India is considering changing the base year for its key statistical indices from 2011-12 to fiscal 2023 (FY23) or FY24, potentially starting in 2026, according to various media reports. This shift will significantly impact key inflation indices such as the Consumer Price Index (CPI), the Wholesale Price Index (WPI), and the Index of Industrial Production (IIP). Updating the base year will reflect more current economic conditions and consumption patterns, thus providing a more accurate picture of the economy. This change will also affect economic policies, making it crucial to monitor and analyse how these indices respond to the new base year. The updated indices will be essential for evaluating economic performance and formulating effective policies.

Understanding the importance of indices and base year

Every country needs to track inflation to ensure it remains within the tolerable limits set by their central banks. Each inflation metric has its specific significance and is used by different organisations and ministries. These metrics are crucial in the Indian economy, especially for policymaking.

The CPI is vital for decisions regarding interest rates, which fall under the jurisdiction of the Reserve Bank of India (RBI). Economists also use the CPI to assess changes in the standard of living of households by tracking variations in the price level.

Similarly, the WPI is crucial for understanding the status of the manufacturing sector. It helps in monitoring the impact of price changes in raw materials, machinery, and other inputs on the manufacturing sector.

The IIP is equally important for estimating the manufacturing sector's Gross Value Added (GVA). The GVA measures the value added by producers during the manufacturing process, providing insight into the sector's overall contribution to the economy. These indices collectively inform economic policies and strategies, making them essential tools for maintaining economic stability and growth.

All these indices have a base year to serve as a reference point for comparing the current scenario with conditions in the base year. A base year is crucial for accurately reflecting changes in the economic situation.

It is essential to update the base year periodically. The proposed change in the base year to 2023-24 by 2026 aims to provide a more accurate reflection of the economy's structure, consumption patterns, sectoral weights, and the impact of emerging sectors. Currently, the base year is 2011-12, which is now twelve years old. This outdated base year can lead to overestimations or underestimations of the economy's growth prospects.

Changing the base year every five years ensures a recent period for comparison, offering a more accurate picture of economic changes. Regularly updating the base year helps maintain the relevance and accuracy of economic indices, thereby aiding in effective policymaking and economic analysis.

Implications of changing the base year for economic indices

If the base year is changed from FY12 to FY23 or FY24, all the indices will more accurately reflect the current state of the economy. The RBI, which uses CPI as one of the key metrics to measure inflation, will also prefer an index that aligns more closely with recent events to capture true economic outcomes. With this update, there will be significant changes in the weights assigned to each parameter within the individual indices.

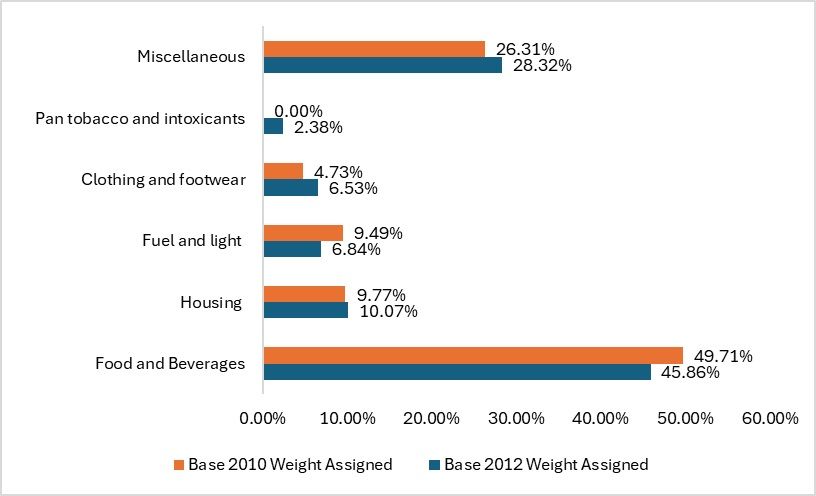

For example, with the CPI, comparing the current base year of FY12 to the past base year of FY10, the following changes can be observed: The consumption basket in FY12 reflects different goods and services compared to FY10 due to changes in consumer preferences and the introduction of new products and services. For example, in the FY12 base year CPI, products like pan and intoxicants are included in the product basket, which were absent in the FY10 product basket.

The recent Household Consumption Expenditure Survey (HCES 2022-2023) reveals an increase in the share of discretionary expenses to 60.83 per cent of total spending in 2022-23 and a reduction in necessary expenses to 39.17 per cent in 2022-23. This suggests that many discretionary products are likely to be included in the CPI product basket.

