BRICS’ share in global trade

For BRICS to deal in local currencies, a strong trade share in exports is needed for economic transactions to be successful in local currencies. Currently, China holds the largest share of global exports within BRICS, followed by Russia and India, making China the dominant exporter in the bloc.

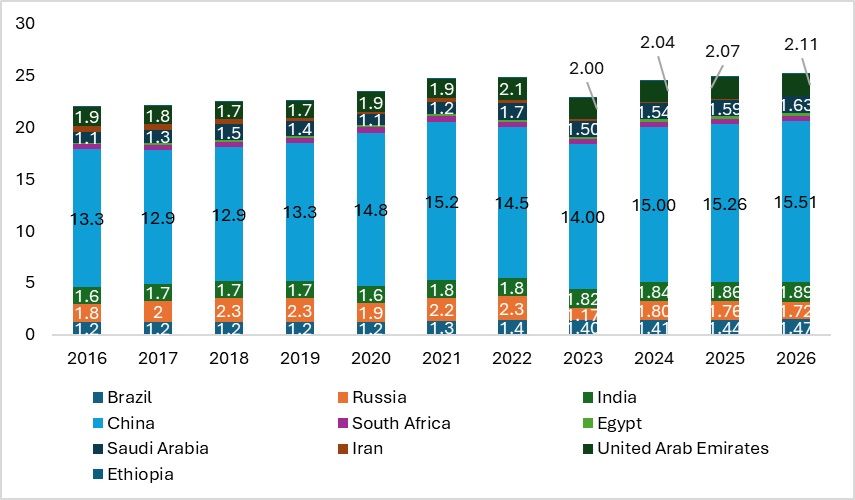

Figure 1: Share of BRICS countries in global exports (in %)

Source: ITC Trade Map, F2F analysis

China's share in global exports is expected to rise to 15.51 per cent by 2026, indicating continued dominance despite global ‘China plus one’ strategies. Russia's share may decline due to sanctions and export bans, but sustained demand from China and India for oil and gas mitigates this impact. Brazil, an emerging economy, is steadily increasing its share, projected to reach 1.47 per cent from 1.4 per cent. The country has implemented export-friendly policies including tax incentives, financing options, and quality improvement measures. The addition of the new members has increased the share of BRICS in global exports to 22.8 per cent in 2023 compared to 18.3 per cent with the original five-member bloc. However, the issue remains the same: will the BRICS bloc be able to deal in local currency or with a common currency?

Is trade in local currency viable?

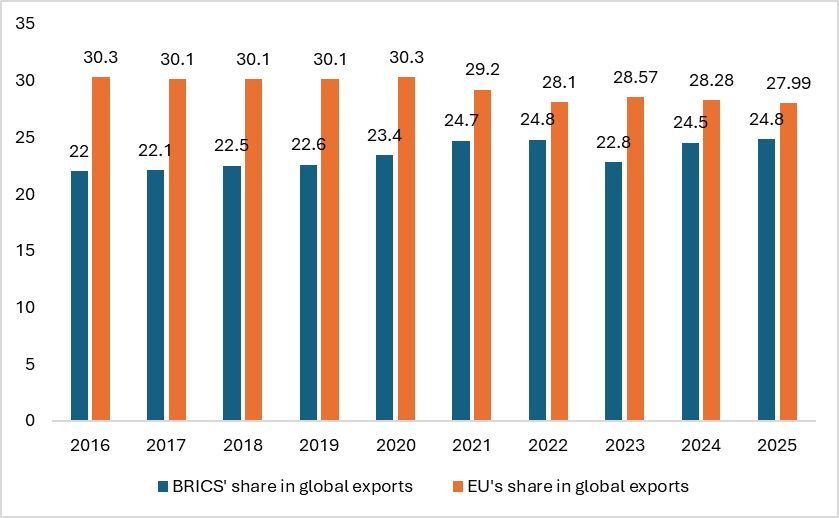

To trade using local currencies, economic similarities and a significant share in global trade are essential. The EU has a larger share in world exports than BRICS, although the EU's share is declining due to many free trade agreements (FTAs). These FTAs might also explain the potential increase in BRICS's share of global exports. By 2026, BRICS's share in global exports is expected to rise. However, a larger share of world trade alone is insufficient for implementing local currency trading. In 2023, BRICS's collective exports were $3,838 billion, projected to increase to $4,714.96 billion by 2024. On the other hand, if we consider the exports of BRICS plus five, they are expected to grow to $5,122.4 billion, an increase of 33 per cent by 2024. According to Boston Consulting Group, the trade between the nations in the bloc is increasing faster than any other global bloc. However, in the BRICS case, Chinese dominance may prevail, and the country may lead the trade and currency deals too.

