Indian textile stocks surged following the resignation of Bangladeshi Prime Minister Sheikh Hasina, driven by optimism that major apparel brands might shift some of their manufacturing orders to India. Bangladesh, a key player in the global garment industry due to its low labour costs and flexible labour policies, has recently experienced significant disruptions. Student protests and political turmoil in the country brought its textile and manufacturing sectors to a standstill.

As Bangladesh, a major beneficiary of the China-plus-one strategy, faces geopolitical and domestic challenges, other textile-producing nations are positioning themselves to capitalise on the ongoing turmoil. The central question remains: can these countries, including India, leverage this short-term disruption to gain an advantage in the global textile market?

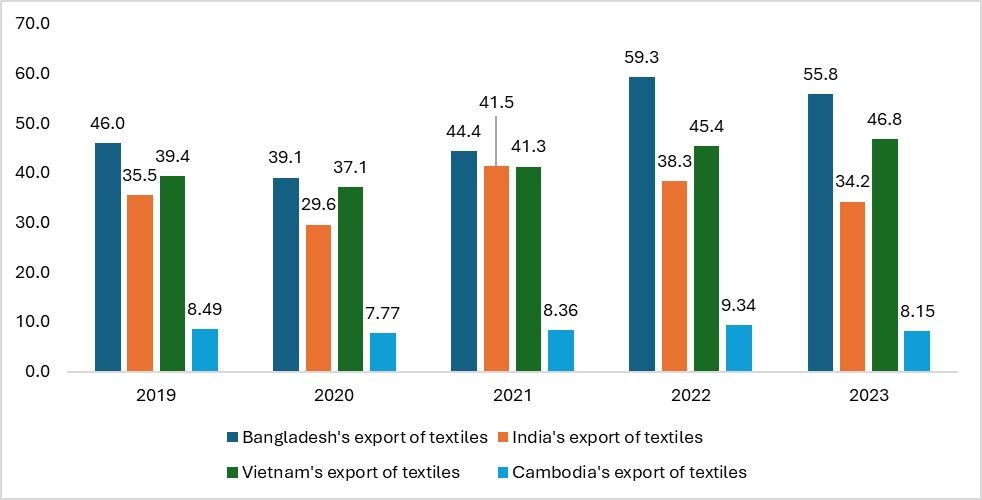

Export growth of Asian majors

Bangladesh and Vietnam have demonstrated impressive export growth in recent years. However, Bangladesh saw a decline in exports in 2023, primarily due to an energy crisis that increased production costs for garment factories. This crisis led to a 30 per cent reduction in garment production and the temporary shutdown of several factories.

In contrast, India's export decline was due to reduced demand from major markets such as the EU and the US, resulting in a drop of over 5 per cent in exports in 2023.

Figure 1: Textile exports of major Asian textile manufacturing nations (in $ bn)

Source: ITC Trade map

India's textile sector has faced significant challenges, with exports declining by 10 per cent in 2023 compared to the previous year. Key factors contributing to this downturn include a weakening currency, rising production costs, and increased shipping and freight expenses. These pressures have strained Indian textile MSMEs, leading to reduced production capacity.

Additionally, the situation in Bangladesh poses further concerns for India, as nearly 50 per cent of India's cotton yarn exports are destined for that country. While there is potential for Tiruppur—India’s apparel manufacturing hub—to benefit from a de-risking strategy, the complexities involved suggest that these advantages may not be straightforward.

Shifting production bases amid policy complexity

Amid increasing political and social uncertainty in Bangladesh, there is speculation that Indian textile manufacturers might benefit as companies consider relocating their operations. Many Indian garment manufacturers currently have units in Bangladesh, and if the crisis persists beyond a month, there could be a shift to India. However, whether India is a suitable alternative depends on several factors, including manpower, wages, labour policies, and the significance of the textile industry to the country's GDP and employment.

India’s textile industry employs approximately 45 million people, significantly more than Bangladesh (4 million), Vietnam (2.5 million), and Cambodia (0.8 million). Despite this, differences in total work hours and technological advancements between these countries could influence the decision to shift production. Bangladesh, for instance, excels in mass production and sustainability initiatives, having adopted water-saving technologies, direct-to-garment printers, enterprise resource planning (ERP), and computer-aided design (CAD) for modifications and design.

