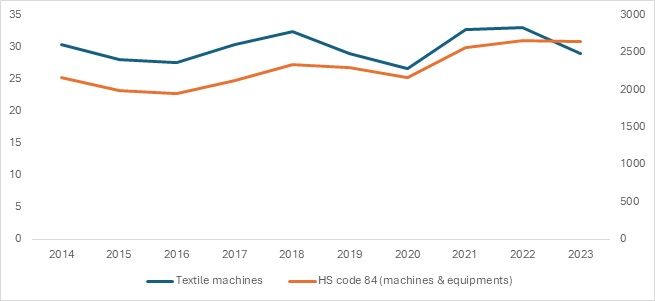

Exhibit 1: HS code 84 (machines) and textile machines imports in CY 2023 (in $ bn)

Source: ITC Trademap

The data provided reveals trends in the import of textile machines and total machines from 2014 to 2023. Over this period, the import of textile machines shows fluctuations, with a notable peak in 2018 at $32.40 billion, followed by a sharp decline in 2020 to $26.67 billion, likely influenced by global economic disruptions such as the COVID-19 pandemic. In comparison, the total machine imports generally follow a similar trajectory, experiencing a dip in 2020 ($2163.98 billion) before rebounding in 2021 and 2022, with a peak of $2661.18 billion in 2022. Both categories exhibit some alignment in their trends, especially between 2014 to 2018 and 2021, where both textile and total machine imports increased after a low in 2020.

However, the textile machine imports tend to be more volatile than the overall machine imports, suggesting that the textile sector may be more sensitive to economic conditions or changes in industry-specific demand. Notably, the textile machines’ share of total machine imports appears to have decreased in recent years, with 2023 showing textile machines at $28.94 billion compared to total machine imports of $2,646.66 billion, indicating a relative reduction in textile machinery's contribution to the overall machine import market.

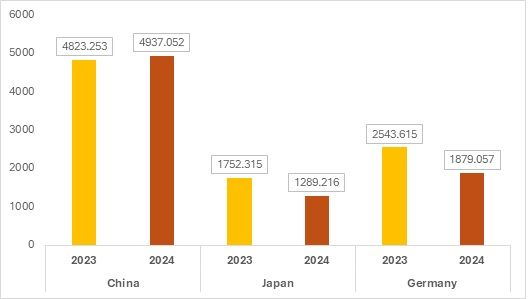

Current trends: How do the top 3 textile machine countries fare in CY 2024?

Exhibit 2: Top 3 textile machinery exporting countries in CY 2023 (Feb-Sept) and CY 2024 (Feb-Sept) (in $ Mn)

Source: ITC Trademap, F2F Analysis

*Please note that the years 2023 and 2024 depict the total sum between February and September for comparison purposes, due to the lack of data for January 2023.

The data reveals trends in textile machinery exports from China, Japan, and Germany for 2023 and 2024. China leads as the dominant exporter, with figures consistently higher than those of Japan and Germany across both years. While China's exports show a relatively stable pattern with slight fluctuations between months, there is a general upward trend in 2024, especially in August, when the value peaks at $702.892 million. Japan's exports in 2024 show a decline compared to 2023, with the most notable drop occurring in April ($148.814 million) and a general reduction across most months. On the other hand, Germany demonstrates more stability in its export values, with its highest export in March 2023 at $375.238 million, followed by a decline in 2024, particularly in the second half of the year. Despite the dips, Germany's values remain relatively strong, indicating its sustained focus on high-quality, specialised machinery. Overall, China maintains its dominance in the market, while Japan and Germany face slight fluctuations, with Germany showing resilience in its export figures.

The data indicates that China experienced a slight increase in textile machinery exports from $4,823.25 million in 2023 to $4,937.05 million in 2024, reflecting continued dominance and growth in its export market. Japan, however, saw a significant decline in its exports, dropping from $1,752.31 million in 2023 to $1,289.21 million in 2024, indicating a reduction in its market share. Germany also experienced a decline, with exports falling from $2,543.61 million in 2023 to $1,879.05 million in 2024, though its export figures remain robust. Overall, while China shows growth, both Japan and Germany have faced challenges with a reduction in textile machinery exports in 2024 compared to the previous year.

