The United States Trade Representative (USTR) recently released a report on the country's trade and policy status, revealing some interesting trends in overall trade, specifically textile. The year 2023 has been interesting, with many markets like the EU and the US proposing and discussing policies for enforcing sustainability in the textile value chain. The report mentions that the coming years may involve implementing and enforcing these policies.

Decreasing textile imports in 2023

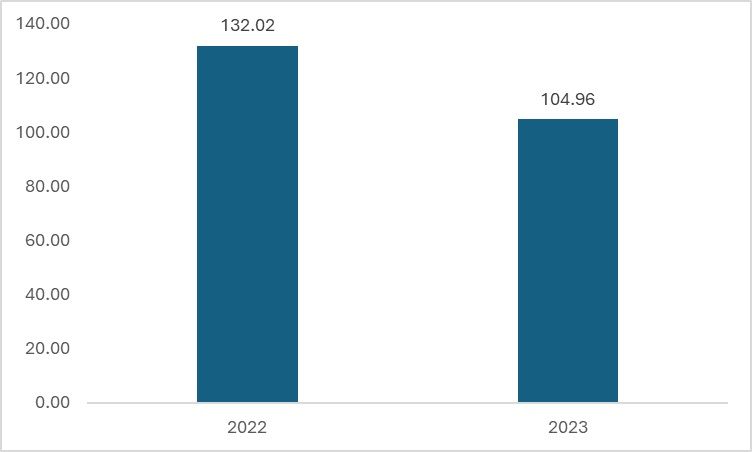

The US, one of the major importers globally, saw imports fall in the region. This was the result of uncertainty and a decline in the overall prospects of the economy, which is set to recover in the coming years. Along with overall trade, the textile trade is no different, with textile and apparel products worldwide experiencing a 20 per cent decrease in total textile imports in 2023 compared to 2022. However, there were significant developments throughout 2023, and in 2024, there are higher chances that the government may take proactive steps to make the desired changes.

Figure 1: US' textile and apprel imports (in $ bn)

Source: OTEXA

The textile imports along with the overall imports, were reduced due to the inflationary pressures and weak consumer confidence in the US economy amid wars and a risk of reduction in the wages due to the ongoing global economic slump. However, the trade scenario hasn't stopped the US authorities from making policy changes.

Changes in import policy and FTA discussions

The highlight in the report, concerning textile and related policies and trade, is the mention of issues regarding de minimis, trade negotiations such as AGOA, and discussions on the Uyghur Forced Labour Prevention Act (UFLPA). The FTAs are deemed to be one of the most underutilised avenues for US imports, but approximately 14 per cent of textile and apparel imports enter duty-free via these agreements. Specifically for textile and apparel imports, the US utilises nine trade agreements—seven Free Trade Agreements and two Preferential Trade Agreements.

The importance of FTAs is larger for a country like the US. However, many recent reports, such as those from the United States Fashion Industry Association, have mentioned a gross underutilisation of FTAs. The US administration is holding separate meetings to discuss the utilisation of FTAs.

Expectation of tighter regulation and utilisation of FTAs

As domestic producers highlight differences in scrutiny between their textile production processes and those of foreign producers, there's a higher likelihood of tighter regulation concerning sustainability and traceability factors. This increased scrutiny has been particularly challenging for much of the American textile industry, which has been struggling domestically. Consequently, there may be more amendments to de minimis and other policies to scrutinise imports.

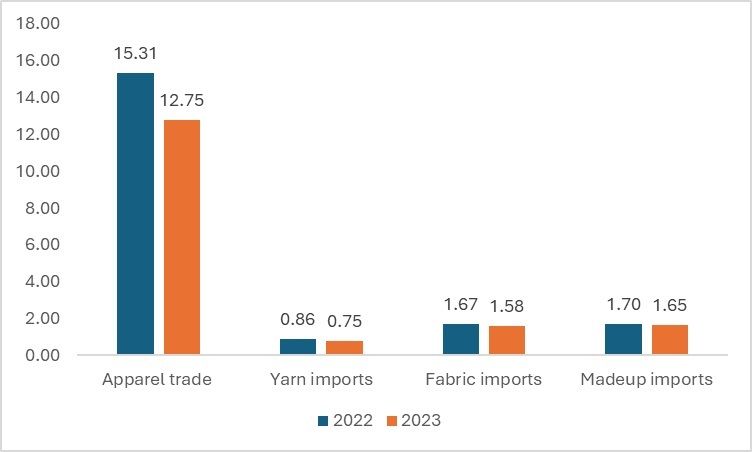

However, there is a silver lining in the US textile trade scenario. Despite the overall decrease in textile imports, imports from FTA countries have decreased, but their overall share has increased by approximately one per cent. When comparing 2022 to 2023, the share of imports from FTA countries has increased, indicating two potential outcomes: first, the utilisation of FTAs may increase as the year progresses, and second, there's a probability that the US may nearshore its imports. Figure 2 illustrates the imports of textiles and apparel from FTA countries.

