Since November 21, vessels passing through the Red Sea have faced increased attacks from the Houthis, raising security threats in the passage and fears of increasing associated costs. The global shipping community, losing hope for a quick resolution, anticipates that these prolonged attacks may inflate trade costs and, consequently, the prices of the goods traded.

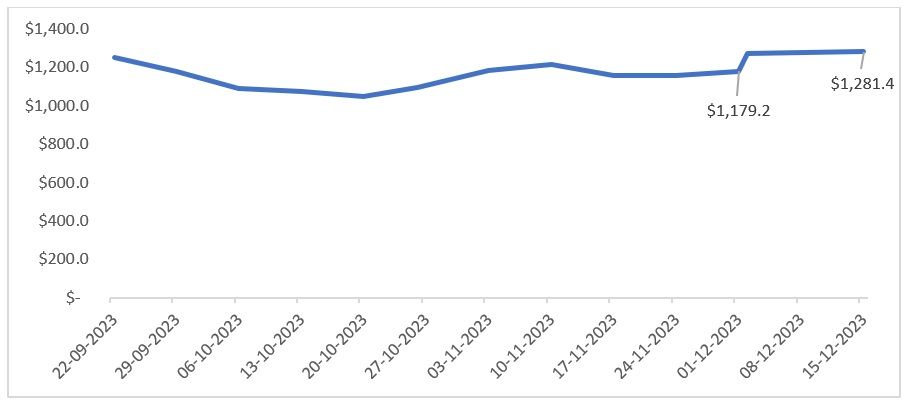

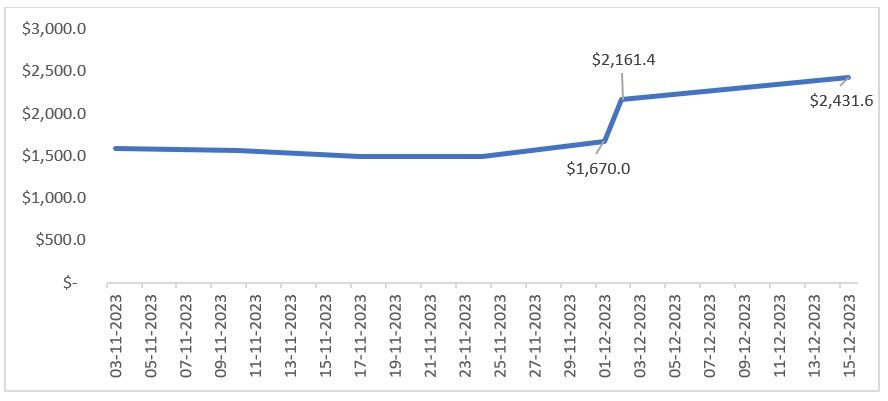

The global geopolitical wars, spilling out in the form of trade restrictions, are not new. However, the recent attacks on cargo vessels passing through the Red Sea are causing fears among shipping companies regarding the safety of their vessels. Globally, this has resulted in an overall increase in the cost of shipping. A shipping cost index from FBX - a US shipping company - demonstrated that as of now, the prices of cargo vessels globally have increased by 1 per cent, which is minor. However, after the attacks, the rates for the Suez routes increased from 3 per cent to 12 per cent.

Figure 1: Weekly global shipping prices (in $)

Source: Freightos FBX Shipping index

Navigating troubled waters

As 30 per cent of global trade happens through the Suez Canal and mostly involves essential goods like oil, the longer the disruption at the Red Sea, the higher and more serious the implications on trade will be. The alternate route, the Cape of Good Hope, which passes through the African peninsula, will delay shipments by two weeks and also increase the insurance costs for companies. This increase will be reflected in the prices of goods in the coming time, as the prices of goods also include transportation costs as an important factor.

