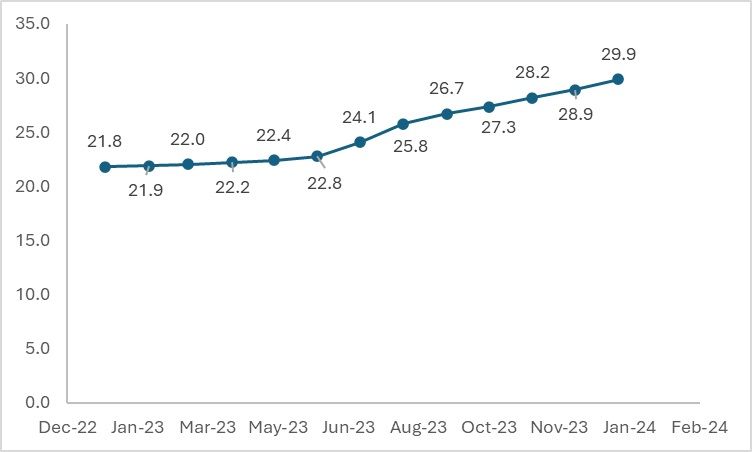

The root cause of these challenges lies in misguided policies and a deficiency in foreign exchange reserves. Currently, Nigeria accounts for approximately 18.6 per cent of Africa's GDP, underscoring its pivotal role in the region's economic landscape. However, the nation is plagued by inflation, with rates surging to as high as 30 per cent, exacerbating the cost-of-living crisis. Figure 1 illustrates the alarming trajectory of inflation within the Nigerian economy, which has been steadily escalating since 2022. Moreover, the monetary policy framework has compounded the existing woes, further straining Nigeria's economic stability.

Figure 1: Inflation in Nigeria (in %)

Source: Central Bank of Nigeria (CBN)

However, inflation in the country is not solely due to the global economy. Many internal factors have also contributed to the current situation in which Nigeria finds itself. There are major factors exacerbating the condition of the Nigerian economy, including increasing unemployment, high government debt, declining oil production, and constant power shortages affecting households and manufacturing alike. Despite the increasing population, the Nigerian economy relies heavily on imports for almost all commodities. The current inflationary trend could spiral into a crisis detrimental to the entire economy.

The current inflation is a result of monetary policies and food price hikes. Nigeria imports most food due to the insufficiency of domestic capacity to meet domestic demand. Another factor is the change in monetary policy. The Nigerian Central Bank has again shifted from pegging to a market-determined exchange rate system. A significant disparity between the official and unofficial exchange rates has resulted in a shortage of foreign exchange in the system. Amidst all the chaos, foreign direct investment (FDI) has significantly dwindled in the Nigerian economy, further tightening the supply of foreign exchange. Over 90 per cent of the country's foreign exchange is earned through oil production and exports, which have recently dwindled due to insufficient production, leading to a crash in exports and a crunch in foreign exchange supply.

The economics of overdependence on imports

The increasing reliance on oil has led to the neglect of other equally viable sectors in Nigeria, resulting in a heavy dependence on imports. The economics here is quite straightforward, albeit it involves foreign exchange (FOREX). As the supply of FOREX diminished in the market, the Nigerian Naira depreciated, making it expensive for the country to finance its imports. With imports becoming more costly, there is a higher likelihood of increased domestic prices, especially for essential commodities like food grains.

As domestic prices rise, consumers become less willing to purchase goods. While food remains a necessary expenditure, other discretionary expenses are either reduced or altogether abandoned. Consequently, all other sectors of the economy are equally affected.

Nigeria imports nearly all commodities, rendering it vulnerable to external economic shocks. With ongoing trade disruptions due to conflicts and many countries adopting protectionist policies, global prices soar, further impacting countries heavily reliant on imports. However, there is always a long-term solution. By prioritising the development of sectors beyond oil and natural gas, such as the neglected textile industry, Nigerian authorities can mitigate the country's vulnerability to import dependence.

Rise and fall of Nigerian textile sector

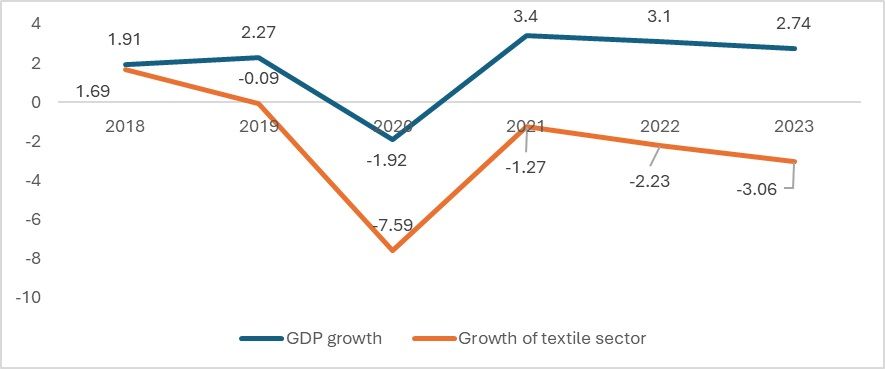

Similar to other African countries such as Kenya, Benin, and Ghana, Nigeria boasted a dynamic and thriving textile industry, which was once the second-largest employer in the country after agriculture. However, due to policy and financial shifts towards oil and gas production, the industry lost its lustre. While the country's GDP is experiencing decent growth, along with the manufacturing sector, the textile industry is facing negative growth. What was once an industry employing around 250,000 people now employs less than 20,000 individuals. According to the Oxford Business Group, the number of textile industries in the country has dwindled from over 200 to barely 25.

