These factors have significantly hampered the bloc's growth prospects. Growth projections have been capped at a modest 1 to 1.5 per cent until 2025. Growth disparities are evident, with some regions showing moderate growth while others teeter on the brink of recession. As the current inflation stands at 2.4 per cent, the ECB is sceptical about the bad days gone by. As we live in a globalised world, trade is paramount, even in the face of a shallow recession.

Recession on, trade off

Recession is defined as declining growth for two consecutive quarters. The EU has been at risk of entering a recession since the beginning of the Russia-Ukraine and Israel-Hamas conflicts, which have added fuel to the fire. During this period of negative growth, manufacturing is the first economic activity to be affected, with consequences for employment and wage rates. Surprisingly, the EU has maintained a record-low unemployment rate of 6.2 per cent.

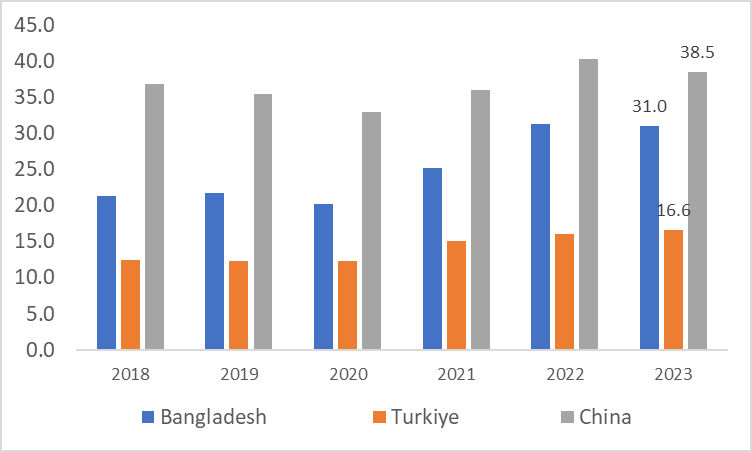

The European Union primarily imports apparel and carpets from Asian countries. The main suppliers of apparel are China, Bangladesh, and Turkiye. Italy is the largest exporter of apparel within the bloc. With recession concerns looming in most eurozone areas, a preliminary analysis indicates a minor reduction in trade in the short term.

Declining imports and a tightly zipped purse

Figure 1: EU’s apparel imports (in $ mn)

Source: ITC Trade Map

With apparel falling into both discretionary and necessary spending categories, the impact on the textile trade may not become evident immediately. Meanwhile, the suppliers of apparel to the EU are also grappling with their own crises. With this shallow recession looming, imports are likely to be affected as well. Imports of apparel from countries like Bangladesh and China are already showing signs of decline, with a glimmer of hope for Turkiye. Apparel imports into the EU are projected to decrease, with an estimated reduction of approximately 1 per cent from Bangladesh, 0.04 per cent from China, and a modest growth of 3 per cent from Turkiye, according to Fibre2Fashion’s analysis. The increased imports from Turkiye could be attributed to its proximity to the region and the recent inclination of all the western nations to decouple from China.

The reason for a slight reduction in the imports for the region is the economic condition of the major apparel importing economies. There are 6 major importers in the EU for apparel: Germany, Spain, Netherlands, France, Italy, and Poland. Out of these six economies, Germany, France, and the Netherlands are contracting, whereas Spain and Poland registered minor growth, and Italy escaped recession by registering zero growth this quarter. Therefore, the current fall in the imports may show only a slight decrease and not a major downturn in imports. Thus, the imports may not significantly impact the exporting major economies in the medium term.

Europeans do like to spend on clothes and footwear. According to Eurostat data, an average European spends 4.2 per cent of their income on clothing and apparel. However, the cost-of-living crisis may have a negative impact on apparel imports if consumer confidence shifts, leading them to curtail their spending, which could affect apparel imports in the coming months.

Currency fears

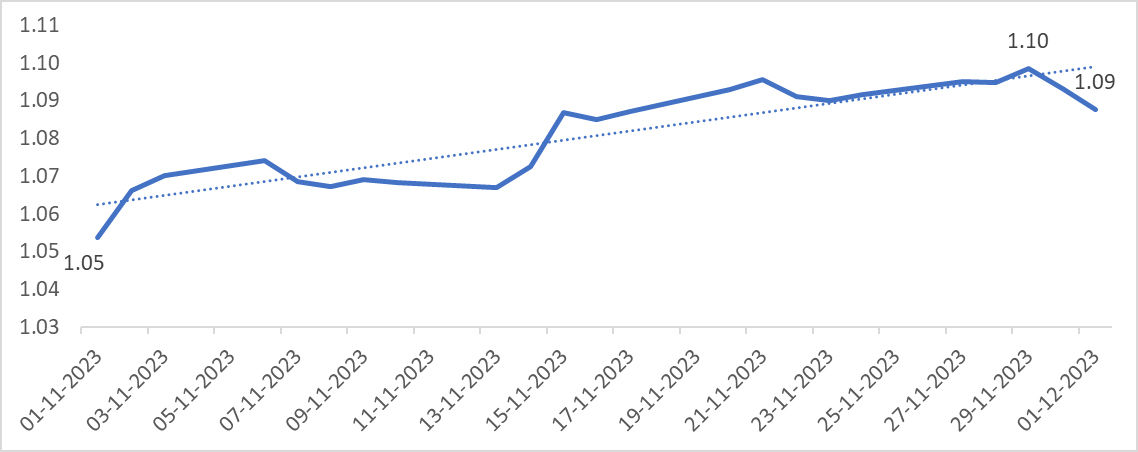

With the economy constantly entering a period of recession or a supposed economic slowdown, the currency of the country is equivalently at risk of depreciating. During a crisis, the currency loses its appeal and weakens against major world currencies. The euro, in particular, is following a similar trend. It has consistently depreciated against the dollar as fears of a recession loom over the entire bloc. One of the reasons for the decline in imports may also be the drop in the exchange rate against the dollar.

