The agreement signed by the US greatly benefits its textile industry, as US-manufactured products can enter the signatory nations duty-free. The ‘yarn forward’ rule under the agreement requires that garments and textile products be made using fabrics and yarns produced either in CAFTA-DR nations or the US. The current analysis focuses on the trade dynamics between the US and one of the strongest nations in the Caribbean.

US relations with the Dominican Republic

The relationship between the US and the Dominican Republic is one of the oldest and strongest, both economically and strategically. The CAFTA-DR agreement has helped boost trade between the two nations. US textile exports to the Dominican Republic are robust and are expected to grow at a CAGR of around 2 per cent, reaching $641 million by 2025. This growth in exports is occurring at a time when the US enjoys a trade surplus with the Dominican Republic. On the other hand, the Dominican Republic is also experiencing growth in its textile trade with the US.

Both nations have actively engaged in negotiations, leading to the establishment of the CAFTA-DR agreement and other initiatives, such as the Americas Partnership for Economic Prosperity. In addition to trade agreements, the US has provided strong support to small businesses in the Dominican Republic, empowering the country’s economic development. The two nations are also planning a gradual transition towards the adoption of green energy.

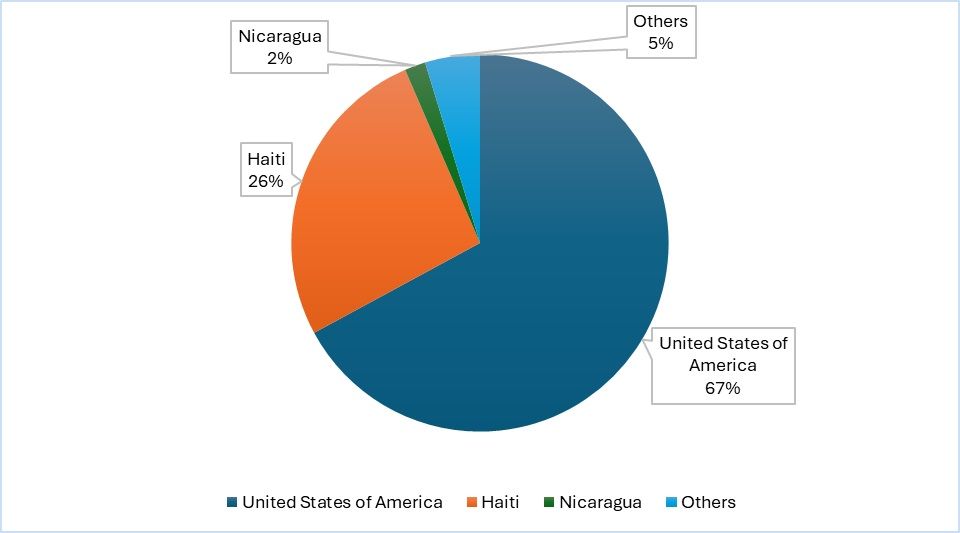

Exhibit 1: Share of countries in the Dominican Republic's exports (in %)

Source: ITC Trade map, F2F analysis

Due to the excellent relations between the two nations, the US stands out as the top export destination for the Dominican Republic. In addition to the smooth trade relations, the signing of the CAFTA-DR agreement has contributed to a significant increase in the US' share of Dominican exports. As of 2023, the US accounts for 67 per cent of the Dominican Republic's export market, while other countries each hold less than one per cent.

Dominance of the textile exports to the US

For the Dominican Republic, textiles are the fourth-largest export category, following metals, tobacco, and electronic products. Although the country exports textile products to 47 countries worldwide, the majority of its textile exports—66 per cent—are sent to the US, followed by Haiti.