Figure 2: EU’s and BRICS’ share in global exports (in %)

Source: ITC Trade Map

With this forecast in focus, according to the Asian Development Bank (ADB), having a common currency will boost trade among countries and will lead to ease in trade and transactions, and the volume of intra-bloc/regional trade will also increase. However, the question remains: will a regional currency be viable and what are the challenges? There are going to be significant challenges. When one must deal in local currency, the convertibility of the currency is equally important. Convertibility refers to the ease with which one country’s currency can be converted into another country’s currency without restrictions. The Indian Rupee and Chinese Renminbi are not fully convertible, which makes dealing in these currencies difficult. In the new bloc, it’s just Saudi Arabia’s Riyal and UAE’s Dirham that are fully convertible.

China’s dominance continues

With the need to deal and trade with local currencies, there must be significant trade and considerable investments and business between the nations. If this does not happen, the deal may end up in failure. An example is the India-Russia regional currency agreement, or the rupee-rouble deal. The deal, which was signed at the peak of the Russia-Ukraine war, did not materialise due to India’s ballooning deficit with Russia. Thus, the deal was frozen as Russia had a surplus of around $48 billion in rupees and was not able to use the rupees for any other transactions due to the convertibility issue of the rupee. However, China is succeeding in regional currency trading due to bilateral currency swap agreements, which bypass the need for currency convertibility, and substantial bilateral trade.

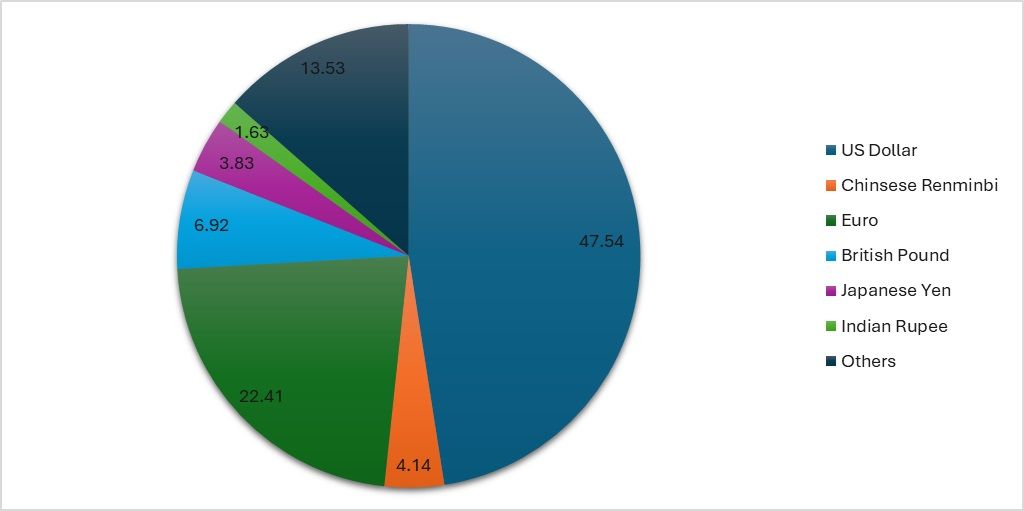

Figure 3: Share of all currencies in the global payment system (in %)

Source: SWIFT

China is a dominant force in global trade and currency trading, with its currency now the fourth most traded worldwide, according to SWIFT's RMB tracker report. The US dollar leads with 47 per cent of global transactions, followed by the euro and the British pound. China spearheads the de-dollarisation movement, supported by other developing nations, due to distrust in the US dollar's stability and US actions like banning the Russian currency from SWIFT and freezing Russian assets. This distrust highlights the power of developed nations to restrict economic activities.

The Asian Development Bank emphasises that trade openness is crucial for trading in local currencies. As of 2024, BRICS nations have trade openness ranging from 16 to 30 per cent, according to UNCTAD. Trade significantly contributes to the GDP of BRICS nations, making local currency trading more feasible.

BRICS trade

Trade volume among BRICS nations is steadily increasing, driven by bilateral FTAs such as the Comprehensive Economic Partnership Agreement (CEPA) of India and UAE, Preferential Trade Agreement (PTA) with MERCOSUR; Brazil’s agreements with the South African Customs Union (SCAU); among many others. Though smaller than the EU in global trade share, BRICS countries are enhancing integration. Each nation has boosted its export share within the bloc: India by 27 per cent, China by 17 per cent, and Russia by 19.48 per cent.

Table 1: Nations' share in exports to BRICS and YoY increase (in %)

Source: ITC Trade Map, author’s analysis

The increase in the share of trade among BRICS nations is due to the establishment of more FTAs, making trading in local currencies more feasible. BRICS members are enhancing integration through various agreements. China is improving trade relations and infrastructure through initiatives such as the Belt and Road Initiative (BRI), the International North-South Transport Corridor (INSTC), and the Regional Comprehensive Economic Partnership (RCEP) among others. India is focusing on strengthening ties with African nations and increasing access to Russia through the South Asian Association for Regional Cooperation (SAARC) and the Eurasian Economic Union (EAEU) FTA. Russia is boosting trade through individual agreements and preferential access.

