Bangladesh is about to graduate from Least Developed Country (LDC) status in 2026, the transition of which has begun in 2022. Since it secured independence in 1971, the country has significantly improved its overall economy, and the textiles and clothing sectors have played an instrumental role. The country, after experiencing the textile revolution, saw its growth skyrocket. There was immense growth in the overall GDP per capita and GNI (Gross National Income), along with an increase in foreign investments, among many other things.

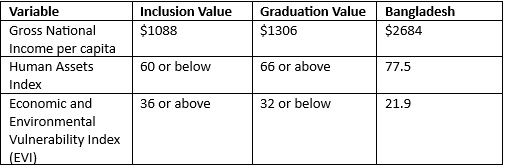

Bangladesh has already reached the threshold required to graduate from LDC and move to the status of a developing country. United Nations Department of Economic and Social Affairs (UN DESA) lists the following targets to be achieved for a country in the period of transition from LDC to a developing country:

However, the August 2024 political upheaval in Bangladesh raises the question whether the country has satisfied all these variables.

The threshold stage

If seen from the perspective of the UN variables, the country is fully eligible to graduate from a LDC to a developing nation. The country has passed all the threshold values.

Table 1: Threshold values required to graduate to developing nation

Source: UN DESA

If considered GNI per capita, Bangladesh is already ahead of several of its neighbours in South Asia. GNI considers all the sources of income for a nation as compared to the GDP per capita. At $2684, the GNI per capita of Bangladesh is higher compared to India ($2540) and Pakistan ($1500). Bangladesh relies majorly on the earnings from apparel exports and remittances received from the people residing in other nations. The Human Assets Index (HAI) and the Economic Vulnerability Index (EVI) which shows the quality of life, and the to-be-employed labour indicate improvement in the overall health and the educational system in the country. The country has been taking positive steps to ensure improvement in health and education. The indicators also show any structural improvements required for the country’s development. A lower value indicates impediments to sustainable development. While considering the inclusion in GSP+; these two indices along with an improvement in the ground situation will be needed to get the preferential tariff rates even after the graduation to a developing country. Therefore, looking at the state of the indices, the country can successfully graduate from the current LDC status. Looking at the macro variables and some of the other points listed by the UN DESA, we can get a clear picture of the country’s current state in transition.

The state of investment and GDP

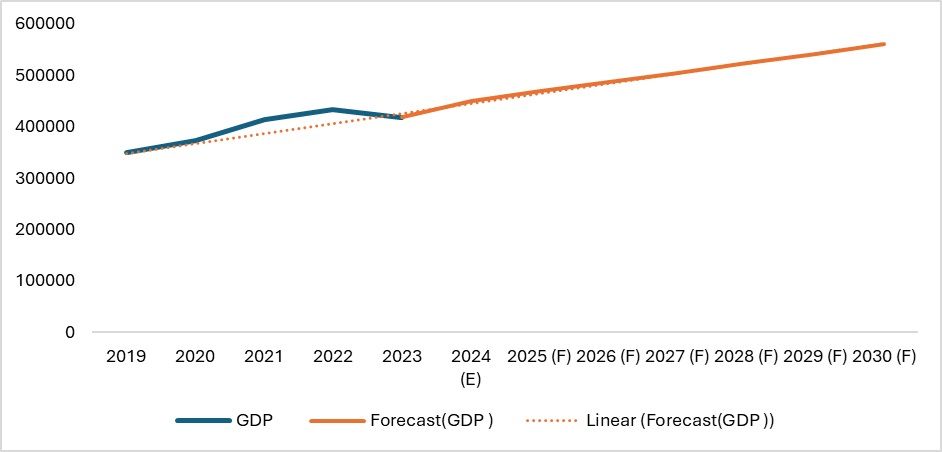

Bangladesh’s GDP has shown spectacular growth. Except for COVID-led crises, the country has been growing at a steady rate and is poised to grow linearly at a rate of consistent 4 per cent and a CAGR of 4 per cent in the period of seven years from 2023 to 2030.

Exhibit 1: GDP of Bangladesh

Source: UN DESA

If the Muhammad Yunus-led interim government is able to bring stability, the country may see stronger growth which can prop up investments and increase the confidence among the investors. The country’s continuous efforts to innovate and invest in infrastructure can also result in an increased GDP. Likewise, innovation and consistent efforts to improve transparency and sustainability can improve the economy. However, there are some potential challenges facing the country, including:

All of these can have an impact on the growth of GDP in the long term. Political instability can see reduced investments and lowered confidence in the functioning of the economy in the long term. Social unrest and continued protests in the country can disrupt textile operations, leading to lower profitability, reduced employment and decreased consumption, which can derail the economic growth of the nation. Any decline in manufacturing can also impact textile and apparel exports, which form a major chunk of the country’s forex earnings.

