Key factors behind the downturn included:

Turning point expected in May 2025

Rising crude oil prices, increased freight costs, and recent trade related geopolitical developments were the primary drivers of the global toluene market's upward trend in May 2025.

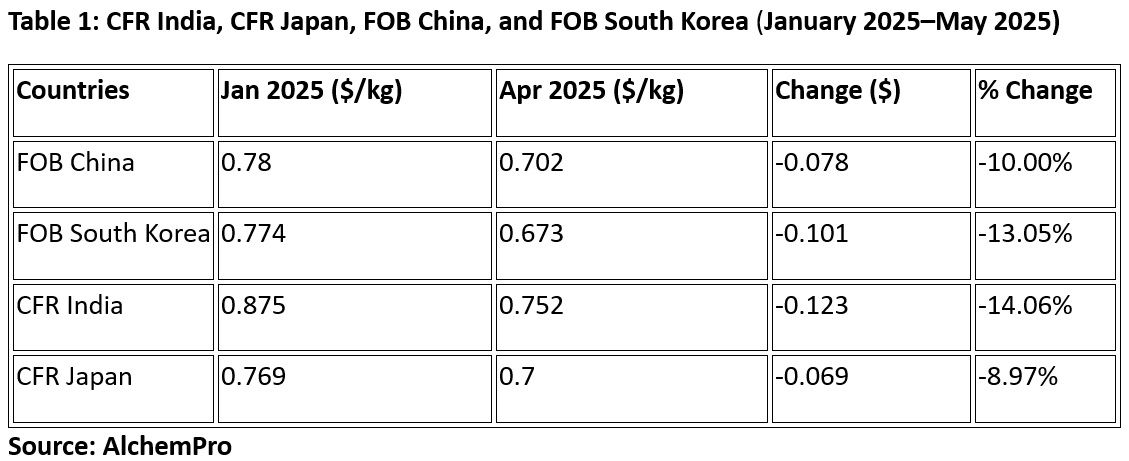

Historical pricing data from Fibre2Fashion’s AlchemPro platform shows that CFR India prices began climbing steadily from May 22, 2025, when they surged to $0.730/kg. Prices for CFR Japan and FOB South Korea also rose to $0.675/kg. The upward trend is closely linked to the rise in crude oil prices, which directly influences petrochemical derivative costs, including toluene. Increased freight costs have also contributed to the price rebound.

Freight: Importing nations have seen a rise in toluene prices in May 2025, largely due to increased freight costs. These cost pressures have been compounded by shifts in geopolitical tariffs.

Tariff: Following the imposition of steep tariffs of up to 145 per cent on Chinese goods, the US administration implemented a temporary 90-day reprieve, reducing duties to 30 per cent. This shift has boosted trade activity, leading to higher shipment volumes and increased shipping rates. Consequently, end-user prices may rise, adding inflationary pressure in importing markets.

Freight cost impact

The Drewry World Container Index (WCI) stood at approximately $2,200 per 40-foot container as of May 22, 2025, marking a sharp decline of 78 per cent from its pandemic-era peak. During the height of the COVID-19 crisis, rates had soared to nearly $10,000 due to severe supply chain disruptions, port congestion, and surging global demand.

The chart depicts a sharp decline from the mid-2024 peak of around $5,900, with the Drewry World Container Index continuing on a downward trajectory into early 2025. This substantial drop reflects excess capacity in the container shipping market and the broader normalisation of global logistics. In Asia—particularly in India—CFR values indicate improved shipping economics. Despite subdued product demand, the sharp correction in freight costs has eased import-related pressures and helped lower landed prices for chemical markets such as toluene.

ALCHEMPro News Desk (VK)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!