The Research and Technology (R&T) expenses as a percentage of sales stood at 3.0 per cent, and adjusted operating income was $45.3 million or 9.9 per cent of sales.

The other operating expense for Q1 2025 included charges of $1.1 million related to a previously announced divestiture. The impact of exchange rates on operating income as a percentage of sales was favourable by approximately 60 basis points (bps) in Q1 2025, Hexcel said in a press release.

In Q1 2025, Commercial Aerospace sales totalled $280.1 million, reflecting a 6.4 per cent decline (6.3 per cent in constant currency) compared to Q1 2024, as customers continued to face challenges in ramping up production rates.

Sales in the Defence, Space & Other segment reached $176.4 million, marking a 2.0 per cent increase (2.7 per cent in constant currency). This included 2.9 per cent growth (3.3 per cent in constant currency) in the Defence & Space sub-segment, driven by programmes such as the CH-53K, Black Hawk, classified contracts, various Space initiatives, and an international fighter jet programme. However, this was partially offset by a 1.8 per cent sales decline in Industrial (though a 0.3 per cent increase in constant currency), where Automotive showed year-over-year growth, while Wind continued to weaken, and Recreation remained soft.

The company has revised its 2025 guidance, projecting sales between $1.88 billion and $1.95 billion, down from the earlier range of $1.95 billion to $2.05 billion. Adjusted diluted EPS is expected to range from $1.85 to $2.05, lowered from the previous estimate of $2.05 to $2.25. Free cash flow is forecast at approximately $190 million, a reduction from the earlier projection of over $220 million. Capital expenditures are now expected to be less than $90 million, compared to the prior estimate of under $100 million. The company maintains an effective tax rate forecast of 21 per cent.

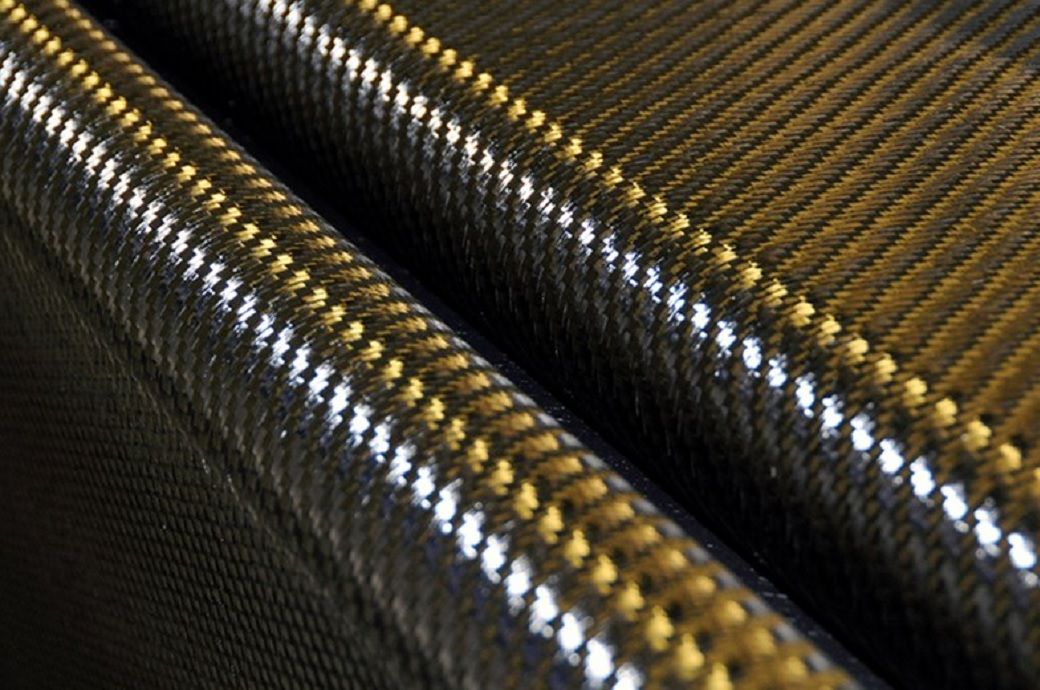

“The underlying value proposition of Hexcel remains robust, driven by the demand for our innovative lightweight composites, which will generate strong cyclical and secular sales growth over time,” said Tom Gentile, chairman, chief executive officer (CEO) and president of Hexcel Corporation. “Hexcel’s value proposition is fortified by our extensive intellectual property, scale, and deep customer relationships globally. With a strong balance sheet and a compelling multi-year cash generation profile, Hexcel is well-positioned to navigate the current environment and for the future. However, because of continued supply chain driven delays in commercial aircraft production rate ramps, particularly on the Airbus A350 program, our 2025 growth will not be what we initially forecasted. As a result, we are revising our 2025 guidance.”

“We will continue to focus on the fundamentals of our business this year, carefully managing costs given the current realities in the commercial aerospace market. This includes tightly managing our headcount as we right size for the demand we have and not outpacing the future rate increases by our Original Equipment Manufacturer (OEM) customers,” continued Gentile.

ALCHEMPro News Desk (SG)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!