to be temporary, and textiles—key sectors for both the economies—are expected to recover quickly. Additionally, Portugal, as a European country and a trusted trade partner, has a competitive advantage within the European Union (EU). For India to compete with EU members like Portugal, it must underscore its commitment to sustainable practices within the textile industry.

The India-UK agreement has the potential to position Indian home textiles as a compelling choice by balancing cost-effectiveness with high quality, thereby enhancing India’s competitive edge in the global market.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!