Economic rationale and trade efficiency gains

By serving as India’s first major domestic transhipment hub, Vizhinjam is expected to significantly reduce transport costs and transit times for exporters by as much as 30–40 per cent. This drastic improvement in trade efficiency will reduce India’s reliance on foreign transhipment hubs (such as Colombo, Dubai or Singapore) for handling large shipping vessels. Currently, about 75 per cent of India’s container transhipment cargo is handled at overseas ports, causing an estimated $200–$220 million in revenue to be lost each year on transhipment fees. With Vizhinjam, much of this activity (and revenue) can be retained domestically, lowering overall logistics costs and boosting export competitiveness.

Crucially, the port’s efficiency gains can translate into broader economic benefits. Lower shipping and handling costs mean exporters can offer more competitive prices for their goods abroad, which ultimately benefits end consumers through lower prices. This buffer is especially important amid a global trade environment of rising tariffs and protectionist measures (such as the heightened tariffs seen during the Trump era) that put pressure on profit margins. By cutting logistics expenses, Vizhinjam helps Indian exporters offset external trade barriers, ensuring that Indian goods remain price-competitive in international markets. The port’s inauguration is not just a regional infrastructure upgrade—it is an economic enabler that improves trade flow, reduces dependency on foreign ports, and fortifies India’s position in global supply chains.

Strategic value for the textile industry

The textile and apparel sector is one of India’s largest export earners, contributing roughly 9 per cent of India’s export revenues, with export values reaching $40 billion in FY 2023–24. This sector operates on seasonal fashion cycles and increasingly tight turnaround times, especially with the rise of ‘fast fashion’ trends. Retailers worldwide now demand frequent, just-in-time inventory refreshes aligned with the latest styles and seasons.

In this context, a domestic transhipment hub like Vizhinjam offers a critical advantage. It enables quicker and more reliable shipment of textiles, helping manufacturers meet seasonal peaks in demand and ship new fashion lines to market without delay. By handling large container ships directly, the port can shorten delivery timelines and avoid the additional time lag incurred when routing through foreign ports. This agility is crucial for India’s apparel makers to capitalise on fast-moving fashion trends and rejuvenate the country’s apparel industry through greater responsiveness and speed to market.

Furthermore, given the bulky nature of textile goods, the industry is heavily reliant on maritime transport for exports. (For context, roughly 70 per cent of world trade by value travels via sea, and textiles are no exception.) Approximately 70 per cent of India’s textile shipments (by volume) are transported via waterways, underscoring the importance of seaport efficiency for this sector. With most Indian textile exporters traditionally shipping through distant transhipment hubs, Vizhinjam provides a cost-effective and direct gateway to key overseas markets. The port’s 40 per cent reduction in logistics costs is expected to lower freight expenses for textile exporters, allowing them to price products more competitively abroad.

Additionally, direct transhipment in India reduces double-handling of cargo, minimising damage risk and logistics complexities for apparel shipments. The net effect is that Indian textile products can reach international buyers faster and at a lower cost. This improved supply chain efficiency enhances India’s appeal as a sourcing destination at a time when buyers are diversifying suppliers and seeking greater agility.

India’s soaring logistics costs: Fuel product price hikes

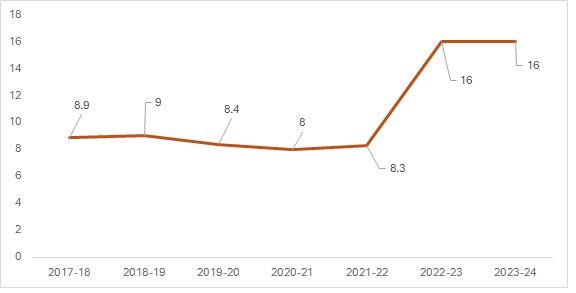

Exhibit 1: India’s logistics cost (% of GDP)

Source: NCAER, Economic Survey of India

*Please note that the average of the estimated range is taken into consideration in the above figure

India’s logistics cost as a percentage of GDP has been increasing considerably over the years. The Indian logistics sector is as fragmented as its manufacturing sector, with smaller tier 2 and tier 3 cities dependent on local, unorganised logistics providers. These MSMEs particularly include cottage industries, weaving units, and the handicraft sector. Increasing fuel prices, along with post-COVID fluctuations in freight costs, have significantly raised logistics expenses, harming India’s exports. India’s freight costs have almost doubled compared to other countries such as China and those in Europe, where logistics costs account for approximately 9 per cent and 8 per cent of GDP, respectively.

How will the Indian textile industry benefit from this move?

Vizhinjam Port will be a major boost for exporters in cities like Chennai, Coimbatore, Bengaluru, Tirunelveli, Tuticorin, Hyderabad, Vizag, and Goa by offering a faster and more cost-effective gateway to global markets. With direct road and rail connectivity enabling goods to reach the port within 18 to 48 hours, exporters can significantly reduce inland transit time. The port’s proximity to major international shipping lanes allows direct access for large vessels, eliminating the need to route containers through foreign transhipment hubs like Colombo. This alone can save exporters $80–$100 per container in handling costs. Additionally, Vizhinjam’s deep draft and advanced cargo-handling infrastructure ensure quicker turnaround times, making it easier for businesses to meet tight export deadlines.

