Donald Trump is set to be back in the White House next year, and his strong anti-China stance, along with the proposed increase in tariffs will impact the retail sector in the US. Imposing higher tariffs on all US imports would entail significant costs to the US economy. Increasing tariffs will increase the revenue of the US Government, but at the end, it would cost a considerable amount to the US consumers.

Major countries for imports

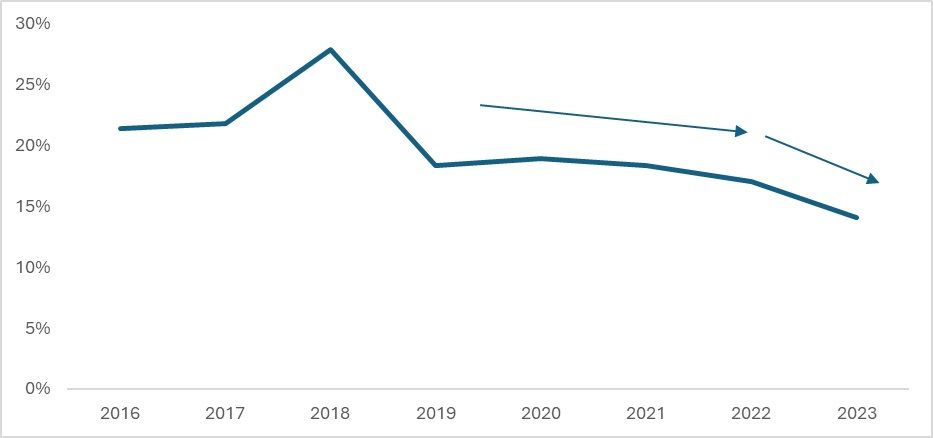

China has been the exporter of many products to the US, and the share of Chinese products was as high as 28 per cent in 2018, which has reduced to around 14 per cent as of 2023. On the other hand, the share of imports from Mexico has increased from 13 per cent in 2016 to 15 per cent in 2020. China has continued to maintain its dominant position in the US; even though the Western country is imposing higher tariffs on Chinese imports, the country continues to dominate the retail chains in the US. A lot of sectors of US are heavily dependent on Chinese imports. Automobile parts, clothing, and lithium-ion batteries are some of the highest imported commodities from China, where it still commands a significant share.

Exhibit 1: The share of Chinese imports in total US imports (in %)

Source: ITC Trade map, F2F analysis

The share of Chinese imports in the US is gradually declining. Tariffs are partially responsible, along with the increase in the de-coupling efforts from both the US and China. Due to this, the share of the total imports from China fell by 2.9 per cent in the year 2023. Over the period of 8 years ending 2023, the average fall in Chinese imports was around 1.4 per cent. Although this indicates partial success of the US policies, there is no complete cut in Chinese imports. China still dominates some of the US’ imports and the share is well above 20 per cent. Surprisingly, this happens even as section 301 is still in play in the US and the recent De-minimis reformation also excludes all the section 301 restrictions which show the continuous tariff restrictions on the US imports from China. There was a tariff revision in August 2022 where majority of the Chinese imports were charged from 25 per cent to 100 per cent.

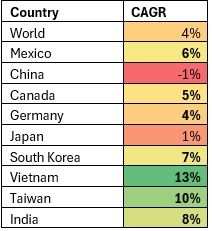

Table 1: Growth of US imports from the other countries (CAGR: %)

Source: ITC Trademap, F2F analysis

In the last five years, the growth of the Chinese share in the US imports has been declining, which is one of the greatest achievements of the US policies towards reducing China’s share in the total imports. Due to the reduction in China’s share in the US imports, countries like Vietnam, Taiwan, India, Canada, Mexico Germany etc are seeing their share increase by a higher CAGR. Imports from Vietnam, for example, are growing by a CAGR of 13 per cent, and from Taiwan by 10 per cent. The confidence in the Indian exports and the economy has increased with the Hong Kong-based rating firm CLSA giving an ‘Overweight’ status to India and an ‘Equal’ weight to China owing to the trade war hurting the Chinese economy further and benefitting Indian exports due to lower vulnerability of the country to the US trade policies. The US also has been building relations with Vietnam and Taiwan; owing to the geopolitical and strategic benefit to the country in Asia; which can change significantly under Donald Trump.