Figure 2: Imports of textile and apparel products from FTA countries (in $ bn)

Source: OTEXA

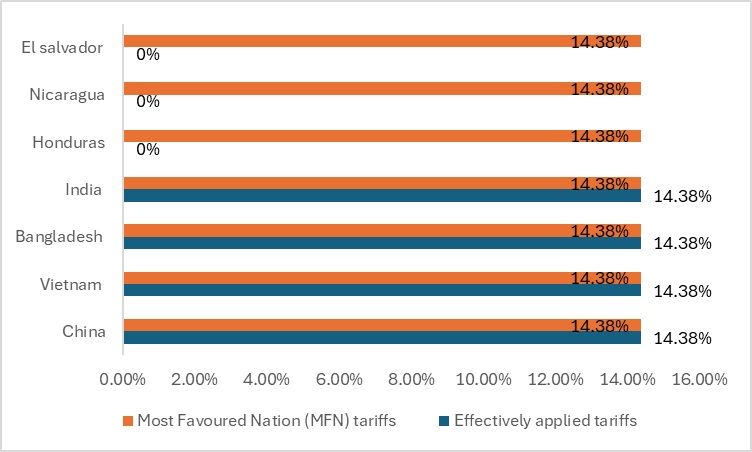

The increase in the imports from the FTA countries amid a fall in the overall imports shows a positive move in the direction of the FTA utilisation by the US. With its yarn-forward policy, the US can actively achieve the aims of promoting the US textile industry and importing textile products at a cheaper price, thereby easing prices. The US charges a tariff as high as 14 per cent for knitted apparel and 10.38 per cent for woven apparel. This tariff is higher for countries like China, from which it imports the highest number of apparels; they are charged the same high duty. However, for the CAFTA-DR countries such as El Salvador, Nicaragua, and Honduras, the effectively applied tariff is zero, and they have an application of the yarn-forward policy, thus helping the US achieve its dual aims. In the future, there are higher chances that the country will import more from FTA countries.

Figure 3: Tariff on imports of knitted apparel in US (in %)

Source: ITC Trade Map

This becomes more evident as one carefully observes the conditions in the FTA, the tariffs, and the benefits to domestic US companies.

What lies ahead?

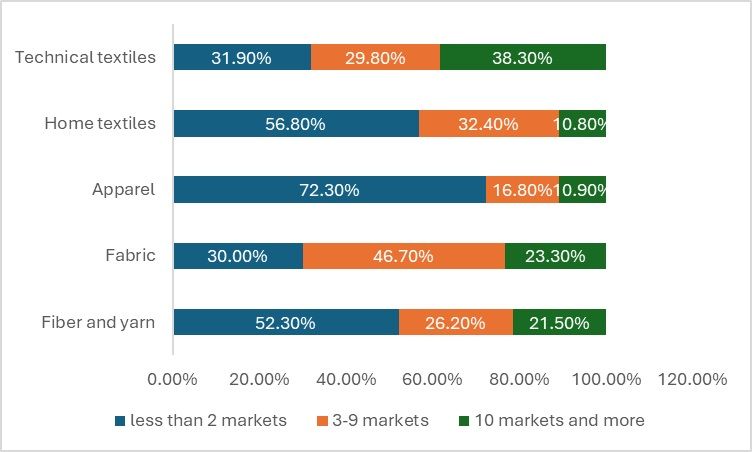

Considering the US economy and the importance of the textile industry in generating employment, the US may tighten policies relating to sustainability and promote policies to ensure that the domestic economy does not bear the cost of liberalised trade. The US also has a dynamic textile industry, with most industries exporting products to only two or fewer markets. According to data from OTEXA, it has been found that the apparel industry, home textiles, and the fibre and yarn industries rely on fewer than two markets, mainly those in the FTA areas like CAFTA-DR and USMCA.

Figure 4: The export destinations of industries across value chain (in %)

Source: OTEXA

Thus, in a bid to diversify US export destinations and give them global scope, the US is highly likely to increase scrutiny for imported apparel and boost US textile exports not only to FTA countries but also to others. While the country is already promoting the production of technical textiles domestically, under the new policy, it will be harder to promote the development of the entire value chain due to its high concentration and lack of vertical integration. Therefore, it may take some years for the US to see a reduction in textile imports.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!