On the other hand, India's smaller textile industries have been slower to embrace advanced technologies, which could affect its appeal as a relocation destination for manufacturers looking for efficiency and innovation.

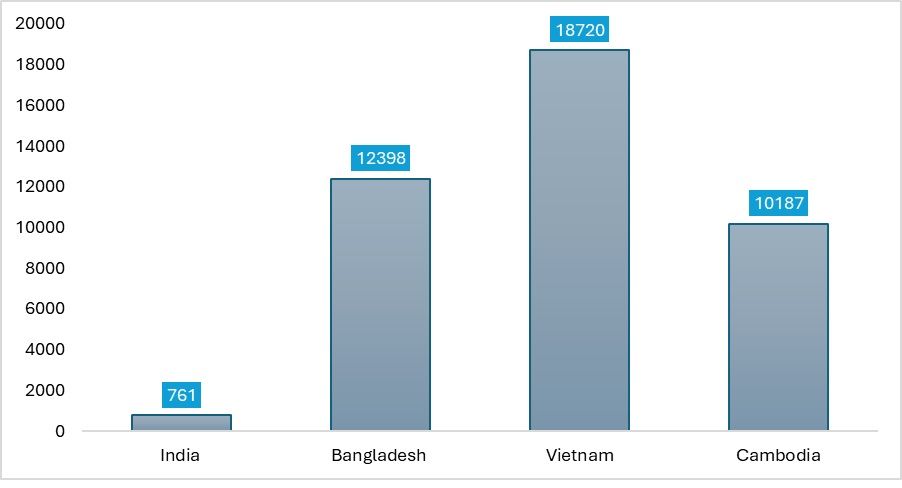

Figure 2: Exports per person (in $)

Source: ITC Trade map, F2F analysis

If exports per person, also known as export efficiency per person, are an indicator of the labour force's efficiency, the industry's contribution to the economy, and industrial developments, then it is evident that India, despite having a much larger workforce than Bangladesh, Vietnam, and Cambodia, demonstrates a clear lack of efficiency and technological advancement in its textile industry. Many Indian textile industries have significant production capacities; however, they urgently need to accelerate the pace of technological advancements.

In contrast, Bangladesh, Vietnam, and Cambodia have benefitted from substantial foreign investments, enabling them to adopt advanced technologies, even in an industry that remains highly labour-intensive. Indian textile exports have been consistently declining, with a recent 10 per cent drop in textile exports, a trend that has persisted for several years.

Therefore, if India is to capitalise on the current situation, it is imperative to implement structural reforms in the textile sector, coupled with substantial investments to give the industry the necessary boost.

Is India the Next Global Production Hub? Assessing Readiness and Potential.

Despite high expectations, India's textile and apparel sector has not reaped the anticipated benefits from recent shifts in the global market. Since 2014, the export share of Indian textiles has remained below 4.5 per cent and further declined to 3.5 per cent in 2023. This stagnation is largely attributed to unfavourable economic conditions and India's limited market penetration in Southeast Asia, leading to a significant contraction in exports.

India's textile industry is highly labour-intensive, and improving labour productivity could offer a comparative advantage. To enhance exports, it is crucial that the increase in export value exceeds the rise in labour productivity. Furthermore, there should be greater integration of both backward and forward linkages within the industry to strengthen its competitiveness.

However, structural issues such as outdated legal frameworks and inadequate infrastructure present significant challenges. India's labour laws, often considered some of the most complex globally, create considerable ambiguity for businesses. These complications can lead to increased transportation costs and hinder the sector's growth.

