However, the African continent also seeks to benefit from trade with China. Beyond continuous infrastructure investments, African nations aim to leverage infrastructure and technology transfers to increase their exports, particularly to China. The trade relationship between South Africa and China is strengthening, marked by several significant announcements made during the BRICS Summit in August 2023. Among the highlights was the signing of agreements by Chinese companies to purchase South African products, totalling approximately $2.2 billion.

Additionally, China donated energy equipment valued at $8.9 million to South Africa, along with a grant of $26.9 million to help address the country’s energy crisis. Across Africa, China is increasingly focused on importing agricultural products and manufactured goods from the continent, while also emphasising its interests in oil, critical minerals, and metals. The primary imports from China into Africa consist of manufactured goods, including electronics, clothing, appliances, and technology.

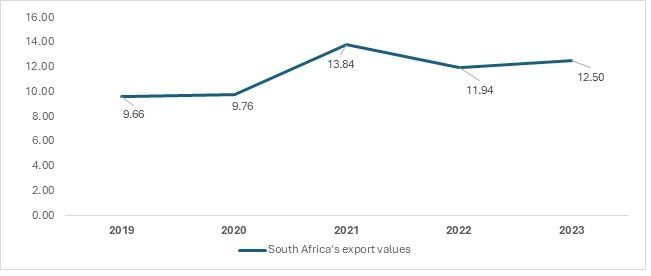

Exhibit 1: South Africa’s exports to China (in $ bn)

Source: TexPro, F2F Analysis

Data on South Africa's exports to China from 2019 to 2023 reveals notable trends. South Africa's exports rose from $9.66 billion in 2019 to a peak of $13.84 billion in 2021, followed by a slight decline in 2022 and a modest recovery to $12.50 billion in 2023. This fluctuation suggests challenges in maintaining consistent growth, possibly due to global economic factors or shifts in demand.

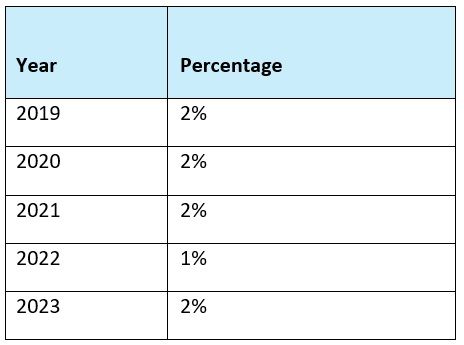

Table 1: Percentage occupied by South African textiles in its total exports to China (in %)

Source: F2F Analysis

Data on South Africa's textile exports to China reveals distinct trends from calendar year (CY) 2019 to CY 2023. South Africa's share of textiles in total exports has remained relatively stable, fluctuating between 1 per cent and 2 per cent, indicating a consistent but limited presence in the market. This stability suggests that South Africa's textile industry is less affected by market changes and demand fluctuations than those of other countries. Overall, while South Africa is engaged in textile exports to China, its performance shows a steady market share over the years.

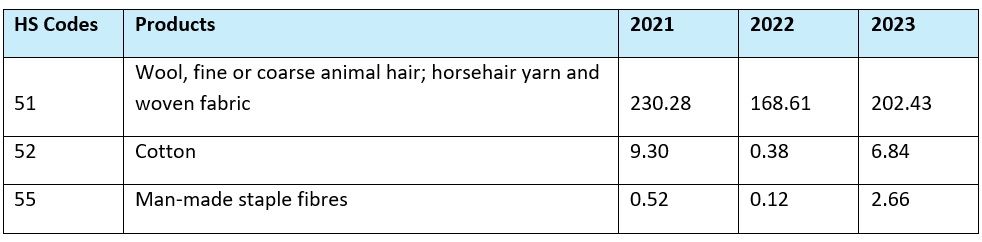

Table 2: South Africa’s top exports to China (in $ mn)

Source: TexPro, F2F Analysis

Data on textile exports under various HS codes reveals significant fluctuations over recent years. For wool and animal hair products (HS Code 51), exports saw a notable decline from $230.28 million in 2021 to $168.61 million in 2022, followed by a recovery to $202.43 million in 2023, indicating some volatility but an overall return to growth. In contrast, cotton exports (HS Code 52) experienced a dramatic drop from $9.30 million in 2021 to just $0.38 million in 2022, with a modest recovery to $6.84 million in 2023, reflecting ongoing challenges in this segment. Lastly, exports of man-made staple fibres (HS Code 55) remained minimal, with slight growth from $0.52 million in 2021 to $2.66 million in 2023, suggesting a gradual increase in demand for these materials.

