How has the retail index increased?

The recent retail index rose by 0.7 per cent compared to February, while the core retail index, which excludes volatile components like automobiles, increased by 1.1 per cent. These sales figures are unexpected, given the inflationary pressures and economic conditions that should theoretically lead to reduced prices and decreased consumer spending. However, both month-on-month and year-on-year growth tell a different story.

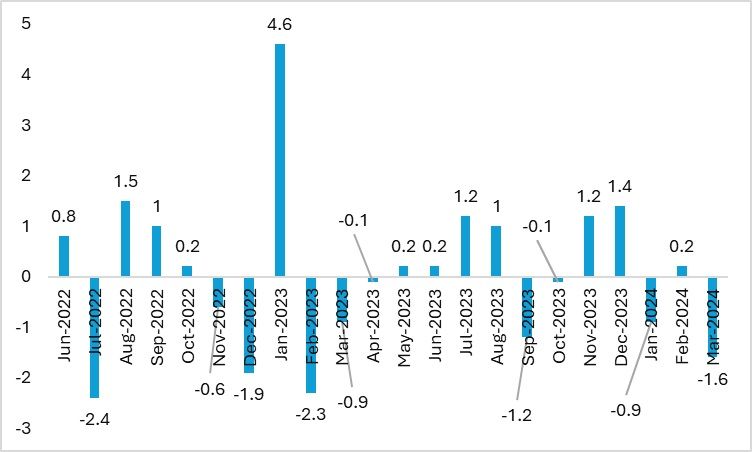

Figure 1: Growth in overall retail sales and clothing sales (in %)

Source: United States Census Bureau

As per the data released by the Census Bureau, retail sales increased in March by 0.7 per cent compared to the previous month. This occurred even though inflation remained steady at 3.5 per cent, contrary to expectations of lower retail sales growth. The increase in retail sector sales also suggests higher consumption, indicating that it may be more challenging to control inflation under these conditions.

Factors overlooked

The primary reason for the rise in retail sales is the increase in total employment in the US. With more people employed and wage growth exceeding expectations, higher wages are leading to increased expenditure on goods, thereby boosting retail sales.

The retail sector is experiencing challenges due to higher interest rates. The current situation, with rising incomes and an expanding consumer base, is expected to increase demand, potentially leading to further inflation. However, this also suggests that the retail sector may continue to expand with increased sales. This chain of events, as previously explained, is all part of basic economics and is likely to persist even if interest rates do not immediately impact inflation.

Disappointing trend in apparel sales

Even though overall retail sales have surpassed expectations, the clothing sector was notably excluded from this upward trend. Clothing sales fell by 1.6 per cent compared to last month. The decline has been attributed to shifts in which income bracket is spending more. Reports indicate that the lower income bracket in the US has benefitted most from the current boost in the job market. Consequently, despite the factors of inflation and higher interest rates, overall sales are expected to rise due to increases in income. Furthermore, disposable incomes are also on the rise, further fuelling retail sales.

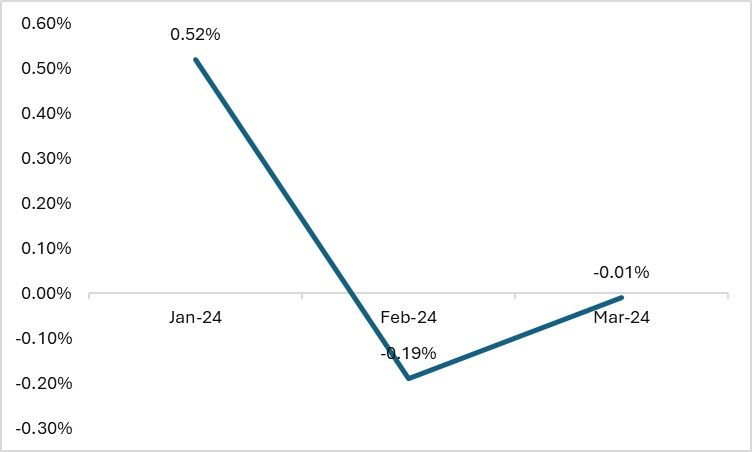

Figure 2: Growth in clothing and accessories sales (in %)

Source: United States Census Bureau

However, this trend does not hold for clothing. Expenditure on clothing and accessories is considered discretionary, and typically, an increase in income would lead to an increase in such spending. Yet, a critical factor to consider is the inflation specific to the clothing sector. A rise in overall inflation also entails an increase in clothing prices. Therefore, even though incomes and expenditures on clothing generally move in tandem, a price increase can negatively impact clothing sales, as reflected in the above index.

Sales to dip, but a glimmer of hope remains

Another report by the National Retail Federation (NRF) also noted a decline in the clothing index. The organisation, which conducts surveys across the US, observed that the US clothing index fell by 0.01 per cent in March. Despite these lower figures, the survey report highlighted a decrease in clothing sales even amidst an increase in overall retail spending, as illustrated in the figure below.

Figure 3: Growth in retail sales of clothing and clothing accessories stores (in %)

Source: National Retail Federation

Even as other categories experience growth, the rise in interest rates means that retailers are likely to pass on increased costs to consumers in the forthcoming period, as indicated by various apparel foundations across the US. Therefore, despite the job growth and wage increases contributing to the overall rise in retail sales, the future of clothing and accessories sales remains uncertain.

However, there is an important aspect to consider. Clothing sales typically surge during the festive season in the US. According to survey results from the National Retail Federation (NRF), clothing was the fourth most purchased item by households for Easter. NRF estimates suggest that for Easter alone, consumers across the US spent $3.5 billion. Thus, although there may be a decline in clothing sales during regular periods, festive seasons provide an opportunity to offset these losses.

Road Ahead: Navigating future challenges in clothing sales

Even though festive periods traditionally boost clothing sales, the current trends suggest a shift in direction. While retail expenditure on apparel is directly influenced by increases in income, other factors such as rising prices, the real income of consumers, and the interplay of various economic variables also play crucial roles in shaping the sector's growth trajectory, particularly for clothing. As interest rates eventually decrease, it is anticipated that consumer appetite for purchasing apparel will increase.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!