In 2023, Turkiye proposed the Iraq Development Road, which aims to connect the Persian Gulf to Europe via Turkiye, as an alternative to the India-Middle East-Europe Economic Corridor (IMEC), since the IMEC bypasses Turkiye and connects Europe directly with Asia via the Middle East. With Turkiye proposing this project as a serious alternative to the IMEC, it will be interesting to conduct an initial comparative analysis of the trade routes, as both ultimately aim to facilitate easy connectivity to Europe. Europe is one of the largest consumers of textiles and apparel after the US.

Low cost, high impact

Turkiye's strategic position as a natural bridge between Asia and Europe has long been a cornerstone of its economic significance. However, the impact of the Suez Canal on Turkiye's economy underscores the need for alternative trade routes. The proposed Development Road, in conjunction with the existing IMEC, reaffirms Turkiye's pivotal role as a central link between the Middle East and Europe while also facilitating connectivity with Asian nations through the Belt and Road Initiative.

From the cost perspective, the Turkiye-Iraq links of the Development Road may offer cost advantages over the overall expenses of the IMEC, considering the former is the shorter route. Despite variations in the number of members and links due to geographical proximity, the Development Road has the potential to serve as a crucial link between Asia, Europe, and the Middle East.

The estimated cost of the entire Development Road project is approximately $17 billion, with investments from the United Arab Emirates (UAE), Qatar, and Turkiye. Like the IMEC, private sector involvement in the Development Road project complicates precise cost estimations. However, the project's components mirror those of the IMEC, aiming to enhance connectivity to Europe via Turkiye. Conversely, the IMEC predominantly focuses on facilitating connectivity to Europe via the Middle East. Despite cost differences, both initiatives underscore the growing importance of alternative trade routes and regional connectivity in fostering economic growth and development.

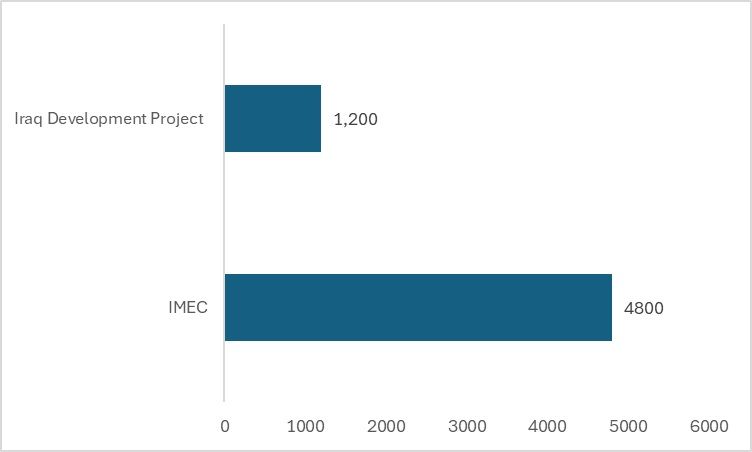

Figure 1: Estimated costs of the projects (in $ bn)

Source: PIB, Presidency of the Republic of Turkiye

As the IMEC connects to Europe via the port of Piraeus in Greece, the Development Road links the Middle East to Europe and the other main supplying Asian regions via Turkiye. The distance covered by the link is a total of 1,200 kilometres, which is halfway through the total route of 4,800 kilometres of the IMEC. However, China remains involved in both routes in one way or another. The port of Piraeus—one of the important links to Europe for the IMEC—is largely operated by a Chinese company, while in Turkiye's plan, the Belt and Road Initiative (BRI) plays an instrumental role. Thanks to the shorter route and BRI, the Development Road will have the added benefit of further connectivity to other Asian regions, potentially boosting the textile trade.

Figure 2: Total distance covered by the respective proposed trade routes (in km)

Source: Media reports, Presidency of the Republic of Turkiye

With the main objective of both the Development Road and the IMEC being to enhance connectivity to Europe via rail and sea routes, the number of days taken by the different routes also becomes crucial, as the main purpose of both routes is to reduce the cost and transit times. In comparison, the IMEC substantially reduces the time to transport goods from India to Europe from 18 days to 10 days, whereas the overall time taken by the Development Road will reduce the journey to around 25 days, which currently takes 35 days from Suez Canal and 45 days from the Cape of Good Hope. Thus, both routes substantially reduce transit times. However, whether both are alternatives to each other is a question to be answered, since the main aim of both projects is synonymous, except for the geopolitics implications.

Figure 3: Days required to transit across different routes

Source: Ministry of Trade of Turkiye and Turkish Media Reports

The Trade Gamble

The Development Road merges with the Middle Corridor, which represents a comprehensive land and maritime transport pathway that begins in China, traverses Central Asia and the Caspian Sea, and extends through the South Caucasus and Turkiye, culminating in Europe. The Development Road, along with the Middle Corridor, can benefit Turkiye as the country not only serves as a pivotal midpoint for numerous nations seeking access to Europe but also has the opportunity to tap into a diverse array of markets for its own exports.

