India is already an observer in the Pacific Alliance, whose member countries include Chile, Colombia, Mexico, and Peru. This alignment underscores India’s broader geopolitical and trade outreach towards Latin America. While India currently lacks direct trade routes to Chile, efforts are underway to strengthen air connectivity and secure access to transshipment hubs, thereby addressing logistical barriers and enhancing trade efficiency.

Textiles and apparel remain one of India’s primary export categories to the Chilean market, despite India accounting for just 4 per cent of Chile’s overall imports. Indian textiles and apparel account for approximately 20 per cent of India’s total exports to Chile, indicating the sector’s relative importance and potential for growth under a favourable CEPA framework.

Fibre2Fashion has identified both the challenges and potential advantages associated with a reduction in Chilean tariff rates on textile and apparel imports. While structural and logistical challenges remain, the ongoing CEPA negotiations are expected to yield a more favourable trade environment, especially for textile exporters. A reduction in tariffs could boost India’s competitiveness, improve market access, and strengthen trade relations between the two countries.

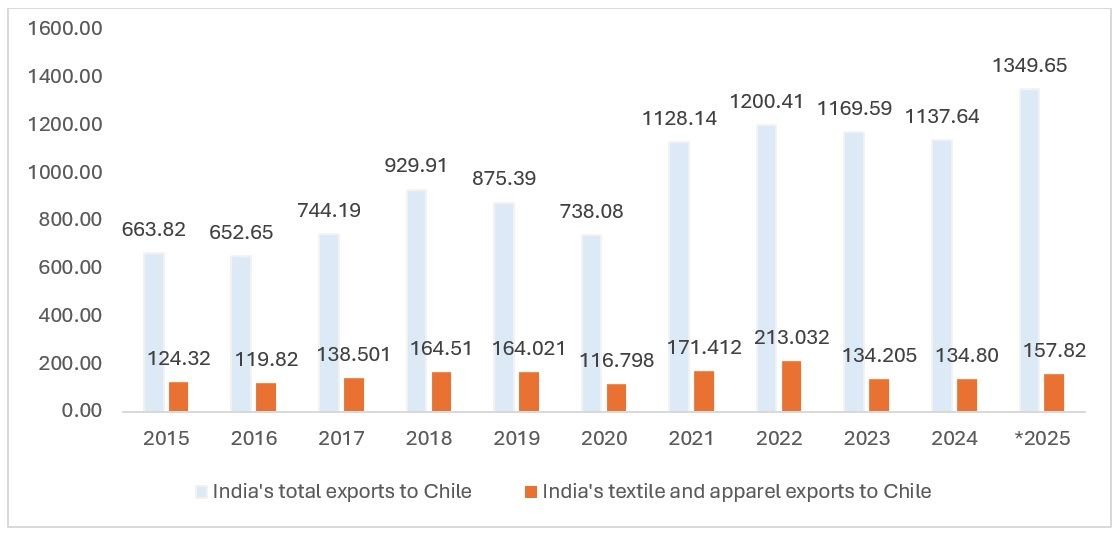

Export Trends: Performance and Forecasts

Exhibit 1: India’s total and textile & apparel exports to Chile from 2015-2024 (in $ mn)

Source: TexPro, F2F Analysis

India has shown considerable growth in exports over the years, with a CAGR of 11 per cent between 2019 and 2024 for its total exports. However, textiles and apparel experienced a decline after the post-COVID surge in demand. Fibre2Fashion forecasts a steady rejuvenation with an expected year-on-year growth rate of 17 per cent, considering the improving bilateral relations.