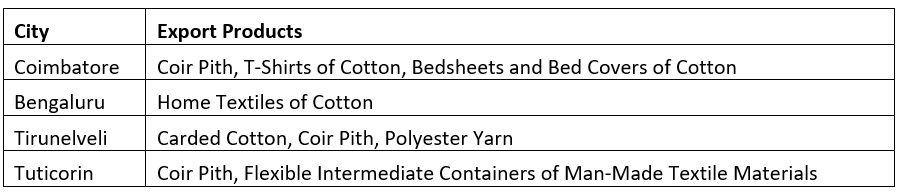

Table 1: India’s textile export-oriented cities and products set to benefit

Source: DGCIS, Ministry of Commerce and Industry

The southern Indian cities of Coimbatore, Bengaluru, Tirunelveli, and Tuticorin are key textile and agro-based export hubs, each specialising in products such as cotton T-shirts, home textiles, polyester yarn, and notably coir pith—a widely used horticultural product. Among these, coir pith stands out as a time-sensitive export due to its role in seasonal agricultural cycles abroad and its susceptibility to moisture if delayed. Ensuring timely shipments is crucial to maintaining product quality and meeting international demand. The upcoming Vizhinjam Port, with its deep draft, proximity to major shipping lanes, and fast road-rail connectivity to these cities, is expected to play a pivotal role in enabling faster and more reliable exports.

India is set to increase exports to Europe and East Africa at a faster turnaround time

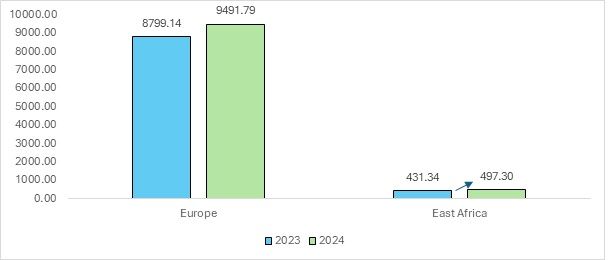

Figure 2: Potential markets for textile export expansion and their export values in CY 2024 (in $ mn)

Source: TexPro

Given the current trade and geopolitical conditions, India needs to explore its dominant markets, such as the European continent, to safeguard its export base. The Vizhinjam Port would give India access to the European market via direct East–West shipping through the Suez Canal, without dependence on its neighbouring country, Sri Lanka’s Colombo Port. The East African region is also an emerging destination for Indian textile exports, with exports increasing by 15 per cent—from $431.34 million to $497.30 million. The new transhipment port would facilitate direct connectivity to the East African region, reflecting India’s efforts to diversify its export markets.

Summing it up

India’s logistics strategy must leverage Vizhinjam Port as a domestic transhipment hub to strengthen supply chain resilience and expand trade. The following strategic advantages highlight how Vizhinjam can be a game-changer:

Reduced reliance on foreign hubs

Vizhinjam Port enables India to significantly reduce its dependence on foreign transhipment hubs like Colombo, Singapore, and Dubai. Colombo alone accounts for over 40 per cent, despite its depth and congestion limitations. With a 24-metre natural draft and proximity to the East–West shipping lane, Vizhinjam can berth Ultra Large Container Ships and handle cargo domestically. This shift could cut logistics costs by up to 30 per cent through improved efficiency and faster turnaround.

Securing access to key trade routes

Vizhinjam’s strategic location—just 10 nautical miles from the Suez–Far East shipping route—positions India to tap into one of the world’s busiest maritime corridors with minimal deviation. Handling 12 per cent of global trade, this route is critical for connecting Asia, Europe, and Africa. Vizhinjam offers a reliable, Indian-controlled hub for cargo aggregation, reducing dependency on foreign ports and mitigating risks from disruptions like the 2021 Suez blockage. It ensures uninterrupted westbound trade and strengthens India’s control over key global supply lines.

Support for time-sensitive industries

Vizhinjam strengthens export reliability for time-critical sectors like textiles and apparel, which contribute around 12 per cent of India’s exports. These industries operate on tight schedules where even a one-week delay can result in missed seasons and lost revenue. Global disruptions have already extended shipping lead times from 5–6 weeks to over 8 weeks. By offering faster, domestic transhipment with advanced infrastructure, Vizhinjam reduces delays, eliminates dependency on foreign hubs, and ensures timely delivery—critical for maintaining competitiveness and fulfilling export commitments.

Diversification of export markets

Vizhinjam can act as a gateway for expanding India’s exports beyond traditional Western markets, particularly to emerging regions like East Africa, where textile exports have recently grown by 15 per cent. Direct shipping from Vizhinjam would bypass Middle Eastern hubs, reducing costs and transit times. With Adani Ports targeting East Africa and Southeast Asia for trade expansion, Vizhinjam supports India’s broader strategy to reduce market concentration and tap into new demand centres—especially for affordable apparel.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!