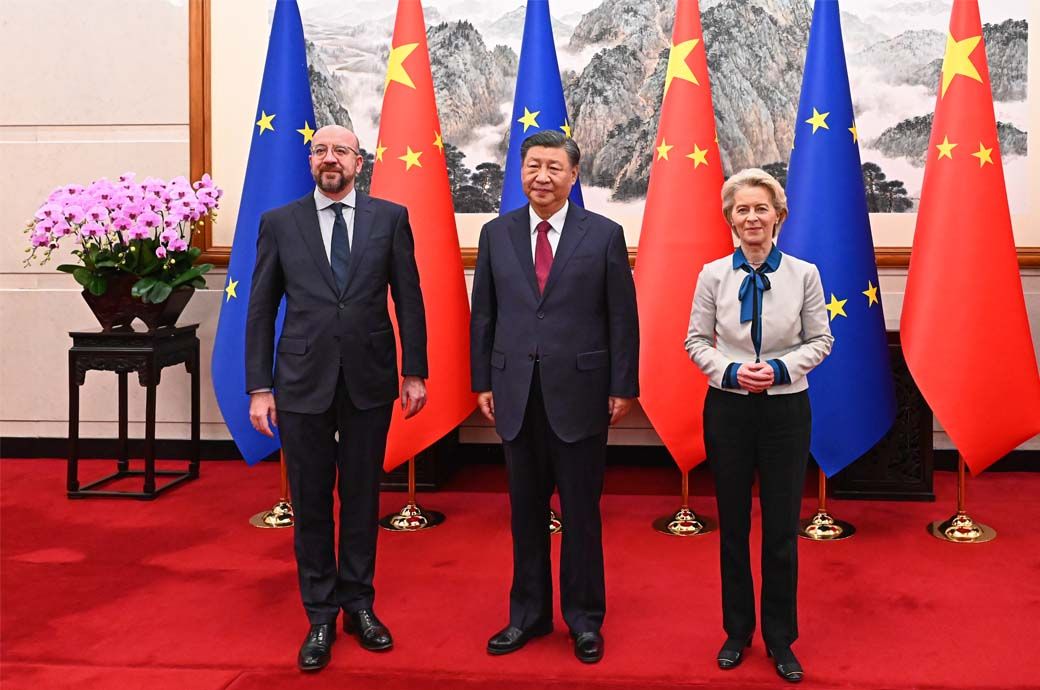

In the wake of widening trade imbalances and growing concerns of over-dependence on China, the European Union (EU) is exploring alternatives to address its trade deficits. The EU-China trade summit, currently underway in Beijing, is expected to address this pressing issue. As China shifts its focus towards the electric vehicle and related component market, can Turkiye and Bangladesh emerge as potential contenders to fill the gap in the textile and apparel category?

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Imbalanced scales of trade.

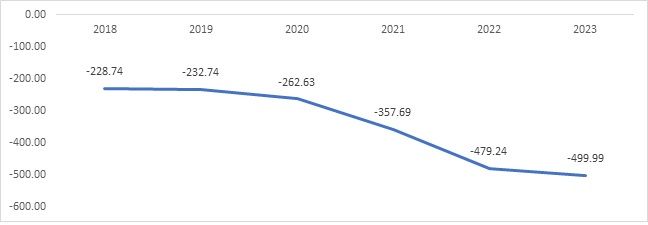

The European Union imports products such as electrical equipment, toys, steel, apparel, plastics, aluminium, and rubber articles from China. The trade balance of the bloc has been in a deficit, and it is increasing as the years pass by. The EU recently announced a risk mitigation strategy with China to reduce its reliance on the country for various products thus far.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Figure 1: Trade Balance of European Union with China (in $ mn)

Source: ITC Trade Map

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

The trade balance of the bloc is widening. When coupled with geopolitical issues, the bloc has every reason to initiate a ‘de-risking’ strategy, as the European Commission President Ursula von der Leyen has already mentioned. While China is attempting to normalise its relationship with the EU, the latter is still upset over a range of issues, with subsidies to electric vehicles in China being a major concern.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

