Key trade routes, including the Suez Canal and the Red Sea—crucial for connecting Asia to the Western Hemisphere—are now under threat. The MENA region, a major consumer of labour-intensive goods such as low-end machinery, textiles, and garments, is experiencing significant strain. According to the Global Trade Research Initiative, reduced trade flows will primarily affect low-value, high-volume goods like apparel. Exporters in the region are grappling with rising freight and transportation costs, exacerbated by anticipated oil price surges due to the threat against oil-rich nations.

This analysis focuses on Israel and Iran, two dominant players in the MENA region. While countries such as the UAE, Kuwait, Qatar, and Saudi Arabia have so far maintained a stance of non-engagement, the ongoing spread of the conflict could lead to economic spillovers, affecting not only the MENA region but also its major trading partners and exporters. The situation underscores the fragility of global supply chains in the face of regional conflicts, especially for key industries like textiles.

Attack on Haifa port: Consequences for Israel's textile export industry

The Lebanese group Hezbollah recently launched a rocket attack near Israel’s Haifa base, putting the strategically vital Haifa port—the largest international seaport in Israel—at significant risk. Despite the robust multi-layered security systems in place at Israeli ports, the ongoing conflict has heightened vulnerabilities, posing serious threats to Israel's export activities, particularly in key sectors like textiles.

Israel imports textiles from a diverse group of top 10 trading partners, including China, Turkiye, Bangladesh, India, the US, Italy, Vietnam, and Cambodia. These nations are global leaders in the textile industry, with a substantial portion of their GDP reliant on exports. The growing threat to Haifa, driven by Iranian proxy groups such as Hezbollah, raises significant concerns about the stability of Israel's international trade routes.

Disruptions at the Haifa port could have major economic consequences for these leading textile-exporting nations. The interruption of supply chains, increased shipping costs, and potential rerouting of goods could profoundly affect the flow of textile products into Israel, impacting the economies of these exporting countries in the following ways:

The escalating conflict threatens not only Israel's export infrastructure but also the wider global textile supply chain, underscoring the fragility of interconnected economies amidst geopolitical unrest.

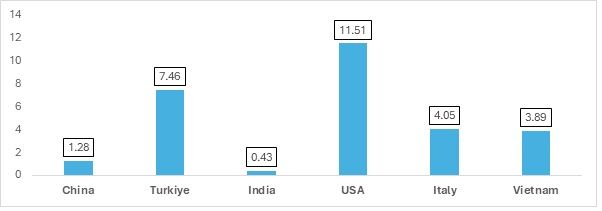

Exhibit 1: Haifa port disruption: Impact on top textile exporters to Israel (in %)

Source: IMF Port Watch

The above graph depicts the percentage of GDP from textile exports that would be affected by a 90-day disruption in Haifa port activities. The US would have the most affected textile sector due to the volume of textiles it sends to Israel compared to other countries. Another country likely to be greatly impacted is Turkiye. While the Turkish government has shown solidarity with the Iranians, Turkiye's status as a major textile exporter in the MENA region and Europe means that any harm to seaports in West Asia would significantly impact Turkiye’s textile exports.

Israel’s top imported textile products

Data on US textile exports to Israel reveals a varied and substantial trade relationship. Tents made from textile materials lead with an export value of approximately $14.71 million, highlighting strong demand for portable shelter solutions. This is followed by made-up articles of textile materials, including dress patterns, valued at around $8.10 million, indicating a diverse market for finished textile goods. Woven fabrics made from high-tenacity yarns, particularly nylon and polyester, represent a notable export worth about $7.81 million, reflecting Israel's need for durable materials for various applications. The export of artificial staple fibres, valued at approximately $7.17 million, and nonwoven fabrics at $5.08 million, further underscores the demand for specialised textiles in manufacturing.

The United States' prominence in technical textiles is vital to Israel's military efforts. Any damage to the Haifa port would significantly impact Israel’s logistics and supply chain. A notable trend in Israel’s imports from the US is the increasing reliance on military textiles, a sub-category of technical textiles, particularly in a conflict-prone region like West Asia. Notably, two of the top five textile imports from the US—tents and high-tenacity woven fabrics—are extensively utilised in military operations due to their strength, durability, and specific functionality. These materials play a crucial role in supporting Israel's operational capabilities in challenging environments.

Iran's import landscape: Key commodities and leading supplier nations

Iran’s continued involvement in the crisis is sure to hit the textile sector. It has become vital to explore Iran’s textile import impact, as it is likely to be heavily involved in the war for some time to come. Iran’s top imported products by value include cotton, woven fabrics of polyurethane, and staple fibres. Iran has an interesting mix of top suppliers for its textile imports.