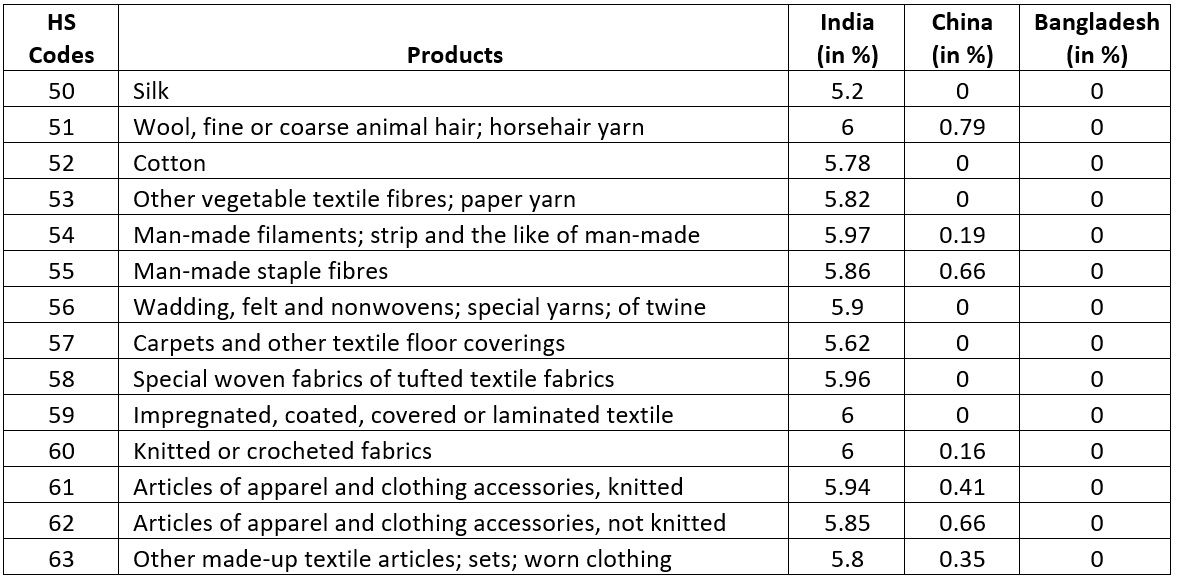

Tariff Landscape: Comparative Analysis

Table 1: India, China and Bangladesh - effectively applied tariff rates

Source: TexPro, F2F Analysis

Chile applies an MFN tariff rate of 6 per cent to all WTO members, including India. However, due to an existing Preferential Trade Agreement between the two countries, key categories such as silk, cotton, and carpets already benefit from slightly lower tariff rates. With further negotiations, India could push for textiles to be included in Chile’s immediate tariff elimination list.

India’s textiles form a major part of the export basket that it sends to Chile. However, Chile is dependent on several other countries for its textile and apparel needs, as follows:

China is India’s biggest competitor, accounting for almost 62 per cent of Chile’s textile and apparel imports. In addition, Bangladesh holds a 7 per cent share, just ahead of India, which accounts for 4 per cent of Chile’s textile and apparel imports. The FTA becomes even more important for Indian textiles, as the top two countries—China and Bangladesh—enjoy significantly lower tariffs on their textile and apparel exports. A zero per cent tariff would be beneficial at the 6-digit HS code level as well, with certain products likely to witness trade creation and increased demand in Chile.

