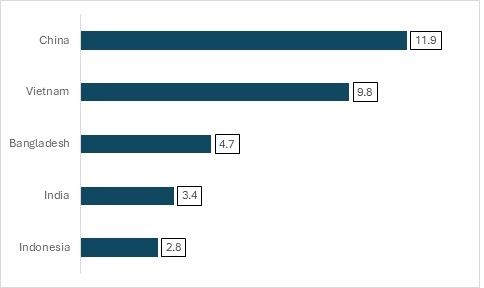

Exhibit 1: Top countries by apparel import share (%) in the US

Source: TexPro, F2F Analysis

Specialised product exporter to the US

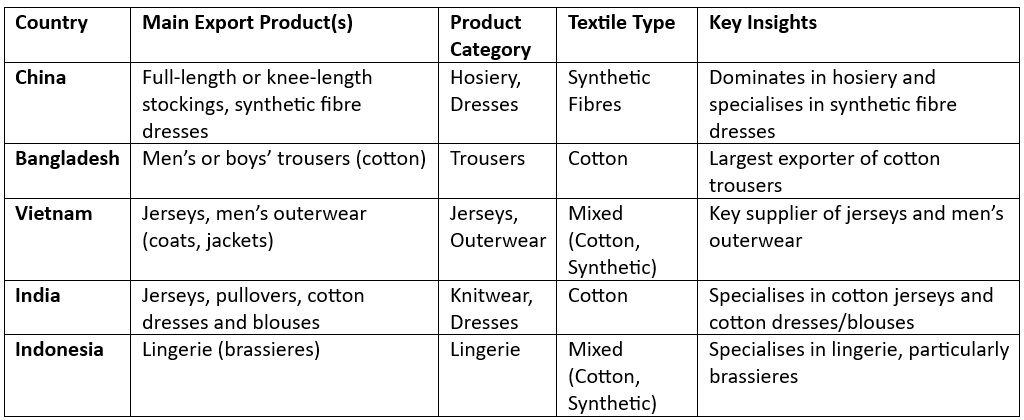

Table 1: Top apparel exporters to the US and their key specialties

Source: F2F Analysis

China dominates the export of full-length and knee-length stockings, socks, and other hosiery products. Bangladesh is the largest supplier of men’s or boys’ cotton trousers to the US market. Vietnam, India, and Indonesia play significant roles in meeting the high demand for jerseys in the US, which remain some of the country’s most sought-after apparel products.

The analysis highlights the dominance of cotton-based products—such as jerseys, pullovers, shirts, and trousers—in the apparel trade between the US and its key supplier nations. This underscores the importance of cotton textiles in countries like Bangladesh, India, and Indonesia. Meanwhile, synthetic fibre products hold distinct significance for China and Vietnam, reflecting their specialisation in non-natural fibre textiles.

Vietnam stands out for its strong exports of men’s outerwear, such as coats and jackets, while Indonesia is known for its focus on lingerie, particularly brassieres. China excels in exporting synthetic fibre dresses, whereas India leads in cotton dresses and blouses. These distinctions reveal the unique strengths of each country in the global apparel market.

While there is some overlap in popular product categories—such as cotton knitwear and trousers—each country has carved out specific niches, emphasising its expertise in different segments of textile manufacturing.

Performance and key products of US’ top suppliers

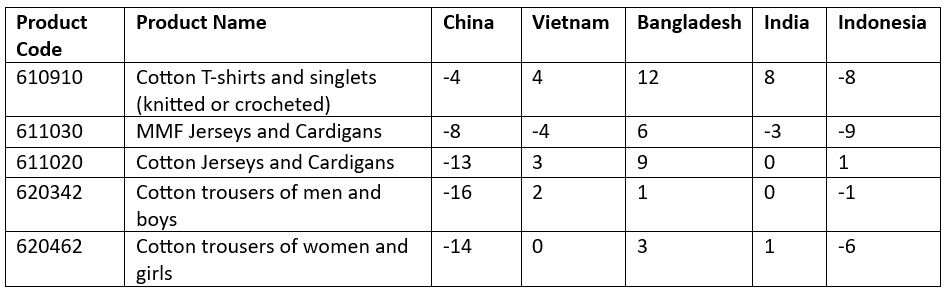

Table 2: CAGR (%) of top apparel products: Leading exporters (2016-2023)