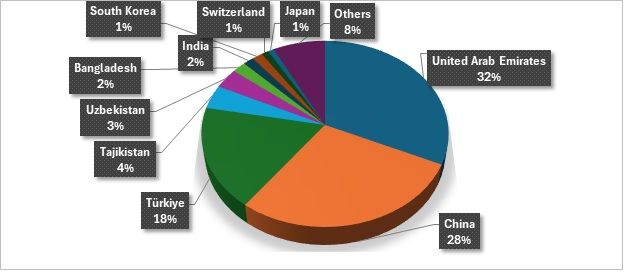

Exhibit 2: Iran's top textile suppliers for CY 2023 (in %)

Source: TexPro, F2F Analysis

The data on textile imports to Iran highlights a diverse array of trade partners, with the United Arab Emirates leading significantly at approximately $616.50 million. This underscores the UAE's pivotal role as a hub for trade in the region, likely facilitating access to a variety of textile products. Following the UAE, China remains a crucial supplier, contributing around $551.89 million to Iran's textile imports, reflecting China's strong manufacturing capabilities and established trade relationships. Turkiye also plays an important role, with imports valued at approximately $345.20 million, likely due to geographical proximity and cultural ties. Other notable contributors include Tajikistan and Uzbekistan, with imports valued at $80.13 million and $67.86 million, respectively, suggesting that Central Asian countries are becoming increasingly relevant in Iran's textile market.

Smaller but still significant contributions come from Bangladesh, India, South Korea, Switzerland, and Japan, indicating a broader diversification of sources. The ‘Others’ category, totalling about $145.88 million, suggests that Iran is sourcing textiles from various other nations, further enhancing its import portfolio amid ongoing geopolitical complexities.

Winners and Losers: West Asia's Top Textile Exporters Amidst Crisis.

US: It stands to gain significantly from technical textile exports amid the Israel-Iran conflict. Israel, in a consistent state of war, has doubled its military textile imports from the US. The US has a clear stance on the conflict, firmly supporting Israel due to shared interests and longstanding diplomatic relations. However, any attacks on Israeli airports or seaports could directly impact the US due to its substantial bilateral trade with Israel.

China: It maintains strong relations with Iran and signed a 25-year investment deal with the country in 2021. Iran is a major oil exporter to China, and Chinese partners have vocally supported their Iranian counterparts. China primarily exports man-made fibres, filaments, and knitted or crocheted apparel. While China's supply chain may be partly affected by the Suez Canal and Red Sea crises, its Belt and Road Initiative will likely keep it connected to Iran through Central Asian countries that are not directly involved in the West Asian crisis.

Bangladesh: It has a significant stake in the textile imports of both Israel and Iran. However, the country is currently grappling with economic upheaval following the ousting of Sheikh Hasina and the formation of a new government. Despite this, Bangladesh is unlikely to be severely affected, as Israel and Iran represent a minimal share of its total textile exports. Nonetheless, the anticipated surge in oil prices due to the war could harm Bangladesh's already fragile economy. Disruptions in key ports like the Suez Canal and those along the Red Sea could adversely impact its exports to major textile partners, including the US and European countries.

India: It stands at a pivotal juncture regarding its textile exports to West Asia. Historically, India has maintained a neutral stance toward various countries, but it increasingly leans toward Israel due to strategic interests and a shared commitment to anti-terrorism. However, India’s Chabahar port initiative has brought Indian traders closer to Iran, complicating the situation. Given India’s affinity for Israel, any tensions with Iran could pose challenges. Iran, as the largest cotton importer, is a crucial partner for India, which relies heavily on cotton exports. Maintaining the Chabahar port agreement is vital, as any uncertainty regarding this port could harm Iran's textile ecosystem, especially with Tajikistan and Uzbekistan being key players in the region.

Economic repercussions on textile exporters and consumers

The ongoing war has significant economic repercussions for both exporters and consumers. West Asia, particularly larger economies such as the UAE, Saudi Arabia, Israel, and Iran, are emerging consumers of textiles and other products. Given their polarised positions in the US vs China discourse, these countries have clear preferences regarding their import sources. Iran has consistently avoided trade with the US and its allies due to longstanding tensions, while Israel has aligned more closely with the US and its allies through ongoing diplomatic efforts. However, countries like Saudi Arabia and the UAE, which have so far remained uninvolved, are likely to face repercussions in an increasingly unstable environment. Exporters to these nations will need to consider the increased costs associated with navigating dangerous waters and the threat of piracy.

Consumers in the West Asian region will inevitably face rising prices for their imports. Escalating freight, shipping, and insurance costs—stemming from threats to vessels—are likely to be passed on to consumers, leading to higher overall prices. This could result in reduced spending on discretionary items such as textiles. Consequently, textile exports to these countries may increasingly focus on military textiles and related subcategories.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!