BRICS’ main motto

This year, under Russia's presidency, the main motto of BRICS is strengthening multilateralism for joint global development and security. The primary aim of BRICS is to ensure that underdeveloped and developing economies—specifically those in the global south—receive the necessary representation in major multilateral platforms such as the UN and UNGA. All the member nations were significantly affected by the economic crash of 2008, which led the group to focus on economic cooperation in various fields, including monetary policies and, most importantly, trade policies, which play a crucial role in shaping or breaking a country’s fiscal position.

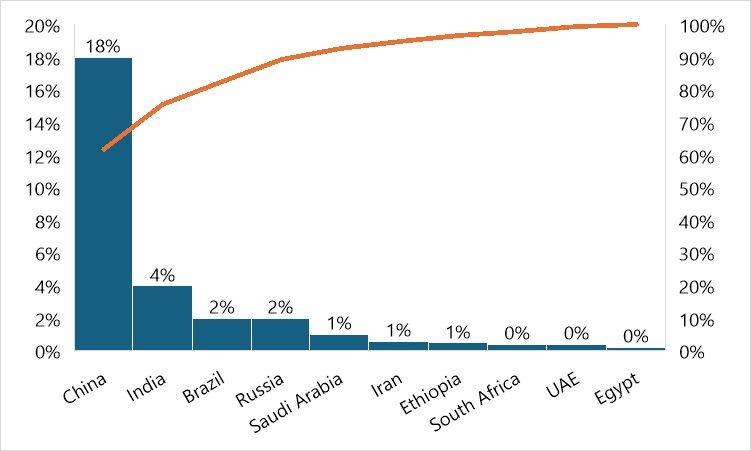

Exhibit 1: Share of the BRICS+ countries in the global GDP (in %)

Source: IMF, F2F analysis

BRICS poses a strong challenge to other groups like the G7. While the G7 represents only 29 per cent of the global GDP, BRICS now holds 30 per cent, making the group potentially more effective compared to conventional partners. Within the original BRICS bloc, only China wields significant influence, with an 18 per cent share of the global GDP. China has been expanding its reach by investing in infrastructure and signing new trade agreements worldwide. Nearly all countries—regardless of their development status—have some form of Chinese investment or swap agreements.

India is another key player in the bloc, actively increasing economic and strategic cooperation with other nations, making its role unique and instrumental within BRICS. However, the inclusion of Iran in the bloc has raised concerns among many nations. Given Iran's sanctions by the US and several European countries, how the bloc will be perceived as a representative of the global south at major events is a point of concern.

Thus far, BRICS has successfully established financial institutions to support the needs of developing nations, such as the New Development Bank (NDB) and the Contingent Reserve Agreement (CRA), which finance green projects and infrastructure developments in various countries. India and China have been the largest beneficiaries of NDB funds for infrastructure projects. Consequently, the bloc does have the potential to extend its role beyond traditional expectations. To date, the NDB has approved loans worth $32.8 billion, along with 96 infrastructure projects across member nations. The bank uses CNY and USD for loans, and although the total amount lent is currently small, with more stakeholders joining, the total investment is expected to grow.

BRICS in Trade

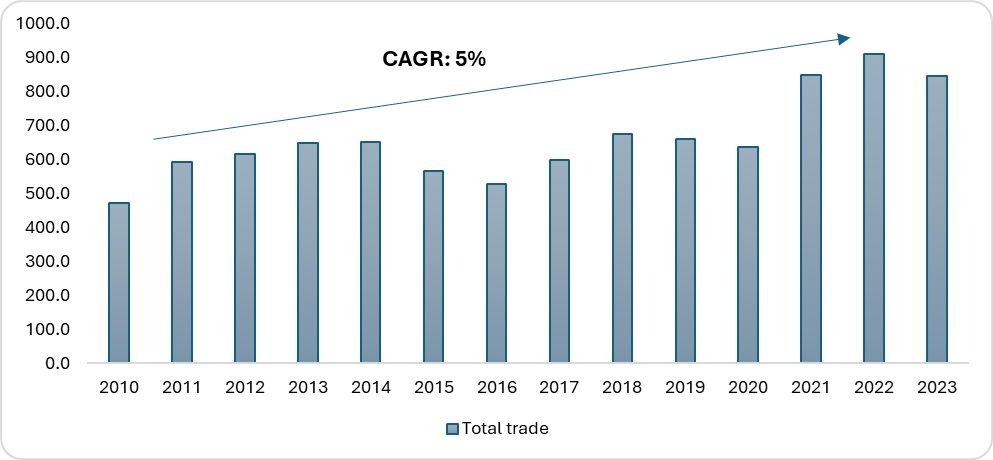

Intra-BRICS trade has been booming since the foundation of the group. However, when considering the overall trade of the group, it has grown at a CAGR of 5 per cent from 2010 to 2023, according to our analysis, and is estimated to grow further. Trade within the bloc is dominated by countries like Russia and China, which are manufacturing behemoths.

Exhibit 2: BRICS’ total trade (in $ bn, %)

Source: ITC Trade Map, F2F Analysis

The BRICS Plus nations occupy a 20 per cent share of global trade. However, the rate at which this share is increasing remains stagnant. The overall share in global trade is expected to increase by only a marginal rate of 1 per cent, mainly due to the presence of China and Russia in the group, as well as uncertainty in trade policies and the trade sanctions on Russia, which could undermine the bloc's total share in global trade. BRICS now collectively represents 45 per cent of the world’s population, thanks to the inclusion of consumer countries like India, China, and several African nations, which also have a significant young population. The bloc now also represents 30 per cent of the world’s GDP on a nominal basis and 35 per cent on a PPP basis, both of which are substantial portions of the total world GDP.

