China leads in manufacturing and ultimately exports. With Indian policies framed to curb imports from China, recent data reveals a significant uptick in overall trade with the country. According to a report by the Global Trade Research Initiative (GTRI), India's total imports surged by 31 per cent over fifteen years. The rise in imports from China surpasses even those from the US, where India achieved a trade surplus. Nonetheless, reducing imports presents a monumental challenge, particularly concerning China.

Persistent imports

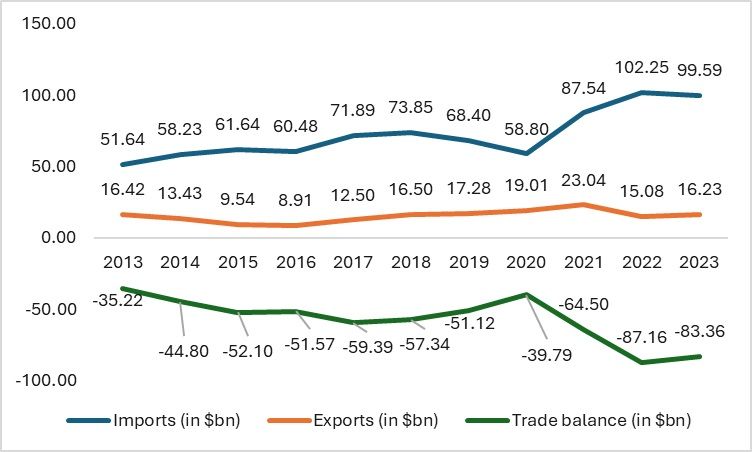

India's imports from China continue to rise steadily. Despite a nominal 2 per cent decrease in overall imports, the trade balance between the two nations shows no significant improvement. In 2023, for instance, the trade deficit stood at $83 billion, reflecting a 4 per cent decrease. While imports have only marginally declined by 2 per cent, exports to China in 2023 witnessed a notable 7 per cent increase. However, appearances can be deceiving. Indian exports remain largely stagnant, while imports are decreasing at a sluggish pace.

Figure 1: India’s imports, exports and trade balance with China (in $bn)

Source: ITC Trade map and F2F analysis

Imports have surged by a staggering 99 per cent when comparing data from 2013 to 2023, painting a clear picture of the trend. This surge is reflected in the trade balance as well. India's persistent trade deficit with China has been exacerbated since 2020, posing significant challenges. Despite India's efforts to mitigate its reliance on Chinese imports through measures such as increased import duties, bans on specific commodities, and the imposition of quality checks, the country's dependence on China remains largely unchanged, or in some cases, has worsened over the years. This dependency presents a concerning scenario for local industries in India.

The underlying economics behind this issue are straightforward: Cheaper imports imply that the competitiveness of imported goods matches or exceeds that of locally produced goods. Consequently, readily available substitutes for local products diminish their market share domestically.

Higher imports inflict a harder blow on domestic industries

India imports larger quantities of machinery, pharmaceuticals, plastics, textiles, automobiles, and electronics, among many other things. Among the goods mentioned, some are also produced locally in the country. Therefore, higher imports may end up damaging the prospects of local industries. Recently, India aggressively provided production-linked incentives for pharmaceuticals and textiles, among others, to reduce reliance on China. Despite the government's efforts to reduce imports through higher import duties and taxes, imports continue to increase. Even with tariffs as high as 14 per cent on cotton imports, 18 per cent on silk imports, and 24.47 per cent on imports of man-made filaments, India has still experienced an increase in imports of these textile commodities from China.