Compare this to the IMEC, the trade route does not merge with any other trade project. And therefore, the bloc can have a greater impact on its trade as compared to the impact of IMEC on any other nation.

Besides Turkiye, another nation that stands to benefit is the UAE, which is not only the connecting point for the IMEC but also is one of the key investors for the Development Road. This dual role positions the UAE to leverage its strategic location and investments for enhanced trade opportunities within the region and beyond.

Potential for increased trade

The Development Road project also seeks to revitalise bilateral trade between Turkiye and Iraq. Despite a significant decline in trade volume, Turkish exports to Iraq have shown an upward trend. By bolstering connectivity between Iraq and Turkiye, the project anticipates a resurgence in trade between the two nations. Given Turkiye's prominence as a leading supplier of textiles and ready-made garments, the Development Road initiative holds the promise of substantially enhancing Turkiye's textile trade as well.

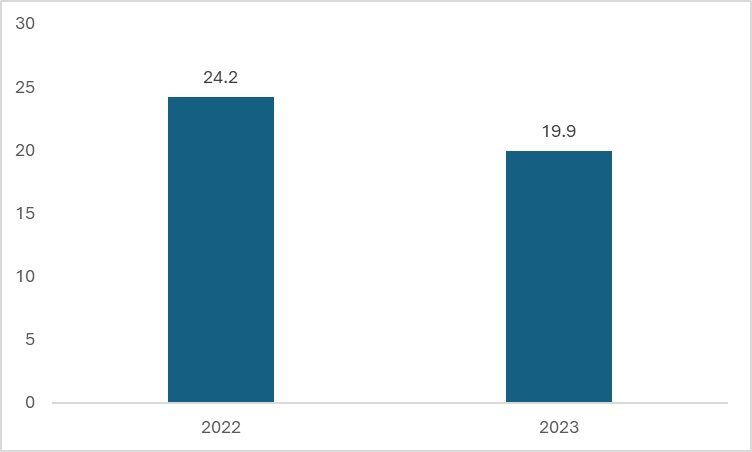

Figure 4: Turkiye's trade with Iraq (in $ bn)

Source: Trade Map

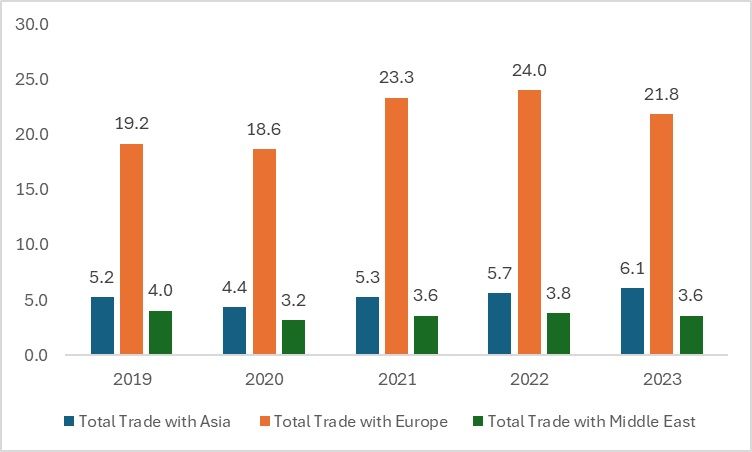

According to data from the ITC Trade Map, Turkiye currently exports the largest quantity of textiles to European nations, with Asia and the Middle East following closely behind. With the implementation of the Development Road and the consequent reduction in transit times, there is a strong likelihood that trade with Iraq will experience a significant uptick. Moreover, Turkiye stands to benefit from increased access to European and Middle Eastern markets, particularly in the textile sector, where exports are currently valued at a modest $3 billion.

In light of these opportunities, Turkiye has much to gain from the simultaneous development of both the Development Road and the Middle Corridor initiatives. By leveraging these projects, Turkiye can enhance its trade relationships, capitalise on emerging markets, and bolster its position as a key player in regional economic integration.

Figure 5: Turkiye’s exports to Asia, Middle East and Europe (in $ bn)

Source: ITC Trade map

Is Development Road really an alternative to IMEC?

From a practicality perspective, it could become a serious alternative to the IMEC, especially due to the Middle Corridor proposed by Turkiye in the Belt and Road Initiative (BRI). With the Development Road currently not involving any disputed nations, the chances of this project being realised are higher compared to the IMEC at this stage, due to the Israel-Hamas conflict. Moreover, when considering the costs and overall benefits, it is likely that the Development Road initiative will reap more benefits as it is directly connected to the Middle Corridor which passes through the Asian continent, thus providing wider coverage. For now, it appears that the Turkish route may have an advantage in terms of successful completion and the kickstarting of the trade corridor.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!