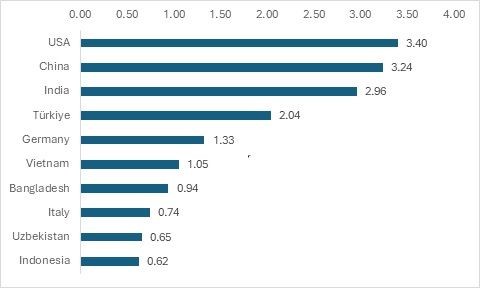

Exhibit 3: Top textile machinery importing countries in CY 2023 (in $ Bn)

Source: ITC Trademap

The data for CY 2023 reflects the general trends with countries that are major textile exporters also being among the major textile machine importers. However, the US, one of the biggest consumers of all kinds of goods, occupies the top position despite not being a leading textile exporter to the world. This could be due to the textiles and apparel manufactured within the US borders for domestic use.

The rest of the data aligns with large textile manufacturers and exporters such as China, India, and Turkiye leading the list. It is interesting to observe that the current world leaders in textile exports, Vietnam and Bangladesh, do not feature in the top five importing countries. Vietnam saw a surge in textile machinery imports particularly in 2019, leading to it consistently being a top textile exporter in the succeeding years. Bangladesh experienced a dip in 2020 due to the COVID-19 pandemic; however, it also imported the highest value of textile machines ($1.5 billion) in CY 2022, which coincidentally was the highest year for textile exports worldwide.

Among the top textile exporters, Indonesia stands in ninth position, despite its declining status as a major textile exporter. The US and Japanese markets provide ample opportunities for Indonesian textiles, given its Generalized System of Preferences (GSP) status. Uzbekistan could rise as a regional leader in Central Asia, given its position in the top 10 importing countries for textile machinery. Indonesia’s consistent imports of textile machines could indicate the adoption of renewed textile policies aimed at positioning itself among the top textile exporting countries.

Current trends

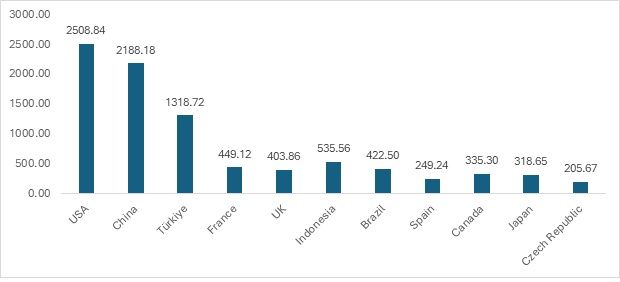

Exhibit 3: Top textile machinery importing countries in CY 2024 (Jan-Nov) (in $ Mn)

Source: ITC Trademap

In 2024, the textile machinery imports of these countries show distinct seasonal patterns. The United States leads with consistently high imports across most months, with a notable peak in November, reflecting strong industry demand throughout the year. China’s imports, while generally steady, experienced a drop in mid-year but rebounded later, suggesting possible production adjustments or economic shifts.

Türkiye exhibits a more varied trend, with imports peaking in early spring and mid-summer, potentially tied to production cycles or demand for specific machinery types. France, the UK, and Spain show a slight seasonal dip in summer months, with noticeable spikes in late fall, likely driven by year-end procurement. Brazil and Indonesia exhibit more fluctuating imports, with increases in mid-year months, indicating a rise in textile production activities. Overall, the data suggests that the textile machinery market is influenced by a combination of economic cycles, seasonal production demands, and strategic procurement timings.

Share of exporting countries

The exporter profile of textile machines plays a crucial role for major textile exporters, as lower tariff rates, especially for developing countries, would be a boon for the textile industry. China, Germany, Japan, and Italy lead in the percentage share of countries exporting textile machinery to the world.