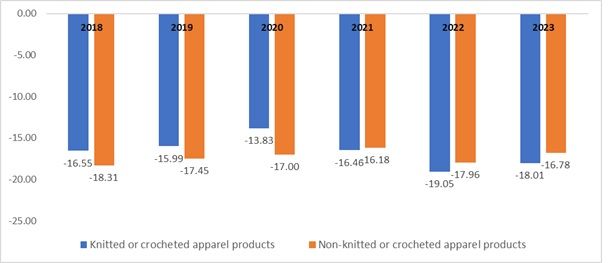

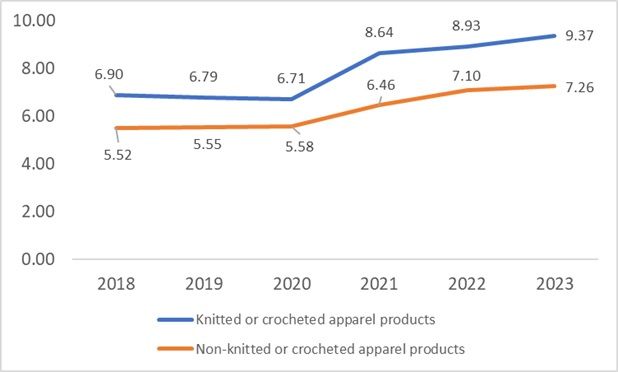

According to data from the ITC Trade Map, the EU faces the highest deficit in technology, followed by the textiles and apparel (T&A) category. Within the T&A category, the EU imports a significant amount of apparel, leading to an increasing deficit with China. Figure 2 illustrates this growing deficit. Although the deficit in the knitted and crocheted apparel category has been decreasing, it has not done so significantly.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

De-risking and diversification

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

China, which is transitioning away from the T&A category, is now looking ahead of the times as it seeks to capitalise on the electric vehicles and related components market. This space is potentially to be filled by countries such as Bangladesh and Turkiye, which rank as the second and third-largest apparel exporters to the bloc.

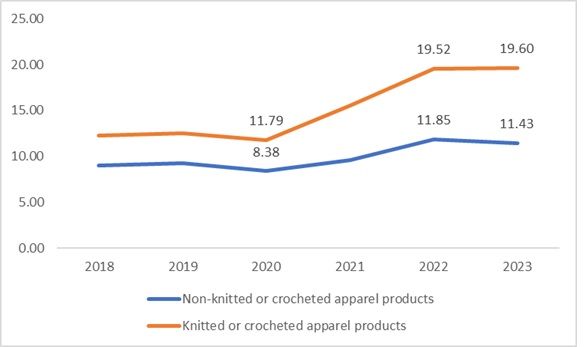

However, the question remains whether Bangladesh will be able to secure the position as the largest exporter of apparel to the European Union, considering that the bloc has implemented a new policy on the circular economy, which could potentially raise concerns about apparel imports. Data from the ITC trade map indicates an increase in imports from the same source.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Figure 2: Category-wise break up of EU’s apparel trade deficit with China (in $ mn)

Source: ITC Trade Map

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Figure 3: Apparel exports from Bangladesh to EU (in $ mn)

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Source: ITC Trade Map

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Another potential exporter that can replace or assist the EU in diversification is Turkiye. The nation is the third-largest apparel exporter to the Union and has the potential to surpass the top two countries as a major exporter. One of the reasons is its proximity to the EU. The country, which gained attention during the pandemic for its cheap shipping and overall lower costs, is currently facing challenges but still has the potential to increase trade with the EU. The EU has a trade deficit with Turkiye, although not as significant as that with China. The proximity proves to be a bonus point for the EU, which is seeking alternatives in its ‘de-risking’ strategy with China. Although imports from the country decreased by 6 per cent in the first quarter of 2023-24, apparel imports are expected to rise for the current year.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Tie-ups with other Asian producers

Bangladesh, although facing some hiccups in its supply chain due to labour protests, is still one of the suppliers of readymade garments to the EU. As Bangladesh already enjoys significant benefits under the Generalised System of Preferences (GSP), expanding trade through an agreement may be an idea that requires proper consideration and study.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Apart from alternatives within the European region and Bangladesh, other Asian countries can also become potential exporters to the EU in the coming months. The economic outlook by Euratex has pointed out double-digit growth in the import of textiles from countries like India. If the free trade agreement (FTA) materialises, imports into the EU will be at zero duty, further boosting Indian trade in apparel and textiles with the EU.

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

Figure 4: Apparel exports from Turkiye to EU (in $ mn)

Source: ITC Trade Map

Amid rising trade imbalances and concerns about China dependency, the European Union (EU) is seeking alternatives.

The EU-China trade summit in Beijing aims to address this issue.

While China focuses on electric vehicles, Turkiye and Bangladesh may fill the textile and apparel gap.

The EU's de-risking strategy will depend on outcomes from the ongoing summit.

The current resolution of the EU to actually de-risk trade with China will potentially involve the bloc attempting to diversify trade by increasing trade with countries like Bangladesh, Turkiye, and other countries in South Asia and Central Asia. However, the true outcomes will only be known in the future and will depend on what is discussed in the upcoming summit regarding the EU's trade balance with China.

ALCHEMPro News Desk (KL)