The company delivered a robust jump in profits, supported by improved operating efficiency and better cost management. PBT surged 35.43 per cent YoY to ₹238.9 lakh (~$269,507), up from ₹176.4 lakh in Q2 of the previous year. QoQ, PBT rose 47.3 per cent from ₹162.19 lakh.

Profit after tax (PAT) displayed even stronger momentum, jumping 70.59 per cent YoY to ₹181.32 lakh against ₹106.29 lakh last year. On a QoQ basis, PAT increased 42.92 per cent from ₹126.87 lakh. EPS for the quarter stood at ₹1.15, expanding 74 per cent YoY and 32.18 per cent QoQ, signalling enhanced shareholder value, Vipul Organics said in a press release.

For the first half of FY26, Vipul Organics reported steady top-line performance and healthy improvement in profitability metrics. Profit before tax (PBT) increased 19.71 per cent to ₹401.1 lakh, compared with ₹335.07 lakh in H1 of FY25.

PAT rose 39.97 per cent to ₹308.20 lakh from ₹220.19 lakh a year earlier. Earnings per share (EPS) improved 43.38 per cent to ₹1.95, up from ₹1.36 in H1 last year. Total revenue for H1 stood at ₹7,735.17 lakh, marginally lower than ₹7,763.07 lakh in the same period last year, reflecting stability despite market fluctuations.

Consolidated financials closely mirrored the standalone numbers across revenue, PBT, PAT, and EPS, highlighting the streamlined nature of operations. Consolidated PAT for Q2 stood at ₹181.16 lakh, while consolidated EPS was ₹1.15.

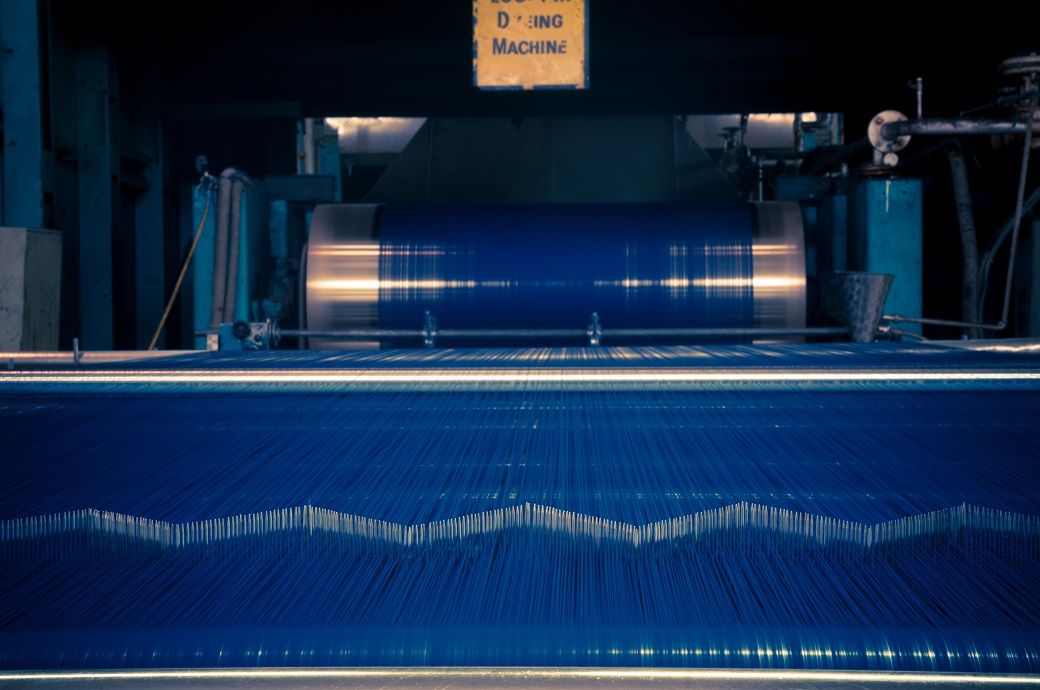

The company’s strong profitability indicators reflect improving margin discipline and resilient demand for its pigments and dyes portfolio. With sharper gains in PAT and EPS compared with revenue growth, Vipul Organics has entered the second half of the fiscal on a firm financial footing.

“Over the past few quarters, we have maintained a strong focus on enhancing operational efficiencies, and we are pleased to see these efforts beginning to translate into improved profitability. While revenue remained broadly stable during the period, we are confident of a healthy uptick in business momentum from Q4 onwards,” said Vipul Shah, managing director of Vipul Organics Limited. “At our Sayakha facility, we now anticipate the start of commercial production in Q4 of the current financial year. In parallel, we have begun presenting our Membrane Technology product range to both domestic and international customers, and the initial response has been highly encouraging. We expect this segment to begin contributing meaningfully over the next few quarters.”

“After a phase of subdued growth over the past 2–3 years, we believe the business is now well-positioned for renewed growth. With the introduction of new products, strengthened R&D capabilities, the completion of key Capex initiatives, and expanded capacities, we are confident that Vipul Organics is entering a new growth phase,” added Shah.

ALCHEMPro News Desk (SG)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!