Rigorous regulations and standards concerning product safety, labour practices, and environmental sustainability are enforced by the EU, prerequisites for suppliers seeking access to these markets. Additionally, shifting consumer preferences, fashion trends, and technological advancements continually shape import patterns across the EU regions. Nevertheless, recent years have seen a decline in exports.

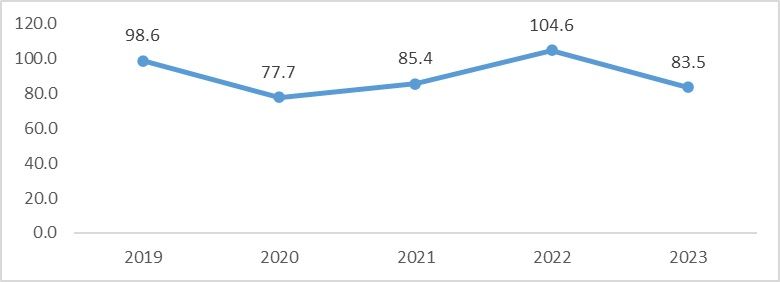

Figure 1: European Union apparel trade (in $ bn)

Source: UN Comtrade

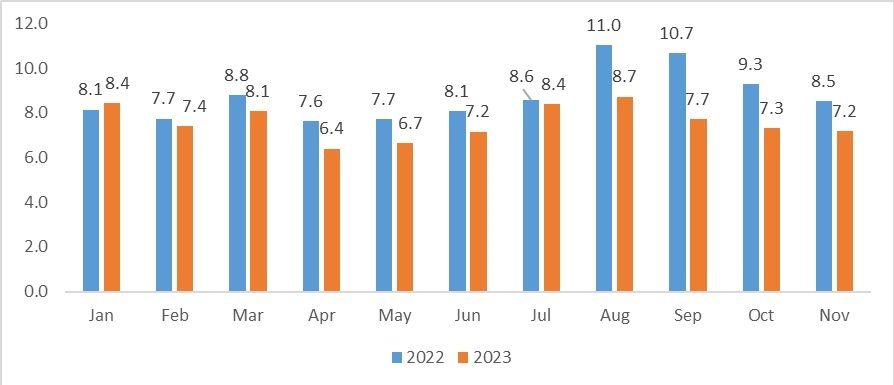

Figure 2: European Union apparel imports (in $ bn)

Source – UN Comtrade

Apparel imports experienced a notable decline of 19.7 per cent in 2023 compared to the preceding year. This decrease was particularly significant in imports from countries such as China, down by 24.4 per cent, Bangladesh by 23.6 per cent, Turkiye by 18 per cent, and Vietnam by 19 per cent, with India also witnessing a decrease of 16 per cent. The reduction in imports from China aligns with the widespread adoption of de-risking policies by nations globally. Meanwhile, the downturn in imports from other nations can be attributed solely to the economic challenges within the bloc.

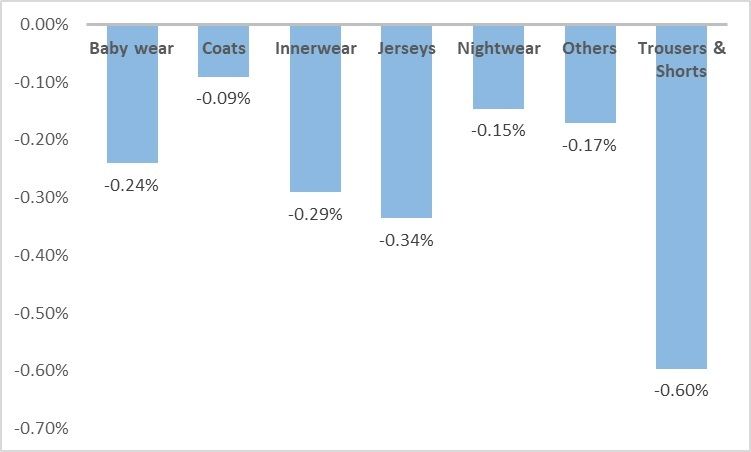

Figure 3: Category-wise decline in EU's apparel imports (in %)

Source – UN Comtrade

Among the eighteen major apparel categories analysed, imports of trousers & shorts experienced the highest decline at 0.6 per cent, followed by innerwear and jerseys at 0.3 per cent. When examined from a gender perspective, only men’s apparel saw an increase of 0.9 per cent, while other categories experienced decreases. Unisex, kids' wear, and women’s wear fell by 0.6 per cent, 0.2 per cent, and 0.1 per cent respectively. The decrease in imports can be attributed to the sluggish growth of the EU economy, which narrowly escaped recession in 2023. With a stagnant labour market and reduced consumer spending, apparel items classified as discretionary expenses were likely impacted. In 2024, the EU economy is forecast to grow by only 0.8 per cent, indicating limited prospects for a significant increase in imports.

With much of the EU economy grappling with sluggishness and anticipating a year of tepid growth in 2024, the projected GDP growth of 1.7 per cent for 2025 offers a glimmer of hope for trade improvement. However, the prolonged conflict in Ukraine, along with tensions in the Red Sea and West Asia, stand as potential triggers that could exacerbate the slowdown of the EU economy and further disrupt trade.

FIbre2Fashion News Desk (NJS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!