In response to Trump’s imposition of 10 per cent tariff on all Chinese goods, China is likely to accelerate efforts to diversify its export markets beyond the US. Along with the 10 per cent tariff, Chinese apparel could face further challenges due to the halt on de minimis exports from Chinese e-commerce companies. Low-priced apparel, which constitutes a significant portion of Chinese shipments, is likely to be particularly impacted by this change. All these factors have made China to cushion the impact of these disadvantages through strengthening trade ties with emerging markets and its existing top export destinations.China’s textile industry is already grappling with sluggish domestic consumption and an overbuilt supply infrastructure. Additionally, it has faced multiple trade restrictions from developed economies such as the US and the EU. With escalating trade tensions, China may increasingly seek alternative markets where its textile exports can achieve comparable value to those destined for the US.

With new US tariffs on Chinese textiles, China may look at diversifying its exports.

Japan and South Korea may absorb more due to trade agreements, but political ties pose risks.

Kyrgyzstan and Kazakhstan remain key, yet domestic industries struggle.

The UK and Germany are vital but face scrutiny.

Malaysia and Vietnam offer potential, though geopolitical shifts may limit China's dominance.

China’s apparel and home textile export markets at present

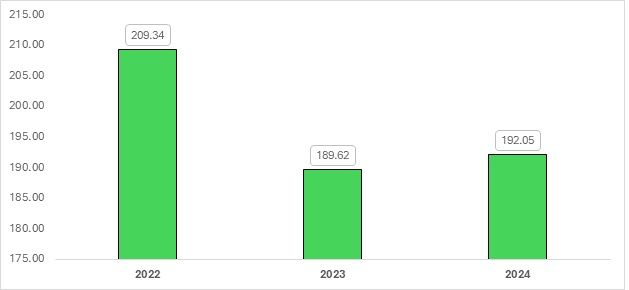

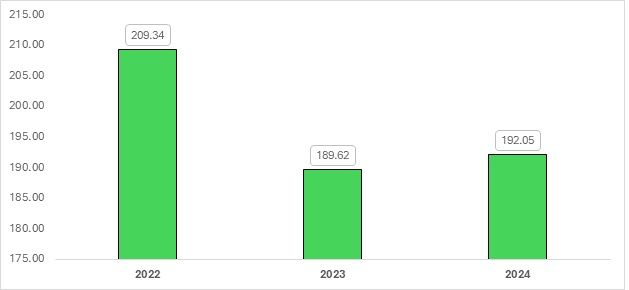

Exhibit 1: China’s exports of apparel and home textiles to the world (in $ bn)

Source: ITC Trademap, F2F Analysis

China’s apparel and home textile exports saw only a marginal increase in CY 2024, reaching $192 billion from $189 billion in the same period in 2023. This remains significantly below the peak of $209 billion achieved in CY 2022.

Among China’s top export categories, trousers, jerseys, and T-shirts lead the market. Trousers exhibit a balanced segmentation, with 60 per cent catering to women’s wear and 40 per cent to men’s, reflecting the strong global demand for women’s clothing. Meanwhile, jerseys and T-shirts are largely unisex, demonstrating China’s strategic approach to serving high-demand segments efficiently.

China also maintains its dominance in the textile material sector, with man-made fibre (MMF) accounting for 47 per cent of apparel materials used in CY 2024, while cotton comprises 33 per cent. This highlights the country’s stronghold in synthetic textile production.

There was a sharp uptick in exports in December 2024 as expected, due to reports that had indicated that several US companies were stockpiling Chinese textile and apparel products ahead of stricter trade regulations expected under Trump’s new administration. According to trade data provider Descartes Systems Group, US seaports handled the equivalent of 451,000 40-foot containers of Chinese goods in December, a 14.5 per cent year-over-year increase.

China’s textile and apparel exports to top 10 destinations: Value and market share analysis

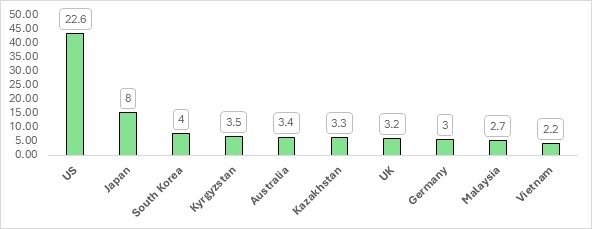

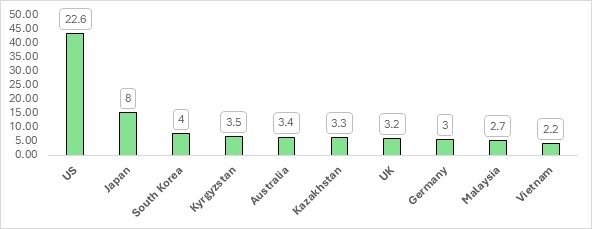

Exhibit 2: Distribution of China’s exports to top 10 exporting countries (in per cent)

Source: ITC Trademap, F2F Analysis

China’s apparel and home textile exports currently rely heavily on the US, which accounts for 22 per cent of its total shipments. However, considering the impending 60 per cent tariff on Chinese textile exports under Trump’s proposed trade policies, China is expected to intensify its market diversification efforts. Notably, China’s other key export destinations include several neighbouring Asian countries—Japan, South Korea, Kyrgyzstan, Kazakhstan, Malaysia, and Vietnam—as well as developed economies like Australia, the UK, and Germany. This analysis explores how these markets may absorb a larger share of Chinese textile exports, and the potential challenges China might face.