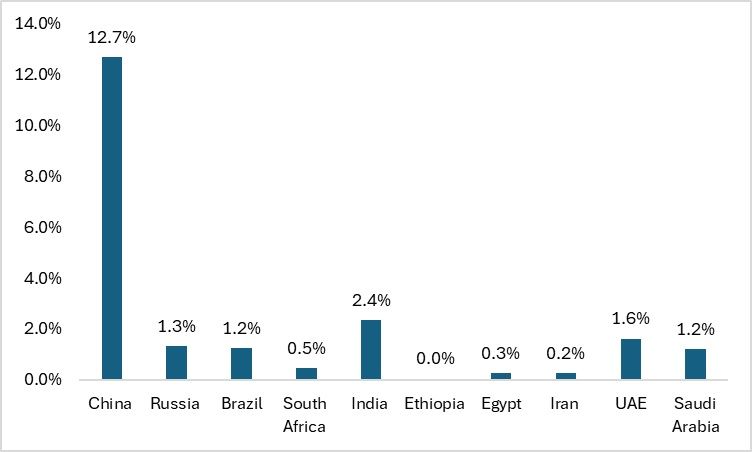

Exhibit 3: Share of BRICS+ nations in global trade (in %)

Source: ITC Trade Map, F2F Analysis

The bloc consists of nations that are among the world's agricultural powerhouses. India, Brazil, and South Africa all hold significant dominance in agricultural exports. BRICS+, for example, is responsible for around 20 per cent of global agricultural exports. This comes at a crucial time when the share of other countries, such as the US, has decreased to 6 per cent. However, from the perspective of global trade share, only China dominates the entire bloc, making it more unilateral in terms of trade and its benefits. India holds the second-highest share of trade in the bloc, but at 2.4 per cent as of 2023, it remains far behind China’s 12.7 per cent.

From the perspective of population, BRICS now represents more than 40 per cent of the world’s population, making the bloc more attractive as a consumer base, a rich source of skilled manpower, and a valuable platform for the exchange of ideas. Therefore, if the bloc is successful, it could have a significant influence on shaping a new world order. However, there is another issue that needs to be addressed.

Can BRICS be truly successful?

BRICS was established to foster economic cooperation and promote better capital flow and investments into member nations. In that regard, the bloc has been successful, with investments within BRICS skyrocketing. According to a report by UNCTAD, foreign direct investment (FDI) in BRICS countries increased by 13.5 per cent between 2001 and 2011, although the pace slowed, growing by just 1.7 per cent between 2011 and 2021.

The US remains the largest investor in BRICS member nations, followed by increased intra-BRICS investment, with China being the highest investor within the bloc. As of 2021–2022, the largest investments have been in the manufacturing sector, according to the latest available data. There has also been a growing focus on sustainability and energy sectors, highlighting the bloc’s willingness to encourage more green projects. In this sense, BRICS appears more proactive than regions like the EU, which implements policies like CBAM but seldom invests in green energy projects in other countries.

However, there remains a challenge. The bloc seems to be shifting its focus from economic integration to a more geopolitical stance, aimed at reducing Western influence. De-dollarisation efforts have accelerated following sanctions on Russia and China’s conflicts with the West. With the inclusion of Iran, which is already sanctioned by many major economic powers, economic transactions are further restricted. Consequently, BRICS is now becoming a platform with more significance from a geopolitical perspective.

Table 1: Sanctioned countries

Source: Coalition Against Nuclear Iran, Callestium AI

Currently, the relevance of the BRICS bloc is under question, as none of the nations have reached a consensus on the common objectives driving the group. The EU, for example, is united by a shared goal of free and seamless trade and economic integration; however, such consensus is lacking in BRICS. The nations are not aligned. Countries like China, Russia, Brazil, and Iran are pushing to make the bloc more anti-West, while others are primarily focused on increasing market access and attracting FDI inflows.

BRICS has three dominant powers: China in terms of economic strength, Russia politically, and India, which is attempting to balance both the economic and geopolitical aspects of the bloc. This ideological tussle is increasingly defining the nature of BRICS.

A key challenge lies in the creation of a financial system that could serve as an alternative to SWIFT. The development of a BRICS common currency could disrupt the global order, with Russia and Iran strongly advocating for de-dollarisation. However, this carries significant risks of increased sanctions. Even if a BRICS currency becomes a reality, it would likely be dominated by the Chinese Renminbi or the Russian Rouble. Given the current geopolitical complications, the Rouble’s dominance seems unlikely, making it probable that a new common currency, if established, would have a greater weight in Renminbi due to the wider acceptance of China's currency.

Due to the improbability of a BRICS common currency, member nations are now concentrating on bilateral currency trade and promoting trade in local currencies. For instance, countries like Brazil and Turkiye are converting their dollar reserves into gold, indicating a shift in expectations for the near future. With Turkiye also applying to join the bloc, the dynamics could become more complex than anticipated.

For BRICS to achieve success, all member nations must align with a shared vision to guide decisions and common policy actions. Without a unified aim, the bloc risks descending into chaos. The original goal of BRICS was to promote economic integration within the Global South and provide stronger representation for underdeveloped nations on the global stage, which could, in turn, enhance investment prospects. However, with the member nations diverging in their political ideologies and worldviews, the bloc must find a common ideological foundation to build upon. The future success of BRICS will depend on the nature of new members added to the bloc and the decisions made regarding de-dollarisation.

There is already considerable interest from countries like Malaysia, Thailand, and Turkiye, all looking to join BRICS. While this signals the growing relevance of the bloc, it is important to note that some countries may be motivated by economic interests, while others are driven by geopolitical considerations. The true test for BRICS leaders will be their ability to unify the member nations around a shared vision, ensuring the bloc's long-term success.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!