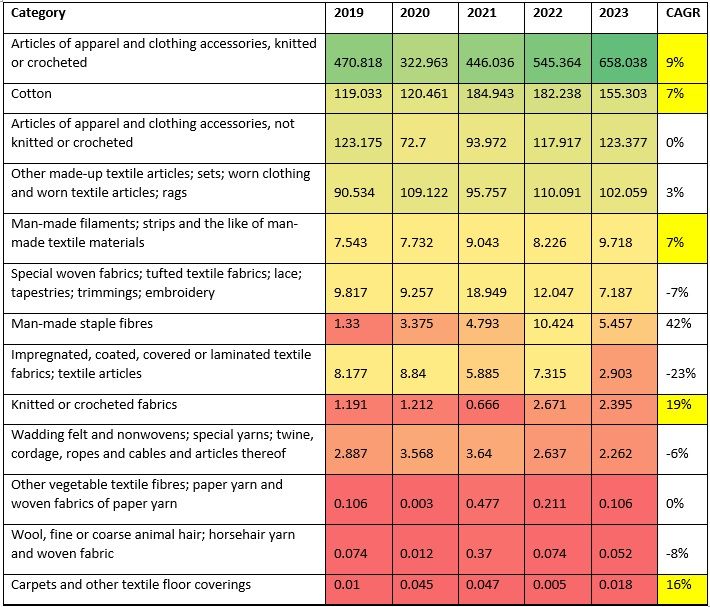

Table 1: Category-wise exports of the Dominican Republic to the US (in $ mn)

Source: ITC Trade Map, F2F analysis

The main exports of the Dominican Republic to the US are knit and woven apparel. These products represent one of the country's strongest export categories to the US, growing at a CAGR of 9 per cent. This growth is forecast to continue at a CAGR of 8 per cent over the next two years. The Dominican Republic has a robust garment industry and significant investments in US apparel and textile sectors, which also explains the country's surging exports to the US.

Although other categories, such as home textiles, are experiencing a higher growth rate, they are not as prominently highlighted due to their lower export volumes and values. The country's main exports by value continue to be knit and woven apparel, which are not only increasing at a significant CAGR but also growing in overall value.

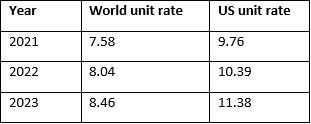

Table 2: Unit rate of the apparel exported by the Dominican Republic (in $)

Source: TexPro

The apparel exported to the US commands a higher value compared to the global average. Between 2021 and 2023, the unit price increased by a compound annual growth rate (CAGR) of 9 per cent, and between 2022 and 2023, it surged by 8 per cent. Given that many of the major manufacturing companies operating in the Dominican Republic are of US origin, these firms may have faced challenges in sourcing fibres, yarns, and fabrics due to supply chain issues at home. This could explain why apparel entered the US at higher prices, despite being duty-free.

The dominance of apparel exports from the Dominican Republic is largely due to the presence of established textile companies and the US' strong position in the sector. Eleven different countries operate within the Dominican Republic's free economic zones, with the US accounting for 48 per cent of the firms in industrial parks dedicated to the textile industry. Investment in the region’s textile industry has grown at a CAGR of 3 per cent since 2018. In 2023, the country saw a 10 per cent increase in investments, amounting to $898.2 million for the sector.

The result is evident: the share of textile exports as a proportion of the Dominican Republic's total exports has been increasing annually. In 2023, the share of textile exports to the US rose to 10 per cent, up from 8 per cent in 2022.

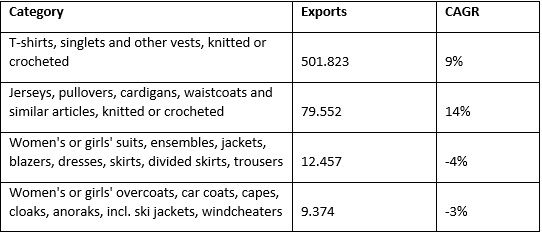

Table 3: Knitted apparel exports by the Dominican Republic to the US (in $ mn & %)

Source: ITC Trade Map, F2F analysis

The exports of knitted T-shirts, jerseys, and cardigans from the Dominican Republic have seen the highest growth over the past five years. While exports of T-shirts grew at a CAGR of 9 per cent, exports of pullovers and cardigans increased by 14 per cent CAGR. However, women’s apparel experienced a decline in total exports over this period. Although the exact cause of this gender-based categorical decline has not been fully examined, the overall downturn in the US economy over the past two years could be a contributing factor. On the other hand, essential items for women, such as brassieres, saw an increase in exports, growing at a CAGR of 6 per cent over the last five years.