The textile scenario

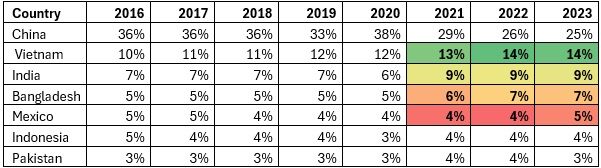

If looked at from the aspect of apparel imports, the US policies implemented to reduce the Chinese dominance have helped to decrease the Chinese imports by 1 to 2 per cent per year. But if looked at in terms of quantity of apparel, the Chinese share has increased to around 35 per cent in the year 2023 (in million square metres equivalent); although significantly lower compared to 2013 when the share was nearly 41 per cent. India, Pakistan, and Vietnam benefitted the most. Post the sanctions on the Chinese imports, many Asian apparel producing countries were the major beneficiaries.

Table 2: % share of the US apparel imports from different countries

Source: ITC Trade map; F2F analysis

The sanctions laid on China in the form of Section 301 and the UFLPA gave the US Customs and Border Protection (CBP) the right to withhold any shipment coming from Asian countries that may potentially use the Xinjiang cotton to produce apparels. This has resulted in increasing the share of other Asian countries which have more vertically integrated textile industries. Countries like India, Bangladesh and Vietnam have seen increased exports to the US.

How a Trump term is going to affect the retail sector in the US

With Trump promising heavy tariff imposition on major imports – a blanket tariff of 20 per cent and a 60 per cent tariff on imports from China, it is bound to have a significant impact on the retail stores that are dependent on the imports to fill their inventory. The tariff imposition by the US on all imports would lead to a huge increase in the expenditure of the consumers on all discretionary items.

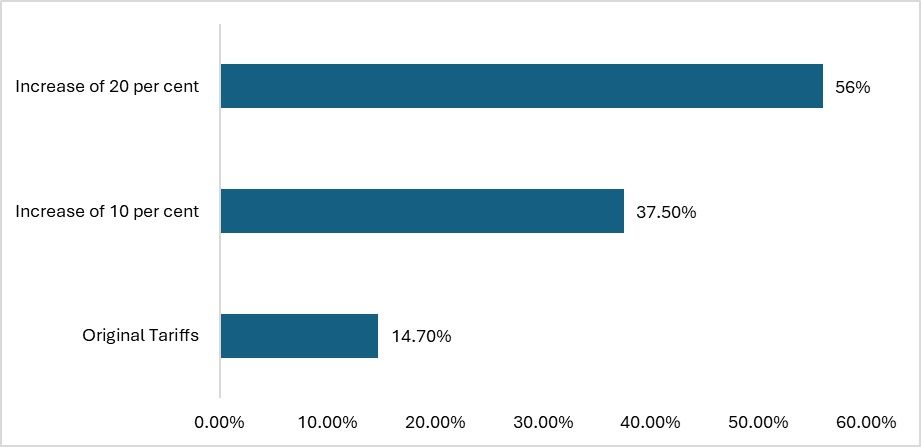

The US has recently recovered from higher inflation and the tariffs would again increase the prices of a lot of goods that are import-oriented in nature. According to a research by the National Retail Foundation (NRF), and Trade Partnership Worldwide (TPW), an increase in the tariff by 10 per cent or 20 per cent can have an added impact on consumers’ spending and the overall US economy.