Japan

China and Japan maintain a complex relationship where deep economic interdependence co-exists with historical and political tensions.

Positives:

- During Trump’s first term, when US-China trade tensions escalated, China pivoted towards Japan, resulting in a 7.3 per cent increase in Chinese exports to the country.

- In 2019, at the peak of the trade war, Japan’s share of Chinese exports rose to 10.5 per cent, compared to its usual 8 per cent, indicating a shift in China’s export strategy.

- No trade remedies have been imposed by Japan on Chinese textile imports.

- Both China and Japan being members of the Regional Comprehensive Economic Partnership (RCEP), it ensures relatively stable trade conditions, with a preferential tariff of 9.6 per cent on Chinese apparel and home textile exports.

Negatives:

- Japan’s stance on China is influenced by political leadership. Under former Prime Minister Shinzo Abe, Japan maintained a balanced approach towards China. While current Prime Minister Shigeru Ishiba leans towards stronger ties with China, the long-term trade impact remains uncertain.

- Japan has initiated anti-dumping investigations on Chinese steel and graphite products, signalling that it remains cautious about China’s trade practices.

South Korea

South Korea strategically balances its relations between China and the US, maintaining close security ties with Washington while heavily relying on Beijing for trade.

Positives:

- With both South Korea and China being members of the RCEP, initially a 9.6 per cent tariff was imposed on Chinese apparel and home textiles. However, the 2020 Free Trade Agreement (FTA) between the two countries eliminated tariffs on these products.

- This zero-tariff advantage positions China as a dominant supplier, potentially displacing smaller competitors such as Indonesia and Myanmar in South Korea’s textile import market.

Negatives:

- South Korea’s security alliance with the US could limit deepening trade relations with China.

- Trump’s engagement with North Korea and his stance on regional security could influence South Korea’s approach to trade with China.

Kyrgyzstan and Kazakhstan

These two Central Asian nations serve as crucial transit points in China’s Belt and Road Initiative (BRI), making them strategic trade partners.

Positives:

- China’s apparel and home textile exports dominate both markets, largely due to affordability and logistical advantages.

- With significant portions of their populations living below the poverty line, consumers in these countries rely on low-cost Chinese textiles.

Negatives:

- The influx of Chinese apparel has weakened local textile industries, which struggle to compete with China’s scale and pricing.

- Increased imports from China could further suppress the domestic apparel sectors, impacting their exports to Russia.

United Kingdom and Germany

Both the UK and Germany are major European importers of Chinese textiles, with varying degrees of trade openness.

Positives:

- The UK maintains an open market for Chinese goods, ensuring a steady flow of Chinese textile imports.

- Germany, a significant importer of intermediate textile products from China, remains a key trade partner.

- The UK’s recent diplomatic engagements with China suggest a potential deepening of trade relations, which could lead to increased exports of high-quality Chinese textiles.

Negatives:

- The European Union (EU) has labelled China as a practitioner of “non-market” trade practices, leading to increased scrutiny of Chinese exports.

- European consumers have expressed concerns about the quality of Chinese textiles, with Bangladesh and Vietnam emerging as preferred suppliers due to their competitive pricing and preferential trade agreements as developing nations.

Malaysia and Vietnam

These two Southeast Asian nations share strong trade relations with China and have free-trade agreements in place, facilitating the entry of Chinese textiles into their markets.

Positives:

- China has made significant investments in both Malaysia and Vietnam, strengthening trade ties.

- Vietnam’s growing trade surplus with the US has caught Trump’s attention, potentially pushing Vietnam to enhance trade relations with China.

- China has leveraged Vietnam as an export channel, sometimes routing its textile goods under the ‘Made in Vietnam’ label to bypass US trade restrictions.

Negatives:

- Malaysia and Vietnam may distance themselves from China to avoid becoming targets of US tariffs.

- Malaysia might increasingly source its textile imports from Vietnam rather than China, benefiting from Vietnam’s strong apparel manufacturing sector and its ASEAN trade agreements.

Conclusion

With the levying of new US tariff on Chinese apparel and home textile exports being a certainty, China is expected to intensify efforts to diversify its trade network. This strategic shift will likely involve redirecting exports to emerging markets while deepening trade relations with key partners.

- Japan and South Korea may absorb more Chinese textiles due to existing trade agreements and tariff advantages, though political dynamics will play a role.

- Kyrgyzstan and Kazakhstan will continue to be major markets, but the influx of Chinese goods may further stifle their domestic textile industries.

- The UK and Germany remain crucial markets, but increasing scrutiny of Chinese trade practices and quality concerns may pose challenges.

- Malaysia and Vietnam offer potential, but geopolitical shifts and competition from local manufacturers could limit China’s dominance.

Beyond these regions, Africa, Brazil, and India present growth opportunities, given rising demand for affordable textiles. China’s ability to supply large volumes of cost-effective apparel positions it well to capture a larger share of these emerging markets. While US tariffs may disrupt China’s exports in the short term, strategic market realignment could help sustain long-term growth in the industry.

ALCHEMPro News Desk (NS)