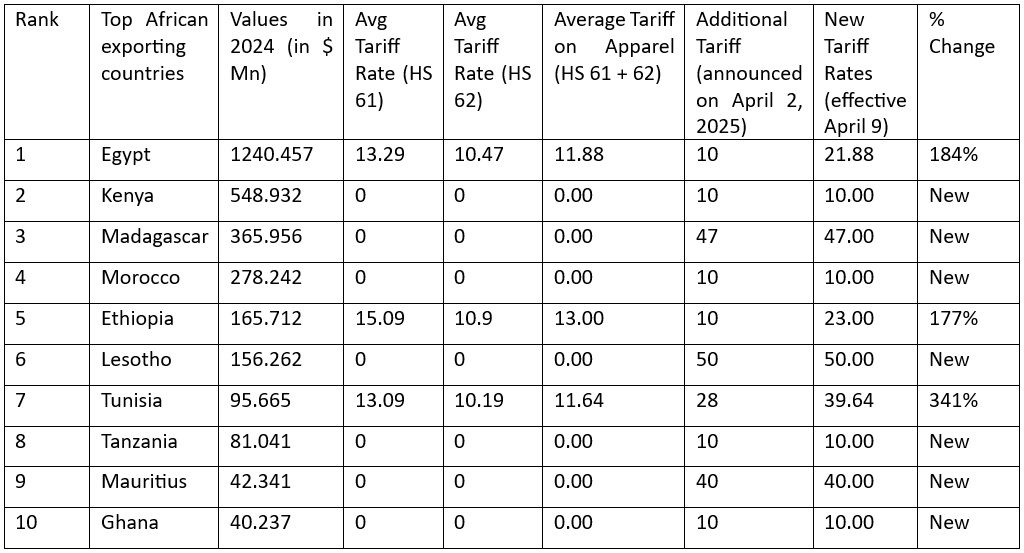

Table 1: Top 10 African countries exporting apparel to the US, their new tariff rates, and change in rates

Source: TexPro

New Tariff Rates explained:

Egypt

The export value of Egyptian garments to the US stood at $1.24 billion in 2024. The recent tariff hike from 11.88 per cent to 21.88 per cent—an increase of 10 percentage points—represents a substantial 184 per cent rise in duties. This sharp escalation significantly raises costs for US importers, potentially affecting retail prices, supply chain decisions, and the overall competitiveness of Egyptian apparel in the US market.

Kenya

Kenya’s garment exports to the US, valued at $548.9 million in 2024, previously enjoyed duty-free export to the US under the African Growth and Opportunity Act (AGOA). The imposition of new 10 per cent tariff will directly affects Kenya’s price competitiveness in the US market, potentially challenging its export growth and attractiveness to international buyers.

Madagascar

With an export value of $366 million to the US in 2024, this country now faces a steep tariff jump from zero per cent to 47 per cent—one of the highest reciprocal tariffs imposed. This dramatic increase severely impacts cost structures, posing a major threat to the competitiveness of its garments in the US market and potentially leading to reduced demand and trade volumes.

Morocco

Garment exports from Morocco to the US were valued at $278 million in 2024. This country now faces a 10 per cent tariff, up from a previous rate of zero per cent. While the new rate is relatively moderate compared to others, it removes the country’s duty-free access to the US market, potentially affecting pricing and reducing its competitive edge.

Ethiopia

Ethiopia’s garment exports to the US, valued at $165.7 million in 2024, now face a tariff increase from 13 per cent to 23 per cent—a 77 per cent rise in duties. This added cost pressure could further strain Ethiopia’s already vulnerable export sector, making it harder to compete in the US market and potentially affecting job creation and economic stability at home.

Lesotho

With exports to the US valued at $156 million in 2024, this AGOA-reliant country now faces a drastic tariff hike from zero per cent to 50 per cent. This sharp increase significantly raises the cost of its garments in the US market, severely undermining competitiveness and posing major challenges for its export-driven apparel sector.

Tunisia

Tunisia’s garment exports to the US worth $95.7 million (in 2024) now face a tariff increase from 11.64 per cent to 39.64 per cent—a staggering 341 per cent rise. This sharp escalation dramatically raises costs for US importers and could severely reduce demand, putting pressure on exporters and threatening market access.

Tanzania

With an export value of $81 million in 2024, this country loses its AGOA duty-free access and now faces a 10 per cent tariff. While the new rate is moderate, it still impacts cost competitiveness and may challenge the country’s position in the US apparel market.

Mauritius

With exports valued at $42.3 million, this country faces a steep tariff hike from zero per cent to 40 per cent. As one of the harshest increases, it significantly raises export costs and greatly undermines the country’s competitiveness in the US apparel market.

Ghana

Ghana’s garment exports to the US, valued at $40.2 million in 2024, now face a 10 per cent tariff after losing duty-free access. While not as steep as some other increases, the shift reduces price competitiveness and may make its exports less attractive in the US market.

Key Implications

Erosion of AGOA Benefits: Countries like Kenya, Madagascar, Lesotho, and Mauritius previously enjoyed duty-free access to the US market under AGOA. The imposition of new tariffs nullifies these advantages, potentially reducing the competitiveness of their apparel exports.

Economic Impact on Export-Dependent Nations: For nations where apparel exports constitute a significant portion of their economy, such as Lesotho and Madagascar, the steep tariffs (50 per cent and 47 per cent, respectively) could lead to substantial economic challenges, including job losses and decreased foreign exchange earnings.

Diversification of US Sourcing Strategies: US importers may seek alternative sourcing destinations with more favourable tariff structures, potentially diverting business away from African suppliers to countries that are least impacted by these increased tariffs.

Potential for Trade Negotiations: Affected African nations might engage in bilateral discussions with the US to seek exemptions or reductions in these tariffs, emphasising the mutual benefits of trade and the developmental goals supported by AGOA.

Conclusion

The newly imposed US tariffs represent a significant challenge for African apparel exporters, particularly those who have benefited from AGOA preferences. The increased tariff rates threaten to diminish the competitiveness of African apparel in the US market, potentially leading to economic repercussions in the affected countries. These nations must explore strategies to mitigate the impact, including seeking negotiations with the US, diversifying their export markets, and enhancing the value proposition of their apparel industries.

Source: TexPro

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!