Source: TexPro, UN Comtrade, F2F Analysis

The table above highlights the top five apparel products imported into the US in 2023, emphasising key categories that maintain consistent demand in the US market. Fibre2Fashion’s analysis reveals that cotton-based apparel remains a favourite among US consumers, thanks to its natural softness and breathability. While China and India, as major cotton exporters, were expected to dominate this segment, both nations have experienced a decline in the majority of the top five imported apparel categories.

China, despite being the largest exporter to the US, appears to have shifted its focus to other industries. This has opened the door for economies like Vietnam and Bangladesh, which have specialised in apparel exports, to gain ground. Nevertheless, China’s economies of scale continue to ensure its competitive edge. However, the Trump administration's proposed 60 per cent tariff on Chinese imports is likely to further dampen the already declining growth of China’s textile industry.

Vietnam has shown immense potential, backed by targeted development of its textile sector and a favourable free trade agreement (FTA) with the US. However, the country has faced a decline in man-made fibre (MMF) trousers, indicating challenges in meeting US demand for MMF-based apparel.

Bangladesh, on the other hand, has excelled despite facing higher tariff rates in the US compared to its Generalised System of Preferences (GSP) benefits in the EU. With a Compound Annual Growth Rate (CAGR) of 12 per cent in T-shirt exports—the most imported apparel product in the US—Bangladesh has successfully focused on high-demand categories to boost revenue.

India and Indonesia, however, are grappling with structural challenges in their export performance to the US. Despite being a significant supplier of raw materials like cotton, India has underperformed in four out of the five top imported apparel categories. Its growth has remained stagnant, except for cotton T-shirts, while it has seen declines in MMF jerseys and cardigans.

Indonesia has faced even greater challenges, with declining production capacity and rising costs for raw materials and energy. The Indonesian Textile Association (API) reports that production utilisation has fallen below 50 per cent, its lowest level since 2020. Once an emerging textile manufacturing hub, Indonesia has been overshadowed by Vietnam and Bangladesh. To regain competitiveness, Indonesia must focus on strengthening its cotton jersey and cardigan exports, which have shown modest growth over the years.

Overall, the analysis underscores the importance of aligning product specialisation with US market demand while addressing structural and policy challenges to remain competitive in the global apparel trade.

Opportunity for men’s and boys’ cotton trousers

Exhibit 2: Import values of men's and boys' cotton trousers & overall US apparel imports (in $ mn)

Source: TexPro, F2F Analysis

Men’s and boys’ cotton trousers (HS code 620342) enjoy a 0 per cent tariff rate and lower regulatory requirements, presenting a seemingly lucrative opportunity for exporters. However, countries have struggled to fully capitalise on these lower entry barriers. Both China and Indonesia have experienced negative CAGRs in this category, while others, like Vietnam and Bangladesh, have shown only stagnant growth. Currently, this product category holds a 31 per cent share of US apparel imports, maintaining a consistent range of 26 per cent to 31 per cent over the years. To maximise returns, countries should prioritise investment in this product type, leveraging its stable demand and favourable trade conditions.

In conclusion, the US apparel market demands close monitoring, especially with the advent of the new Trump administration and its inclination towards higher tariffs on many exporting economies, particularly China. This analysis aimed to highlight key products exported by leading economies and identify opportunities for growth in both established and emerging textile-exporting nations. As the US implements stringent trade policies, it is essential for exporting countries to assess which products may face challenges and to strategically invest in areas that ensure long-term resilience and growth in the global textile trade.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!