Table 4: Woven apparel exports from the Dominican Republic to the US (in $ mn & %)

Source: ITC Trade Map, F2F analysis

A similar trend is observed in men's woven apparel. The decline in apparel exports over the past five years has been largely driven by uncertainty in the value chain, compounded by higher interest rates in the US economy. These factors may have reduced disposable income for American consumers, which in turn impacted demand and led to fewer orders placed by firms. As a result, exports of discretionary items like apparel declined, while exports of essential goods, such as brassieres and vests—which are gender-specific necessities—saw an increase.

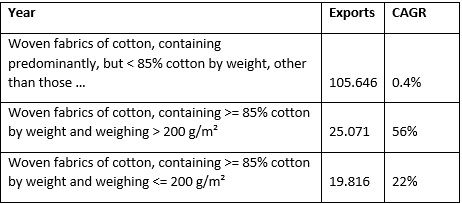

Table 5: Exports of cotton products by Dominican Republic to the US (in $ mn & %)

Source: ITC TradeMap, F2F analysis

The country also exports primarily cotton fabrics to the US, which are growing significantly. Cotton exports have become the country's second-largest export, followed by knitted apparel. The rules under the CAFTA-DR, which include a unique provision for local sourcing to produce apparel, fabrics, and yarns, help the country export these fabrics to the US.

CAFTA-DR: The key to the Dominican Republic's textile export growth

The Dominican Republic entered the CAFTA-DR agreement with the US in 2007. This agreement has brought numerous indirect benefits to the region. The country’s textile industry is now the third-largest by sector, attracting the highest level of investment. It is also the fourth-largest sector in terms of participation in Free Economic Zones. Additionally, in terms of exports, the sector's share has increased to 9 per cent, up from a mere 3 per cent.

US investments are the most dominant in this sector, accounting for 40 per cent of the US industries operating within it. Furthermore, the sector aligns with the joint focus of both nations, with women making up 52 per cent of the workforce. In 2023, the sector employed a total of 36,634 people, reflecting a growth of 0.03 per cent.

The yarn forward rule prioritises local manufacturing. In addition, there is an exception to the rule for certain products, where materials from other countries may be used, provided the final cutting and assembly occur in a CAFTA-DR nation. This is one reason why products like brassieres are exported at a higher CAGR. Brassieres fall under the exception to the ‘yarn forward’ rule and can enter the US at a preferential rate if they comply with the ‘cut and assemble’ rule of origin.

Need for diversification from dependence

Although the CAFTA-DR agreement has benefitted both nations, excessive dependence on the US as an export market could be detrimental to the Dominican Republic. With 65 per cent of its exports going to the US, the Dominican Republic’s economy would be directly impacted by any economic uncertainty in the US. The period from 2020 to 2023 provides a prime example. This was a time when the US economy was battered by pandemic-related supply chain disruptions, followed by war-related supply chain shocks in 2022, and subsequent decisions by the US Federal Reserve, all of which severely affected value chains across sectors, with the textile industry being hit the hardest.

While the Dominican Republic’s textile sector has benefitted from the CAFTA-DR agreement and the preferential rates for textile imports to the US, there is a need for diversification into other regions, such as the EU or Asian countries like Japan and South Korea. Currently, Asian nations account for less than 1 per cent of the country’s overall textile export basket, highlighting how dominant the US is in the nation’s industrial landscape. The agreement has also resulted in significant job creation in the US textile industry.

The Dominican Republic’s textile exports and workforce employment have grown significantly as a result of the agreement. This reflects the joint efforts of both the US and the Dominican Republic to empower the textile sector and its workers, a shared objective of both countries. However, while the CAFTA-DR nations have been advantageous for the US, there is a need to move beyond simply replacing Chinese imports. Now that the Dominican Republic has a strong textile base, the country should consider signing agreements with nations such as the EU, India, Vietnam, and Australia to export its garments to a wider range of markets. Diversifying the industries in the free zones would also help protect the country from economic and geopolitical volatility in the US that could otherwise negatively impact local employment.

Dr. Paramananda Nayak

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!