The surprise

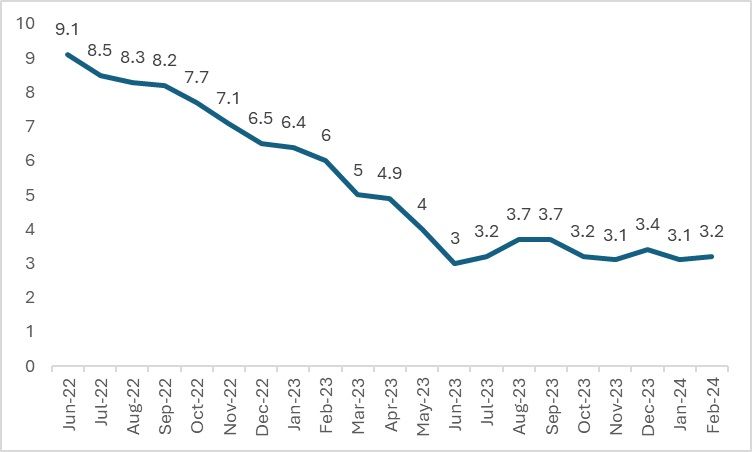

The rate cuts, which were expected to start sooner, have been delayed due to persistent inflation in the economy. The new rate cuts will now be less than a per cent, by 0.75 points and 0.25 points three times, according to the central bank. This rate cut projection is consistent for the years 2025 and 2026. The rate cuts for the current year may occur in the second half, a move that comes amid the nation facing sticky inflation. Inflation has been decreasing by very minor increments, indicating the inability of price levels to adjust to changes in the demand and supply patterns of the economy. The figure below shows how slowly inflation is reducing, indicating a tenacious pattern.

Figure 1: The US inflation (in %)

Source: US Bureau of Labor Statistics

Economic uncertainty, wars, and supply chain disruptions, particularly in shipping, are contributing to the persistently slow decrease in inflation. There is a need for stability within the economy and in consumer confidence levels. The US consumer confidence index showed some signs of improvement, suggesting an increase in spending and a gradual reduction in inflation.

A mixed outlook for the economy

In its meeting, the Fed revised its forecasts for GDP growth, inflation, and unemployment statistics. The GDP growth is now expected to rise by 2.1 per cent in 2024, an increase from the December 2023 forecast. However, the Fed anticipates that inflation will remain stubborn, projecting a decrease to 2.6 per cent, indicating a gradual decline. Unemployment rates are expected to remain stable, suggesting a robust market for the US economy. This raises questions about the implications for the textile industry.

The impact on the US industry

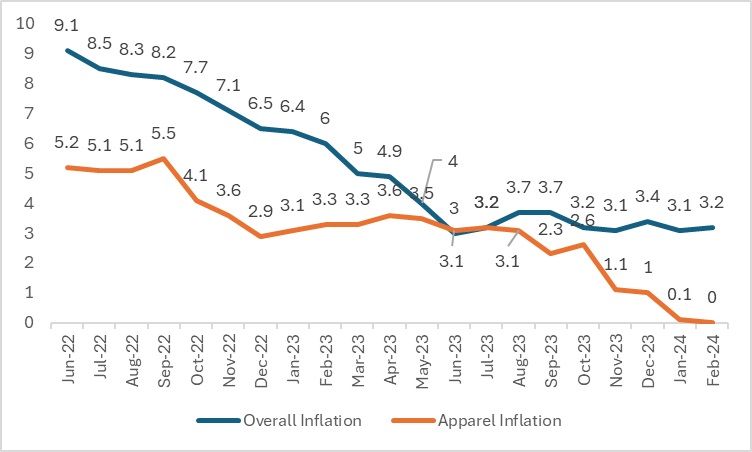

The US textile industry is feeling the effects of rising interest rates. Higher interest rates make it more challenging for industries to finance their inventories. Apparel inflation tends to move in tandem with overall inflation. Further analysis revealed a strong correlation of 0.58 between apparel inflation and overall inflation, indicating that as inflation rises, apparel prices are likely to increase as well.

Figure 2: Overall inflation and apparel inflation in US (in %)

Source: US Bureau of Labor Statistics

The connection between interest rates and corporate borrowing is clear, as many companies rely on loans to maintain or expand their inventory. With inflation leading to higher interest rates, and consumer demand remaining low due to ongoing confidence issues since 2022, the industry is experiencing a decline in profits. Additionally, the rise in interest rates is exacerbating the downturn in business. The US textile and apparel industry has navigated between two extremes: initially, a supply shortage that drove up prices, and currently, a situation characterised by lower demand and increased supplies.

Consequently, the near-term outlook of reduced demand and persistently high interest rates is prompting US industries to adopt a more cautious approach to restocking and managing inventory. In response, they are closely monitoring unemployment statistics, interest rates, and consumer confidence.

The trade

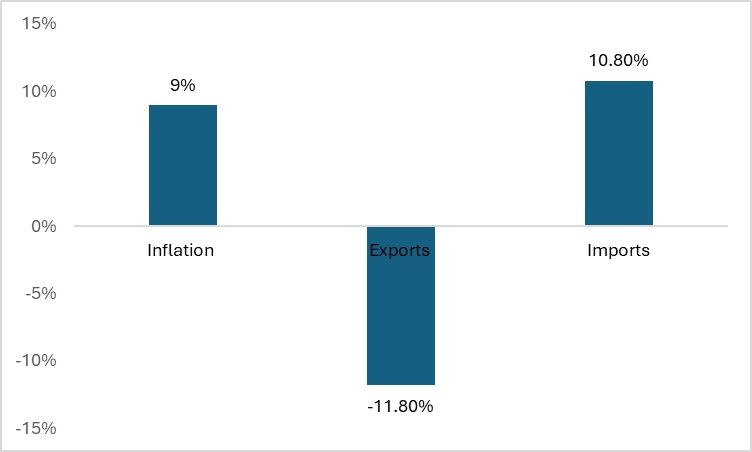

The trade scenario in the US aligns with broader economic trends. The country experienced a decrease in both imports and exports of apparel and textile goods, driven by the surge in inflation that also escalated the cost of raw materials for US industries. As inflation rose, the import price index increased, while the export price index declined. This pattern suggests that inflation leads to currency depreciation, which in turn, raises the cost of imports. During the peak of inflation in June 2022, the import price index surged to 10.8 per cent, and the export price index dropped by 1.8 per cent. Notably, this decrease in export prices did not translate into increased exports for the industry.

Figure 3: US import and export price index for 2022 in relation to inflation (in %)

Source: US Bureau of Labor Statistics

Therefore, the industry is advocating for a reduction in interest rates to ease the burden of financing their debts. This cost reduction in the prices of apparel and other textile products would then be passed on to consumers.

Road ahead

The US policy direction is becoming increasingly clear. The Fed is committed to reducing inflation but is also cautious about preventing a severe downturn in the economy. It is navigating a delicate balance between controlling inflation and managing unemployment and growth. This balancing act is why, despite the potential for persistent inflation, there is an expectation that the Fed might slightly decrease interest rates by the end of 2024, as suggested.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!