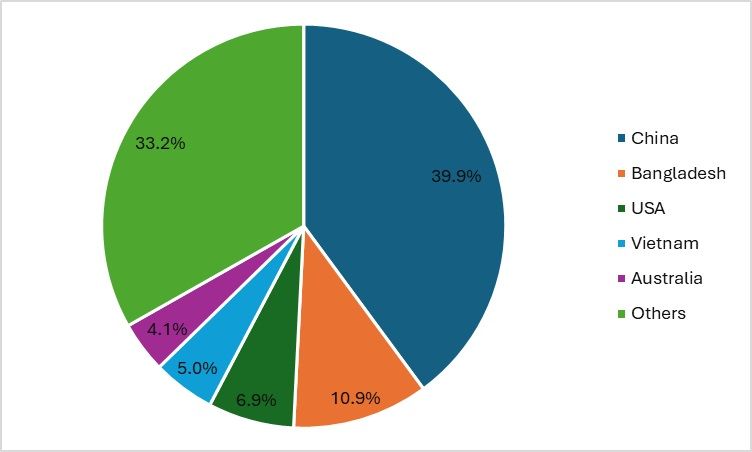

Figure 2: Share of other countries in India’s imports (in %)

Source: ITC Trade map

This can have a significant impact on the Indian industries, which locally employ a considerable amount of manpower. The textile industry, for example, can be widely affected due to the increasing imports from China. It is the second-largest employer in the country, and higher imports from China can significantly affect the sustainability of the industry in the country. This might also reduce the effectiveness of the policies implemented by the government to reduce import dependence on the same.

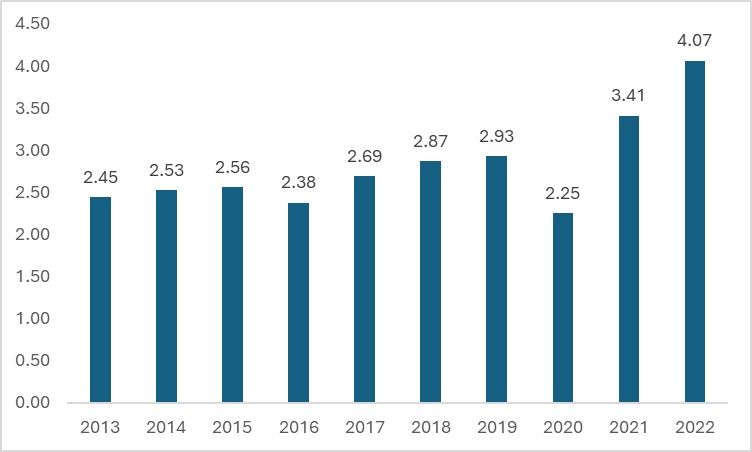

A surge in textile imports

India is considered one of the exporters in the textiles and apparel industry. However, the country's textile imports witnessed a massive surge in the year 2022. The main reason given is the inability of the domestic capacity to meet the surging demand. This can be highly synonymous with the increase in the imports of man-made fibres, filaments, and silk imports. India imports silk, fabrics, man-made filaments, and staple fibres. Although India does not have full capacities like China for these specific categories, it has a lot of policy incentives to boost their production. However, the increasing import from China may undermine the government's efforts to boost textile production across different verticals.

Figure 3: Indian textile imports from China (in $bn)

Source: ITC Trade map

India primarily imports silk, cotton, man-made fibres, staples, and synthetic yarn. Imports of all these categories increased significantly in 2022. Silk imports surged by a substantial 187 per cent, whereas cotton imports rose by 39 per cent. Although in 2023, silk imports decreased by 31 per cent and cotton imports by 29 per cent, the reduction isn't sufficient compared to the rise in imports in 2022 from China. A significant gap is observed in the trade of apparel (HS 61) between the countries. In 2023, India experienced a modest increase of 4 per cent in apparel exports to China and a decline of 21 per cent in exports. Although the reduction in imports is commendable, the trade gap remains substantial, amounting to approximately $0.14 billion, as reported by the DGCI&S.