In the list of the world's busiest ports for trade, China’s Shanghai Port is the busiest trade destination. The increase in attacks has already led to the weekly prices of shipping shooting up by 12 per cent for routes that use the Suez Canal as a trade route for transportation. Notably, the Ever Given ship incident of March 2021 had resulted in trade being disrupted for a week and temporarily increased shipping costs. While that incident did not affect trade on a large scale, the current uncertainty is likely to disrupt trade for unknown periods.

Figure 2: China-Mediterranean shipping charges (in $)

Source: Freightos FBX shipping index

Impact of increasing logistics cost on global trade

Transportation costs will also have an impact on the entire supply chain. With the application of simple trade economics, the higher the transportation cost, the greater the impact on trade and the prices of goods and services in the concerned country. But this is just the pricing part.

If prolonged for a longer period, the inventory may be affected negatively, which can affect the supply, and thus, the prices may rise. Although there have been no discussions regarding inflation, prolonged disruption in the Red Sea will affect pricing in the coming period.

The Suez Canal is important as it is the fastest route from Asia and the Middle East to Europe. According to the Suez Canal Authority, there has been a record crossing of 2,264 vessels passing through the canal compared to last year. The canal is an important route for transporting consumer goods, components, energy, oil, etc. This is why many countries are concerned about the situation in the Red Sea.

Increased Insurance Costs

As the sea becomes more unstable, the expenses for shipping companies to secure their vessels against unforeseen damages—stemming from conflicts such as wars and attacks—rise. A Morningstar report indicated that the Russia-Ukraine war and the Israel-Hamas conflict have compelled more shipping companies to pay an upfront premium for insurance coverage to safeguard their assets. Consequently, for those using the same shipping routes, elevated insurance costs can significantly burden exporters, ultimately impacting the entire supply chain.

How it may affect India and the world

India uses the Red Sea route for automobile parts, textiles, and readymade garments exports, as well as agricultural commodities like rice and wheat. With India exporting most of its apparel and textile products to Europe through the Red Sea, this can pose significant challenges for Indian textile and apparel exports.

The sudden increase in shipping costs—thanks to the increase in the premium that shipping companies must pay—will increase the overall price of goods, thus reducing the export competitiveness of the country. This will also affect the fashion industry in Europe, which imports massively from Asian nations like Bangladesh, Vietnam, China, and India. The increase in shipping costs will also increase the prices of imports and ultimately the overall prices in the industry. The prolonged route through the Cape of Good Hope will also cause delays in shipments, therefore resulting in crowding for shipping and further pressure on shipping costs.

A loss in producers' and consumer’s surplus

With global trade being affected, there is likely to be an impact on both producers and consumers. The rise in shipping costs is expected to diminish the benefits accruing to both groups. As insurance premiums for shipping companies increase, this will affect the total cost for producers. The impact can be seen from two perspectives:

Asian countries, major exporters of textiles and apparel, will face challenges due to an increase in insurance premiums affecting their competitiveness and leading to a loss in producers' surplus. The insurance premium will raise the price of apparel in destination countries, as producers will need to include these costs in their pricing if the uncertainty continues into the next year. With prices largely unchanged currently, producers may experience reduced margins.

On the other hand, Europe and the US are major consumers of apparel and textile products. They import from Asia due to lower costs. However, prices are expected to rise due to the aforementioned reasons, reducing consumer surplus. The average European consumer has already curtailed spending across various categories due to increased uncertainty. Germany, one of the largest apparel importers in the EU, has seen a modest decline in consumer confidence according to McKinsey research. The report indicated that consumers are planning to maintain their spending levels but are becoming more price sensitive, posing a significant threat to the global textile and apparel trade and economy.

A multiverse of uncertainties

As the world recovers from the COVID-19 shock, geopolitical tensions and wars have disturbed global trade and incited widespread concern. In the textile and apparel trade, while nearshoring is considered a potential strategy, it is essential to factor in labour costs, the infrastructure required to produce the desired quality of apparel, and the overall costs compared to global benchmarks. Given that nearshoring may be unfeasible in the short term, the only hope remains that the uncertainties will be resolved, and trade will return to normal.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!