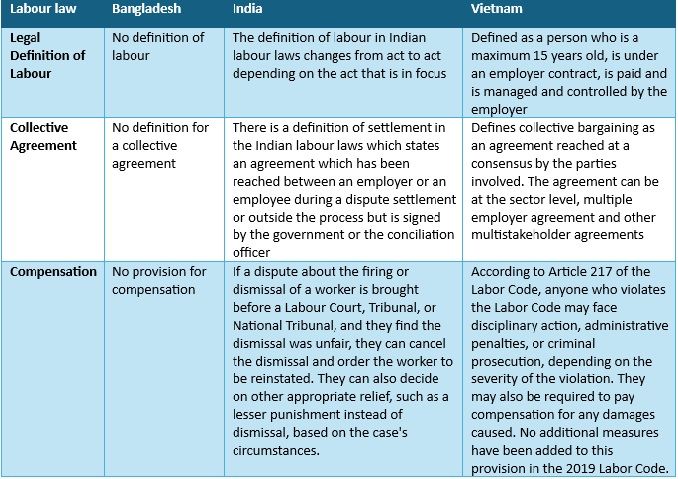

For a comprehensive comparison, here's a brief overview of the labour laws in Bangladesh, India, and Vietnam:

Bangladesh: Known for its relatively flexible labour laws, which have contributed to its competitiveness in the global garment industry. However, concerns remain about labour rights and working conditions.

India: Faces challenges with complex and often ambiguous labour laws, which can create significant difficulties for firms. The intricate legal environment can be a barrier to efficiency and growth in the textile sector.

Vietnam: Has made considerable strides in labour law reforms to attract foreign investment, offering a more streamlined and predictable regulatory environment compared to India.

Table 1: Labour laws in India, Bangladesh & Vietnam

Source: International Labour Organization (ILO)

A comparison of labour laws in Bangladesh, India, and Vietnam reveals significant differences in complexity and predictability. Indian labour laws are notably intricate and often ambiguous, with frequent changes in definitions and provisions depending on the industry and context. This complexity can create substantial uncertainty and challenges for businesses operating in India. In contrast, Vietnam’s labour laws are more streamlined and predictable, offering industries greater clarity and stability. As a result, more companies and brands may prefer transitioning to Vietnam over India due to the latter’s complicated labour regulations.

India has set an ambitious target to increase textile exports to $100 billion by 2030. Achieving this goal will require significant improvements in the speed and efficiency of policy implementation. To support this objective, the Indian government has introduced several initiatives, such as:

PM-MITRA Scheme: This scheme provides common services and infrastructure support to textile hubs, aiming to enhance the efficiency and competitiveness of the textile sector.

Niryaat Bandhu Scheme: Focused on Micro, Small, and Medium Enterprises (MSMEs), this scheme aims to boost skills development and provide crucial export information, helping smaller firms navigate the complexities of global trade.

Export Promotion Capital Goods Scheme (EPCGS): This initiative is designed to encourage the import of capital goods for the production of high-quality goods and services, thereby enhancing the competitiveness of India’s exports.

While these efforts are commendable and may lead to a modest increase in order volumes as part of de-risking strategies, the core issue of complex labour laws persists. Improving labour regulations is crucial for reviving India's share of global textile exports and enhancing the sector’s competitiveness on the international stage.

Road ahead:

India’s textile industry, one of the oldest globally, employs a significant portion of the workforce. However, substantial improvements are needed in policy, investment frameworks, duty structures, and the monitoring of skill development programmes to boost labour productivity. To ensure sustainable growth, India should prioritise long-term strategies over short-term goals. Addressing disparities in policy implementation across states and making structural changes to labour and sustainability policies are crucial for attracting businesses.

India’s long-term objective should be to leverage the China-plus-one strategy by investing in and reforming policies, rather than focusing solely on immediate de-risking objectives. Currently, India holds a 3.9 per cent share in global textile exports, but this share has declined recently due to a heavy reliance on European markets. To counter this, India should redirect its focus towards Southeast Asian markets such as Japan and South Korea, where its presence is relatively small—1.2 per cent in Japanese imports and 1.9 per cent in Korean imports—while China remains dominant.

To enhance India’s export potential, the country should make better use of Free Trade Agreements (FTAs) and Comprehensive Economic Partnership Agreements (CEPAs), negotiating necessary adjustments where needed. Trade relations with ASEAN, BRICS, and other East Asian nations have been underutilised. Increasing the utilisation of FTAs from its current stagnant level of 25 per cent should be a key focus. Modifying FTAs and CEPAs, alongside implementing policy reforms, will be essential for expanding India’s textile exports.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!