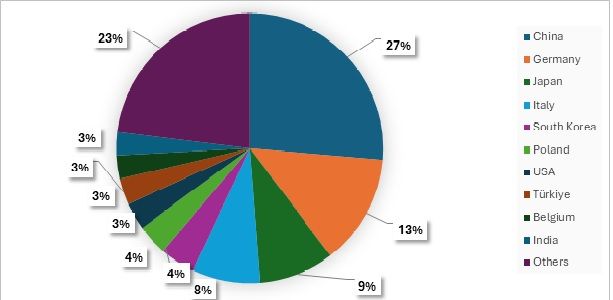

Exhibit 4: Top textile machinery exporters in CY 2023 (in %)

Source: ITC Trade map

China dominates the global textile machinery export market by a wide margin, with a value of $7.33 billion, reflecting its massive production capacity and leadership in the textile industry. Germany, Japan, and Italy follow as key players, contributing significantly with high-quality, advanced machinery, often catering to specialised and high-end markets. South Korea, Poland, Turkiye, and India, while smaller exporters, showcase the growing importance of emerging markets, with India and Turkiye benefitting from competitive manufacturing costs and strategic locations. The ‘Others’ category highlights the fragmentation of the market, with numerous countries contributing, emphasising the diverse and competitive nature of global textile machinery exports.

Current Trends

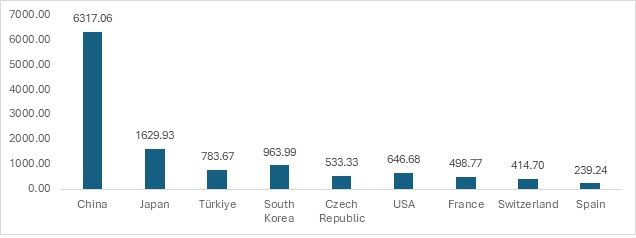

Exhibit 5: Top textile machinery exporter countries in CY 2024 (Jan-Nov) (in $ Mn)

Source: ITC Trademap

In 2024, China is the leading exporter of textile machinery, with a significant share of the global market, underscoring its position as a manufacturing powerhouse. Japan, while not as dominant as China, remains a key exporter, reflecting its advanced technological capabilities and specialized machinery for high-quality textile production. Türkiye, South Korea, and the Czech Republic also show notable exports, suggesting strong textile industries with growing capabilities in machinery manufacturing, although at smaller scales compared to the top exporters. The United States, as a major industrial player, exports a considerable amount of textile machinery, pointing to its advanced manufacturing sector and demand for high-end, specialized machinery. France and Switzerland, with their smaller export volumes, likely focus on niche, high-value machinery catering to specific segments of the textile industry. Spain, with the smallest export volume among the listed countries, indicates a more limited role in the global textile machinery export market.

The Tariff Tangle: How India's import duties on machinery outpace global peers

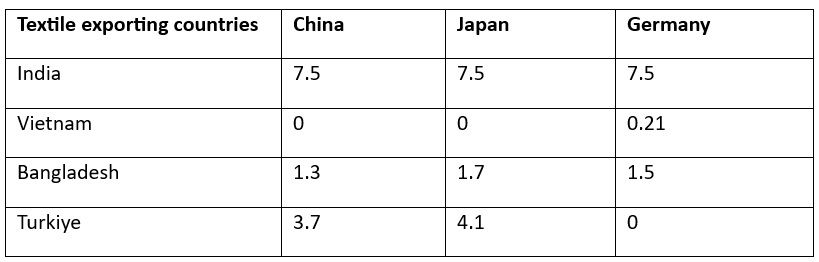

Table 1: Leading textile exporting countries' tariff rates (in %)

Source: WITS Database, F2F Analysis

Tariffs on textile machinery might be one of the main reasons why countries like India and Turkiye have not been fully successful in overtaking countries such as Vietnam and Bangladesh in the apparel and garments sector. Despite Vietnam and Bangladesh’s lower ranking in textile machinery imports compared to India and Turkiye, the former countries import more in quantity given the low tariff rates they impose on the top three textile machine exporting countries. Vietnam has 0 per cent rates across China, Japan, and Germany. Bangladesh has slightly higher tariffs, but they remain low nonetheless. It can choose to import from a more cost-effective country or buy high-quality German goods to produce its finished products such as apparel.

Turkiye, on the other hand, benefits from the European Union-Turkiye Customs Union, hence it should choose to import quality textile machines from Germany at 0 per cent tariff rates. Japan has a Comprehensive Economic Partnership Agreement (CEPA) with Japan; however, India did not negotiate better deals for its textile machinery. India has not been fully able to tap into importing quality textile machinery from the country with which it has a trade agreement. India’s strength still lies in its raw and intermediate products such as cotton and cotton yarn. However, to fully capture the apparel market just like its Southeast Asian neighbours, India will either need to reduce its tariffs or build in-house technologies using the Technology Upgradation Fund Scheme (TUFS).

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!