India is eyeing the Eurasian market in order to broaden its trade horizons. The nation's goal to escalate textile exports to $100 billion is set to benefit from the free trade agreement (FTA) negotiations, promising diversified trade destinations, broader outreach, and significantly, a boost in the global prominence of Indian textiles. This strategic move is further bolstered by external affairs minister Dr. S Jaishankar's recent announcement on the resumption of FTA discussions with the Eurasian Economic Union, marking a potential fortification of yet another vital trade connection.

Engaging with the northern hemisphere

Russia often dominates the narrative due to its status as the region's most significant trade partner. However, the spotlight is now on the FTA negotiations with the Eurasian Economic Union (EaEU), comprising five former Soviet states—Belarus, Russia, Armenia, Kazakhstan, and Kyrgyzstan. The International North Sea Trade Corridor Project (INSTC) which has seen it’s first consignment transported to India from Russia; includes India, Iran, Russia, Armenia, Azerbaijan, Kazakhstan, Kyrgyzstan, Oman, Syria, Turkey, Ukraine, and Bulgaria and has huge potential to reduce shipping costs and make the logistical part of the trade easier. Therefore, this proposed FTA with EaEU can also present an opportunity to utilise this corridor to enhance the logistical aspect of trade, thus benefitting all the parties involved in the agreement.

Creating new opportunities

Overall, India's trade with this Union is highly lopsided in the favour of Russia. Other countries with whom the trade stands out in the union are countries like Armenia and Kazakhstan, but the trade is lesser as compared to the trade with Russia. Consequently, within the economic zone, India faces a deficit in merchandise trade. The country primarily imports oil from Russia, making the trade highly unilateral. With Russia alone, India has a widening deficit of $43 billion.

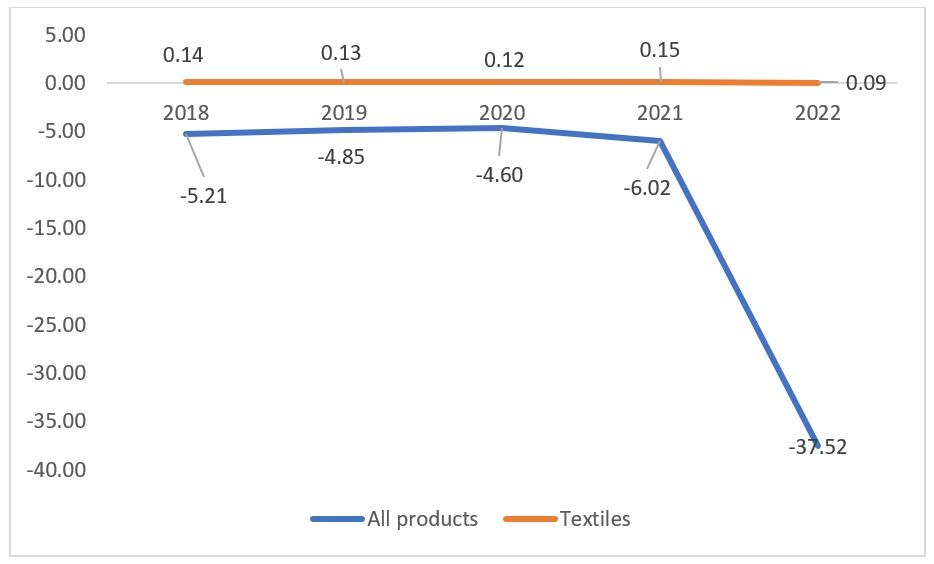

Figure 1: India’s trade balance with Eurasia in merchandise and textile exports ($ mn)

Source: ITC Trade Map

Therefore, with this trade agreement, India has an opportunity to capitalise more on its textile trade and attempt to minimise the widening trade deficit. For instance, according to the ITC Trade Map's export potential data, one of India's major apparel exports is cotton T-shirts. However, India could still increase its exports by approximately 25.5 per cent, according to the export potential of $47 million. This increase will depend on the tariffs or other preferential duties applied to different products, which may be potentially included in the portfolio.

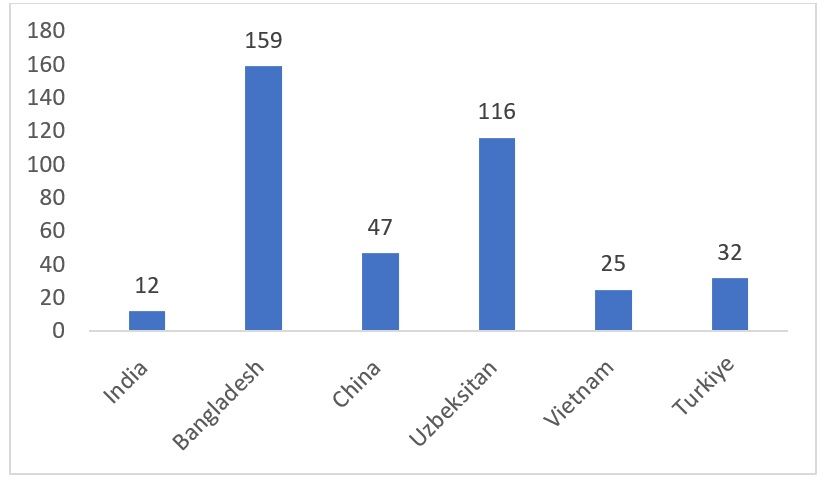

Figure 2: Exports of cotton T-shirts by different countries (in $ mn)