South Africa holds an advantage in wool, which is widely used in the manufacturing of Chinese apparel. Continued focus on wool exports could further integrate South Africa into global supply chains through China, the world’s largest apparel manufacturer and exporter.

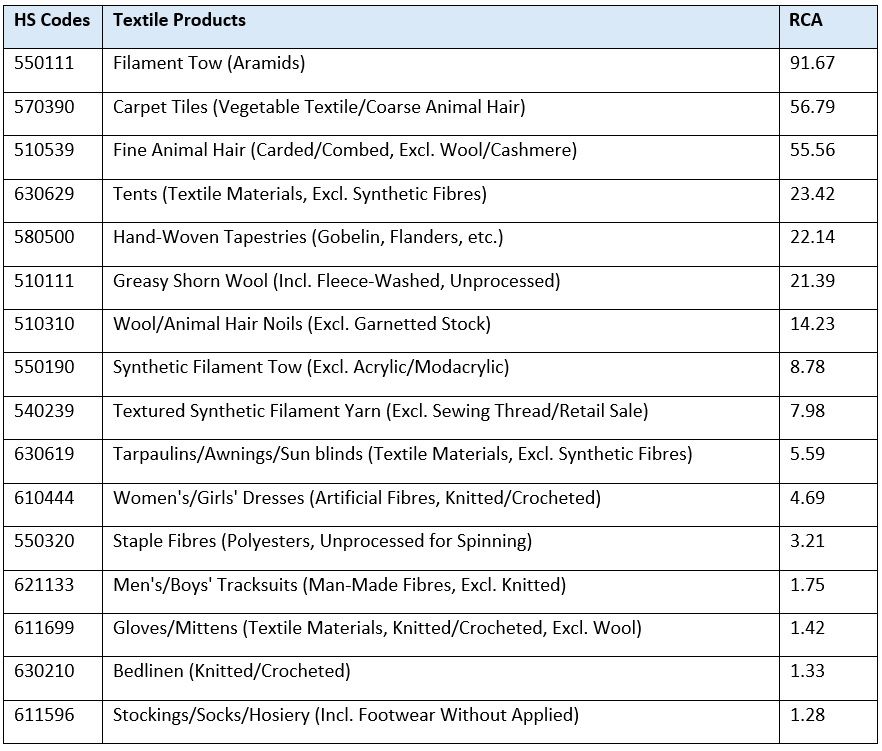

Table 3: Revealed Comparative Advantage (RCA) of South African textiles

Source: TexPro, F2F Analysis

A Revealed Comparative Advantage (RCA) greater than 1 indicates a comparative advantage for South Africa in specific textile products. This advantage suggests that South Africa should prioritise exporting these products to China if it seeks to establish a strong presence in the Chinese market. Notably, South Africa’s competitive product range includes raw materials, apparel, and even home textiles, highlighting the diversity of products with export potential.

Way Forward

The African Continental Free Trade Area (AfCFTA) presents a significant opportunity for economic collaboration, especially for South Africa, given its strategic position on the continent. During the recent BRICS summit, South African President Cyril Ramaphosa emphasised the importance of attracting foreign investments, particularly from BRICS nations. He highlighted the need for investment in labour-intensive industries and women-led businesses, positioning the textile sector as a prime candidate. The textile industry, known for its labour-intensive nature and relatively low technological barriers, is well-suited for such initiatives. Additionally, China’s proximity to South Africa could enable partnerships that strengthen South Africa’s local textile sector. China’s ongoing support for energy infrastructure also promises to improve the operational capabilities of South African textile enterprises, providing a solid foundation for growth.

According to F2F analysis, South Africa has distinct advantages in producing animal-based textile products. While China is often discussed as the world’s leading exporter, it is equally important to recognise its role as the second-largest importer, accounting for approximately 10.9 per cent of global imports, just behind the US at 13.5 per cent. Ignoring China in trade discussions would mean overlooking significant revenue opportunities for exporters. As China’s presence in the South African market continues to expand, global exporters must analyse this trade dynamic carefully. Understanding market shifts will allow South African businesses to strategise effectively and adapt to the evolving landscape of international trade.

In summary, the interplay between the AfCFTA, China, and South Africa’s textile industry presents both challenges and opportunities. By leveraging collaboration and investment potential, South Africa can significantly strengthen its textile sector.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!