With Vietnam seeking to strengthen its trade relations with the MERCOSUR region, textile and apparel exports would play a major role in Vietnamese exports to the region. With tariffs as high as 35 per cent for individual textile products, Vietnam will likely negotiate for the most favourable tariff rates for its apparel.

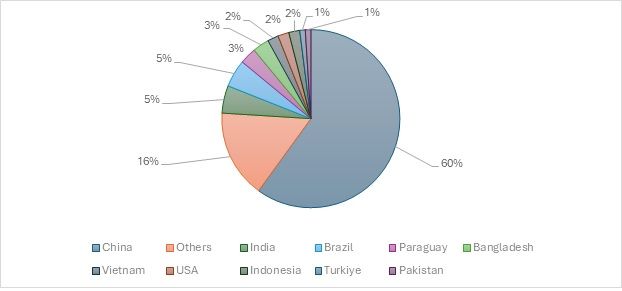

Exhibit 1: Share of top 10 textile and apparel exporting countries to MERCOSUR region (in %)

Source: ITC Trademap, F2F Analysis

China currently holds a significant share of textile exports. India and Brazil each account for 5 per cent of the total. Vietnam currently holds only 2 per cent, just behind its global rival Bangladesh, which stands at 3 per cent. Vietnam’s main competitor in the textile industry is China. Vietnam exported approximately $203 million worth of textiles to the MERCOSUR region collectively.

Vietnam would also face competition from MERCOSUR member country Brazil in the textile trade. However, in the apparel sector, Vietnam competes only with its global rivals, China and Bangladesh. With Vietnam closely monitoring the MERCOSUR market, shifts in market share among competing countries are expected. Additionally, the US’ increasing focus on Latin America to boost its exports has also come into play.

Tariff structure in the MERCOSUR region for imported apparel (HS codes 61 and 62)

The tariff on textiles and apparel is among the highest in the MERCOSUR region. Data shows that MERCOSUR applies a 20.21 per cent tariff on apparel imports from Bangladesh in product category 61 (knit or crocheted) and a 20.2 per cent tariff on category 62 (non-knit or crocheted). For China, the tariffs are slightly higher, with a 20.23 per cent tariff on category 61 and a 20.24 per cent tariff on category 62. Vietnam faces the highest tariffs, with a 21.13 per cent tariff on category 61 and 20.73 per cent on category 62.

These tariff rates can significantly impact the price competitiveness of textile imports from these countries into the MERCOSUR region, raising the overall cost of foreign textiles in MERCOSUR markets. Given the relatively high tariff rates, MERCOSUR is likely seeking to protect its domestic textile industry from foreign competition. For exporters in Bangladesh, China, and Vietnam, this means their goods may face a cost barrier when entering the MERCOSUR market, potentially making it a less attractive destination for their textile exports.

Among the countries listed, Vietnam faces the highest tariff rates applied by MERCOSUR. Vietnam is subject to a 21.13 per cent tariff on category 61 (knit or crocheted) and a 20.73 per cent tariff on category 62 (non-knit or crocheted), making it the country with the highest import duties compared to Bangladesh and China.

Given the developing nature of economies in the MERCOSUR region, it is unlikely that a free trade agreement would lead to a reduction in tariffs, particularly on labour-intensive products. However, the MERCOSUR region has provided a 0 per cent tariff for certain countries, such as Israel and Chile, in the apparel category.

Fibre2Fashion anticipates a decrease to 10 per cent due to Vietnam’s expansive apparel industry, which might challenge MERCOSUR’s domestic apparel market. The SMART analysis is used to identify products where trade creation would be possible. To gain insight into which Vietnamese products would dominate the market, the focus is placed on Brazil, the largest economy among the four MERCOSUR countries.

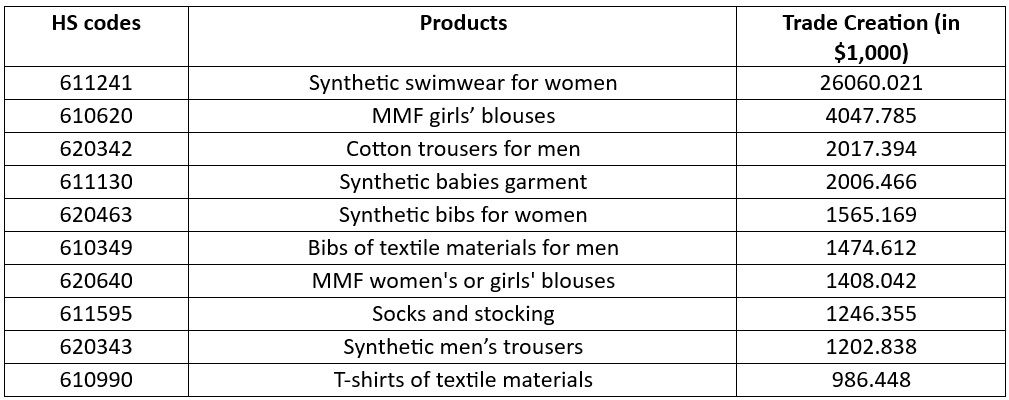

Exhibit 2: Potential trade creation for Vietnamese apparel in case of Brazil (in $1,000)

The table illustrates the potential trade creation for Vietnamese apparel products if Brazil were to reduce its tariffs to 10 per cent. Notably, synthetic swimwear for women (HS 611241) records the highest trade creation value at $26 million, indicating strong demand for this product under the reduced tariff regime. Other apparel items also experience significant trade creation, such as MMF girls' blouses (HS 610620) with $4 million and cotton trousers for men (HS 620342) with $2 million.

Additionally, synthetic baby garments (HS 611130) and synthetic bibs for women (HS 620463) are expected to see moderate trade creation, with values of $2 million and $1.5 million, respectively. Other products, such as bibs of textile materials for men (HS 610349) and synthetic men's trousers (HS 620343), also demonstrate trade creation potential, albeit at lower levels.

The overall trend suggests that Vietnam's apparel sector, particularly synthetic and cotton-based garments, would benefit from Brazil's tariff reduction, especially in specialised categories such as swimwear and children's apparel.

Conclusion

In conclusion, Vietnam's increasing focus on the MERCOSUR region, along with the United States' growing attention toward Latin America, has the potential to reshape textile trade dynamics, particularly if tariff reductions are implemented. Vietnam's competitive advantage in apparel, especially in synthetic and cotton garments, could enable it to secure a larger market share, particularly in Brazil.

This shift could come at the expense of existing exporters such as China, Bangladesh, and other regional players like Peru and Cambodia. As Vietnam continues to expand its robust textile industry, it may gradually displace some of the market share currently held by China and Bangladesh, particularly in high-demand categories such as swimwear, children's apparel, and synthetic fabrics. The path forward for Vietnam lies in negotiating favourable trade terms, including reduced tariffs on at least a select range of apparel items.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!