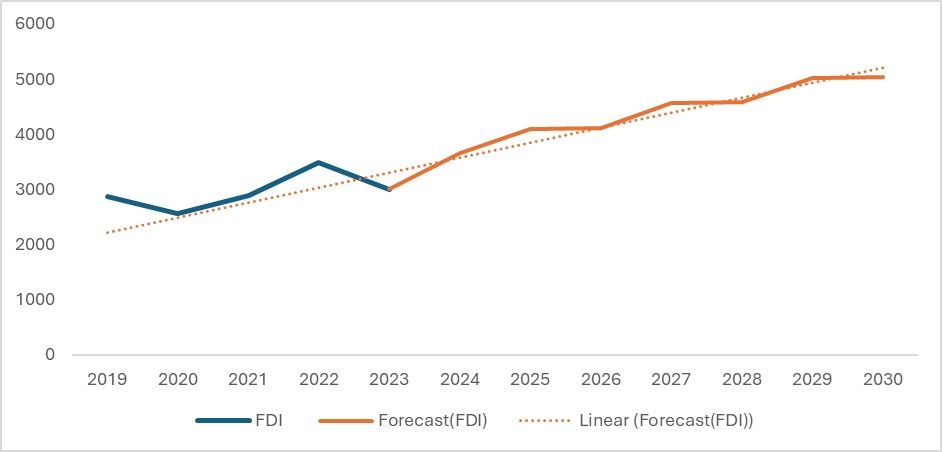

Exhibit 2: FDI investments in Bangladesh (in $mn)

Source: UN DESA

Bangladesh received lower FDI inflows in 2023 as compared to 2022. In 2023, the total FDI stood at $3004.40 million with the textile and apparel being the second largest sector in the manufacturing sector to receive FDI at $591.47 million, which was 19.7 per cent of the total FDI inflows. The United Kingdom has been the largest investor at $613.93 million, followed by the Netherlands at $366.96 million, and the US at $314.9 million.

The country may see further investments if a stable atmosphere is guaranteed. Bangladesh is also making efforts to enforce sustainability in the value chains. As of now, the country has no law for compulsory ESG (Environmental, social and governance) disclosures, and to be promoted in GSP Plus, it needs to ensure the implementation of sustainability measures and maintain the operational stability of the companies.

One of the most important criteria for the transition is macroeconomic stability, which also involves stable GDP growth, a stable policy to ensure smooth flow of investment, and low inflation or stable inflation. This requires a commitment from the side of the government to make policies that can ensure stable economic growth. At present, an action is needed from the side of the interim government to remove the bottlenecks from the current system, including:

Trade facilitation and diversification

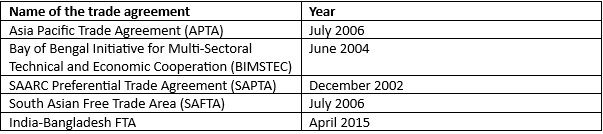

One of the most important points mentioned by the UN DESA for a smooth transition is diversifying trade and ensuring more trade facilitation agreements; to have greater market access as competitiveness of the country will completely reduce post its graduation, as it will be excluded from the EU’s GSP list. When it comes to the trade facilitation agreements, the country needs to ensure higher utilisation of the existing trade agreements and further sign more FTAs and preferential trade agreements (PTAs) with other countries.

Table 2: Trade facilitation agreements by Bangladesh

Source: Bangladesh Ministry of Commerce

So far, the country has signed only five agreements with preferential access to other countries. The country has since 1975 enjoyed the benefits after being classified as an LDC. After the Hong Kong treaty declaration, all the developing and developed countries gave duty-free access to all the products that Bangladesh exports; thus, giving the country the most required export competitiveness. So much so that developing countries like India also do not have that competitiveness. However, the US gave only partial duty-free access to the nation and excluded textiles and apparel, one of the nation’s strongholds. Therefore, it must export textiles and apparel at an average duty rate of 15 per cent.

However, with the graduation, the duty-free access of the nation will be removed, which will suddenly expose the country’s exports to huge tariffs, disrupting the country’s export competitiveness. Therefore, it is necessary for the country to sign deals with other countries and increase its trade competitiveness.

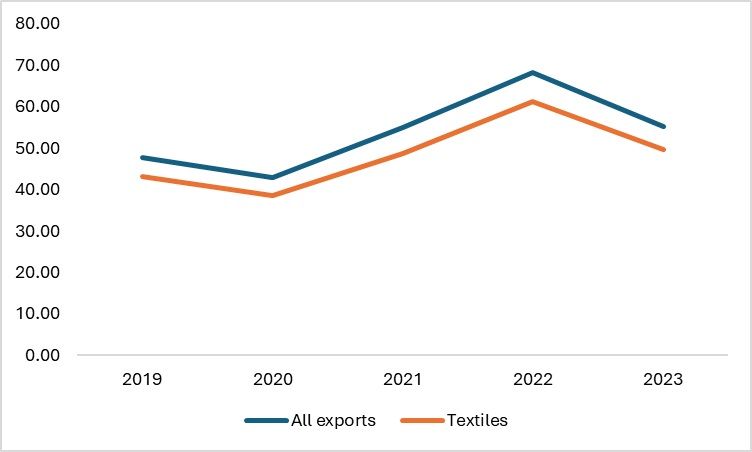

Exhibit 3: Total exports and the textile exports of Bangladesh

Source: Bangladesh Ministry of Commerce

Bangladesh’s total exports in 2023 fell to $55.18 billion, a decline of 19 per cent compared to the previous year. The drop in exports is attributed to labour protests and a gas supply crisis. The supply crunch increased costs and caused temporary shutdowns of firms, leading to a production slowdown. As the country navigates the transition from an LDC to a developing country, it must address domestic challenges. In addition, the challenges in terms of trade for the country are:

The country was excluded from the US GSP system in 2013 due to back-to-back instances reflecting unfair and unsafe atmosphere for labour in the country. The labour protest in 2023 again has brought to light the issue of sustainability and labour welfare, which can once again result in significant roadblocks for the country while seeking preferential access in trade with other countries.

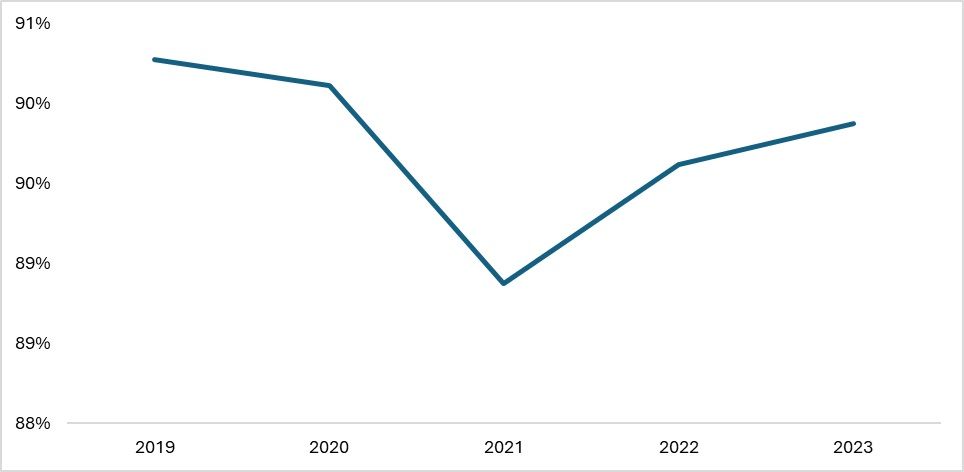

Exhibit 4: Apparel exports as a % of total exports of Bangladesh

Source: ITC Trade map, F2F analysis

Another issue is the dependence on textiles and apparel for exports. During the five-year period from 2019 to 2023, the share of textiles-apparel exports is in the range of 85-90 per cent, which shows an extreme reliance on these exports to earn foreign exchange. Bangladesh also earns major forex through remittances. Therefore, an excessive reliance on these sources can significantly expose the country to geopolitical risks, harming its earnings.

The impact of Bangladesh’s LDC graduation on its exports will largely depend on the country’s efforts to expand market access agreements. Currently, apparel exports enter the EU duty-free under the Generalised Scheme of Preferences (GSP) status. After graduating to a developing country, without any market access policies, the textile and apparel trade could take years to recover from the damages caused by high applicable tariffs.

Bangladesh’s lack of trade portfolio diversification poses an additional risk to its export earnings, which form a significant portion of its foreign exchange reserves. Coupled with the current instability, this could further jeopardise the country’s exports. Without efforts to stabilise the situation and adopt proactive measures to safeguard trade channels, the economic impact could be severe.

To mitigate these challenges, Bangladesh must take steps to stabilise its economy and invest in diversifying its heavily apparel-reliant export base. Proactive policies, enhanced market access agreements, and strategic investment initiatives will be crucial in safeguarding the country’s trade and economic stability post-graduation.

Road ahead

Bangladesh is currently seeking an extension of its LDC status. Until the request is accepted, the country remains in the preparatory stage of the Smooth Transition Strategy (STS) and must ensure macroeconomic stability while fulfilling sustainability requirements, including labour welfare and fair wages.

Political uncertainty and social insecurity are raising concerns about a potential reversal of the progress Bangladesh has achieved after years of effort. While GDP and FDI forecasts are positive, the administration’s willingness to sign new trade agreements, secure market access, and partner on technology upgrades will significantly influence the country’s trajectory as a developing nation in 2026 post-graduation.

The instability coinciding with the country’s transition from LDC to developing nation status poses serious questions about its preparedness. Gas supply disruptions have already hindered production chains, and labour and student protests have brought the country to a standstill. Despite meeting all graduation criteria, the political will to manage the transition effectively appears weak at this juncture.

To navigate this critical phase, Bangladesh must maintain macroeconomic stability and intensify efforts to diversify its manufacturing and trade sectors. According to UN DESA, securing trade preferences and favourable transition measures requires active engagement in negotiating trade agreements, improving labour welfare, and ensuring sustainable production practices.

Whether Bangladesh will truly benefit from its graduation depends on the government’s readiness to enact policies and enhance market access. Given the underutilisation of existing PTAs and FTAs, the country must expedite efforts to maximise their potential while drafting new trade agreements to ensure a smoother transition and sustainable growth.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!