Updating the base year to FY23 or FY24 will incorporate recent economic developments, consumption trends, technological innovations, and sectoral shifts, providing a more accurate and reliable representation of the current economy.

Figure 1: Differences in weights assigned to CPI for base year FY12 and FY10 (in %)

Source: Ministry of Statistics and Programme Implementation (MOSPI)

Comparing the base years FY12 and FY10 reveals significant differences in the importance given to each category within the CPI. The basket includes both necessities and discretionary expenses. Notably, the share of food and beverages decreased from 49.71 per cent to 45.86 per cent, while the weight assigned to discretionary expenses like clothing and footwear increased from 4.73 per cent to 6.53 per cent in FY12. Shifting the base year to FY23 or FY24 will lead to further adjustments in the weights of the items included in the index, based on the latest household survey conducted by the National Statistical Office (NSO).

Changing the base year is crucial for capturing recent changes in consumer preferences. The product basket used for calculating the CPI is derived from the Consumer Expenditure Survey conducted by the National Sample Survey Office (NSSO). If this survey indicates shifts in consumer spending patterns, the product basket for the CPI will be updated accordingly. Therefore, updating the base year not only involves changing the reference period but also adjusting the product basket, ensuring the CPI remains a relevant and accurate indicator of economic conditions.

The RBI aims to maintain inflation at 4 per cent, with a tolerance range of 2 per cent above and below this target. With the imminent base year update by the Central Statistical Organisation (CSO), the CPI will provide a more accurate measure of inflation.

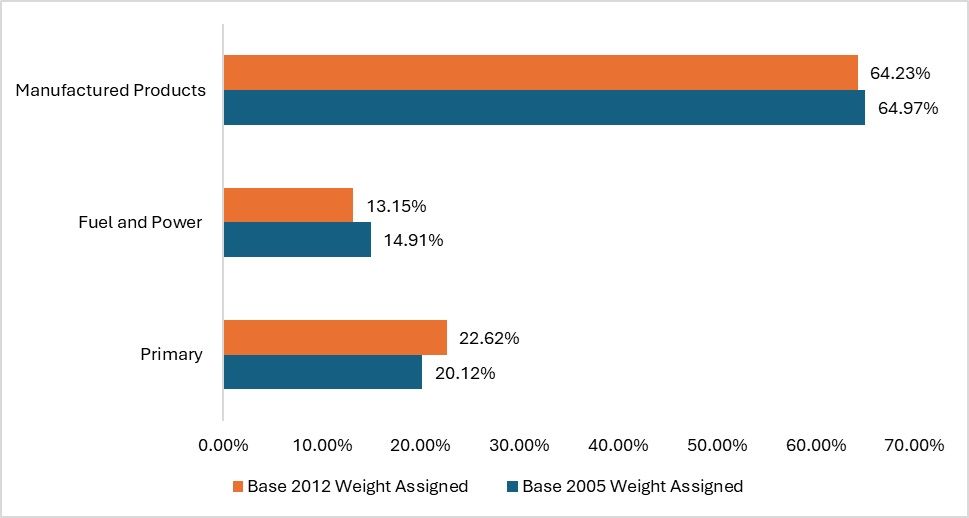

Figure 2: Change in weights for WPI for base year FY05 vs FY12 (in %)

Source: Central Statistics Office (CSO)

In WPI, which measures price levels across the entire Indian economy, the manufacturing sector includes primary goods, manufactured goods, and fuel and power. There have been changes in the weights assigned to different components under different base years. For instance, the weight of the manufacturing sector has decreased with the current base year. With the base year now twelve years behind, the actual changes and dynamics within the manufacturing sector are not accurately reflected. For example, India’s manufacturing exports increased in FY22 and have recently registered a 13 per cent uptick in exports as of May 2024. With the new base year, weights can also differ for the sectors.

Updating the base year to a more recent one will provide a clearer and more accurate picture of the manufacturing sector and other components of the economy. This will allow for the implementation of industry-specific policies that are more aligned with the current issues and challenges faced by the industrial sector. Accurately capturing recent economic conditions and sectoral shifts ensures that policy responses are relevant and effective in addressing the present needs of the economy.