Scope for further trade

In 2023, Brazil led BRICS exports with a 33 per cent share, driven by its cotton production, which has the potential for growth with India and China as consumers. The addition of five new BRICS members (Egypt, Ethiopia, Saudi Arabia, Iran, and UAE) may benefit India's comparative advantage in exporting textiles, food products, plastics, and rubber. However, trading in local currencies requires complex policymaking and resolving inter-nation issues. Despite the potential for local currency trade, geopolitical factors and Chinese dominance within BRICS need consideration. India's and China's textile exports are forecast to decline by 2025, with India facing a trade deficit despite an overall increase in exports. This situation necessitates careful consideration of currency convertibility and trade deficits in economic integration efforts.

Is trade in regional currencies feasible?

The key factors are trade share, bilateral relations, and infrastructure. BRICS launched BRICS Pay in 2018, an integrated payment system, and established the BRICS Bank in 2014 for infrastructure funding. However, funding is still primarily dollar-based. Most BRICS countries heavily import from China, suggesting that if regional currency trade increases, the Chinese Renminbi will dominate.

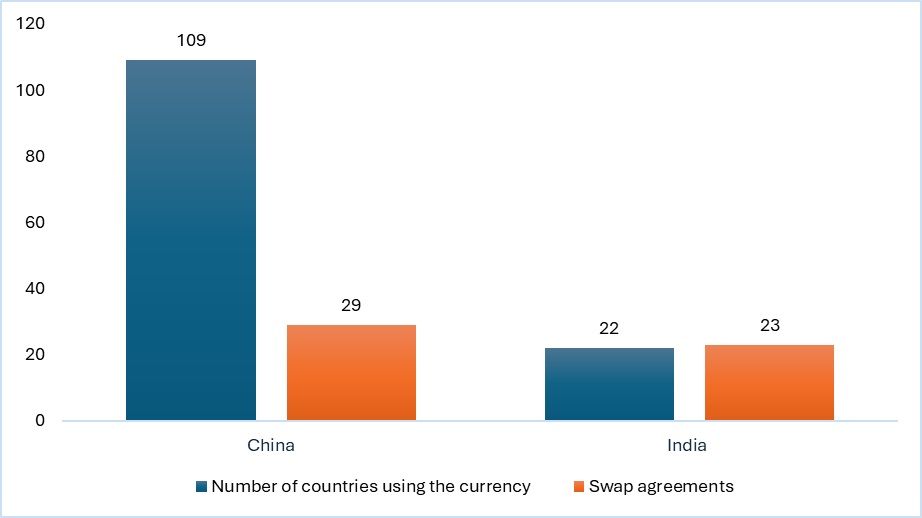

Figure 4: Comparison between Chinese and Indian currency internationalisation

Source: Various media sources, PIB

China and India are working to internationalise their currencies to become highly traded. China’s currency is used by 109 countries, with 29 signing currency swap agreements. China maintains balanced bilateral trade with many of these nations, while India faces increasing trade deficits with major countries, complicating its efforts to internationalise the rupee. These trade deficits and the limited convertibility of the rupee hinder its internationalisation, contributing to the failure of initiatives like the India-Rouble deal.

BRICS countries, such as Brazil, have recently started internationalising their currencies. In contrast, South Africa has not initiated any local currency agreements. Additionally, new members such as Ethiopia, Egypt have not yet explored local currency trade, largely due to the lack of necessary financial and trading infrastructure. BRICS must first develop proper infrastructure in these nations to support local currency trade.

Furthermore, BRICS must ensure that national interests do not overshadow local currency initiatives. Russia seeks an alternative to SWIFT, while China aims to promote its own system, potentially benefitting both nations disproportionately. Geopolitical issues between India and China, sanctions on Iran, and other regional, infrastructural, political, and economic challenges must be thoroughly evaluated, making local currency transactions a complex decision for the bloc.

What lies ahead

The BRICS nations have recently enhanced cooperation in trade by signing FTAs. The Russia-Ukraine war has led to an increased focus on the BRICS nations, as trade with Russia has grown within the bloc due to sanctions imposed by Western countries. However, China's dominance within BRICS presents challenges for trade in regional currencies. All BRICS nations have trade deficits with China, which may make local currency trade one-sided.

With the addition of Gulf and African nations, China remains the dominant trade partner. Therefore, even if trading in local currencies begins, the dominance of the Chinese Renminbi is likely to continue. As a result, China may emerge as the primary beneficiary of local currency trade initiatives. However, geopolitical issues and the inclusion of nations sanctioned by the US may introduce further complications for the bloc, particularly regarding acceptability and potential sanctions.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!