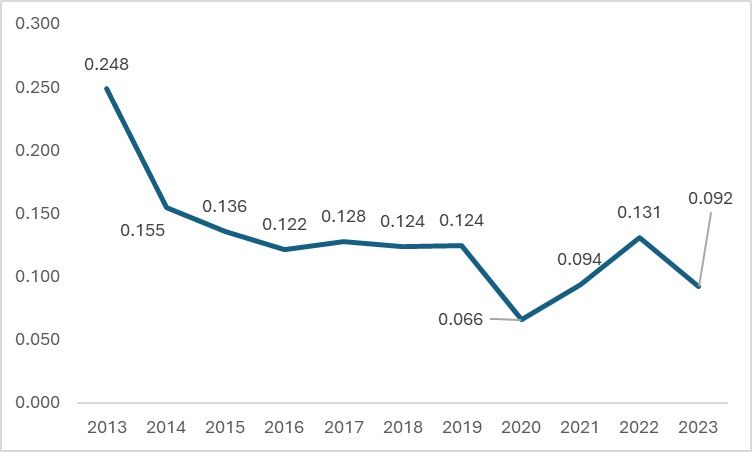

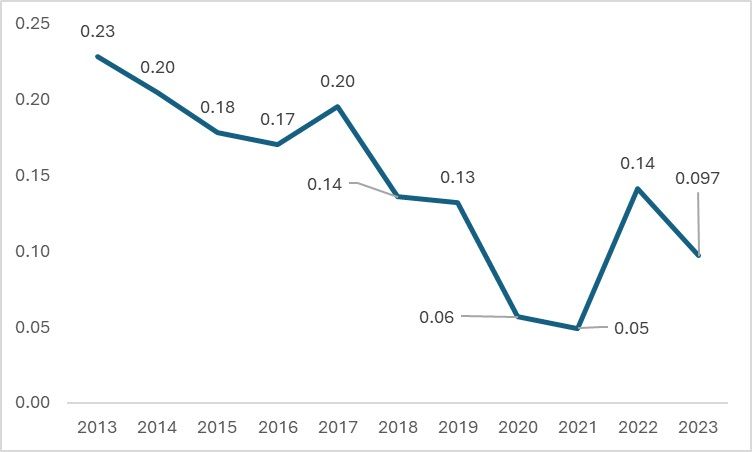

Figure 4: India’s cotton imports from China (in $bn)

Source: ITC Trade map, DGCI&S, F2F analysis

The situation is similar for man-made filaments and fibres. Regarding man-made fibre, India experienced a trade deficit of around $0.33 billion in 2023, importing approximately $0.33 billion worth from China. China accounted for about 41.9 per cent of India's man-made staple fibre imports. Although imports decreased by about 33 per cent in 2023, this represents only superficial improvement. Real progress will only be achieved when there is an increase in the exports of commodities currently imported from China.

Figure 5: India’s silk imports from China (in $bn)

Source: ITC Trade map, DGCI&S, F2F analysis

How will rising imports affect the Indian textile industry?

The Indian textile industry is the second-largest employer in the country. India exports textiles and apparel to countries such as the US, Bangladesh, the UAE, and the UK. Although the country's export basket is diverse, its dependence on China for imports—specifically for raw materials—could paralyse the Indian textile value chain.

Engaging in bilateral trade has its disadvantages. One of the reasons for such trade is the lower cost of products. The Indian textile industry contributes to around 13 per cent of industrial production and approximately 12 per cent to total exports. The sector employs 45 million people directly and another 100 million in allied sectors. India has implemented several policies like PM-MITRA and quality control measures for the import of synthetic fibres. In this scenario, an increase in textile imports from China may delay the impact of policies meant to boost textile exports, such as the Production Linked Incentives (PLIs) and the flagship PM MITRA policy.

What lies ahead?

India reported a significant increase in overall imports from China in 2022, including a massive increase in the textile sector. Although the country can engage in bilateral trade, the rise in Chinese imports is primarily due to lower costs, which could undermine the Indian textile sector. The government is implementing numerous policies to enhance the cost efficiency of the textile sector, thereby aiding in increasing exports. However, for this to be effective, a reduction in imports and a drastic rise in exports of Indian textiles are required to ensure the industry's complete detachment from Chinese imports.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!