Figure 1: India’s total exports & textile exports to New Zealand (in $ mn)

Source: TexPro, F2F Analysis

*Projected figure

The data on India’s exports to New Zealand over the past decade reveals several trends and fluctuations in both total exports and textile exports. From 2014 to 2024, total exports consistently increased, rising significantly from $421.49 million in 2014 to $738.69 million in 2024. Textile exports followed a generally upward trajectory, peaking at $138.91 million in 2021. The percentage of textiles in total exports, however, showed some variation. It started at 18 per cent in 2014 and fluctuated between 17 per cent and 21 per cent over the years, with a noticeable dip to 17 per cent in 2022. Despite these fluctuations, textiles remained a significant portion of total exports, contributing roughly 18–20 per cent throughout the period.

The forecast for CY 2025 suggests that New Zealand will continue showing a positive trend towards Indian products, both overall and specifically for textiles. The forecast value for CY 2025 for textiles is approximately $144.66 million. Projections would be much stronger from CY 2026 onwards, assuming a CECA between the two countries is signed in CY 2025.

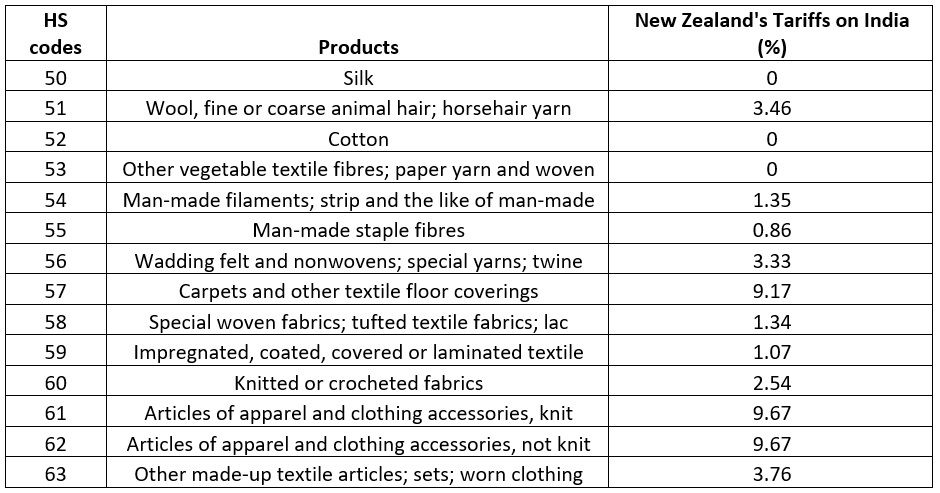

Table 1: Tariff rates for all textile products (HS code 2 digit) (in %)

Source: TexPro, F2F Analysis

According to the figures above, New Zealand currently allows duty-free entry for products in which India is a dominant player. However, for value-added goods such as apparel and home textile products like carpets, the tariff rate exceeds 9 per cent, indicating resistance to high value-added finished goods. Carpets and apparel, both knitted and non-knitted, attract higher tariff rates, making it even more important for India to negotiate for these products to be included in the duty-free list.

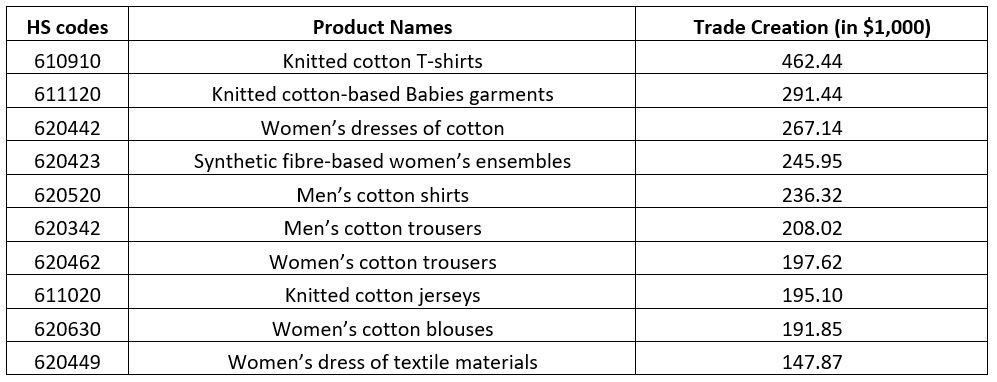

Table 2: SMART analysis of the top 10 Indian products that will experience trade creation (in $1,000)

Source: SMART simulation tool, F2F Analysis

The following data was analysed using the SMART analysis from WITS, based on the 2023 database. If India signs a free trade agreement (FTA) with New Zealand, it is expected to significantly boost trade for various Indian textile and apparel products. The leading trade-creating products include knitted cotton T-shirts (HS Code: 610910), with an estimated trade creation effect of approximately $462,440, followed by cotton-based babies’ garments (HS Code: 611120) at $291,440. Other noteworthy products include women’s cotton dresses (HS Code: 620442) and synthetic fibre-based women’s ensembles (HS Code: 620423), with estimated trade creation effects of $267,140 and $245,950, respectively.

Men’s cotton shirts (HS Code: 620520) and trousers (HS Codes: 620342 and 620462) are also expected to benefit, with trade creation effects ranging from $208,020 to $197,620. Additionally, knitted cotton jerseys (HS Code: 611020) and cotton blouses (HS Code: 620630) will contribute to India’s trade potential. India, in particular, stands to gain in the women’s apparel market, which is also the highest revenue generator for many countries. The FTA could potentially help India focus on its apparel segment, particularly the women’s cotton segment.

However, the lack of trade creation for Indian carpets is concerning, especially as India already faces competition from significant manufacturers such as China, Bangladesh, and Vietnam.

Conclusion

In conclusion, an FTA between India and New Zealand holds promising potential for boosting India’s textile exports, particularly in cotton and synthetic fibre-based apparel. Products such as knitted cotton T-shirts, babies’ garments, and women’s dresses stand to benefit greatly from reduced tariffs, enhancing India's competitive edge in the global market. However, the higher tariffs on value-added goods like carpets and apparel remain a challenge.

To improve trade with New Zealand, India could focus on negotiating the inclusion of high-value products such as carpets and knitted/non-knitted apparel in the duty-free category, leveraging its dominance in these sectors. Additionally, strengthening partnerships in New Zealand’s women’s apparel market could be key, given its revenue potential. Strategic marketing of India’s strengths in textile production and innovation, along with an emphasis on sustainable and eco-friendly production, could further differentiate Indian products and attract New Zealand consumers.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!