Figure 2: Nigerian textile industry’s growth vs GDP growth (in %)

Source: Central Bank of Nigeria (CBN)

Figure 2 illustrates the decline of the textile industry year after year. In an effort to revive the industry and restore its efficiency to its previous levels, the government of Nigeria invested approximately 100 million naira. However, this investment plan failed as it did not adequately account for the costs of raw materials and machinery.

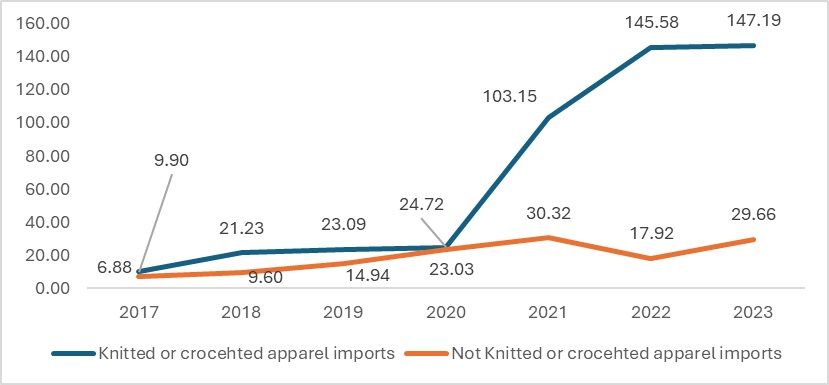

Figure 3: Nigeria's apparel imports (in $ mn)

Source: UN Comtrade

As the Nigerian textile industry failed to recover after the 1990s, the country remained a significant importer of apparel and other textiles, despite having the potential to establish an entire value chain due to the presence of a major raw material – cotton. Even today, Nigeria imports apparel from countries like China, India, and Ethiopia. The country needs to leverage its paralysed textile value chain, which has remained dormant for over a decade. The prevalence of cheaper imports from China, power shortages, and uncertainties in government policies are contributing to the sluggish growth of the textile industry, thereby perpetuating the country's reliance on imported textile products.

Textile trade and opportunities

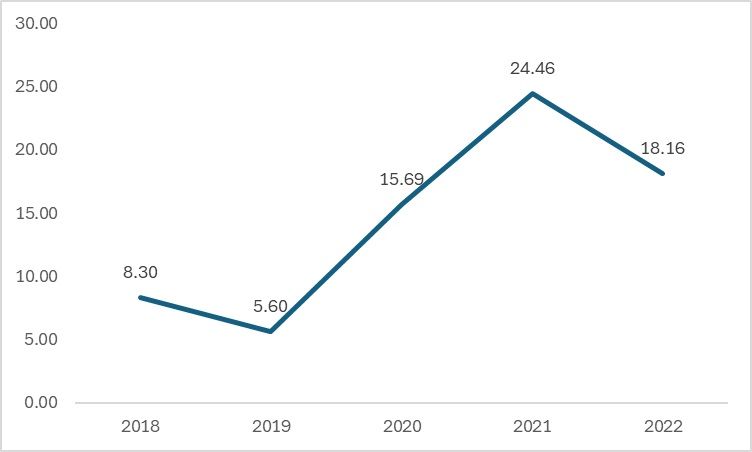

Nigeria produces cotton on a small scale but predominantly exports it in raw form to other major textile-producing countries. The volume of cotton exports is considerably smaller compared to other commodities such as crude oil and related products, cocoa seeds, etc. Figure 3 illustrates the fluctuating exports of Nigerian cotton. The primary recipients of Nigerian cotton are limited to India, Vietnam, and Pakistan, with Pakistan being its largest export partner. However, cotton production is also experiencing a lull period, resulting in a further decline in exports.

Figure 4: Cotton exports from Nigeria (in $ mn):

Source: UN Comtrade

The textile industry in the country has slowed down due to issues such as smuggling and lack of access to finance. The Nigerian government has attempted to boost the textile industry through import restrictions and engagement with industry stakeholders to revive the value chain. Progress, albeit slow, is underway, but the current conditions could undermine these efforts.

The logic is straightforward: Nigeria possesses all the necessary resources for a properly functioning textile value chain, including abundant labour, natural resources, and a growing global demand for natural fibres. With appropriate government support, Nigeria has the capacity to achieve economies of scale similar to China. While this may be a long-term goal, the immediate priority is to reduce the country's dependency on imports, which can help stabilise the economy. Textiles could serve as a starting point for this effort, reviving the once self-sufficient industry and contributing to diversification away from oil and gas. This diversification would protect the economy from global market volatility and associated risks.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!