Reducing household consumption amid global woes

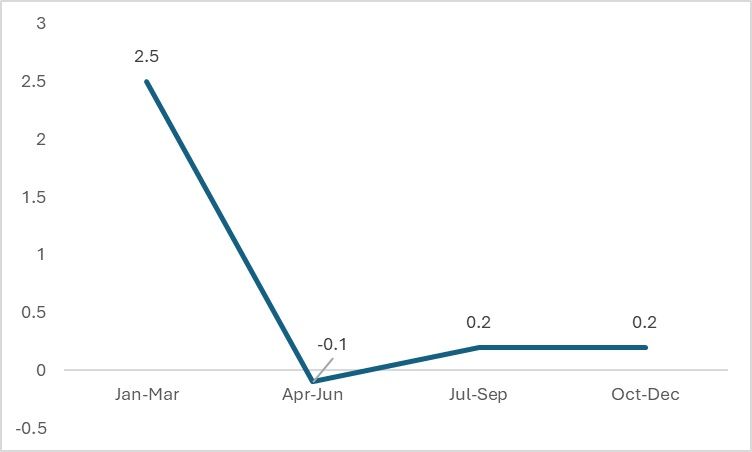

The Japanese economy is being affected by a range of factors, including weak domestic demand, slowing global growth, and the earthquake that hit the country, thus impacting all sectors of the economy. One of the most significant factors contributing to this is the decline in consumption. Domestic consumption, which constitutes more than half of Japan’s GDP, started declining after the January-March quarter of 2023. The contraction in consumption has not been satisfactory, and the reason for this decline is the increase in inflation without a corresponding rise in wages. Real wages in the nation have also fallen by 2.5 per cent, indicating a slowdown in the manufacturing sector of the country.

Figure 1: Change in final consumption expenditure of households (in %)

Source: Cabinet Office Japan

The link between inflation and the functioning of other major aspects of the economy is well established. Higher inflation, coupled with wages not increasing at a proportionate rate, leads to an abrupt fall in consumer spending, as precisely experienced by the Japanese economy. Inflation affects almost all aspects of the economy, from spending to exchange rates. When inflation is under control, the economy thrives, but extremes in either direction paint a disheartening picture of economic health. With wage increases only at 1.6 per cent compared to current inflation, a reduction in consumer spending is highly likely. This encapsulates the basic economics of inflation, growth, and consumer spending.

The case of Japan is no different. With the current inflation—2.60 per cent—being more than its long-term target of 2.42 per cent, wages staying stagnant or declining in the country, and currency depreciating, all of this will surely affect one aspect of the economy the hardest—Trade. There was a 12 per cent decline in the imports whereas the exports fell by a small 0.2 per cent.

Declining apparel imports

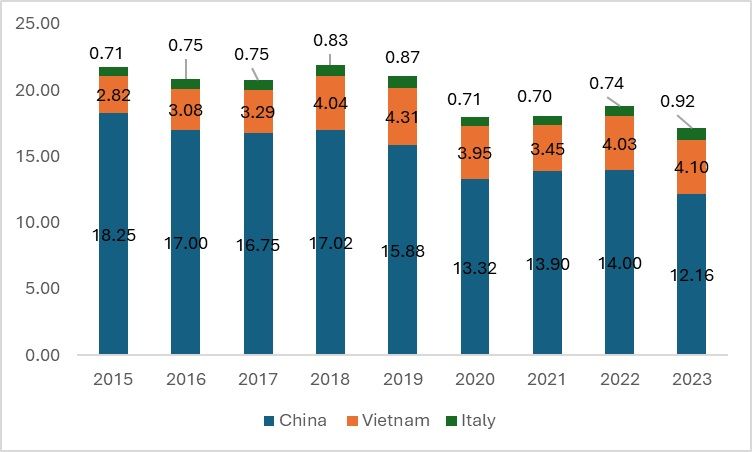

The Land of the Rising Sun imports apparel from China, Vietnam, South Korea, Italy, and the US. Imports from all these nations are declining. Among them, China holds the highest share in Japanese apparel imports, accounting for approximately 70 per cent, followed by Vietnam and then the other nations. The decrease in imports from all these sources indicates a decline in demand. With the recession impacting the economy, consumers are becoming more hesitant to spend their income. Given that the textile and apparel industry falls under discretionary expenses, it is highly likely that imports in this sector will also decrease. There has been a significant decrease in apparel imports from China, by almost 13 per cent compared to the previous year. Imports from Vietnam, the US, and South Korea have experienced only a negligible increase.

Alongside the decline in imports, there is also a significant drop observed in Japanese exports. The economy, which is heavily dependent on manufacturing, is experiencing a slump due to tepid global sentiments, exacerbated by wars and geopolitical issues. As these factors continue to intensify, investment spending is likely to decrease as confidence in the economies recedes.

Figure 2: Apparel imports of Japan from different countries (in $ bn):

Source: ITC trade map

Imports from Asian countries: A ray of hope?

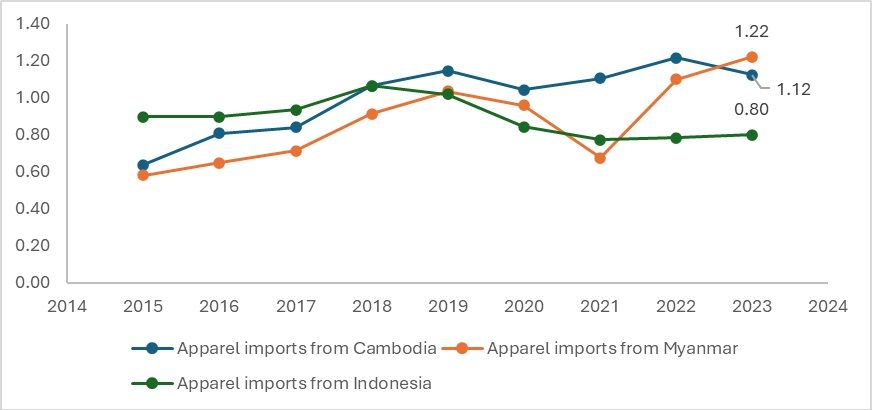

In the analysis conducted, it was observed that imports from certain Asian countries are increasing despite prevailing economic conditions. Apparel imports from Myanmar and Indonesia are on the rise. This trend may be attributed to currency swaps, which enable the involved nations to exchange their local currencies in trade, thereby providing protection against external currency volatility. The same principle applies to Myanmar; however, with the ongoing coup in the nation, it is likely that imports from Myanmar may decline.

Figure 3: Apparel imports of Japan from Asian nations (in $ bn):

Source: ITC trade map

Currency swaps are generally agreed upon to protect the involved parties from potential currency volatility and to safeguard the nation’s trade from any global shocks that could drastically affect exchange rates. During such times, initiatives like the Chiang Mai Initiative, which includes ASEAN countries along with China, Japan, and South Korea, play a significant role. These swaps can be utilised for both importing and exporting commodities to other nations, presenting an opportunity in disguise for these countries. While there is also a swap arrangement with China, its declining share in Japanese apparel imports may open up opportunities for nations like Indonesia and Myanmar, whose imports have been increasing even amidst the onset of a technical recession.

What's Next?

While the Japanese recession has surprised many, the country has experienced significant volatility in trade along with a decline in key economic indicators. Additionally, Japan faces challenges such as a large public debt and an aging population, for whom a recession can be particularly harmful. To reignite growth, there is a pressing need to formulate policies aimed at increasing employment opportunities and curbing recessionary trends. This would stimulate demand and, in turn, boost trade.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!