Figure 2: Euro to dollar exchange rate

Source: ECB

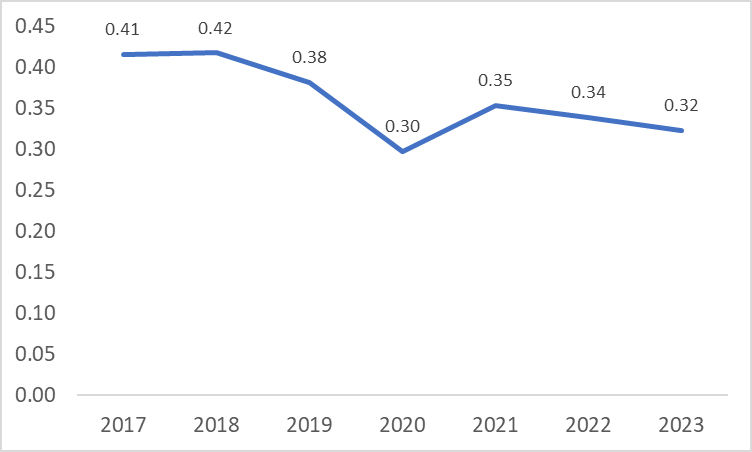

Reduced trade of second-hand clothing

Apart from importing apparel, carpets, and fibres from Asia, the bloc also includes countries that are among the largest exporters of used apparel. Countries like Germany and the United Kingdom export significant quantities of second-hand clothing to countries in Africa and Asia. For instance, Germany is currently facing an economic downturn. According to F2F analysis, the export of second-hand apparel from Germany is expected to decrease by 5 per cent. One of the reasons for this decline in exports is the sluggish economic growth, which is negatively impacting its international trade.

Figure 3: Germany’s used clothing exports (in $ mn)

Source: ITC Trade map

Will Asia be impacted?

The shallow recession in the eurozone and the anticipated decrease in demand within the region will certainly lead to reduced imports of textile products, thereby affecting trade within the continent. While Asia exports a significant amount of apparel and textile products to the eurozone, there is also an intricate network of textile trade within the continent that supports the production of finished products. Countries such as China, Vietnam, Bangladesh, and India, which are major producers of apparel and textile products, import yarn and fabrics on a large scale from other countries within the continent. Additionally, countries like Pakistan, Thailand, Taiwan, South Korea, and Bangladesh are actively engaged in exporting yarns and fabrics to China, Vietnam, and Bangladesh.

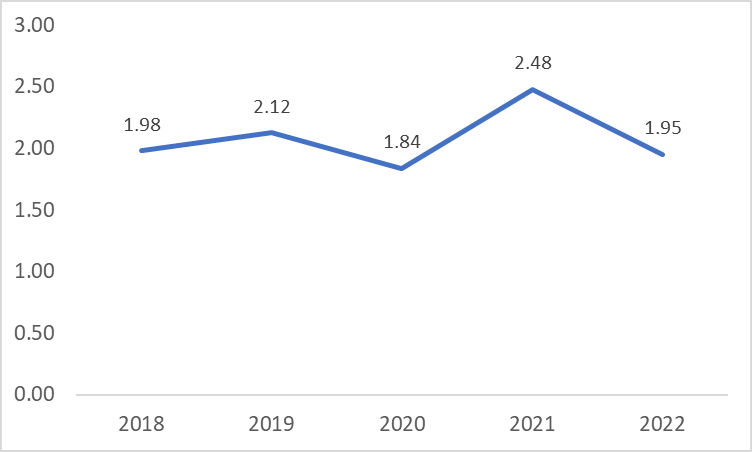

With the expected reduction in trade among these countries, there will also be a decrease in demand for yarn imports from major apparel-producing nations, creating a chain reaction that extends beyond the eurozone. As depicted in the graph below, China significantly reduced its imports of cotton yarn from Vietnam, primarily due to the cost-of-living crisis in the eurozone and the resulting decrease in demand. Although total exports are projected to increase in 2023, the decline in yarn exports during the first half of the year was a substantial 10.9 per cent compared to the same period in 2022. Therefore, rising inflation and reduced demand will impact not only apparel exports but also the trade in intermediary goods such as yarns and fibres.

Figure 4: China’s imports of cotton yarn from Vietnam

Source: ITC Trade Map

Two problems, no solution

European economies are at risk of recession, while the supplying economies face their internal challenges. The EU's economic problems are a precursor to potentially significant developments. Supplying countries such as Bangladesh, China, and Turkiye have their own unique issues to contend with, including labour strikes in Bangladesh, persistent inflation in Turkiye, China's mounting debt, and concerns about a new virus outbreak. With no apparent common solutions in sight for these problems, the world can only watch and await further developments.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!