Source: ITC Trade Map

The same applies to other countries like Kazakhstan, Armenia, Kyrgyzstan, and Belarus. India has a significant unrealised textile export potential with these countries. To balance out the deficit, along with technology, this could be an excellent opportunity for India to enhance its textile trade. For this economic union, India has the potential to increase apparel exports, mainly in trousers, cotton T-shirts, dresses, and shirts, to these countries. India can definitely increase its surplus in the textile category.

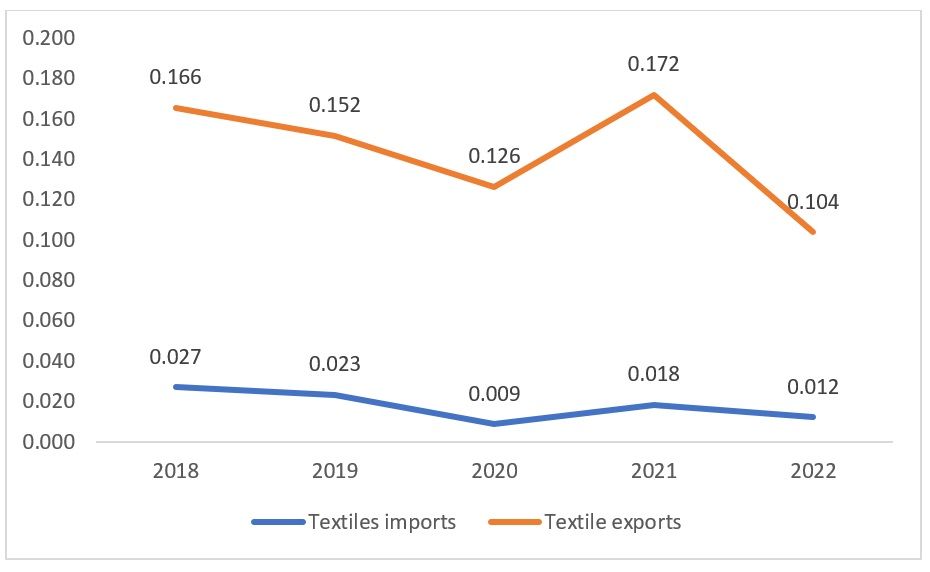

Figure 3: Export and import of textile products by India (in $ mn)

Revitalising trade ties

The proposed free trade agreement could potentially address some of the pain points for the countries involved—specifically, the INSTC and the high tariffs on certain Indian exports, particularly textiles. For instance, India has reported a decline in trade with Kazakhstan, especially in textiles, due to import tariffs as high as 15 per cent and other non-tariff measures that render Indian textile exports non-competitive.

The INSTC offers significant benefits for all nations involved in the free trade agreement. For Iran and Russia, the corridor could provide the much-needed access to the Asian market, which is currently hindered by sanctions imposed by the US, Europe, and several other nations in response to war and various allegations. India, on the other hand, could gain direct access to countries like Kazakhstan and Kyrgyzstan along with Russia in the proximity. Therefore, the free trade pact could significantly impact the weakening trade relations shared by the countries.

A ray of hope for dealing in local currency

India and Russia have signed a rupee-rouble agreement where Russia accepts payments from India in rupees for various Russian exports—dominantly Oil. However, due to disproportionate trade with India, billions of rupees have accumulated with the Russian central bank. The Indian currency is partially convertible, not fully, which poses challenges. With the current negotiations in focus, potential solutions for expanding rupee payments are being explored.

Both countries halted trading in Indian rupees as India is a net importer of Russia, and the total exports of India are not in proportion to Russian exports to India. This has left Russia uncertain about how to utilise the accumulated Indian rupees, especially given India's limited imports and the rupee's partial convertibility. However, with the potential for trade to increase, there is a possibility of resuming rupee-based trade. India currently has currency pacts with 18 countries worldwide, predominantly with African and selected Asian nations where it enjoys a trade surplus. Thus, for India, balancing the scales of trade or boosting exports is a significant challenge.

Road ahead

With this trade agreement in focus, all involved parties stand a potential chance to expand their trade portfolios and strengthen regional trade relations, as well as offering another opportunity for India to diversify its trade portfolio beyond the US and Europe. This trade agreement could also open the door to opportunities for the country to expand the rupee deal beyond the 18 nations with whom it already has established trade relationships.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!