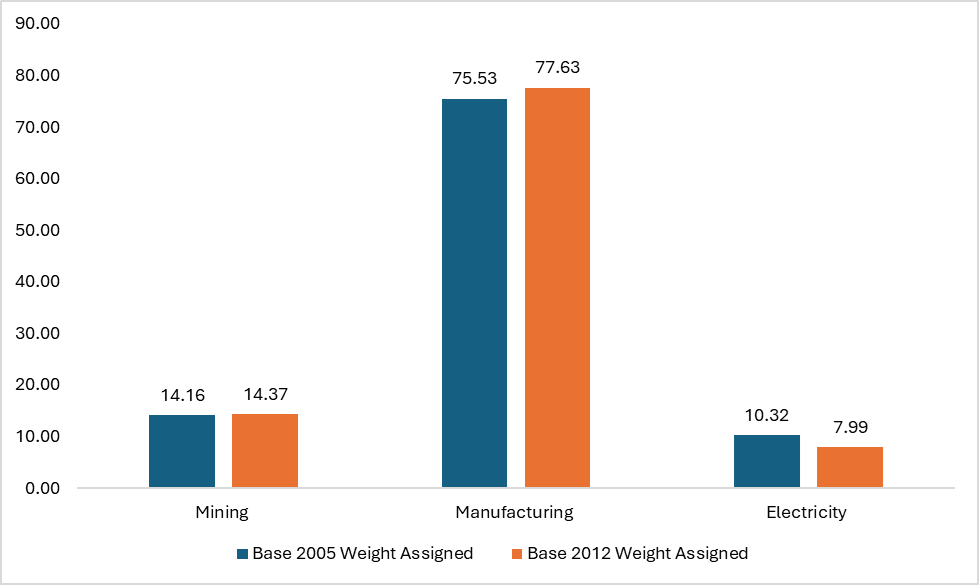

Figure 3: Weights assigned to different categories in IIP for FY05 and FY12 (in %)

Source: Press Information Bureau (PIB)

The Index of Industrial Production (IIP) is a key indicator for the manufacturing sector and other sectors of the economy. This index, which releases data monthly, places significant emphasis on the manufacturing sector. Changes in the base year can lead to significant adjustments in the weights assigned to different sectors within the index. Over the years, the weight of the manufacturing sector has evolved, reflecting shifts in the country’s economic structure.

The IIP also disaggregates data for different sectors, providing detailed insights into sectoral performance. If the base year is updated to FY23 or FY24, the index will offer more accurate projections of manufacturing growth across various industries, including the textile industry. This update will enable more informed policy decisions tailored to the current state of the manufacturing sector and other industries.

By reflecting the latest economic conditions and sectoral shifts, an updated base year will ensure that the IIP remains a relevant and reliable tool for economic analysis and policymaking.

Determination of an ideal base year

Ideally, a base year is chosen during a period of stable economic conditions, free from significant fluctuations or externalities that could disrupt the country's economic trajectory. It should be recent enough to ensure the index accurately reflects current conditions. Using a base year that is too far removed from the period under consideration can result in an inaccurate portrayal of the sector, leading to erroneous policy decisions.

The current base year of FY12 does not meet the criterion of recency, as it is twelve years behind the current period. In contrast, the past four years have been marked by significant events such as the pandemic, geopolitical tensions, and trade disruptions. These events have influenced economic policies and impacted the growth of key sectors.

Using an outdated base year like FY12 can lead to problems such as the overestimation or underestimation of key indices like the CPI, WPI, and IIP. This is particularly problematic for the RBI, which relies on the CPI to make decisions regarding interest rates. Adopting a more recent base year, like FY23 or FY24, will produce more realistic and reliable indices that accurately reflect the current economic situation. This, in turn, will enable more precise and effective policy decisions that are aligned with the actual state of the economy.

The path forward

Every country needs to update the base year periodically to maintain an accurate understanding of its economic conditions. India’s National Statistical Commission recommends that the base year should be updated every five years, which is appropriate given the dynamic changes occurring globally, such as wars, trade wars, recessions, changes in consumer demand, and resulting changes in the supply chain, which ultimately lead to changes in domestic price levels. Maintaining the same base year of FY12 increases the possibility of ballooning current inflation. Thus, a constantly evolving economic landscape requires a dynamic index with a current and relevant base year to enhance the reliability of economic indicators.

By adhering to this approach, India can ensure its economic indices remain relevant and reflective of contemporary realities, enabling precise analysis and fostering robust economic policies that respond to the current needs of the economy.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!