With positive yet cautious steps being taken towards finalising the India-United Kingdom (UK) Free Trade Agreement (FTA), Indian apparel exports could see substantial benefits once the agreement is in place. Recent data reveals noteworthy trends in India’s apparel exports to the UK.

Indian exports of apparel

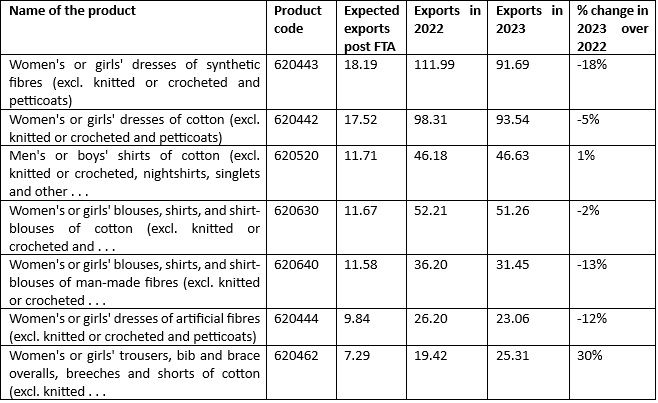

Overall, India’s exports to the UK grew by approximately 19 per cent in 2023. However, within the apparel segment, India’s exports to the UK declined by about 8 per cent during the same period. Despite this dip, if the FTA is finalised, India stands to gain, especially in categories that rank among the top ten exports. A significant trend observed is the stronger growth in women’s apparel exports. Notably, exports of women’s cotton trousers and shorts from India to the UK rose sharply by around 30 per cent in 2023, marking a notable increase in demand within this segment.

Table 1: Expected increase in the exports of apparel post the FTA (in $Mn)

Source: ITC Trade map, F2F analysis

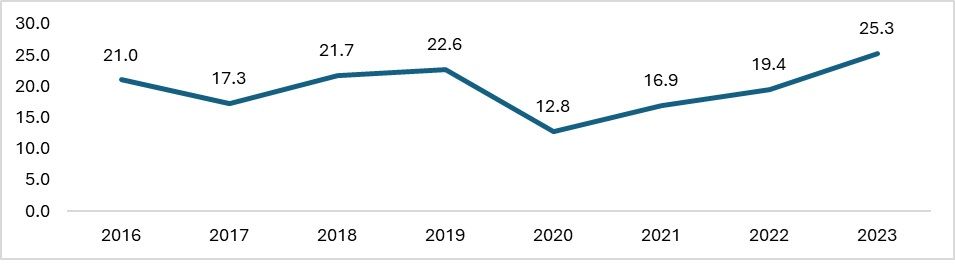

Exports of women’s trousers and shorts from India to the UK have been growing at a compound annual growth rate (CAGR) of 2 per cent from 2016 to 2023, with consistent increases since 2021. This upward trend is expected to continue, with an additional export volume of 7.29 million units projected once the FTA is finalised.

Exhibit 1: The exports of women’s trousers, and shorts of cotton (in $Mn):

Source: ITC Trade map, F2F analysis

The most substantial growth is anticipated in exports of women’s dresses made from synthetic fibres, underscoring a need for India to enhance its capacity of synthetic fibre-based apparel production. Beyond traditional export items like dresses made from natural and synthetic fibres, the FTA is likely to boost exports of emerging products, such as dresses from artificial fibres and cotton trousers. This trend signals a robust expansion in diverse product categories and presents an opportunity for India to strengthen its presence in the UK apparel market.

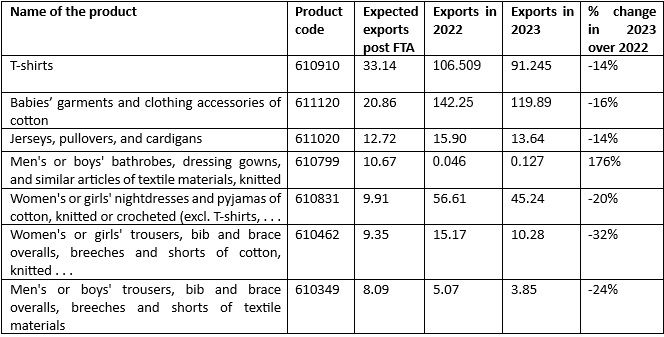

Table 2: Expected exports from India for knitted apparels post the finalisation of FTA (in $Mn):

Source: ITC Trade map, F2F analysis

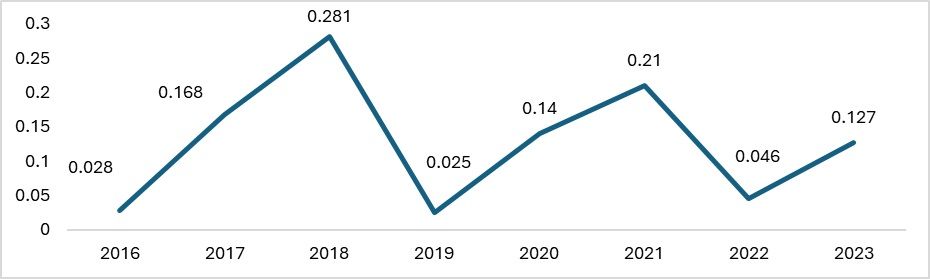

Exhibit 2: The exports of men’s bathrobes (in $Mn):

Source: ITC Trade map, F2F analysis

In the woven apparel segment, men’s bathrobes and dressing gowns are expected to see the most significant export growth for India once the India-UK FTA is finalised. This category saw an impressive increase of 176 per cent in 2023 alone, with an anticipated additional export volume of 10.67 million units after the FTA is in place. Alongside conventional woven exports such as T-shirts, baby garments, jerseys, pullovers, and cardigans, men’s bathrobes and dressing gowns are likely to receive heightened demand from the UK, creating a strategic need for India to expand its production capacity in these areas.

Multiple factors suggest India stands to benefit considerably from the FTA if signed in a timely manner. As the global market looks for affordable and quality alternatives, the UK could view India as an emerging yet cost-effective option for its apparel needs.

However, the UK economy remains in recovery mode, with limited growth across sectors. In September 2024, retail sales in textiles and clothing in the UK showed modest growth of approximately 0.3 per cent, indicating that a full recovery in the economy and retail sector may take time. Despite this, current trends suggest that India’s home textiles and women’s apparel exports could experience the most substantial growth.

Road ahead

The India-UK FTA is yet to be finalised, but the potential benefits for India are substantial. The UK already imports a wide range of textile products from India, spanning from fabrics to finished apparels. The FTA could drive both trade creation and trade diversion, though prior analysis suggests that India stands to gain rather significantly from trade diversion than trade creation. This means that the UK may shift some of its textile orders from countries like China to India. Additionally, Bangladesh has been unable to scale up its textile orders, which may further encourage the UK to redirect trade towards India.

With the Indian textile industry actively expanding its production capacity and modernising its processes to meet the global standards, its market size (textiles and apparels) reached approximately $165 billion in 2022 and is projected to grow to nearly $300 billion by 2025. Agreements like the India-UK FTA are likely to generate additional demand, helping India to utilise its existing excess capacity—an issue that has persisted for the past decade. This opportunity could strengthen India’s position as a key supplier for the UK’s textile needs.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!