Exhibit 2: Impact on US consumers of the increase in the import tariffs

Source: National Retail Federation (NRF), Trade Partnership Worldwide

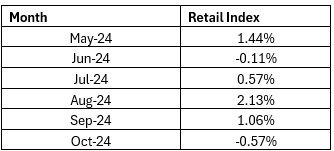

In both the scenarios, the increase in the tariffs could cause a huge reduction in the spending power of consumers in the US. This will also affect the retail sales in the long term which saw some recovery in October. Apparel sales were marginally reduced in October; however, the retail sector of the country started to recover after witnessing a persistent decline. According to the NRF report, the consumers would end up paying $13.9 billion to $24 billion more in aggregate for apparels. Although the imports of apparel account for less than 10 per cent of total imports of the US, if the additional tariffs are applied, the consumers will end up having a lower spending power as there will be less money left for spending on other goods. For apparel only, consumer spending might increase by ~13 per cent which might lead to the nearly recovered retail sector falling back to the phase where the sales would dwindle.

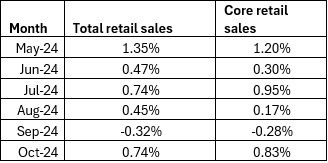

Table 3: The US Retail Index (in %)

Source: National Retail Federation (NRF)

The core retail and the total retail witnessed a solid comeback in the month of October after experiencing a fall in the month of September and a muted growth for the previous three months. An increased tariff also means the cost will be passed on to the consumers which can dampen the retail sales; further affecting the retail index. The report from the NRF also reflected that the increase in the tariff will cut the spending on apparels by US consumers by around 22 per cent. There will be a huge increase in the cost of production for the firms locally producing apparels and the ones importing apparels. Apparels is already subject to the additional penalty under section 301. US households spend 2.7 per cent of their total expenditure on apparels, and with the tariffs, the prices would increase anywhere from 5 per cent to 100 per cent.

Table 4: US Apparel Retail Index (in %)

Source: National Retail Federation (NRF)

With the imposition of the tariffs on all the products, imports from China could reduce anywhere from ~75 per cent to ~88 per cent; along with a reduction in the US consumer spending and, therefore a fall in the growth of the entire economy due to the reduced consumer spending. Therefore, although the import tariff may not have been implemented till now, the impact on the overall economy—from both the consumers and the producers’ aspects is going to be a costly affair—so much so that the potential benefits will be overshadowed by the potential disadvantages.

Road ahead

The economic repercussions of Trump’s tariff imposition are mostly in terms of the consumers paying higher costs and the producers experiencing less than proportional increases in production, leading to an overall loss for the economy.

So far, all the tariff measures by the US have been successful in decreasing the share of Chinese imports in the overall imports by the US. However, there is still a significant Chinese dominance in the US apparel and retail industry. In apparel, for example, 58 per cent of the total shipments held under section 307 of the UFLPA have been denied. The current administration has completely removed Chinese apparel products from the de-minimis rule which will make it difficult for the Chinese e-commerce products including apparels to enter the US borders.

Even though the current norms and the proposed tariffs by Donald Trump together create an atmosphere for the US manufacturing industry to ramp up production to meet the domestic demand, all the research and data so far indicate a gap that can potentially disrupt the settling US economy, in the form of heightened inflation. The US does not have a vertically integrated textile industry due to which there can be potential bottlenecks in the manufacturing industries, and a supply shortage will lead to an increase in the prices of the apparels.

Even though countries like India and Vietnam are gaining from the US-China trade war, it is difficult for any country to match the quantities exported by China to the US. Even though both India and China boast vertically integrated textile industries, the mass production capability of China is currently unmatched, which can therefore lead to bottlenecks in the supply chain. Therefore, apart from reducing the imports from China, there is a need for the US to also ensure parallel sources of imports along with manufacturing, which in the short term can lead to an increase in the prices, leading to potential inflation across all the sectors of the US economy. Thus, there is a challenge in front of the Trump administration to manage the national interests in terms of reducing import reliance while encouraging national manufacturing and balancing inflation.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!