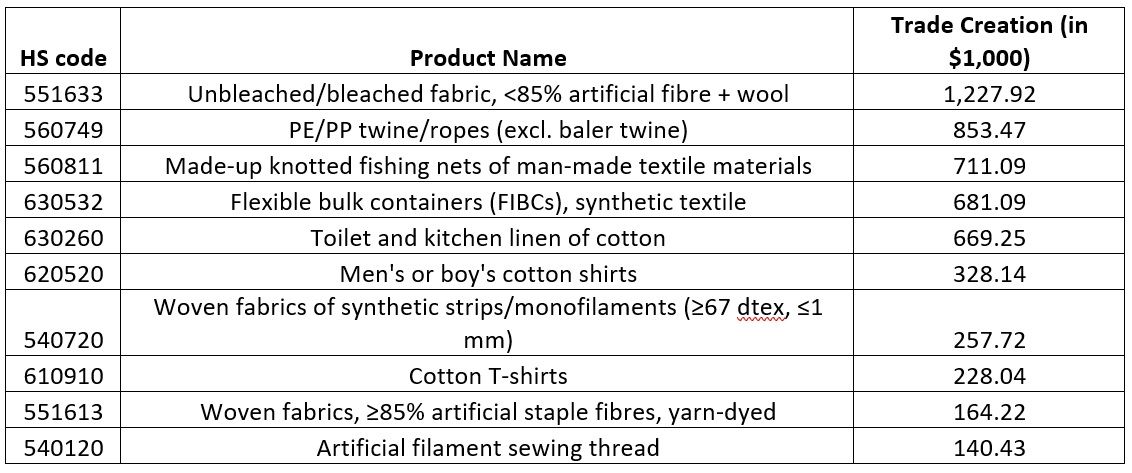

Table 2: Top 10 6-digit products benefitting from the India-Chile CEPA

Source: SMART Analysis using WITS database, F2F Analysis

The data reflects the trade creation impact resulting from Chile’s tariff reductions on Indian textile and apparel products. In this context, trade creation refers to the increase in imports from India to Chile due to lower tariffs, which make Indian goods more price-competitive and encourage Chilean importers to buy more from India instead of from higher-cost or domestic sources.

The top beneficiaries of this tariff reduction are intermediate textile products, particularly fabrics and industrial textile items. Leading the list is unbleached/bleached fabrics, followed by PE/PP twine and ropes and knotted fishing nets. These are typically used in industrial or manufacturing applications, suggesting that technical textiles and semi-finished materials are gaining the most from the tariff cuts. FIBCs and cotton home textiles also show strong trade creation, indicating robust demand in Chile for Indian-made utility and packaging textiles.

Chile’s FTA may prove particularly advantageous for India's industrial and technical textiles sector. India is actively enhancing production in these areas through initiatives like the Production Linked Incentive (PLI) Scheme.

Way Forward

Boosting Technical Textile Production

For India to fully capitalise on reduced tariffs under the India–Chile FTA, it must prioritise upgrading its industrial and technical textiles production to secure short-term gains. The Union Budget 2025–26 has laid a strong foundation by reducing the Basic Customs Duty on two categories of shuttleless looms, which are critical for technical textile manufacturing.

India has already demonstrated its capacity to scale up production rapidly under pressure—for example, by producing approximately 2.5 lakh PPE kits in just 60 days during the COVID-19 pandemic, becoming the world’s second-largest producer after China. With FTAs like the one with Chile on the horizon, India can harness its skilled workforce and growing industrial capabilities to lead in this sunrise sector.

Reviving Fabric Exports

Another area poised to benefit significantly from the FTA is fabric exports. The Union Budget’s decision to increase customs duties on imported fabrics is expected to boost domestic production. This policy shift could generate a spillover effect, encouraging greater use of Indian-made fabrics and leading to increased export output.

Tackling Logistical Challenges

To fully realise these opportunities, India must address its logistical constraints. Trade routes between India and South America stretch over 14,000–17,000 kilometres—among the longest and most expensive for Indian exporters. Building strategic ties with Middle Eastern countries could provide access to transshipment hubs that serve as efficient gateways to Chile.

India’s trade logistics infrastructure for South America remains underdeveloped compared to that of China, which benefits from the Panama Canal and higher trade volumes. Strengthening connections with Southeast Asian transshipment hubs, such as Sri Lanka, could also improve economies of scale through shared export routes with other Asian exporters.

Strengthening Foundations Before CEPA Finalisation

These strategic and infrastructural upgrades are essential before finalising the CEPA with Chile. By addressing these critical gaps, India will be better positioned not only to meet increased demand from Chile but also to expand its long-term footprint in the South American textile and apparel market.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!