In the face of burgeoning uncertainties in the global economy, Vietnam's garment industry is witnessing a significant upturn, positioning the country as one of the leading apparel exporters in Asia. As 2023 draws to a close, forecasts suggest that Vietnam's exports will continue to flourish, heralding a robust start to 2024.

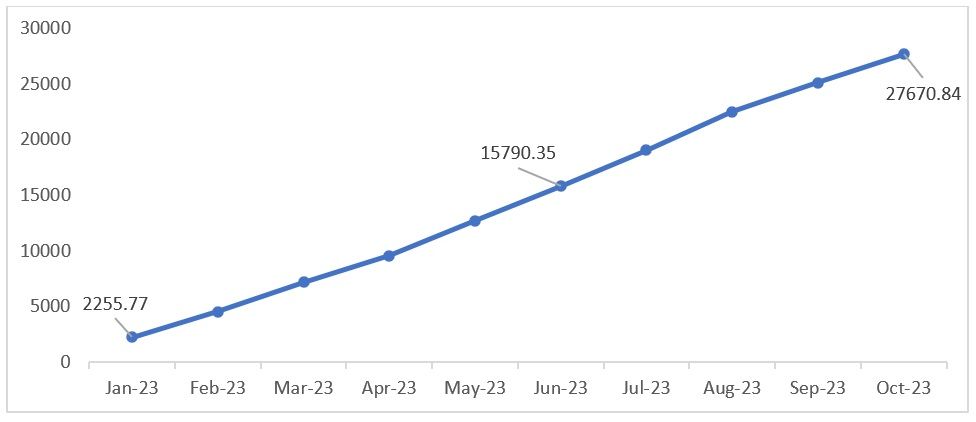

Vietnam is Asia's second-largest apparel exporter, trailing only China and Bangladesh. Sharing a similar background in the textile industry and enjoying equivalent duty exemptions on exports, both countries have benefitted from their apparel trade. Although there was a slight decline in exports in 2023, data released by Vietnam Textile and Apparel Association (VITAS) for September indicates that Vietnam's overall imports increased in October, according to Centre for Economics and Business Research (CEIC) data. The exports in October also offered some relief to the industry, which had been concerned about a potential decrease due to falling consumer confidence in major importing regions like the United States and Europe. Vietnam already has free trade agreements (FTAs) with the US and the EU, enabling the country to reap the associated benefits.

Figure 1: Vietnam’s monthly exports of textiles and garments (in $ mn)

Source: CEIC database

Amid the weakening currency, the country is experiencing a surge in exports, which could be a positive development for the short term. The Asian Development Bank, in its Asian Development Outlook, has stated that the country demonstrates resilient growth and is likely to recover in the short term. The country can continue to rely on the labour-intensive sector for further gains in the coming years. Although VITAS recently expressed concerns about losing competitiveness to Myanmar, the Economic Similarity Index (ESI)1 statistically shows no similarity between the two countries in their major export markets, suggesting that losing competitiveness to Myanmar is not a concern.

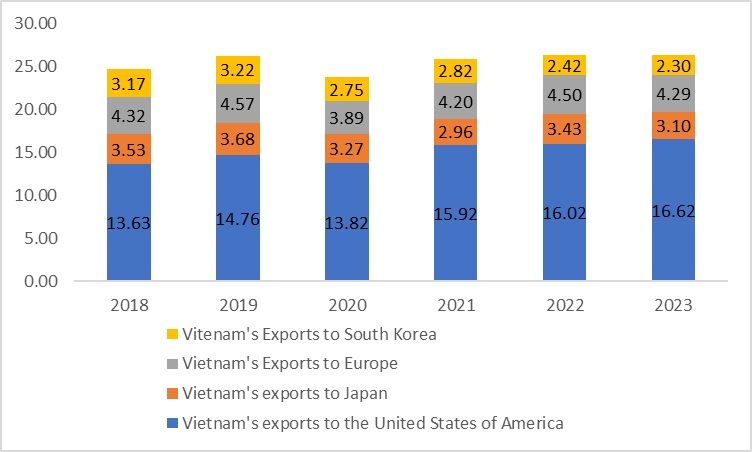

Figure 2: Vietnam’s exports to major export destinations (in $ mn)

Source: Trade Map

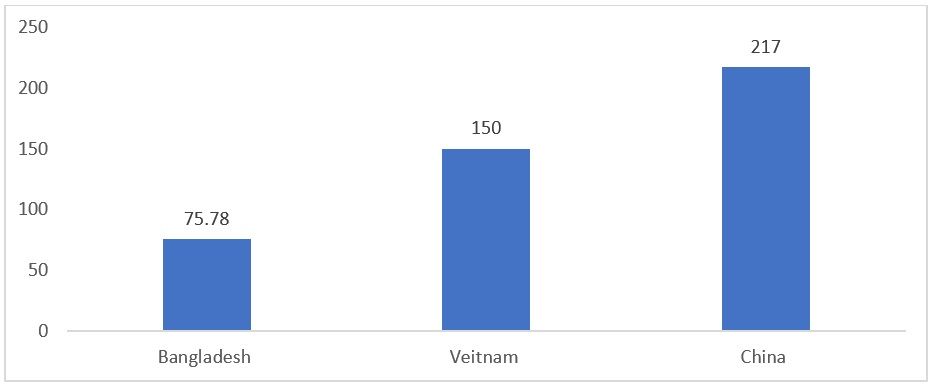

Temporary effect and market competition

The focus on wars and weakening consumer confidence in the US, a major market for Vietnam, suggested a reduction in spending and, consequently, a fall in demand. However, the monthly exports until October indicated the opposite. Vietnam, a major labour-intensive nation involved in the garment industry, shares similar conditions with Bangladesh. Labour costs in Vietnam remain lower compared to China, Turkiye, and Indonesia. While the country maintains close competition with Bangladesh, per-worker labour productivity2 in Vietnam is significantly higher than in both Bangladesh and Myanmar. Therefore, for now, the concern about losing competitiveness does not arise.

Figure 3: Vietnam’s wages compared to other Asian competitors (in $):

Source: Centre for Policy Dialogue

Increasing stability amid uncertainty

As the world grapples with an uncomfortable and uncertain atmosphere, many nations view Vietnam as a stable and safe destination for business. The recent visits of the Presidents of the US and China to Vietnam signal a growing preference for the country, owing to its stable environment. Therefore, even though short-term uncertainties may exist, the nation's long-term economic prospects appear secure.

Light at the end of the tunnel

Even amidst the current uncertain climate in trade and economics, the country retains significant growth potential. Recent figures from October have demonstrated that the country's exports have not decreased as previously anticipated. Major markets such as the US and the European Union, characterised by their consumerist nature, will continue to be significant due to the free trade agreements supporting exports. Moreover, other Southeast Asian nations, along with countries like Australia, present themselves as potential hubs for garment exports, offering further opportunities for the country to expand its export reach.

Notes:

1: Export Similarity Index (ESI): An index which gauges the similarity in the common market country when considering exports. A value closer to one indicates that there is a cut-throat competition between the countries and a value less than one indicates no competition between the countries.

2: Per Labour Productivity: The total volume of output, which is measured in terms of gross domestic product, produced by one labour in each period. It is measured in US dollars.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!